Indian CV makers post export gains in current fiscal

Despite two years of a prolonged downturn in the domestic commercial vehicle (CV) market, exports have helped soften the blow for some of the key players in the last 11 months of the ongoing fiscal year.

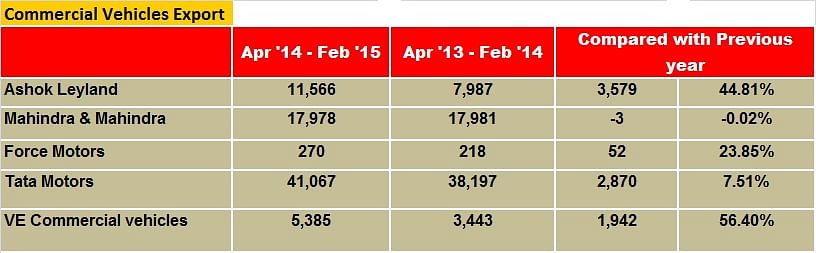

Even as the sales tide is turning positive for the medium and heavy commercial vehicle (M&HCV) sector in the domestic market, exports of commercial vehicles have helped soften the impact of the prolonged two-year slowdown for some of the key OEMs in India. In the past 11 months of the ongoing fiscal year (April 2014-February 2015), leading manufacturers like Ashok Leyland, Tata Motors and VE Commercial Vehicles have recorded exportt-led gains.

The latest figures from industry body SIAM reveal that the Indian CV industry exported a total of 76,599 vehicles and posted a 12.37 percent year-on-year increase.

Tata Motors, which exports its buses and trucks to various markets including Africa, the Middle East, South East Asia and South America, despatched 41,067 units to notch 7.51 percent growth YoY. The company is aggressively pushing its Prima range for exports. Yesterday, it announced that it had launched the Prima range in the UAE and Oman markets.

Ashok Leyland has shipped 11,566 vehicles abroad during this period, marking 44.81 percent growth. The company, which is the fourth largest bus maker in the world, has a clear focus on the export market. It has identified seven clusters – Latin American, CIS countries, SAARC, the Middle East, ASEAN, South Africa and the rest of Africa – for exports. Incidentally Ashok Leyland has a bus assembly operation at Rasal Khaimah, in the Middle East.

VE Commercial vehicles, a strong player in the medium duty segment, has seen its exports rise by 56.40 percent to 5,385 units. The recently launched Pro range of trucks is seeing good demand.

While Force Motors exported 270 units during the period with a growth of 23.85 percent, Mahindra & Mahindra, which largely exports its small commercial vehicles like the Maxximo, Genio, Bolero Maxi Truck and Bolero CV derivatives, exported 17,978 units registering flat growth.

Daimler India Commercial Vehicles (DICV) also banks on exports. In July 2014, the company rolled out its first left-hand drive (LHD) Fuso trucks for export markets from its facility at Oragadam, near Chennai. As part of the first wave of export markets, DICV-made Fuso trucks have already exported to Sri Lanka, Bangladesh, Indonesia, Kenya, Zambia, Zimbabwe, Tanzania and Brunei. According to Daimler, the Fuso trucks have been well received by customers thanks to a strong distribution and service network. DICV sales numbers, however, are not available as the company does not figure in the SIAM manufacturer index.

Automotive component suppliers to the CV industry are also optimistic of growing exports. In a recent interview to Autocar Professional, Jacques Esculier, global chairman & CEO, Wabco, said: "India is a very important market (for us). Plus, we believe truck manufacturers would grow increasingly outside as exporters. So we want to accompany those manufacturers everywhere to export so this business is really essential."

Overall, what’s amply clear is that manufacturers are aggressively targeting increased exports. What is helping them is the fact that the big players have begun rolling out new-generation trucks which are high on technology and driver comfort, essential requirements for foreign markets.

RELATED ARTICLES

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

Maruti Wins in Mid-SUV Space with New Models

Maruti Suzuki’s UV1 volumes nearly doubled in four months. The cause is not the GST cut — it is a deliberate product por...

20 Mar 2015

20 Mar 2015

7420 Views

7420 Views

Arunima Pal

Arunima Pal

Shruti Shiraguppi

Shruti Shiraguppi