INDIA SALES ANALYSIS: MARCH 2015

While passenger car sales are shifting to the growth lane, two-wheelers are already there (albeit motorcycles are slowing down) and commercial vehicle numbers are showing promise of a better tomorrow.

With the closure of the 2014-15 fiscal year, most automakers have revealed their sales numbers and the verdict is out: positive movement. While passenger car sales are shifting to the growth lane, two-wheelers are already there (albeit motorcycles are slowing down) and commercial vehicle numbers are showing promise of a better tomorrow.

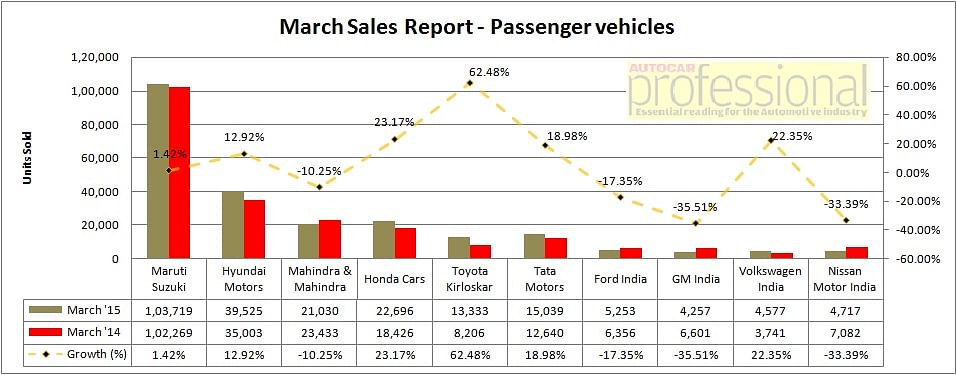

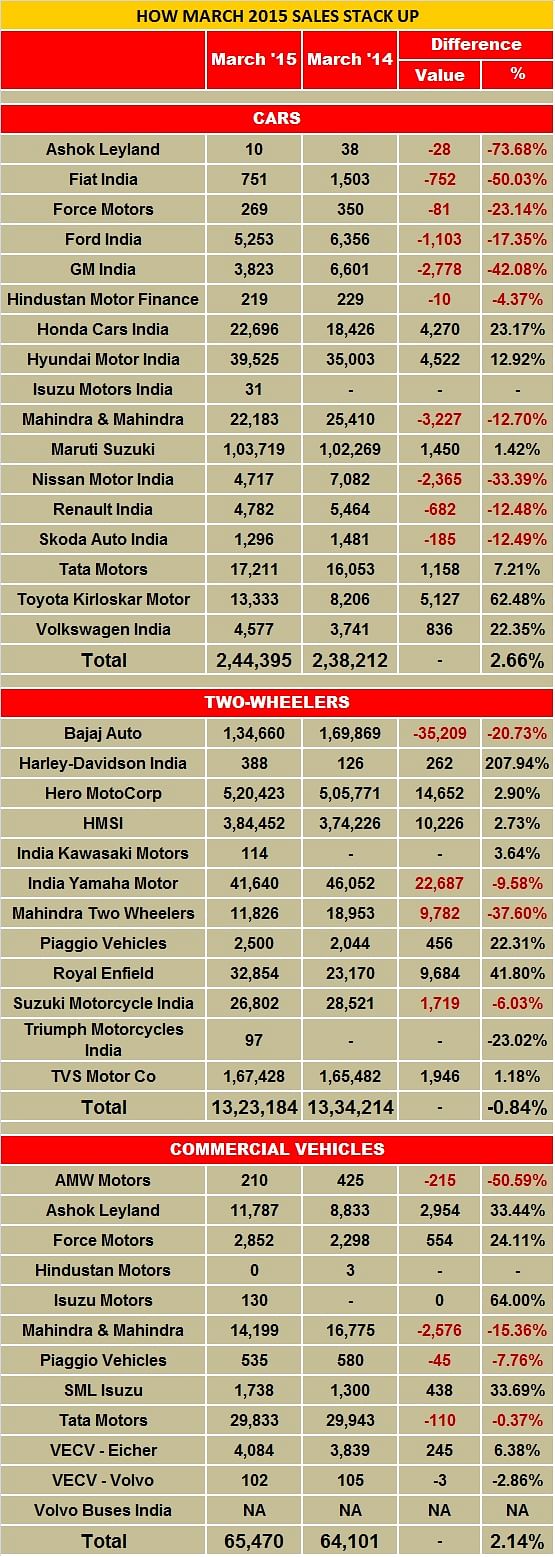

PASSENGER VEHICLES

Maruti Suzuki India’s sales juggernaut continues unabated. Its March 2015 sales growth was small but over the fiscal, the market leader made handsome gains. In March, its sales rose by 1.4 percent to 103,719 units (March 2014: 102,269). The carmaker’s bread-and-butter segments recorded tepid growth rates. In the mini segment, sales of the Alto and Wagon R combined rose to 40,159 units from 40,085 units in the year-earlier month, up 0.2 percent. In the compact segment comprising the Swift, Dzire, Celerio and Ritz, sales were down 12.5 percent to 38,710 units from 44,251 units in the year-earlier month. The Ciaz sold 4,251 units in March 2015, taking the sedan’s total sales to about 32,000 units since its launch last October.

In the UV segment, the Omni and Eeco sold 11,768 units cumulatively, 20 percent up from 9,752 units in March 2014. Sales of the Gypsy and Ertiga together were 6,216 units, down 4 percent from 6,499 units in the year-earlier period. The Gypsy has benefitted from orders from the Indian army, selling on average about 450-500 units a month.

For 2014-15 overall the carmaker has posted big gains. Its cumulative sales were 1,170,702 units, up 11.11 percent on 2013-14 (1,053,689), and the highest ever for the company. Compared to 2013-14, when overall domestic sales were flat at 0.3 percent over 2012-13 (1,051,046), 2014-15 numbers will have brought cheer to Maruti.

Hyundai Motor India, the country’s second largest carmaker, registered domestic sales of 39,525 units, marking an increase of 12.92 percent (March 2014: 35,003). For FY2014-15, the company sold a total of 420,668 units, posting a growth of 10.55 percent (2013-14: 380,523).

Commenting on the March numbers, Rakesh Srivastava, senior VP (Sales and Marketing), HMIL, said: “In a market with weak sentiments, Hyundai achieved its highest-ever single month sales of 39,525 units with highest-ever financial year sales of 420,668 units. The market share of 16.3 percent is the highest ever with a strong performance from new models like the Elite, i20 Active, Xcent and Verna and led by strong marketing initiatives to engage rural markets and repeat buyers.”

“The 2015 outlook seems challenging as currently there is low traction in the market with weak delivery on macro-economic parameters and on low customer sentiment. We are hopeful that an environment will be created to bring-in investment and create employment that will give the required thrust to grow the industry.”

Mahindra & Mahindra (M&M), with its diesel-engined stable of SUVs, has taken a hit in sales both in March 2015 and for the fiscal 2014-15, following deregulation of diesel prices. The company’s passenger vehicles division, which manufactures the UVs and the Verito sedan and Verito Vibe hatchback, sold a total of 21,030 units in March 2015, down 10.25 percent (March 2014 : 23,433). Cumulative sales for the fiscal year were 210,021 units, down 8.35 percent year on year (2013-14 : 229,155).

M&M though is hopeful of a better performance in 2015-16. Pravin Shah, chief executive, Automotive Division, M&M, said, “With factors such as expectation of normal monsoon, settling down of petrol and diesel prices and the likely softening of interest rates, we expect the auto industry to perform better in FY2016.”

Honda Cars India has reported its highest ever monthly domestic sales of 22,696 units during March 2015 and registered a growth of 23.17 percent (March 2014: 18,426). Driven by strong sales momentum for its cars throughout the year, the company also posted its highest ever annual domestic sales of 189,062 units during 2014-15 recording 40.74 percent growth (2013-14: 134,339) .

The product-wise split for Honda cars in March is: City (9,777), Amaze (8,128), Mobilio (3,049), Brio (1,642) and CR-V (100). With its record sales of 9,777 units in a single month, the fourth-generation City sedan crossed the fastest 100,000 cumulative sales mark in just 15 months and registered 101,299 units sales since its launch in January 2014.

Commenting on the company’s sales performance, Jnaneswar Sen, senior vice-president (Marketing & Sales) said, “2014-2015 has been extremely fruitful for Honda. We are thankful to our customers for the great response we have achieved for the Mobilio. The new Honda City has achieved exceptional success. We are excited about the upcoming launch of the Jazz in the new fiscal and look forward to another year of good growth.” During 2014-15, HCIL expanded its dealer network in both existing markets and Tier III cities. The company now has 232 facilities in 152 cities across the country.

Tata Motors’ passenger car division sold 15,039 units last month, a growth of 19 percent (March 2014: 12,640). The company says the Zest sedan and Bolt hatchback were big contributors to the total. While passenger cars sold 12,977 units, higher by 33%, over March 2014, UV sales declined by 28 percent, at 2,062 units, in March 2015.

Toyota Kirloskar Motor sold a total of 13,333 cars in the domestic market in March 2015, posting 62.48 percent growth year on year (March 2014: 8,206). For 2014-15, as per SIAM sales data, the carmaker has delivered a total of 141,887 units, marking a growth of 10.15 percent (FY2013-14: 128,811). March 2015 is the fifth consecutive month that the company has clocked double-digit growth. According to N Raja, director and senior vice-president (Sales and Marketing), “With the launch of the new Corolla Altis, Etios , Etios Liva and Etios Cross in 2014 and new Innova and Fortuner in 2015, we saw an increased acceptance from customers which continues to grow month after month.”

Tata Motors’ passenger car division sold 15,039 units last month, a growth of 19 percent (March 2014: 12,640). The company says the Zest sedan and Bolt hatchback were big contributors to the total. While passenger cars sold 12,977 units, higher by 33%, over March 2014, UV sales declined by 28 percent, at 2,062 units, in March 2015.

General Motors India rounded off the fiscal year with 4,257 vehicles sold in March 2015, down 35.5 percent (March 2014: 6,601). For the fiscal year 2014-15, the carmaker sold 52,273 units, down 35 percent (2013-14: 80,890).

In a statement, the company said that despite the marginal reductions in repo rates earlier this year, the green shoots are still not visible in the economy as ‘we haven’t really seen the banks passing on the reductions entirely to consumers’.

“This, coupled with the economic slowdown, continues to hold the industry performance in the red and a possible turnaround is still not expected in the coming months,” said P Balendran, vice-president, GM India. “We hope that interest rates are reduced in phases going forward and the government takes some decisive steps to improve the consumer sentiment so that there is some uptick seen towards the festive season,” he added.

The Chevrolet Beat is GM India’s highest selling model with sales averaging about 1,000 units a month.

Ford India sold 5,253 cars in March 2015, down 17 percent (March 2014: 6,356). Its 2014-15 cumulative numbers were 75,138 units, down 11 percent YoY. “With the economic recovery being slower than anticipated and a high interest rate and inflation environment, customers continue to defer their discretionary spends,” said Anurag Mehrotra, executive director (Marketing, Sales and Service), Ford India. “However, Ford’s faith in India’s long-term growth prospects remains intact. We are continuing to invest in India’s future growth potential. In March, we took our growth commitment in India to a new peak with the inauguration of US $1-billion integrated manufacturing facility at Sanand, Gujarat,” he added.

Nissan Motor India sold a total of 47,474 units in FY2014-15, registering growth of 24.21 percent (2013-14: 38,220). In March, it sold 4,717 units, down 33 percent (March 2014: 7,082). According to Guillaume Sicard, president – Nissan India Operations, “We are pleased with the progress we demonstrated in our tenth year in India. FY2014 has been a significant year when we reestablished our India business with an independent sales and marketing organization. The growth we achieved was supported by the launch of two new models and fast growing network. As we set ourselves a target of 5 percent market share by FY20, we are focused on sustaining and accelerating our performance.”

Volkswagen India reported sales of 4,577 units in March 2015, up 22 percent (March 2014: 3,741). However, in the fiscal year, its sales dropped 14 percent to 45,018 units (2013-14: 52,528). The company says the Polo, which comes fitted with dual front airbags on all variants and is one of the safest hatchbacks in the India, made a significant contribution to March sales along with the new Jetta and Limited Edition Vento Magnific.

Michael Mayer, director, Volkswagen Passenger Cars, Volkswagen Group Sales India, said: “We are happy to note the significant hike in sales in March 2015. The increase in sales underlines the fact that car buyers in India are increasingly appreciative of the key attributes of our cars, which are best-in-class safety, build quality and driving dynamics, which makes our cars very involving to drive.”

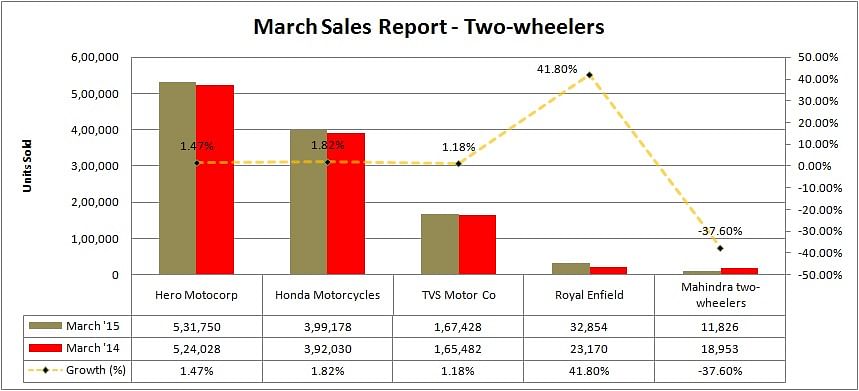

TWO-WHEELER SALES MOVE UP FOR BIGGIES

Hero MotoCorp (HMCL), the world’s largest two-wheeler manufacturer by volume, has registered sales of 531,750 two-wheelers during March 2015, up by a flat 1.47 percent (March 2014: 524,028).

Marking its highest ever annual sales for any fiscal year, in FY2014-15 the company recorded total sales of 66,31,826 units, a growth of 6.17 percent (FY2013-14: 62,45,960). March 2015 also saw Hero MotoCorp inaugurate its first autonomous production and development centre at Manesar in Haryana) under its JV with Magneti Marelli of Italy. The new facility, which will serve as a production and innovation hub for developing new-generation fuelling systems for two- wheelers, has made Hero the first 2W OEM to have its own production line for electronic fuel injection (EFI) systems.

Commenting on the 2014-15 sales, Pawan Munjal, vice- chairman, MD and CEO, HMCL, said: “FY2015 was a year of milestones for us in terms of sales, expansion of our global footprint, product innovation and customer engagement. Our record sales performance is reflective of all these efforts. In FY2015, the industry continued to be sluggish due to the overall market sentiment and the slowing rural economy. Despite such a challenging market environment, we managed to buck the trend and registered healthy growth, further consolidating our leadership. The journey from here promises to get better and exciting. Thanks to a series of measures undertaken by the new government at the Centre, the economic outlook is definitely better, and it is likely to fuel growth and help the industry.”

Honda Motorcycle & Scooter India (HMSI) has reported sales of 399,178 units (including exports) during March 2015, up by a flat 1.82 percent over 392,030 units sold in March last year.

Scooter sales powered HMSI’s March 2015 numbers, selling 238,919 units and notching 21.78 percent growth year on year (March 2014: 196,191).

In comparison, HMSI’s bike sales saw a drop – 145,508 units in March 2015, down 18.25 percent (March 2014: 178,035). As per the company’s monthly sales report, in March 2015 its domestic market share stood at 29 percent, its highest ever since HMSI’s inception.

FY2014-15 was a good year for the company as it grew by 19.62 percent, including exports. It sold a total of 44,52,010 units (2013-14: 37,21,942).

Bajaj Auto’s motorcycle sales, including exports, dropped 22 percent to 209,937 units in March 2015 (March 2014: 270,578). For FY2014-15 motorcycle sales (including exports) fell 4 percent to 3,292,084 units.

TVS Motor Company too has shown progress in the last month of FY2014-15. It sold 167,428 two-wheelers in the domestic market, marking flat growth of 1.17 percent (March 2014: 165,482). Like HMSI, scooters were the better performers on the sales front. TVS’ scooter sales grew 14.44 percent to 54,666 units (March 2014: 47,766). Motorcycle sales saw a growth of 12.88 percent to 76,936 units in March 2015 (March 2014: 68,158).

Royal Enfield continues its dream run with sales growing month on month. In March, the bikemaker sold 32,854 units, up 41.80 percent (March 2014: 23,170).

Mahindra Two Wheelers sold 11,826 units last month, down a steep 60 percent (March 2014: 18,953).

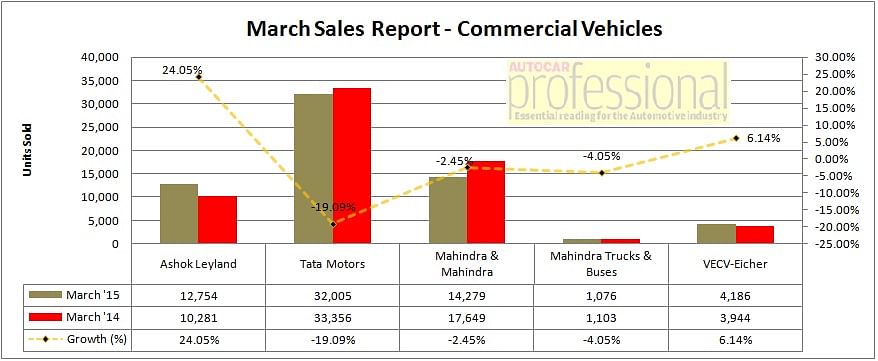

COMMERCIAL VEHICLE SALES SHOW PROMISE OF A BETTER FUTURE

Commercial vehicle sales for March 2015 remained a mixed bag for most manufacturers. While LCV sales continue to be in the slow lane, the gradually improving sales of medium and heavy commercial vehicles (M&HCVs) indicate that the new fiscal year should bring new gains for OEMs. With mining activities resuming in certain parts of the country and a larger push for infrastructure spending by the government, the CV sector should benefit in 2015-16.

Tata Motors’ domestic sales fell 4 percent during March 2015, with deliveries of 32,005 units (March 2014: 33,356). Of note is that sales of the company’s medium and heavy commercial vehicle (M&HCV) range continued to maintain double-digit growth and were up 20 percent with sales of 14,878 units (March 2014: 12,418.) Tata’s LCV sales though remained in negative territory with an 18 percent drop –17,127 units (March 2014: 20,938). For 2014-15 Tata Motors’ cumulative sales were 318,268 units, down 16 percent YoY (2013-14: 378,348) .

Ashok Leyland continued its good run in March, selling 12, 754 units, up 24 percent (March 2014: 10,281). M&HCV sales at 10,027 units were up 30 percent (March 2014:7,718 units). LCV sales rose marginally by 6 percent to 2,727 units (March 2014: 2,563 units). For 2014-15, the company registered a growth of 17 percent with cumulative sales being 104,902 units (2013-14: 89,337).

VE Commercial Vehicles’ sales grew 6 percent in March. The company sold sold 4,186 units in the 5-tonne and above category (March 2014: 3, 944 units).

Mahindra Trucks and Buses’ sales were down 2 percent with deliveries of 1,076 units in the month (March 2014: 1,103 units). For 2014-15, the company posted sales of 8,910 units, marking growth of 9 percent (2013-14: 8,161).

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Autocar Professional Bureau

By Autocar Professional Bureau

02 Apr 2015

02 Apr 2015

71230 Views

71230 Views

Ajit Dalvi

Ajit Dalvi