Indian scooter market grows 24% in April-October 2016

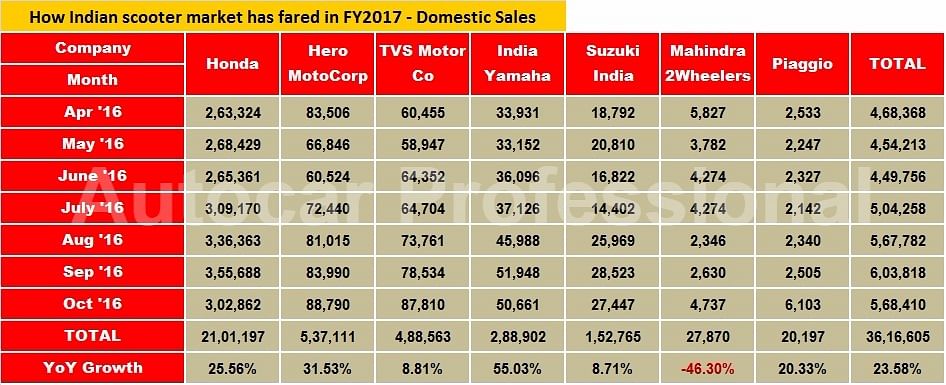

With total sales of 36,16,605 scooters (including all categories – 75cc to 150cc scooters) during the April-October 2016 period, the Indian domestic scooter market has grown by 23.60 percent YoY.

Calendar year 2016, thus far, could be termed as the only year when a scooter brand – Honda Activa – has clearly dominated the most preferred commuting motorcycle, Hero Splendor, in terms of month-on-month sales. Moreover, the rapidly growing scooter market has become top business priority for companies that are looking to efficiently tap the opportunities in this segment.

While Honda Motorcycle & Scooter India (HMSI) is known for prioritising production of scooters over motorcycles each time it faces a capacity crunch, India Yamaha Motor and Piaggio Vehicles are other such examples.

With total sales of 36,16,605 scooters (including all categories – 75cc to 150cc scooters) during the April-October 2016 period, the Indian domestic scooter market has grown by 23.60 percent YoY.

Barring Mahindra Two Wheelers, which is now completely revamping its business strategies going forward, all the other players have recorded healthy YoY growth during the period under consideration.

As expected, most of the companies peaked their sales during the festive months of September and October 2016, with most of them scoring their best performances ever. For example Honda crossed the monthly sales milestone of 350,000 units in September; TVS Motor crossed 87,000 units in October and Yamaha crossed 50,000 units during both the months – all marking their best ever individual monthly sales performances.

Honda sells over 2 million scooters

Having sold more than two million scooters already within the first seven months of the ongoing fiscal, Honda remains the top performing company in the overall scooter segment with a dominating market share of 58.10 percent. It has sold 21,01,197 scooters in the domestic market between April-October 2016, and has recorded a YoY growth of 25.56 percent.

It is interesting to note that the company, for the first time in its Indian operations, has achieved the monthly scooter sales milestone of 300,000 unit mark in July 2016. It continues to sell more than 300,000 scooters every month between July-October 2016.

Honda’s popular Activa scooter brand has recently achieved cumulative sales mark of 10 million units. Other than the Activa, the Dio and Aviator models continue to remain popular among young urban buyers.

Honda has added yet another milestone to its Indian operations this year. The company, which had commenced operations at its Gujarat-based scooter-only manufacturing unit around mid-February 2016, peaked the total production capacity of 1.2 million units (via two assembly lines) in August 2016.

While this feat was historical, as arguably no other scooter-only plant of its scale in the world has ever reached peak capacity within six months of commencement of its operations, it also highlights the rapid pace of scooterisation in India.

Hero marks healthy 32 percent growth

Hero MotoCorp, the number two player in the overall domestic scooter segment, has registered total sales of 537,111 scooters during the same period, up by 31.53 percent YoY. The company, for the seven-month period, has a market share of 14.85 percent in the overall domestic scooter market.

The company received instant gains from its latest 110cc scooter models, the Duet and the all-new Maestro Edge, which were launched last year. Garnering healthy sales volumes, while both the models soon entered into the list of India’s top 10 bestselling scooters, they also helped Hero MotoCorp grab crucial market share in the hotly contested segment.

Also, the company was reportedly grappling with scooter production capacity constraints last year, with only 75,000 units per month. According to Autocar Professional, Hero MotoCorp’s current scooter production capacity would be around 100,000 units per month, if not more.

Recently, Hero MotoCorp has invested Rs 180 crore in the Bangalore-based startup Ather Energy. Ather is known for developing an all-electric smart scooter for urban commuters. The company plans to roll out its first product(s) next year.

TVS Motor Co closes gap with Hero MotoCorp

Marching ahead steadily, TVS Motor Company recorded total domestic sales of 488,563 scooters during the April-October period, which marked a YoY growth of 8.81 percent. The Chennai-based company, which is known for its strong R&D capabilities, commands a market share of 13.51 percent in the overall scooter market. This clearly indicates that TVS is not far behind Hero MotoCorp in the scooter segment.

It is understood that, besides Jupiter, TVS Motor is marred by the absence of a second successful scooter brand that otherwise could have contributed to an additional monthly volume of more than 20,000 units to surpass Hero MotoCorp and become the second largest player in the segment.

The Jupiter, which has currently stabilised with monthly sales volume in the range of 45,000–55,000 units, is India’s second most-selling scooter brand.

Autocar Professional, last week, broke the story on TVS Motor planning to foray into the 125cc scooter segment, which potentially could be rolled under an all-new scooter brand. The story clearly highlighted TVS Motor’s attempt to establish another successful scooter thereby filling the crucial volume gap with Hero MotoCorp.

India Yamaha Motor grows by 55 percent

Taking a commendable leap, India Yamaha recorded sales of 288,902 scooters during the seven-month period, up by 55.03 percent. The company, which is gunning for a market share of 10 percent as early as December 2016, holds a market share of 7.99 percent in the overall scooter market during April–October.

The company recently had a recall for its Fascino and Ray scooter models. During the festive months, the Fascino and Ray together accounted for monthly sales of more than 45,000 units.

In a recent interaction with Autocar Professional, Roy Kurian, VP, marketing & sales, Yamaha Motor India Sales, said: “We plan to establish the Fascino as one of the top three scooters in India in terms of its recall value at the time of purchase by any buyer.”

All-new Access 125 peps up Suzuki

Suzuki Motorcycle India (SMIL) has reported total sales of 152,765 units during the period, up by 8.71 percent YoY. The company was earlier struggling to sell 20,000 units per month. However, this dramatically changed after it rolled out the all-new Access 125 model earlier this year.

The popular model, which has singlehandedly contested against Honda’s Activa in the family scooter market for close to a decade, is now selling around 25,000 units for the past few months.

It is understood that Suzuki still retains its leadership in the 125cc scooter segment, which sees participation from Honda’s Activa 125 and Vespa 125 models.

Piaggio Vehicles bank on Aprilia SR150

Piaggio Vehicles, which owns the Vespa, Aprilia and Moto Guzzi brands worldwide, stands with lowest volumes for the April-October 2016 period. This is because it sells the most expensive line-up of scooters in the market under the Vespa brand.

During April–October period, Piaggio has reported sales of 20,197 scooters, marking growth of 20.33 percent YoY.

Nevertheless, the company has recently debuted the SR150 under its Aprilia brand, which has been attractively priced for its features. The company now hopes to make deeper inroads into the scooter segment with its Aprilia brand.

Overall scooter market stood 31.91 percent of the total two-wheeler market (including mopeds) in India between April-October 2016. In contrast, it was 29.94 percent of the total two-wheeler market in India for the corresponding period of the last financial year.

Honda largest, TVS Motor second largest scooter exporter

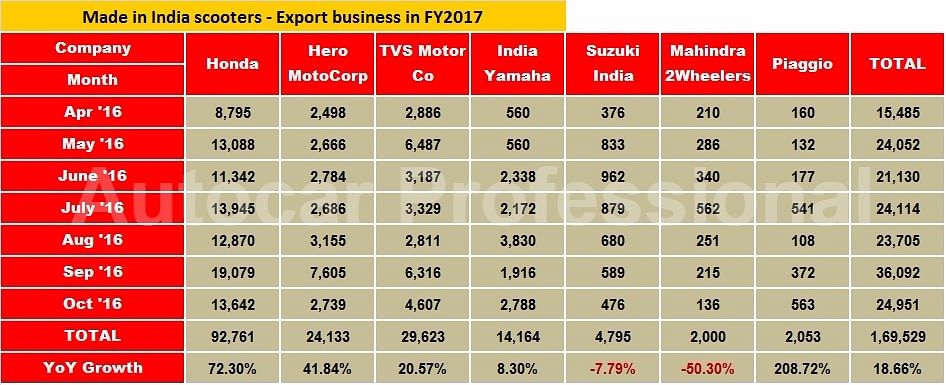

The overall scooter export business has also seen a boost so far this year with total exports being 169,529 units until October 2016, up by 18.66 percent YoY.

HMSI’s performance on the export front too has been commendable so far in this financial year. It has exported 92,761 scooters during the seven-month period, marking a growth of 72.30 percent YoY.

Turning out to be the second largest scooter exporter from India, TVS Motor has shipped out 29,623 units between April-October, up by 20.57 percent YoY. Hero MotoCorp stood third with total scooter exports of 24,133 units, up by 41.84 percent YoY.

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

By Amit Panday

By Amit Panday

15 Nov 2016

15 Nov 2016

11289 Views

11289 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal