India Sales: Top 10 Scooters – August 2017 | Honda Activa supreme, TVS Jupiter sees sharp spike

Scooters are to the two-wheeler industry what SUVs are to the passenger vehicle segment in India. With the festive season underway, sales on the scootering front are going to be up, up and away

Scooters and SUVs seem to be playing the same role in the two-wheeler and passenger vehicle segments respectively. While SUVs account for one out of four PVs sold in the domestic market, scooters are making their presence felt strongly. This segment now constitutes 34.15 percent of the overall domestic two-wheeler market in April-August 2017 compared to 31.88 percent a year ago.

Total scooter sales, at 28,90,943 units, for the five-month period in FY2018, have grown by 18.27 percent YoY – more than the motorcycle and moped segments which has seen 7.89 percent and -8.60 percent YoY growth respectively.

Triggered by the convenience of automatic transmission system, good fuel efficiency figures due to improvements made in powertrain technologies, and value-for-money features on offer, buying scooters now make sense for many in the urban markets. The hassle-and maintenance-free riding offered by scooters now appear to be luring many conventional motorcycle buyers in rural pockets too. Interestingly, improving standards of female education and employment avenues across urban and rural markets have directly impacted scooter sales. To put this in perspective, growing scooter market can be understood as one of the social indicators that reflect thriving socio-economic conditions for the women in the society.

Honda Motorcycle & Scooter India (HMSI) continues to drive the scooter segment across all regions and commands a market share of 59.22 percent (April-August 2017). The company is now banking on its strengths to further propel growth by penetrating into rural India with its newly launched rural-focused product – the 110cc Cliq.

Honda’s pricing of its Cliq, which is positioned as India’s most affordable scooter, brings it below the average price range of all the other scooters currently sold. According to HMSI management, the Honda Cliq’s price (~Rs 42,000) directly rivals that of the 100cc mass commuter motorcycles, thus positioning it specifically for the semi-urban and rural pockets across the country. Although Honda has not disclosed its internal target for Cliq in FY2017-18, it clearly reveals its intent and aggression to further drive consumer acceptance for scooters in India.

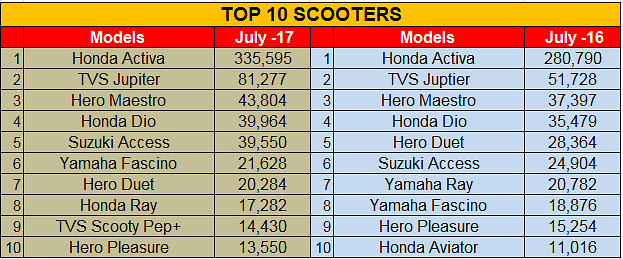

Coming to the largest sellers, the Honda Activa continues to be the unchallenged No. 1 by a massive margin and does not look to be in danger of losing that spot in the near- as well as not-so-near future. The company sold a total of 335,595 scooters under its Activa brand, which comprises three models – the Activa 125 (three variants), Activa 4G and Activa i.

The Honda Activa has seen YoY growth of 19.52 percent in August 2017, which clearly outperforms the overall scooter segment’s growth for the month.

The TVS Jupiter, India’s second most successful scooter, has become a steady and consistent performer for the company over the years. It saw sales of 81,277 units last month (up an impressive 57.12 percent YoY).

Hero MotoCorp’s Maestro, which used to once compete with the TVS Jupiter for the second spot, has now settled into third positon. This scooter sold 43,804 units in August 2017, which marks a YoY growth of 17.13 percent.

At No. 4 is the Honda Dio which sold 39,964 units, up 12.64 percent YoY. The Dio, which is particularly a hit among the young college goers, typically reports a spike in sales when new college sessions start, besides the festive season.

The Suzuki Access 125, the Honda Activa’s oldest rival in the domestic scooter market, is the fifth largest selling scooter in August. This Suzuki on two wheels sold 39,550 units, up 58.81 percent YoY.

Yamaha’s stylish Fascino takes sixth position with sales of 21,628 units in August 2017. Yamaha’s top selling scooter model has grown by 14.58 percent YoY last month.

The Hero Duet, Yamaha Ray and Hero Pleasure are the only three scooter models to record a decline in the fast-growing scooter market. The Hero Duet lags at No. 7 with sales of 20,284 units, thereby recording a sales decline of 28.49 percent YoY.

At No. 8 is the Yamaha Ray, which secured sales of 17,282 units in August, down by 16.84 percent YoY. With sales of 14,430 units in August, TVS Motor’s Pep+ stood as the ninth bestselling scooter while the Hero Pleasure took last spot with sales of 13,550 units, down by 11.17 percent YoY.

Also read - India Sales: Top 5 UVs – August 2017 | Maruti Vitara Brezza and Hyundai Creta post strong numbers

RELATED ARTICLES

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

21 Sep 2017

21 Sep 2017

62373 Views

62373 Views

Ajit Dalvi

Ajit Dalvi