Indian CV sector posts muted sales in FY2016-17

Having motored smoothly till October 2016, the sector first bore the brunt of demonetisation and then not-so-good pre-buying ahead of the BS IV upgrade.Sales results of four OEMs reveals a 3.4 percent YoY growth.

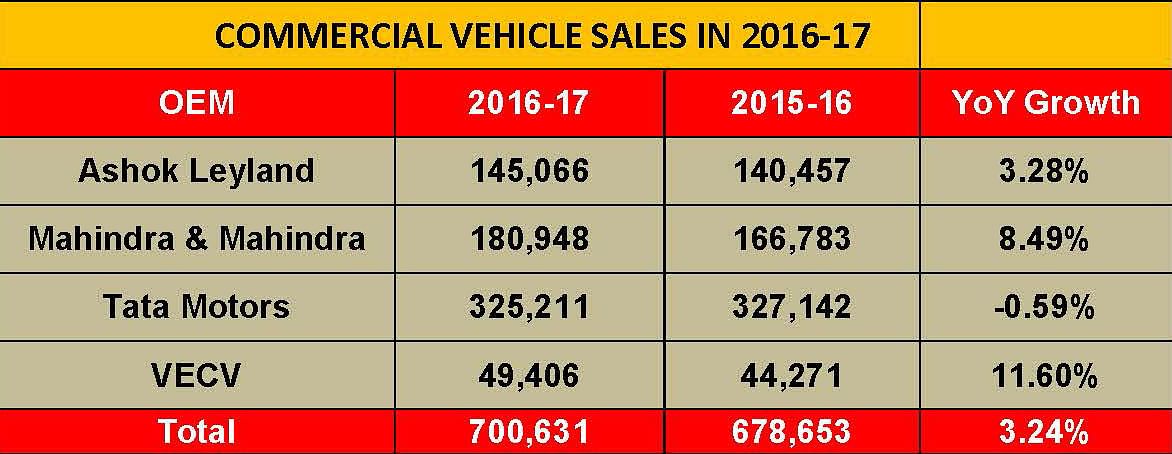

As commercial vehicle OEMs declare their results for March 2017, it is amply clear that the sector will have closed the just-ended fiscal year 2016-17 with muted sales numbers. Sales results of four leading OEMs reveals a 3.4 percent YoY growth.

While the CV industry was motoring along quite smoothly thanks to replacement-led demand till end-October 2016 with total sales of 399,000 unit and YoY growth of nearly 7 percent, it was buffeted strongly by the wind of demonetisation and more recently by the mandatory shift to BS IV. CV players also saw sales slow down as buyers delayed their fleet expansion plans expecting that the upcoming GST may bring down vehicle prices.

As per our CV industry analysis of overall sales of both small CVs and medium and heavy commercial vehicles (M&HCVs), Tata Motors, the leader in the field, has been impacted the most and has posted flat sales. In 2016-17, the company sold a total of 325,211 units, down 0.59 percent on year-ago sales of 327,142 units. The pressure would have been felt on M&HCVs.

In an interview last month, Ravi Pisharody, executive director (commercial vehicles), Tata Motors, told Autocar Professional that he expected total industry volume to "be close to last year (FY2016)". Last year, sales (wholesale) of M&HCVs in the domestic market stood at 302,000 units (Trucks: 258,488, Buses: 44,000), or a growth of 30 percent over FY'15. "It's not been a bad year, just that it's been unpredictable," he said.

The tipper segment is currently driving M&HCV sales, while weak demand for long-haul cargo trucks is a worry for Tata Motors. According to the company, the demonetisation drive took away the steam from the market "for at least three months". For a few weeks after the announcement of the demonetisation drive on November 8, operators in the cargo segment were "completely paralysed" as they depend largely on cash for regular operations of trucks. This led to companies cut down production of trucks. The impact has largely gone away but for the M&HCV market's drive to be stable again, it may take another 6 months or so. "Post BS IV and GST (implementation), it may a bit uncertain. But after that I really expect the market to be quite strong for the next two, two-and-a-half years," said Pisharody.

Ashok Leyland, the second largest CV OEM, has sold a total of 145,066 units in 2016-17, which marks a growth of 3.28 percent (2015-16: 140,457). As a result of its M&HCVs maintaining higher growth levels through the year, the company closed the fiscal on a positive note.

Mahindra & Mahindra, which has a strong presence in the small commercial vehicle segment, has registered overall growth of 8.49 percent. However, as a result of the Supreme Court banning sale of BS III vehicles from April 1, 2017 in the new BS IV regime across the country, the company will have suffered losses. In a statement to the Bombay Stock Exchange on April 3, M&M said it has an inventory of around 18,000 vehicles from two-wheelers to trucks. While it may be able to export some of these vehicles and convert some to BS-IV (at Rs 3,000-4,000 for some SCVs and Rs 200,000 for HCVs), some of the vehicles can neither be exported nor converted to BS-IV.

VE Commercial Vehicles sold a total of 49,406 units in 2016-17 to record 11.60 YoY growth. The company continues to have a strong presence in the ICV segment and is looking to step up its presence in the HCV segment with its Pro Series range.

BS IV: One country, one fuel

Starting April, the automotive industry across segments has moved to BS IV emission norms with the fuel being made available countrywide. This transition has had the biggest impact on the M&HCV segment, as most OEMs catering to the other segments – passenger vehicles, two-wheelers and three-wheelers – had upgraded their products to the new norm.

Given the transition to BS IV, CV makers were expecting a windfall of higher sales in March 2017 as a result of pre-buying but the numbers are not very encouraging. According to ICRA, “With transition to BS IV from April 2017, the industry was expected to witness pre-buying in the last quarter as vehicles complying with new emission norms can be 6-10 percent more expensive because of technology upgradation. Although the industry growth recovered in January-February 2017, the extent of recovery has been below expectations. Subdued economic activity along impending GST implementation in the near-term has prompted fleet operators to defer fleet expansion or renewal plans.”

The ratings agency adds, “The Indian CV industry is expected to end 2016-17 with a marginal growth of 5-6 percent in comparison to 11.5 percent witnessed in the prior year. Confluence of factors including waning replacement-led demand, weak cargo availability from industrial sectors and uncertainty related to effective taxation on CV industry under the GST regime were the key factors that contributed to the slowdown. The domestic CV volumes took a further hit after November 2016 when the government’s demonetisation move put the brakes on the operations of the road logistics sector which depends heavily on cash transactions’, notes ICRA.

ICRA predicts that the CV industry is likely to witness 6-8 percent growth in FY2018 aided by higher budgetary allocation towards the infrastructure and rural sectors. Potential implementation of a scrappage programme will also trigger replacement demand.

Given the Supreme Court ruling, the industry saw industry rush to clear BS III inventory as OEMs were left with no choice. These distress sales will impact OEMs as most have offered large discounts, thereby denting profitability.

According to CRISIL, “Commercial vehicle makers disposed off over half their stock of BS-III vehicles before the Supreme Court-set April 1, 2017, deadline. The discounts and incentives on vehicles sold till March 31, 2017, are expected to have cost them about Rs 1,200 crore. Additionally, Rs 1,300 crore would be incurred to dispose off the unsold inventory.”

CRISIL Research estimates the impact of this on the EBIDTA margins of listed truck makers (Ashok Leyland and Tata Motors’ standalone) to equal around 2.5 percent of their revenues. The impact would be staggered across FY2017 and FY2018, because the unsold inventory will have to be brought back from dealerships and then dealt with.

HOW THE COMPANIES FARED IN MARCH 2017

In the monthly sales for March 2017, Tata Motors’ overall commercial vehicles sales declined by 6 percent to 35,876 units. M&HCV sales fell 5 percent YoY at 17,648 units although bus sales grew 26 percent, thanks to STU orders. According to the company, the wholesale figures of CVs were affected by the Supreme Court ruling on March 29, leading to confusion and consequent focus at the dealer level to increase retail and also to reduce the levels of unsold stock. LCV sales also declined, by 8 percent to 18,228 units (March 2016: 19,777 units).

Speaking on the sales performance, Vinod K Dasari, CEO and MD, Ashok Leyland, said, "We are happy to have achieved an overall growth of 12 percent during March 2017 and a growth of 3 percent for FY2017, despite various challenges. The last financial year was significant for us considering the number of new product launches, which were well received by our customers, expansion of dealerships in North and East, and the opening up of an assembly unit in Dhaka and offices in Dubai and Bangladesh.”

Commenting on the Supreme Court's BS III verdict, he added, “The industry has been affected by this unexpected outcome. However, at Ashok Leyland we are currently working on minimising the impact of this decision.”

Ashok Leyland’s total sales remained positive, growing by 12 percent YoY at 18,682 units (March 2016: 16,702). Similarly, its M&HCV sales were also up, growing by 15 percent to 15,258 units (March 2016: 13,240 units). LCV numbers were down marginally by 1 percent to 3,424 units (March 2016: 3,462).

Mahindra & Mahindra’s total CV sales saw a substantial increase of 31 percent at 22,908 units (March 2016: 17,438). M&HCV sales rose 67 percent to 1,471 units (March 2016: 879). While the below-3.5T GVW products maintained strong double-digit growth with a 29 percent increase with sales of 20,334 units (March 2016: 15,729), those in the above-3.5T GVW segment continued to post strong sales – up 33 percent at 1,103 units (March 2016: 830 units).

VE Commercial Vehicles’ overall sales in March 2017 were 6,410 units, up 7.84 percent (March 2016: 5,944 units).

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

04 Apr 2017

04 Apr 2017

17261 Views

17261 Views

Shahkar Abidi

Shahkar Abidi