Indian scooter segment is now a 5 million unit market

The booming Indian scooter market is now worth five million units annually, as per the latest data from apex industry body SIAM.

A close analysis of all scooter models on sale in India across three different engine displacement categories underlines that the total domestic scooter market has reached the size of five million units during FY2015-16.

The scooter models currently sold in India range from the 88cc TVS Scooty Pep+ to Piaggio’s 150cc top-end Vespas. In terms of the on-road price range, the scooter market operates from as low as Rs 44,000 to over Rs 100,000.

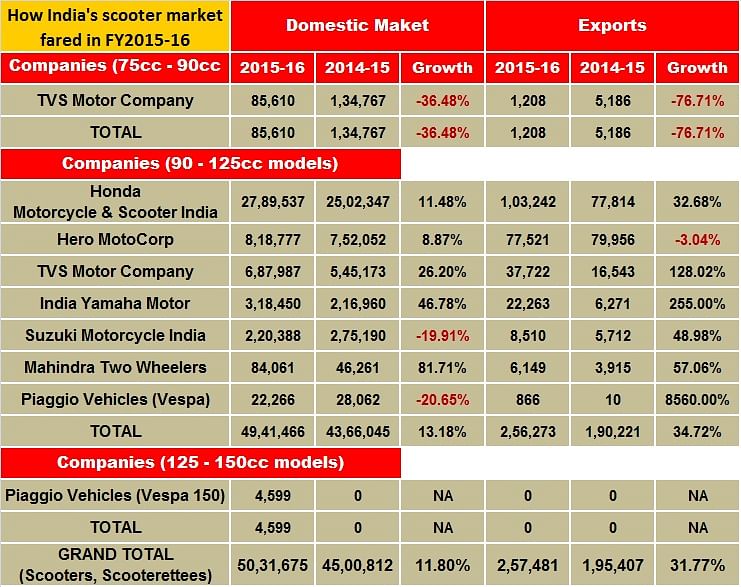

Total scooters sold in India during FY2015-16 stood at 50,31,675 units, a growth of 11.80 percent YoY. Of all three categories, the most popular segment belongs to the 110cc engines, which, as OEMs say, offer a good mix of power and performance.

Sales of 90cc-125cc scooter models at 49,41,466 units in the domestic market marked a healthy growth of 13.18 percent YoY. The biggest volume gainer was Honda Motorcycle & Scooter India (HMSI), which added 287,190 units to its FY2014-15 sales of 25,02,347 units. HMSI registered a growth of 11.48 percent YoY.

Honda now commands a market share of 56.45 percent in the 90cc-125cc scooter league. On the overall front, it still rides with an impressive 55.44 percent.

The number two player in this market, Hero MotoCorp marked a surprise jump of 8.87 percent YoY, thanks to its recent models – Duet and Maestro Edge. Hero MotoCorp sold total of 818,777 units during the last fiscal, which helped it with a market share of 16.57 percent in the 90cc-125cc scooter segment.

On the overall scooter market front, Hero MotoCorp’s market share stands at 16.27 percent.

Growing fast to catch up with Hero, TVS Motor Company registered total sales of 773,597 units during the last fiscal. This came from a split sales of 687,987 units sold in 90cc-125cc category and 85,610 units sold in 75cc-90cc category. The company has seen an alarming decline of 36.48 percent YoY in the sales of its small scooters, which primarily comprises of Scooty Pep+.

Industry experts attribute this to the migration of Pep+ buyers to the Scooty Zest 110 model, which can also be understood as model-to-model cannibalisation with its portfolio.

In its 110cc scooter portfolio, which comprises of bestsellers such as the Wego and Jupiter, TVS Motor recorded sales of 687,987 units during FY2015-16, marking a growth of 26.20 percent YoY.

TVS Motors’ market share in the 90cc-125cc scooter category stands at 13.92 percent. In the total scooter market covering up all the categories, the company’s share is 15.37 percent.

The number four player in the scooter market is India Yamaha Motor, which sold 318,450 units in FY2015-16. The company registered a YoY growth of 46.78 percent, thanks to the Fascino model which garnered instant popularity among buyers.

Yamaha’s market share in the 90cc-125cc scooter market stands at 6.44 percent.

Falling behind the aggressive Yamaha, Suzuki Motorcycle India’s scooter sales stood at 220,388 units in FY2015-16, a decline of 19.91 percent YoY. Suzuki’s falling sales in this space can be attributed to the absence of new models and facelifts during the year. However, changing that, the company rolled out an all-new Suzuki Access during the Auto Expo in February. Market reports confirm that the model is gaining traction in terms of bookings. The coming months should convey a better outlook of the same.

Mahindra Two Wheelers too reported an increase in its annual scooter sales during FY2015-16. The company sold 84,061 units last fiscal as against 46,261 units in FY2014-15. The improvement in sales is backed by its Gusto model, which saw some acceptance in the market.

The booming scooter market now accounts for 30.58 percent of the overall domestic two wheeler industry (FY2015-16). It stood at 28.17 percent of the overall domestic two wheeler market during FY2014-15.

Honda now largest scooter exporter from India

Scooter exports saw an impressive jump during the last fiscal, growing by 34.72 percent YoY. Total scooter exports stood at 256,273 units during the year. Interestingly, all the scooter manufacturers in India reported a growth in their respective exports barring Hero MotoCorp, which saw a marginal decline.

Leaving Hero behind, Honda is now the largest scooter exporter from India. In FY2014-15, while Hero stood as the largest scooter exporter with 79,956 units, Honda had ranked second with exports of 77,814 units.

However, in FY2015-16, while Hero MotoCorp’s total scooter exports saw a marginal decline of 3 percent YoY, Honda grew its exports by 32.68 percent YoY.

Honda exported 103,242 units in FY2015-16. Hero MotoCorp, on the other hand, reported exports of 77,521 units during the same period. Industry analysts say that Hero’s FY2014-15 scooter exports had surged because of a large, one-time order from Sri Lanka. In FY2015-16, however, the company focused on raising its production capacity and increasing its domestic market share.

Doubling its scooter exports during the last fiscal, TVS Motors’ offshore shipments accounted for 37,722 units as against 16,543 units exported in FY2014-15. The company, nevertheless, reported a severe decline of 76.71 percent YoY in exports of its 70cc-90cc models – only 1,208 units in FY2015-16.

While India Yamaha more than tripled its scooter exports to 22,263 units, Suzuki too reported exports of 8,510 units during FY2015-16. Both companies are looking at aggressively growing their respective export volumes in FY2016-17.

Also read:

- India Sales Analysis: March 2016

- Indian auto industry crosses domestic sales of 20 million units for the first time

RELATED ARTICLES

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

By Amit Panday

By Amit Panday

15 Apr 2016

15 Apr 2016

16528 Views

16528 Views

Ajit Dalvi

Ajit Dalvi