INDIA SALES: Top 10 Two-wheelers in May 2016

Honda Motorcycle & Scooter India (HMSI)’s hugely popular Activa brand has emerged as the bestselling two-wheeler in India for the fifth successive month in May 2016.

Honda Activa is India’s best-selling two-wheeler for fifth successive month in May 2016

Honda Motorcycle & Scooter India (HMSI)’s hugely popular Activa brand has emerged as the bestselling two-wheeler in India for the fifth successive month in May 2016. The company has outsold its closest rival (in terms of all-India sales volumes), Hero MotoCorp’s Splendor by almost 30,000 units for the last month.

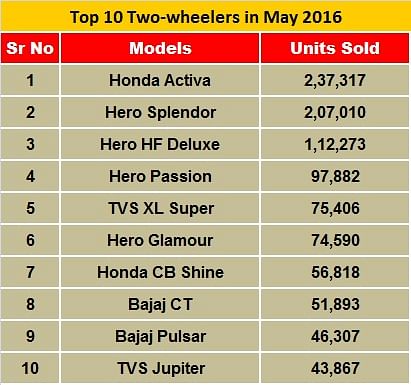

Honda sold a total of 237,317 scooters under the umbrella of its Activa brand in May 2016. Hero MotoCorp, the largest two-wheeler manufacturer, registered total Splendor sales of 207,010 units last month. It is interesting to recall that the Hero Splendor had last outsold Honda Activa in December 2015 with a margin of close to 10,000 units.

Hero MotoCorp, however, continues to retain its four slots in the top 10 bestselling two-wheelers’ list for May 2016 via its bulk sellers such as HF Deluxe, Passion and Glamour commuter motorcycles, besides the trusted Splendor brand.

The Hero HF Deluxe takes third position with sales of 112,273 units in May 2016. Hero Passion, which sold an average of 94,965 units per month during the last fiscal, registered sales of 97,882 units last month. It is the fourth bestselling two-wheeler for the month.

TVS Motor’s steady performer, the cost-effective and mileage friendly XL Super moped, which is a huge hit among the rural masses, scored sales of 75,406 units in May 2016 and holds the fifth spot in the list.

Hero MotoCorp’s 125cc Glamour, which has been outselling Honda’s CB Shine – the conventional bestseller in the 125cc commuter motorcycle segment – garnered sales of 74,590 units in May 2016. Its rival, the Honda CB Shine sold 70,818 units (including the sales of the recently launched CB Shine SP, which sold 14,040 units last month.)

While the Hero Glamour ranks sixth in the list, Honda’s CB Shine stands as the seventh bestselling two-wheeler for the month.

Bajaj Auto’s big-volume fetching model, the 100cc CT100 sold 51,893 units last month and ranks eighth in the list. Its Pulsar brand, on the other hand, is at ninth position with total sales of 46,307 motorcycles. The company has recently dropped the prices of its smallest Pulsar – Pulsar 135LS – bringing it in the price range of the 125cc bestsellers – Hero’s Glamour and Honda’s CB Shine. It would be interesting to take note of how the demand for the Pulsar 135LS shapes up as against the potent models from Hero and Honda in the coming months.

TVS Motor’s consistently performing scooter model, the 110cc Jupiter, which has also enabled the company to keep pace with the growing scooter segment, has emerged as the 10th bestselling two-wheeler in India for May 2016. The company sold 43,867 units of the Jupiter last month.

HMSI and Hero battle for market share

On the overall front, while Hero MotoCorp continued to occupy four slots in the bestselling two-wheelers’ list, Honda, TVS Motor and Bajaj Auto held two slots each for May 2016 with their most popular models.

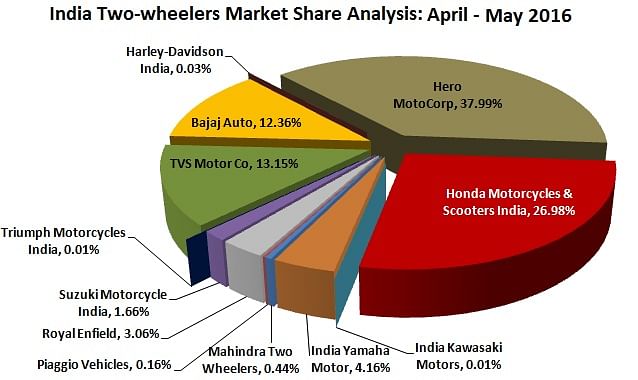

The fight for market share is growing even more intense in the overall two-wheeler sector. Hero MotoCorp has a near-40% share while HMSI with 27% is looking to grow faster.

For the April-May 2016 period, Honda, Yamaha, Royal Enfield and TVS Motor Company stand out in terms of accelerating their respective market shares in the overall two-wheeler market early in FY2017. Honda, which sold 829,895 units, has upped its market share from 25.58 percent to 26.98 percent on a year-on-year basis. The company achieved this primarily on the back of its scooter sales, duly supported by new models including the 110cc Livo commuter motorcycle, 150cc CB Unicorn, 160cc CB Unicorn 160 and CB Hornet 160R among other variants.

TVS Motor Company has also grown its market share from 12.67 percent to 13.15 percent, selling 404,578 units as against 338,049 units in April-May 2015. The growth has come on the back of consistently performing 110cc Jupiter scooter along with the new launches, mainly the return of its popular 110cc commuter motorcycle, Victor.

Recording a substantial boost in its month-on-month sales, powered by its stylish 113cc Fascino scooter, India Yamaha has also increased its market share during April-May 2016. The company, which had a share of 3.17 percent a year ago, now has a 4.16 percent share. It sold a total of 127,884 units between April-May 2016.

Royal Enfield has also witnessed its market share grow from 2.54 percent (April-May 2015) to 3.06 percent for April-May 2016. With linear month-on-month sales growth, the company recorded sales of 94,269 units during the first two months of the ongoing fiscal (April-May 2015: 67,733). The company is also betting big on its recently launched adventure-tourer, 411cc Himalayan model, which is positioned as an on- and off-road motorcycle, a first in the midsize bike segment.

Those who lost market share

Among the prominent companies that lost market share are Hero MotoCorp, Bajaj Auto, Suzuki Motorcycle India and Mahindra Two Wheelers. While Hero MotoCorp and Bajaj Auto both registered an increase in their respective YoY April-May sales, both companies failed to keep pace with the booming market, predominantly the scooter segment.

Although Hero MotoCorp continues to command a 37.99 percent market share – the largest in the two- wheeler industry – its share during April-May 2015 was 40.68 percent.

Bajaj Auto, on the other hand, recorded a marginal loss in its market share, which for the first two months of FY2017 stands at 12.36 percent. Its market share in April-May 2015 was 12.41 percent.

You may like:

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

By Amit Panday

By Amit Panday

17 Jun 2016

17 Jun 2016

52473 Views

52473 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi