Indian auto industry sales grow 2.27% in April-December 2015

The highlights of the first three quarters is that seven out of 12 vehicle sub-segments see growth in April-December 2015 and also the export of the first batch of 116 quadricycles by Bajaj Auto.

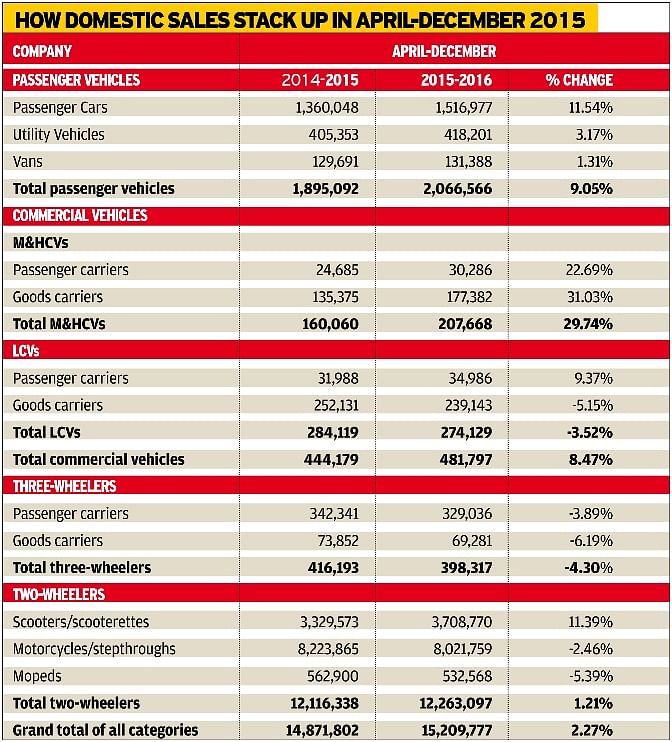

Overall sales numbers in the first three quarters of fiscal year 2015-16 have saved the blushes for the Indian automobile industry. While December 2015 sales across segments are down 0.17 percent to 1,502,314 units. cumulative sales in April-December 2015 are up 2.27% with sales of 15,209,777 compared to 14,871,802 units in April-December 2014. The first three quarters of 2015-16 see seven out of 12 vehicle sub-segments posting growth and also the export of the first batch of 116 quadricycles by Bajaj Auto.

Sales of the passenger vehicle (PV) segment grew by 9.05% in April-December 2015 to 2,066,566 units compared to the same period in 2014. Within the PV segment, passenger cars, utility vehicles and vans grew by 11.54%, 3.17% and 1.31% respectively during April-December 2015 over the same period in 2014. The overall Commercial Vehicles segment registered a growth of 8.47% in April-December 2015 year on year. This is thanks to the smart growth of medium and heavy commercial vehicles, which registered a rise of 31.38% (481,797 units). However, sales of Light Commercial Vehicles continued to lag and registered a decline at (-) 3.52% with sales of 274,129 units.

Another laggard was the three-wheeler segment as sales declined by (-) 6.60 percent (398,317 units) in April-December 2015 over the same period in 2014. While the goods carrier sales declined by (-) 6.58 percent, the passenger carrier sales were up 9.37 percent in the first three quarters of the fiscal.

Growth in the two-wheeler segment was once again marred by a decline in motorcycle sales. The segment registered a marginal growth at 1.21 percent during April- December 2015 (12,263097 units) over April-December 2014. Within the segment, scooters grew by 12.44 percent while motorcycles and mopeds dropped by (-) 2.46 percent and (-) 5.39 percent respectively.

While a host of factors might have weighed on the automotive industry in 2015, the new year is set to further the pace of growth. A high build-up in manufacturer activities, new vehicle introduction momentum, falling cost of ownership, increased government spending and growing urban incomes are likely to shape up the fortunes of the Indian automotive industry in 2016.

HOW THE CARMAKERS FARE

For the April-December 2015 period, passenger car manufacturers have clocked 9.05% year-on-year growth, selling a total of 2,066,566 units. Maruti Suzuki India, which has an overwhelming 52.77% market share, has sold 971,958 cars (+13.87%) during this nine-month period and is nearing the million mark for the fiscal. Hyundai Motor India, with sales of 364,391 units, has clocked 17.90% YoY growth. Mahindra & Mahindra, with sales of 163,616 units, has seen flat growth of 0.14% while Honda Cars India has posted 10.17% growth on its sales of 144,474 units. Tata Motors sales of 112,030 units is down 1.99% while Toyota Kirloskar Motor, with 102,034 units sold, is down 1.48% YoY. Ford India has sold 59,856 units to record 4.40% growth while Nissan Motor India’s sales are down 18.69% on 28,493 units sold. Renault India, thanks to rising sales of the Kwid, has sold a total of 42,443 units, up 32.72%. VW India, which has been hit by the emissions scandal, sold 30,996 units between April-December 2015, down 5.65% YoY.

COMMERCIAL VEHICLES SEE 11.45% GROWTH

The CV sector, thanks to M&HCVs posting a near-30 percent YoY growth, has risen by 8.47% to register overall sales of 481,797 units in April-December 2015. The LCV numbers though continue to plod, down 3.52 percent at 274,129 units.

Tata Motors, the biggest player, sold a total of 212,015 units but saw flat growth, pulled down mainly by the decline in its LCV sales. Ashok Leyland sold 86,869 units to record 42% growth while VE Commercial Vehicles (Eicher) posted 20.83% growth with sales of 30,648 units and VECV (Volvo) saw 33% growth with 965 units sold. Meanwhile, Mahindra & Mahindra saw 5.45% growth with sales of 121,096 units. AMW Motors’ sales are down 64% with 826 vehicles sold. Force Motors sold a total of 16,099 units to clock 10.28% growth and Isuzu Motors India did well to sell 975 units, up 72% year on year.

Recommended:

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

By Autocar Professional Bureau

By Autocar Professional Bureau

11 Jan 2016

11 Jan 2016

8590 Views

8590 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal