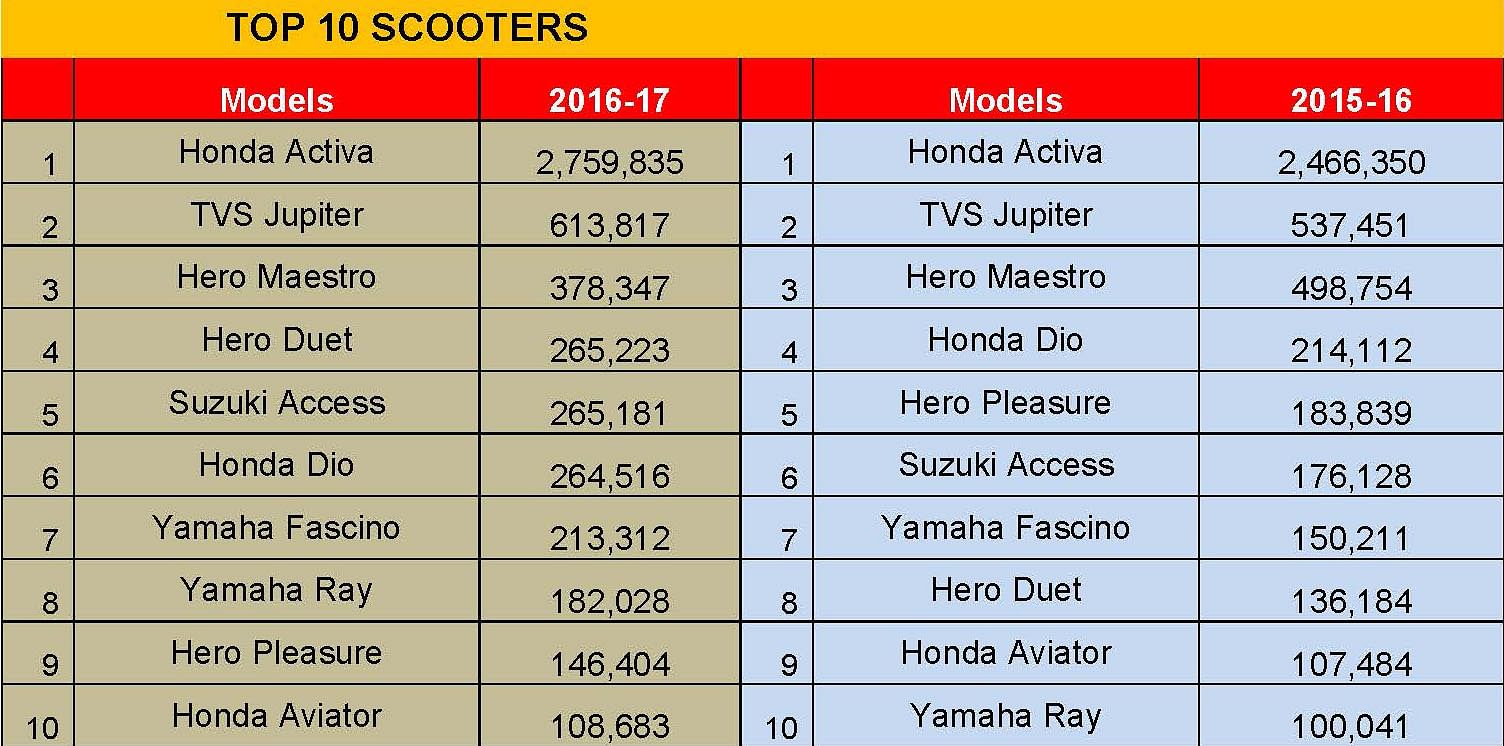

INDIA SALES: Top 10 scooters in 2016-17

While the Hero Duet, Suzuki Access and Honda Dio compete neck-to-neck for the fourth rank, the Honda Activa, TVS Jupiter and Hero Maestro continue to seal the top 3 positions.

Think scooters and Honda Motorcycle & Scooter India (HMSI) rides into the mind space. The company retails scooter models under three brands – Activa, Dio and Aviator – which have consistently appeared in the top 10 bestselling scooters list for years with the Activa being the market leader.

Driving scooterisation to new heights in the domestic market in FY2016-17, HMSI not only increased its market share from 55.44 percent (in FY2015-16) to 56.90 percent but also ensured that the Activa usurp the crown from the Hero Splendor to become the bestselling two-wheeler brand in India for 2016-17.

The Honda Activa outsold India’s traditional bestseller – the Splendor – with a solid margin of 209,005 units during the last fiscal. With sales of 2,759,835 units in FY2017, the top-selling scooter brand registered YoY growth of 11.90 percent. Honda had sold 2,466,350 Activa scooters in FY2015-16.

HMSI's new president and CEO Minoru Kato today revealed ambitious plans to drive future growth, starting with the sales target of 6 million two-wheelers in 2017-18 along with other growth initiatives.

TVS Motor’s 110cc Honda Activa-rival, Jupiter stands as the second largest-selling scooter brand for the last fiscal. At sales of 613,817 units in FY2017, TVS Jupiter has recorded growth of 14.21 percent YoY. The TVS Jupiter has sold over a million units within 30 months of its launch, the brand crossing the landmark in April-May 2016. An Autocar Professional analysis of the Indian scooter market estimates that this model has, as of 31 March 2017, sold close to 1.6 million units in the domestic market alone.

It is noteworthy to mention here that TVS Motor Company has now become India’s second largest scooter player with 14.74 percent market share in FY2016-17. The company has surpassed Hero MotoCorp, which reported a market share of 14.10 percent in the domestic scooter market in FY2016-17. Continuing to fuel its growth, TVS Motor is now expected to soon venture into the 125cc scooter segment and is looking to further consolidate its share in the domestic scooter market going forward.

Arch rival to TVS Jupiter, the 110cc Hero Maestro is the third largest selling scooter brand in India. It sold 378,347 units in FY2017 as against the sales of 498,754 units in FY2016. Hero Maestro, therefore, has recorded a YoY decline of 24.14 percent.

The number four slot has become the most hotly contested position in the top 10 scooters list. The rank saw three close competitors in the form of 110cc Hero Duet, 125cc Suzuki Access 125 and 110cc Honda Dio. Amongst the three, the Hero Duet, a sober-looking model positioned for the families, bagged the fourth spot.

This scooter model has turned out to be a decent success for the company as its sales in FY2017 has doubled up. The company has sold 265,223 units of Duet models in FY2017, up by 94.75 percent YoY. Hero Duet’s domestic sales in FY2016 stood at 136,184 units.

At No. 5 and closely following the Hero Duet is Suzuki’s 125cc Access, which has made a commendable recovery in the market in FY2017. The model’s annual sales stood at 265,181 units during the last fiscal, up by 50.56 percent YoY. Suzuki had sold 176,128 units of the Access 125 in FY2016. Notably, the all-new Access, unveiled at Auto Expo 2016, has helped Suzuki recover its lost market share, which stands at 5.01 percent for FY2017. The company reported a market share of 4.38 percent in the domestic scooter segment in FY2016.

Honda’s funky scooter model, 110cc Dio is India’s sixth largest selling scooter with sales of 264,516 units in FY2017. Honda Dio, which held the fourth slot in FY2016, has grown by 23.54 percent YoY. It had sold 214,112 units in FY2016.

Yamaha’s bestselling scooter model, 113cc Fascino continues to hold the seventh spot in the top 10 list. Fascino, which has sold 213,312 units in FY2017, has grown by 42 percent YoY. While on one hand Fascino sales highlight an impressive jump in its market demand, it also underlines the need for rapid expansion in Yamaha’s India footprint.

At number eight is Yamaha’s Ray, which has recorded sales of 182,028 units in FY2017. The Ray models (Z and ZR variants) have registered an impressive YoY growth of 81.95 percent, thanks to the Ray-ZR model that was first unveiled at the Auto Expo last year and went on sale later.

Backed by the performance of Fascino and Ray models, India Yamaha has managed to improve its market share from 6.33 percent in FY2016 to 7.86 percent in FY2017 in the domestic scooter segment. The company is aiming to achieve landmark sales of one million units in CY2017, which underlines its aggression to further consolidate its growing hold in the scooter space.

At No. 9 is Hero MotoCorp’s 100cc Pleasure, a scooter model targeted at female riders. The Hero Pleasure has retailed 146,404 units in FY2017, down by 20.36 percent YoY. The model had ranked fifth in the Top 10 scooters list in FY2016 with total yearly sales of 183,839 units. This can be attributed to the ageing lifecycle of this model, which has not seen a facelift for a long time. However, it is commendable that it continues to fetch respectable numbers to Hero MotoCorp each year.

Honda’s urban scooter model, the 110cc Aviator continues to be a consistent performer and takes No. 10 position. The model has garnered total sales of 108,683 units in FY2017, marking a flat growth of 1.12 percent YoY. The model, which continues to enjoy a stable class of customers across the several domestic urban pockets, has ranked tenth in the list for FY2017. It had ranked ninth in FY2016.

The scooter market is set to see several new entrants this fiscal including two new automatic scooters from HMSI. While the 125cc scooter segment is slated to see rapid expansion, the 110cc category is expected to continue dominating the scooter market in the near future. Stay tuned for further updates.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

20 Apr 2017

20 Apr 2017

40088 Views

40088 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau