AUGUST SALES ANALYSIS: Cess hike fears drive PV sales, smart gains for CVs and Two-Wheelers

All the vehicle segments and sub-segments, other than passenger-carrying M&HCVs and LCVs, are in the black and indicative of good traction in the market, the spoiler of an additional GST cess notwithstanding.

While PV sales in July rose to a record high thanks to GST-driven price reductions, buyers rushed to buy midsized cars and SUVs ahead of the new GST cess kicking in. The good news though is that rural demand has bounced back for CVs and two-wheelers.

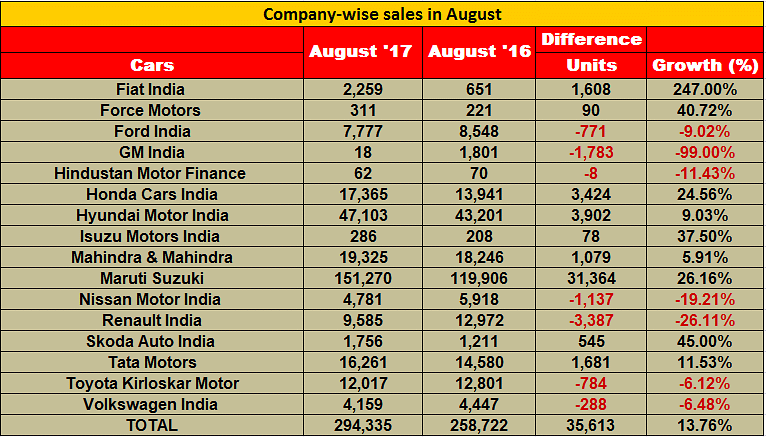

It was known, even before SIAM revealed the monthly sales numbers for August 2017, that the overall passenger vehicle (PV) sales were going to be of the august type. If in July 2017, domestic PV industry came close to crossing the 300,000 unit mark (298,997 / +15.12%), then overall sales in August 2017 were close at 294,335 units (+13.76%). That’s because customers plonked their money on their favourite models, benefiting from handsome GST-driven price cuts before the new, additional GST cess – between 2-7 percent – kicked in on September 11.

Overall numbers, at 2,302,158 units sold and a year-on-year growth of 14.49 percent, are the best yet this year. All the vehicle segments and sub-segments, other than passenger-carrying M&HCVs and LCVs, are in the black and indicate growth momentum.

Sales of passenger cars stood at 198,811 units, registering a growth of 11.80 percent (August 2016: 177,829). While this is still some distance away from the best-ever numbers which industry had seen in March 2012 (233,151), consumer demand for UVs continues to gain momentum – 78,664 units (+19.62%) compared to sales in August 2016 (65,760 units). The UV segment had seen record sales in July 2017 at 86,874 units, owing to pent-up demand in June getting fulfilled, topped with huge taxation benefits of up to 12 percent with the new GST regime kicking in on July 1, 2017. The van segment continues to grow and saw sales of 16,860 units (+11.30%) last month, as opposed to the 15,148 units sold in August 2016.

According to Vishnu Mathur, director general, SIAM, “The PV numbers could be ascertained to remain sustainable hereon because the basic economies have become right. The interest rates are good; the rural market, which contributes 30 percent to total PV sales, is back on track with higher disposable incomes after demonetisation, and consumer sentiment ahead of the festive season is looking good as well. We hope this demand to continue through the rest of the year.”

Commenting on the 2-7 percent hike in maximum applicable cess on cars, Mathur said, “With the government’s increment in implemented cess on automobiles, the industry is again more or less at the pre-GST stage, with large cars still placed with a benefit of 1-2 percent. The OEMs will have to work on their prices once again. Now with the new cess rates, we hope the structure sticks the same for at least a year, without being modulated any further.”

MARUTI MAINTAINS ITS STRANGLEHOLD

Maruti Suzuki India, which posted its highest-ever monthly sales in July 2017 (153,298 units / +21.9%), has clocked another month of robust sales. In August 2017, the carmaker sold a total of 151,270 units (+26.2%), showing there’s little the competition can do to impact the company’s stranglehold on the domestic market.

Other than flat sales for the entry-level hatchback duo of the Alto and Wagon R, which sold 35,428 units, down 0.2 percent (August 2016: 35,490), overall numbers for other segments are all up. Demand for the five compact cars (Swift, Celerio, Ignis, Baleno and Dzire) soared 62.4 percent to 74,012 units (August 2016: 45,579), which is indicative of strong demand for the premium Baleno hatchback and the new Dzire sedan. It may be recollected that the Baleno, the largest of the company’s hatchbacks which comes with ABS and dual airbags as standard across the 11-variant range, sold a total of 19,153 units in July 2017, its best-ever monthly total since launch in October 2015.

Meanwhile, monthly sales of the Ciaz premium sedan seem to be settling down in the 6,000 unit range. The car sold a total of 6,457 units last month, up 3.9 percent (August 2016: 6,214), a pointer to the fact that the Ciaz's sales shift to the premium Nexa retail channel is working. The Ciaz posted its best-ever monthly sales in April 2017 (7,024). Overall passenger car sales for Maruti at 115,897 units marked 28.4 percent growth (August 2016: 90,629).

Utility vehicles – Gypsy, Ertiga, Vitara Brezza and S-Cross – as usual provided firepower for monthly sales: at 21,442 units sold and 27.6 percent YoY growth (August 2016: 16,806). Bringing up the rear were the two vans, the Omni and the Eeco which together sold 13,931 units, up 8.6 percent (August 2016: 12,831).

Meanwhile, Hyundai Motor India, the No. 2 PV player in the country, sold 47,103 units in August 2017, registering growth of 9 percent (August 2016: 43,201) and its best monthly sales yet in this calendar year. Commenting on the sales, Rakesh Srivastava, director - Sales and Marketing, said, “Hyundai volumes at 47,103 units grew by 9 percent on the strong acceptance of the next-gen Verna with more than 7,000 bookings within 10 days of launch along with strong demand for the Grand i10, Elite i20 and Creta in a market fueled with speculations on the GST cess increase and challenges posed by floods in many states.”

Mahindra & Mahindra sold a total of 19,325 units in August 2017, which marks 6 percent YoY growth (August 2016: 18,246). This comprised 18,255 UVs (+7%) and 1,070 cars and vans (-5%). Rajan Wadhera, president, Automotive Sector, M&M, said: “We are happy with our performance in August. Our passenger vehicles grew by 6 percent and our overall sales grew by 4 percent. Our brands continue to gain traction despite several external challenges. As we get into festive season, we are confident of a good growth over the next couple of months.”

Honda Cars India seems to be on a dream run. The carmaker sold 17,365 units in August 2017, up 25 percent (August 2016: 13,941). The company has been maintaining strong sales momentum and has sold 73,012 units during April-August 2017 with a cumulative growth of over 22 percent (April-August 2016: 59,821).

In August, the City sedan wrested back its numero uno position from the WR-V, which had beaten it in July. The City sold 5,538 units, followed by the WR-V (5,200), Jazz (2,747), Amaze (1,928), BR-V (1,247), Brio (640), CR-V (55) and the Accord Hybrid (10).

Yoichiro Ueno, president and CEO, Honda Cars India, said, “Honda Cars India continues to record strong sales in August led by the City and WR-V. Festive purchases have already begun in some parts of the country and we expect the festival season to further boost our sales numbers in the next two months.”

Tata Motors registered total sales of 14,340 PVs, comprising 11,462 cars and 2,878 UVs. This marks a 10.29 percent YoY growth (August 2016: 13,002). While strong demand for the Tiago hatchback and Tigor compact sedan bolstered passenger car sales, the Hexa crossover was the UV sales accelerator.

Toyota Kirloskar Motor, which notched handsome sales in July, did not manage the same in August. At 12,017 units, numbers were down 6 percent (August 2016: 12,801). The company says it witnessed a 40-50 percent jump in customer orders last month following the announcement about the potential GST cess hike. While enquiries continue to be significantly high, the company has not been able to cater to the enhanced demand due to production constraints. According to N Raja, director and senior VP, Sales & Marketing, Toyota Kirloskar Motor, “Our sales numbers are not truly reflective of the existing customer orders. After the announcement on potential cess hike, there was a considerable rise in customer enquiries and orders. Yet we had production limitations which held us back from catching up with the high demand. Due to holidays in August, we further had the constraint of lesser number of production days. With demand on the rise, the current waiting period for the Innova has gone up to around 6-8 weeks and the Fortuner to around 10-12 weeks. We are trying our best to bring down the waiting period."

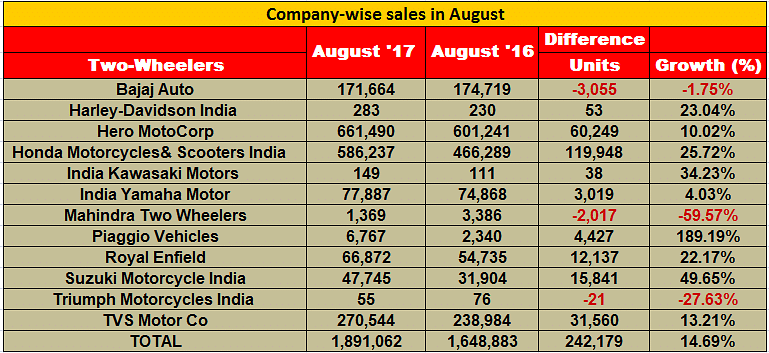

TWO-WHEELER SALES REV UP

Demand for two-wheelers is back on its growth trajectory, thanks to the early arrival of the festive season this year, above-average rainfall across major parts of the country clubbed with the positive sentiment prevailing in the market. As a result, August 2017 has turned out to be one of the best performing months for the Indian two-wheeler industry since the festive season last year.

The highlights of the last month’s performance include Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), Royal Enfield and Suzuki Motorcycle India recording their best-ever monthly sales.

Bajaj Auto and India Yamaha Motor, however, reported numbers that are not at par with the current industry growth.

Market leader Hero MotoCorp has reportedly clocked its highest-ever sales for any single month in August 2017. It sold total of 678,797 units including exports (17,307 units) for the month. Domestic sales at 661,490 units were up 10.02 percent. Hero’s previous highest monthly performance was in September 2016 (674,961 units). August 2017 marked the fourth consecutive month when Hero MotoCorp has managed to sell more than 600,000 units.

The company aims to further consolidate its position during the festive months of September and October. It is learnt that the market leader has already started preparing for the required inventory levels to meet the surging demand. Notably, it aims to launch about six new models that would include a 125cc scooter and 200cc premium motorcycle for urban commuting.

Recording its best-ever sales for any month, Honda Motorcycle & Scooter India (HMSI) sold 622,180 units (including exports) in August 2017, the first time that it has breached the 600,000-unit sales mark. On the domestic front, HMSI sold 586,173 units (growing by 25.72 percent YoY), which is also its best-ever performance in India.

The company claims that its scooter and motorcycle sales have recorded all-time high numbers in August, which marked the commencement of the festive season.

HMSI sold 191,944 motorcycles, recording a YoY growth of 48 percent (August 2016: 129,926) and 394,229 scooters, up 17 percent YoY (August 2016: 336,363 scooters). Expanding its production capacity further, Honda has recently added the fourth assembly line at its Narsapura plant (near Bangalore). While this increased the annual production capacity from 5.8 million units to 6.4 million units, India has now become the largest production hub for the Honda’s global two-wheeler business.

TVS Motor Company sold 270,544 units last month, up by a stable 13.21 percent YoY. Its scooter sales grew by about 49 percent from 76,572 units in August last year to 114,354 units in August 2017. Motorcycle sales, on the other hand, were marginally down at 111,927 motorcycles compared to 114,195 units in August 2016.

Addressing this mild decline and to ensure that its motorcycle sales pick up as the festive season approaches, the company has now rolled out the updated version of its 110cc mass commuter motorcycle, TVS Star City+. It primarily competes with Honda’s Dream series and Livo models, Bajaj Auto’s Platina range, Hero’s Splendor iSmart 110, Yamaha Saluto RX and other models.

TVS Motor is also planning to launch its first-ever hybrid vehicle in December this year followed by pure electric vehicle(s) by March-April 2018. The company is also understood to be readying up at least two all-new two-wheeler models – a 125cc scooter and 310cc motorcycle – based on its alliance with BMW Motorrad for launch in the ongoing fiscal.

Bajaj Auto, the fourth largest two-wheeler company in India, recorded sales of 171,664 units, marginally down by 1.75 percent YoY. The company had sold 174,719 units in August last year. To boost its domestic sales, Bajaj Auto recently rolled out the electric start variant of its 100cc mass commuter CT100, which sits in the entry-level segment. Bajaj Auto’s CT100 models are also one of the most affordable 100cc motorcycle models in the domestic market. The company is also understood to roll out the updated Pulsar line-up later this year to boost its domestic sales.

India Yamaha Motor has reported sales of 77,887 units (including Nepal) in August, up by 4.03 percent. Focusing on the premium category, the company has recently launched the single-cylinder, 249cc, 20bhp Fazer 25, which borrows the powertrain from FZ 25 launches earlier this year.

Continuing its streak of month-on-month growth, Royal Enfield registered its best-ever sales of 66,872 units in August 2017, up by 22.17 percent YoY (August 2016: 54,735). The company has recently commenced production at its third manufacturing facility at Vallam Vadagal near Chennai. Royal Enfield’s combined production capacity now stands at 825,000 units across the three plants for FY2017-18.

Suzuki Motorcycle India too has reported its best-ever monthly performance with sales of 56,745 units last month, up by a commendable 78 percent YoY. The company is targeting annual sales of half a million units in FY2017-18 in the domestic market. Suzuki has evidently done well so far this fiscal, thanks to its bestselling models, Access 125 and the Gixxer range.

The two-wheeler industry – like the PV and CV segments – is expecting further growth in the festive months of September and October. It remains to be seen how Hero and Honda’s rivalry shapes up, if Bajaj Auto manages to restore its domestic growth, and whether Royal Enfield breaches the 75,000 unit mark for the first time during the forthcoming festive season. Exciting times ahead. Stay tuned.

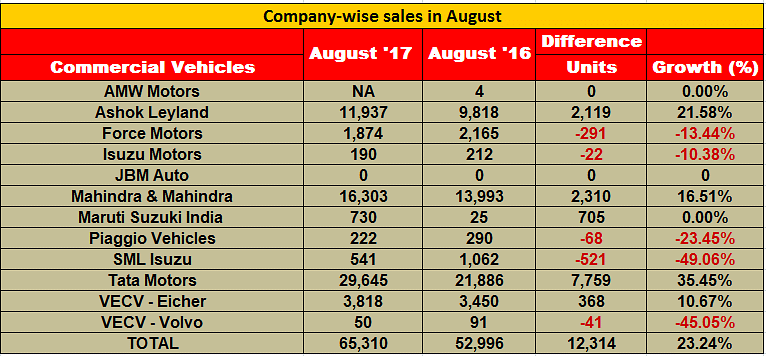

COMMERCIAL VEHICLE SALES SHIFT INTO GROWTH MODE

There's good news on the commercial vehicle industry front. After a tepid Q1, growth continued for the second straight month in August. All the key OEMs have clocked sizeable growth. Importantly, sales of the critical medium and heavy commercial vehicle (M&HCV) sector have maintained an upward trajectory. If there is a concern, then it relates to slow sales of M&HCV buses and LCV passenger carriers.

The higher overall growth indicates that OEMs have been able to address bottlenecks in the supply chain and streamline their BS IV production. It also appears that fleet operators are now gradually upgrading their fleets as their initial concerns pertaining to BS IV vehicles efficiencies, production ramp-up and uncertainty about prices after GST have now largely been addressed.

The past two months' sales have given the much-needed impetus to CV sales and manufacturers are anticipating growth to remain intact, fingers firmly crossed. With the festival season having just begun, they are hoping overall CV buying in the country will improve. The uptick in infrastructure spending and higher construction activities also driving higher tipper sales; this trend is likely to continue further helping the overall M&HCV segment's growth.

In its outlook for FY2018, ratings agency ICRA expects the M&HCV truck segment to grow by 6-8 percent, LCVs by 7-8 percent and buses by 7-9 percent. According to ICRA, higher budgetary allocation towards the infrastructure and rural sectors, scrappage program, NGT’s ban to drive replacement demand, and also stricter compliance with respect to overloading and vehicle dimension (for specific applications i.e. car carriers) will help drive demand for additional vehicles in the M&HCV segment in FY18.

Tata Motors’ CV sales rose 34 percent at 31,566 units (August 2016: 23,464) due to the continued ramp-up in production of BS IV vehicles since April. Tata M&HCVs posted strong growth of 52 percent at 10,926 units (August 2016: 7,190), mainly due to increasing acceptance of SCR tech and stricter implementation of norms on overloading, as well as sector-specific (trucks and construction tippers) demand. Its I&LCV truck sales were up by 44 percent at 3,881 units (August 2016: 2,703).

Passenger carrier sales (including buses) were down 4 percent at 4,078 units (August 2016: 4,238) due to delay in procurement from STUs. SCV cargo and pickups sold 12,681 units, up 35 percent (August 2016: 9,377) as demand for new products like the XL range of Tata Ace and the Xenon Yodha pickup rose.

Ashok Leyland saw smart growth at 25 percent at 13,634 units (August 2016: 10,897.) Its M&HCV sales rose 29 percent to 10,567 units (August 2016: 8,201) while LCVs posted 14 percent YoY growth at 3,067 units (August 2016: 2,696).

Mahindra & Mahindra’s numbers were up 17 percent to 16,303 units (August 2016: 13,993). M&HCV sales rose 45 percent to 538 units albeit on a low year-ago base (August 2016: 371). The below-3.5T GVW segment grew 18 percent YoY at 15,346 units (August 2016: 13,049), while those in the above-3.5T GVW segment turned negative, down by 27 percent with sales of 419 units (August 2016: 573).

VE Commercial Vehicles’ sales were up 10.67 percent at 3,818 units (August 2016: 3, 450 units). It will be looking to drive numbers with its recently launched Pro 5000 Series of trucks. Speaking to Autocar Professional, Vinod Aggarwal, MD and CEO, said, “The Pro 5000 series trucks have been received well by customers and with the old VE Series trucks, Pro 6000, Pro 8000 range and now the Pro 5000 Series, we have products across every price point, applications and every customer need with the widest range of engines equipped with both EGR and SCR technologies."

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Autocar Professional Bureau

By Autocar Professional Bureau

11 Sep 2017

11 Sep 2017

7665 Views

7665 Views

Ajit Dalvi

Ajit Dalvi