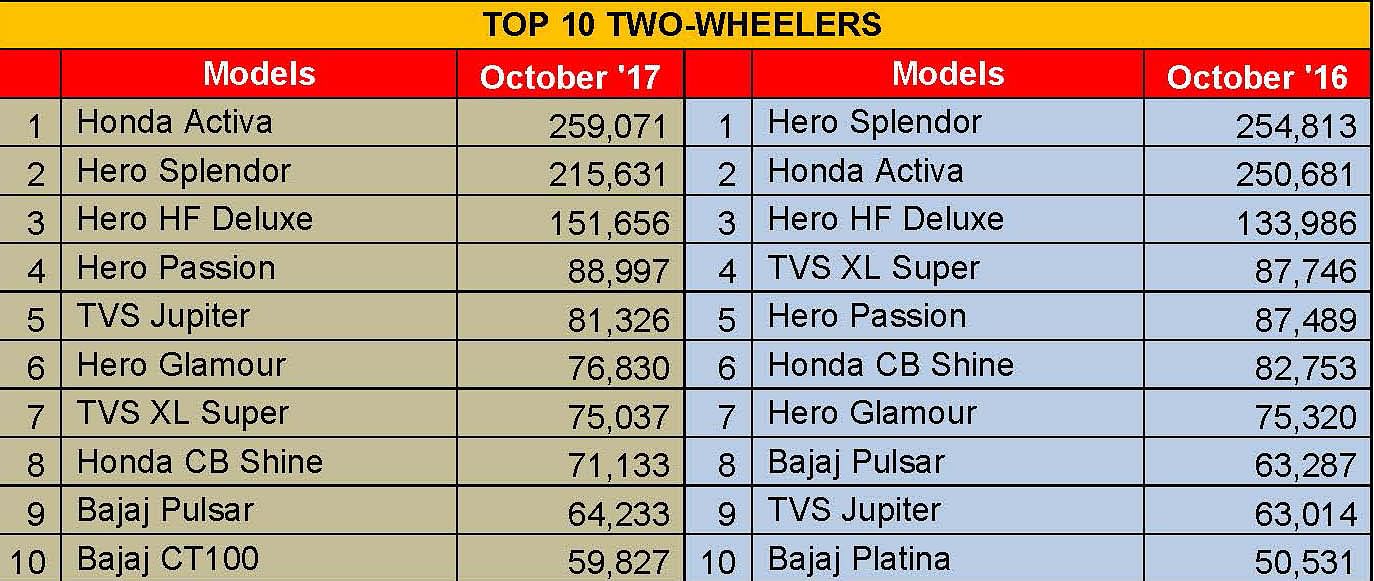

INDIA SALES: Top 10 Two-Wheelers – October 2017 | Activa reigns strong, Hero Glamour beats Honda Shine to be new 125cc king

Honda Activa keeps the Hero Splendor at bay, Hero Glamour becomes 125cc bestseller, and TVS Jupiter rises four ranks over a year.

For the past fortnight, the Indian two-wheeler industry has been making news – both on the global front and in the domestic market. At EICMA 2017 in Milan, Hero MotoCorp took the covers off its XPulse adventure bike concept and Royal Enfield wowed aficionados with its latest set of wheels – the Interceptor INT 650 roadster and the Continental GT café racer.

Inside India, the two-wheeler industry, the most affordable form of motorised commuting, is forging ahead on the sales front. With overall sales of 12,258,274 units in the April-October 2017 period, OEMs have registered year-on-year growth of 8.09 percent.

Scooter makers are making the most of the wave of demand for scooterisation and have clocked sales of 4,148,852 units, which marks crisp 14.63 percent YoY growth. Motorcycles, with 7,613,450 units in the first seven months of the fiscal, are up 5.93 percent and just about beginning to turn on the accelerator. The third sibling in the sector – mopeds – though is feeling the pressure of commuters upgrading to affordable alternatives; at 495,972 mopeds sold, this segment is down 7.08 percent YoY.

Toppers in a slow-selling October

Compared to a high-selling September, October 2017 sales were placid for the two-wheeler industry. At 1,750,966 units sold, it saw de-growth of 2.76 percent. Of the 12 OEMs which record their sales with apex industry body SIAM, only five – India Kawasaki Motors, Piaggio Vehicles, Royal Enfield, Suzuki Motorcycle India and Triumph Motorcycles India – posted positive growth but their monthly numbers are also on the lower side compared to the Big Four.

Nevertheless, that could do little to hamper Honda’s popular scooter brand Activa which stands out – head and shoulders above the competition – as the bestselling two-wheeler for the seventh month (in October) in a row in FY2018. It remained the top-seller despite recording a flat growth of 3.35 percent YoY at sales of 259,071 units last month. Honda had sold 250,681 Activa scooters in October last year.

It appears that the Hero Splendor’s YoY decline in its October 2017 sales has contributed more to Honda Activa retaining the top slot. The Splendor brand, Hero MotoCorp’s flagship motorcycle family, registered sales of 215,631 units, down by 15.38 percent YoY (October 2016: 254,813 units).

Industry sales data indicates that October 2017 was not a typical Diwali month for OEMs in terms of retail sale, which conventionally peaks during the Dhanteras-Diwali month for the entire fiscal. Autocar Professional spoke to several two-wheeler dealers located in the western region, and they all strongly voiced out that retails were far below expectations on Dhanteras as well as Diwali this year. Industry voices attribute the lasting impact of demonetisation and the short-term ripples caused by the implementation of the Goods and Services tax (GST) regime in the recent past for the not-so-bright Diwali this year.

Nevertheless, Hero’s number two bestseller, the 100cc HF Deluxe, continues to drive volumes YoY. The third top-selling two-wheeler brand registered sales of 151,656 units last month, up 13.19 percent YoY.

At No. 4 is the Hero Passion, which recorded sales of 88,997 units (up 1.72 percent YoY) in October 2017. It had sold 87,489 units in October 2016 and had ranked fifth in the list then.

TVS Motor’s 110cc Jupiter, which is India’s second largest selling scooter, has now become the fifth top-selling two-wheeler brand in the domestic market. The company reported sales of 81,326 units of its highest selling model for October 2017. It recorded an impressive YoY jump of 29.06 percent.

In a notable development, Hero MotoCorp’s 125cc model Glamour has now become the bestseller in its segment, beating rival Honda’s CB Shine by a close margin of about 5,500 units. Hero Glamour garnered sales of 76,830 units (up 2 percent YoY) last month, thereby ranking sixth in the list.

It is closely followed by the TVS XL Super (75,037 units, down 14.48 percent YoY) and Honda CB Shine (71,133 units, down 14.04 percent YoY) which take seventh and eighth positions respectively.

Bajaj Auto’s popular Pulsar and 100cc mass commuter brand CT100 occupy the ninth and tenth ranks respectively in October. While the Pulsar sold 64,233 units (up 1.49 percent YoY), the CT100 fetched sales of 59,827 units last month (up 42.39 percent YoY).

Bajaj Pulsar and CT100 volumes were driven by the new model additions before Diwali. The company management now hopes to stabilise the monthly volumes of its two bestselling motorcycle families in the coming months of this fiscal.

Interestingly, among the top 10 bestselling two-wheeler brands in October, while four names registered flat growth, three reported YoY decline in their respective performances. Only three models – Hero HF Deluxe, TVS Jupiter and Bajaj CT100 – reported healthy growth last month.

Of more interest is how the OEMs are gaining or losing market share. Of the 12 players, only four have increased their share, seven have ceded it and one stays flat. But for more details on that front, you will have to wait for the specific two-wheeler market share report. Stay tuned in to Autocar Professional.

Also read: INDIA SALES: Top 10 motorcycles – October 2017 | Hero MotoCorp models on a high

INDIA SALES: Top 10 Scooters in October 2017 | Suzuki Access 125 shines in surging scooter segment

INDIA SALES: Top 10 Passenger Vehicles – October 2017 | Maruti’s magnificent seven

INDIA SALES: Top 5 UVs – October 2017: Maruti S-Cross springs a surprise

Tata Motors and Mahindra make smart gains as demand grows for LCV goods carriers

INDIA MARKET ANALYSIS – October 2017: Sales cool off after a bumper September

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

19 Nov 2017

19 Nov 2017

47906 Views

47906 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau