INDIA SALES ANALYSIS: January 2017

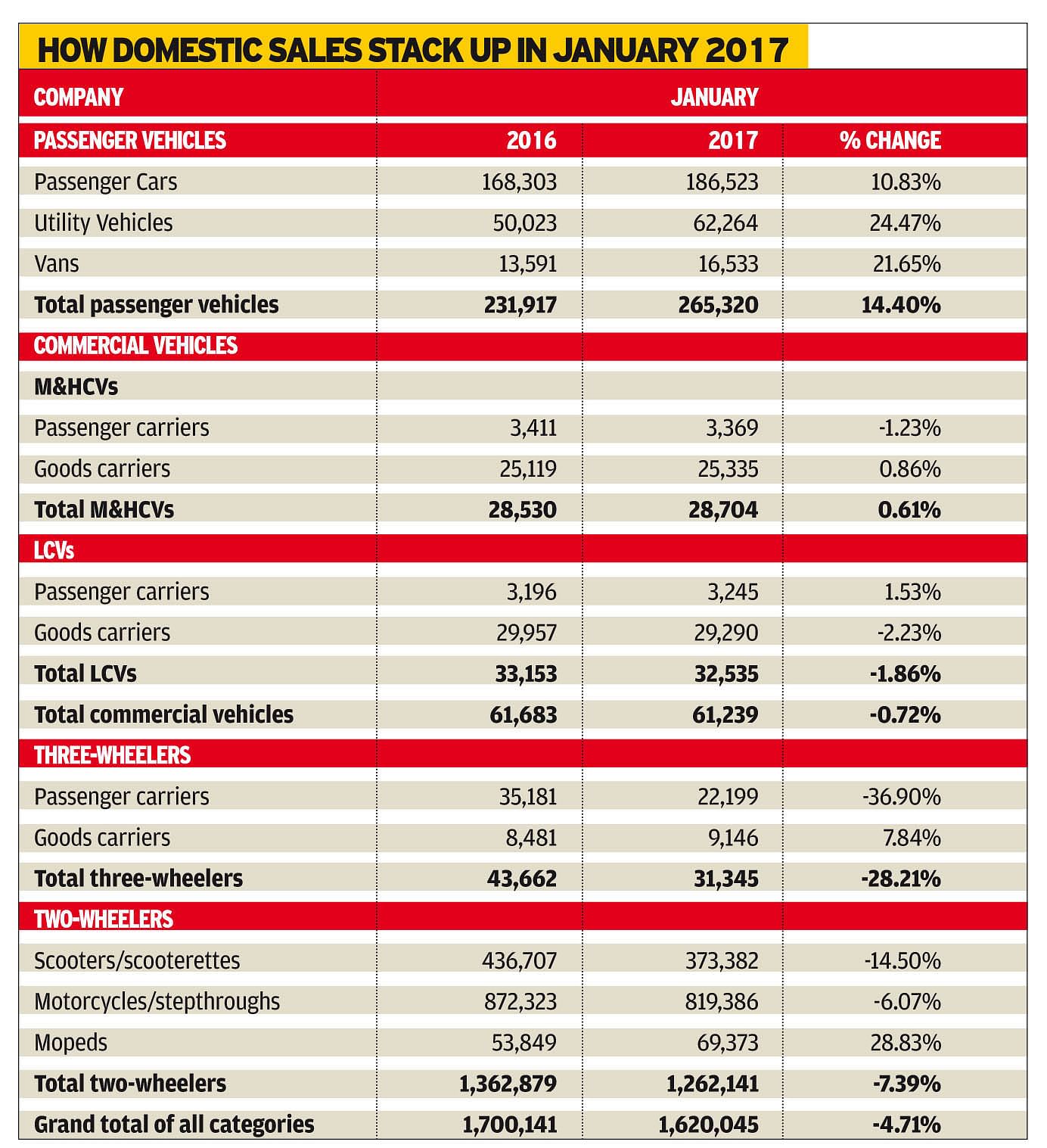

With total sales of 265,320 units, the passenger vehicle segment notched 14.40% YoY growth. However, the other vehicle segments are yet to shrug off the collateral damage caused by demonetisation.

The first month of a new year always brings in good tidings and it is no different for 2017, albeit the difference is that the last two months of 2016 saw the economy and consumers alike being hugely impacted by the sudden demonetisation of Rs 500 and Rs 1,000 currency notes. What also helps numbers is that in India, as in other global markets, vehicle buyers prefer to have a new vehicle registration in the new year, which means some pent-up demand from the previous month (December 2016) would have been carried over into January.

January 2017 sales numbers, particularly for the passenger vehicle (PV) segment, point to a sharp rebound. With total sales of 265,320 units across the passenger car, utility vehicle and van segments, the PV segment has notched 14.40 percent year-on-year growth, enough to bring a smile and more to PV players. The numbers compare very favourably versus December 2016’s de-growth of 1.36 percent and sales of 227,824 with demand for passenger cars down 8.4 percent and for vans by 18.76 percent. UVs, as always, were the buffer with 30 percent growth that month.

As against that, January 2017’s numbers are very heartening – demand for cars has risen by 10.83 percent to 186,523 units, UV sales surged by 24.47 percent to 62,264 units and van sales rose 21.65 percent to 16,533 units. Clearly, the buzz is back in the PV industry, thanks to new models courtesy Maruti Suzuki (Ignis) and Tata Motors (Hexa). The smart uptick in January sales is also due to pent-up demand from December 2016. Usually, the last month of a year sees consumers delaying purchase decisions, preferring to buy a new set of wheels that are registered in the new year, and in turn enabling better resale value down the line.

While the PV sector has regained sales traction, the demonetisation-caused crash crunch is still weighing heavy on both the commercial vehicle and two-wheeler segments, albeit the rate of decline has slowed down. It may take a couple of months for them to be back in the black.

In the CV sector, M&HCV sales were flat (0.61%) at 28,704 units in January, much better than the 22,788 units sold in December 2016 (-12.41%). The LCV segment saw sales dip 1.86 percent to 32,535 units. Given that BS IV compliance will be mandatory for all CVs from April 1, 2017, expect a sizeable amount of pre-buying to happen this month and in March 2017. That in itself should bring cheer to the CV sector which had seen the green shoots of recovery till around October 2016 only to face a speedbreaker in the form of demonetisation.

The two-wheeler segment seems to have borne the brunt of the cash crunch. The once hard-charging scooter market has slowed down. In January 2017, sales were down 14.50 percent to 33,382 units albeit growth has returned to the motorcycle market with numbers reaching 819,386 units (-6.07%) but considerably higher than the 516,690 units (-22.50%) sold in December 2016. Interestingly, demand for mopeds continues to be sustained – DeMo or otherwise. In January, these machines were bought by 69,373 consumers, enough to notch their maker, TVS Motor Co a 28.83 percent growth.

With the Union Budget 2017 behind it, and no nasty surprises for the vehicle buying public, industry should see sales returning at a fairly good clip. With the Budget bounty reserved for rural India, sales from this part of the country will also witness a gradual mark-up.

HOW THE CARMAKERS FARED

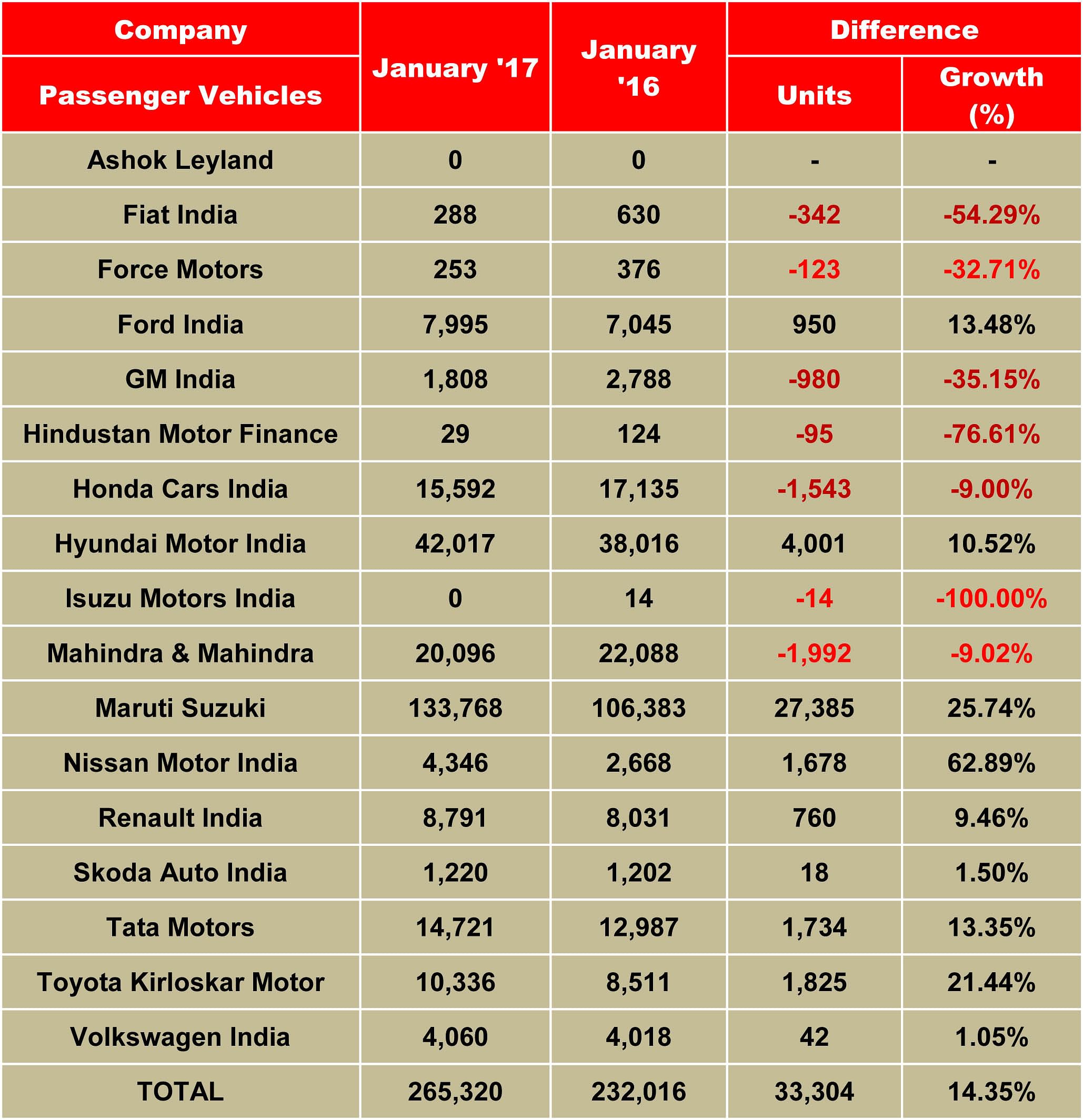

Maruti Suzuki India, the barometer of the Indian passenger vehicle (PV) industry, set the tone for Indian PV sales when it announced sales of 133,768 units, up 25.7 percent year on year (January 2016: 106,383). This comes on the back of the company’s 4.4 percent sales decline in December 2016, which saw overall PV industry numbers down 1.36 percent.

Importantly, for Maruti, sales of all its vehicles, other than the Dzire Tour taxi, are back in the black. The bread-and-butter duo of the Alto and Wagon R, sold 37,928 units in January 2017 (January 2016: 34,206), up 10.9 percent YoY, indicating return of consumer demand for the entry level cars. Sales of the six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire posted 25.2 percent growth at 55,817 units (January 2016: 44,575). The Dzire Tour, which is sold only as a taxi, sold 3,001 units, down 15.3 percent (January 2016: 3,545). The Ciaz premium sedan went home to 6,530 buyers, up 20.2 percent on January 2016 sales of 5,431 units. The two vans – Omni and Eeco – have given a fillip to overall sales numbers with sales of 14,179 units, up 35 percent (January 2016: 10,512).

Maruti Suzuki has a problem of plenty when it comes to the UVs, thanks to surging demand for its first-ever compact SUV, the Vitara Brezza. Total UV sales (Gypsy, Ertiga, S-Cross, Vitara Brezza) zoomed 101 percent YoY to 14,179 units (January 2016: 10,512). Maruti's UVs have, for the past few months, buffered slowing sales of its entry level cars but now it seems henceforth they will take on a new trajectory. For the past year or so, Maruti Suzuki, with its combined 1.5 million units manufacturing capacity at the Gurgaon and Manesar plants was running at full capacity utilisation. With the new Gujarat plant having begun production from February 1, starting with the premium Baleno hatchback, the carmaker will be able to increase production of the much-in-demand Vitara Brezza, which continues to have a sizeable waiting period.

Hyundai Motor India, the No. 2 PV manufacturer, registered domestic sales of 42,017 units, up 10.52 percent (January 2016: 38,016). Commenting on the sales performance, Rakesh Srivastava, senior vice-president (Sales & Marketing), said, “2017 looks promising with the entire industry optimistically looking forward to positive growth. Hyundai has shown growth on account of a good performance by the Grand i10, Elite i20 and Creta and without any new mass model launches. The Union Budget will give a boost to the economy, especially rural India, with its focus on infrastructure creating a robust business environment, thus helping the auto industry.”

Mahindra & Mahindra’s passenger vehicles division sold a total of 20,096 vehicles in January 2017, down 9 percent (January 2016: 22,088). According to Pravin Shah, president and chief executive (Automotive), M&M, “The auto industry continues to see mixed reactions and some of the segments including the rural market and the commercial vehicles category continue to face challenging times. Going forward, we expect Union Budget 2017 to positively impact the economy and also the industry, especially in view of the emphasis and the allocations made for rural, agriculture and infrastructure. We are confident that this will spur demand.”

Honda Cars India, which sold 15,592 units in January 2017, saw its numbers slide 9 percent year on year (January 2016: 17,135). The popular City continued to be Honda’s best-seller with 6,355 units, followed by the Amaze (3,911) and the Jazz (3,124). While the BR-V SUV sold 1,458 units, the Bio sold 627 units, Mobilio MPV sold 63. Since its launch in July 2014, the MPV has sold a total of 40,659 units in India – 26,841 petrol and 13,818 diesel. Yoichiro Ueno, president and CEO, Honda Cars India, said, “Our sales results recovered in January as consumer sentiment and the currency situation have started improving gradually. We hope the situation normalises and the market recovers quickly.”

Thanks to growing consumer demand for the Tiago hatchback, Tata Motors is witnessing a consistent uptick in its sales. The company sold 12,907 PVs which mark a 20 percent growth (January 2016: 10,728). Meanwhile, following the launch of its new Hexa flagship on January 18, there has been a considerable buzz in the market; expect Tata Motors’ sales to get a fillip in its February 2017 sales.

Like Tata Motors, Toyota Kirloskar Motor is benefitting from introducing new models in the domestic market. The company posted 21 percent YoY growth with sales of 10,336 units (January 2016: 8,511). According to N Raja, director and senior vice-president (Sales & Marketing), “Three months into demonetisation and we can slowly see that the market is reviving with increased footfalls and customer enquiries. In fact, even with demonetisation in effect, we have still managed to record a 17 percent growth in sales in the past three months. This has been possible due to the overwhelming customer response to the new Fortuner and Innova Crysta.”

Ford India continued its growth momentum in January with a steady rise in domestic wholesales which grew 13 percent YoY to 7,995 vehicles (January 2016: 7,045). “We continue to grow faster than the industry which is a testament to our strategy focused on product-led innovation, delivering differentiated customer experience and busting the myth of cost of ownership,” said Anurag Mehrotra, executive director (Marketing, Sales and Service), Ford India. “The industry continues to face short-term headwinds even as long-term outlook continues to be positive. The outlook is further strengthened by the government’s roadmap to boost rural economy, provide relief to personal income tax, and investment in further building the infrastructure. A timely implementation of GST is expected to make a significant positive impact on the economy while raising consumer sentiment in the months to come,” Mehrotra added. In January, Ford India launched the technology and feature-laden ‘Platinum Edition’ of the EcoSport. This variant features a host of interior and exterior changes. New features include cruise control, an all-new eight-inch touchscreen infotainment system, satellite navigation, reverse parking camera, dual tone exteriors and larger 17-inch tyres with new alloys.

Nissan Motor India reported sales of 4,346 units comprising both the Nissan and Datsun brands in January 2017, a year-on-year growth of 62 percent (January 2016: 2,668). The company attributes the growth to positive customer response to the Datsun Redigo and the recently launched 2017 Nissan Sunny. Commenting on the sales results, Arun Malhotra, managing director, Nissan Motor India, said, “We have started the new year on a positive note. Despite the challenging market conditions, we have seen a substantial year-on-year growth in January which signifies strong customer response and trust in the Nissan and Datsun brands.”

TWO-WHEELER OEMS CONTINUE TO FEEL THE HEAT

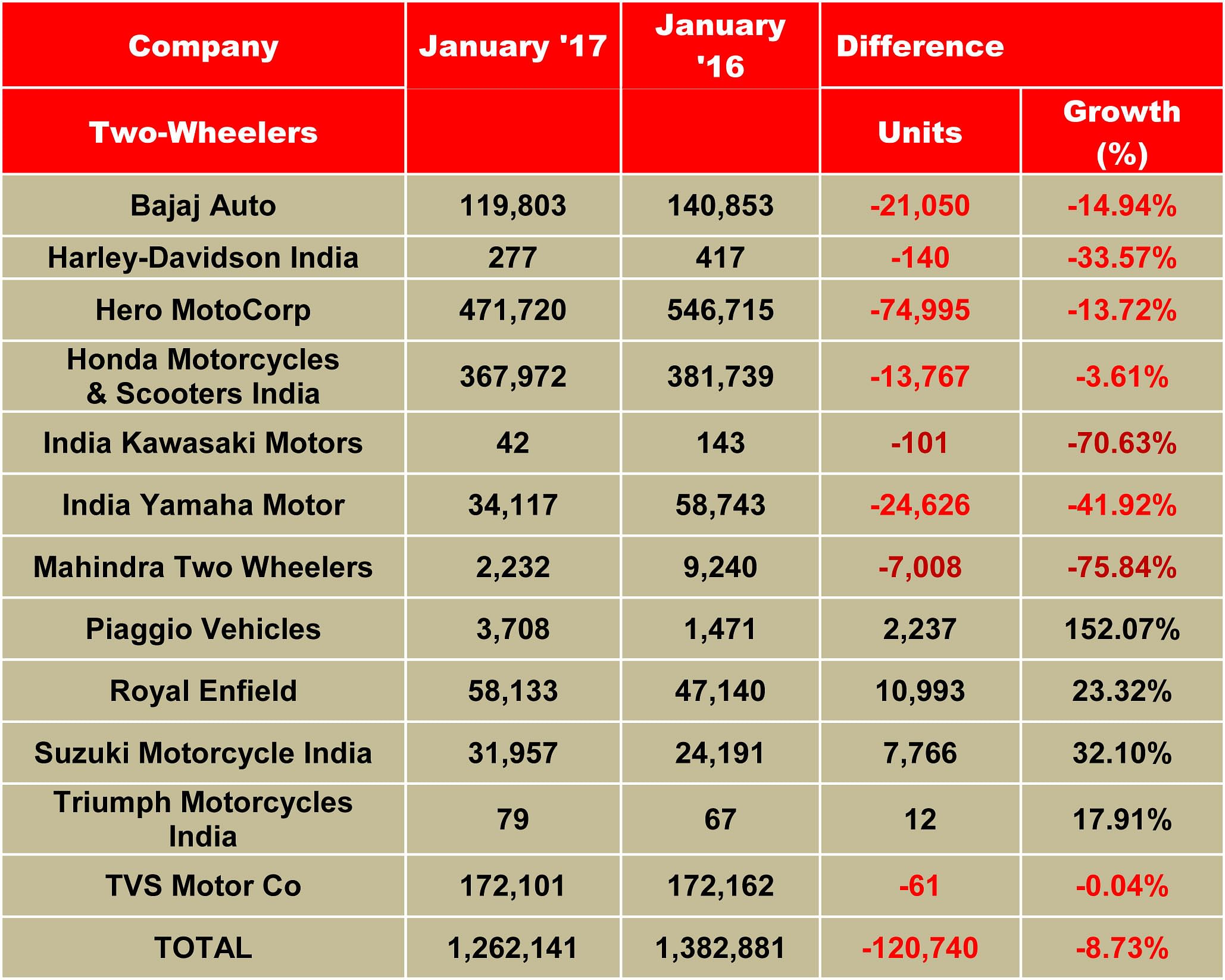

Although the two-wheeler segment is inching back to normalcy, the consolidated domestic sales in January 2017 remained negative. The segment reported total domestic sales of 12,62,141 units, down 7.39 percent year-on-year (YoY) in January 2017 albeit the rate of decline is slowing down; YoY growth in December 2016 was -22.04 percent.

On the cumulative front, the segment, with sales of 1,47,55,890 units between April 2016-January 2017, continues to grow at 8.29 percent YoY. But it’s poor compared to the cumulative growth of 16.01 percent for the April-October 2016 period. Clearly, demonetization eroded the growth momentum of the two-wheeler segment by nearly 8 percentage points.

Negative growth in January came from scooters as well as motorcycles. While total scooter sales stood at 373,382 units (-14.50%), the motorcycle category reported sales of 819,386 units (-6.07%). The sterling performer in the two-wheeler segment was the humble moped. TVS Motor Company, the sole only retailer in this category, reported sales of 69,373 units (+28.83%).

Among the major OEMs, while Hero MotoCorp, Bajaj Auto, India Yamaha Motor, Harley-Davidson and India Kawasaki Motors reported negative growth, Honda Motorcycle & Scooter India (HMSI), Royal Enfield, Suzuki Motorcycle India, Piaggio Vehicles and Triumph Motorcycles India clocked positive YoY numbers. TVS Motor Co’s sales remained flat with a marginal decline of -0.04 percent YoY in January 2017.

Industry leader Hero MotoCorp, which sold 471,720 units in January witnessed a YoY decline of 13.72 percent. On the cumulative front, however, it has retailed 53,85,114 units, which marks its slowed-down performance of 1.57 percent growth YoY. Hero is working on a bunch of new models that are being developed at its in-house R&D facility in Kukas, near Jaipur. It is learnt that the company plans to launch an all-new 125cc scooter model later this year. Also scheduled is the single-cylinder, 200cc Hero Xtreme, first revealed at the Auto Expo last year.

India’s second largest two-wheeler maker Honda Motorcycle & Scooter India (HMSI) reported sales of 367,972 units in January (+1.72%). It is learnt that after the announcement of demonetisation on November 8, 2016, the company moved swiftly to equip its network with digital payment facilities and also focussed on boosting its exports to grab the overseas orders in the wake of the temporary fall in domestic demand. HMSI’s strategy to steer through the cash crunch has paid off well as it has bounced back faster than its top three rivals.

On the cumulative front, HMSI has sold 40,16,089 units thereby posting a double-digit growth of 12.60 percent YoY. Honda has just launched the refresh of its existing models including Activa 125, and CB Shine. Both 2017 edition models are BS IV compliant and are expected to boost the sales for the company in the remaining months of this fiscal.

Number three player, TVS Motor Company retailed 172,101 units (-0.04%). Cumulatively, it has sold 21,00,167 units between April-January this fiscal, which is an impressive growth of 15.02 percent YoY. TVS plans to introduce an all-new scooter later this year. Sources say the new model could be a 125cc scooter positioned under an all-new brand name.

Bajaj Auto clocked total sales of 119,803 units in January (-14.94%). However, on the cumulative front, the company has done well by reporting growth of 8.70 percent YoY with total sales of 17,07,655 units in the past 10 months.

Autocar Professional had earlier estimated that Bajaj Auto would end FY2016-17 with total volumes of close to the two-million units mark. Although the company is down with its month-on-month sales over the past three months, recovering markets may help it bounce back to cross the annual volume of two million units for the first time.

Royal Enfield, which has moved up the rank and has become the fifth largest two-wheeler retailer overtaking Yamaha in January, sold 58,133 units last month. The midsize motorcycle brand marked a YoY growth of 23.32 percent. Cumulatively, RE has sold 535,821 units over the last 10 months thereby reporting YoY growth of 33.57 percent.

At number six is India Yamaha Motor, which sold 34,117 units, down by 41.92 percent YoY. The fast growing company has registered cumulative growth of 20.67 percent YoY at 644,857 units over the past 10 months of this fiscal.

While Suzuki Motorcycle India sold 31,957 units last month (+32.10%), Piaggio Vehicles clocked sales of 3,708 units (+152.07%) all thanks to the aggressively priced Aprilia SR150.

Among the premium motorcycle retailers, while Harley-Davidson reported sales of 277 units (-33.57%) and India Kawasaki sold only 42 units (-70.21%) in January, Triumph Motorcycles clocked sales of 79 units (+17.91%).

The two-wheeler industry expects market demand recovers soon and the lost growth momentum restored. It’s what the auto industry is also hoping for, considering that the two-wheeler’s performance is what drives or pulls down overall industry numbers.

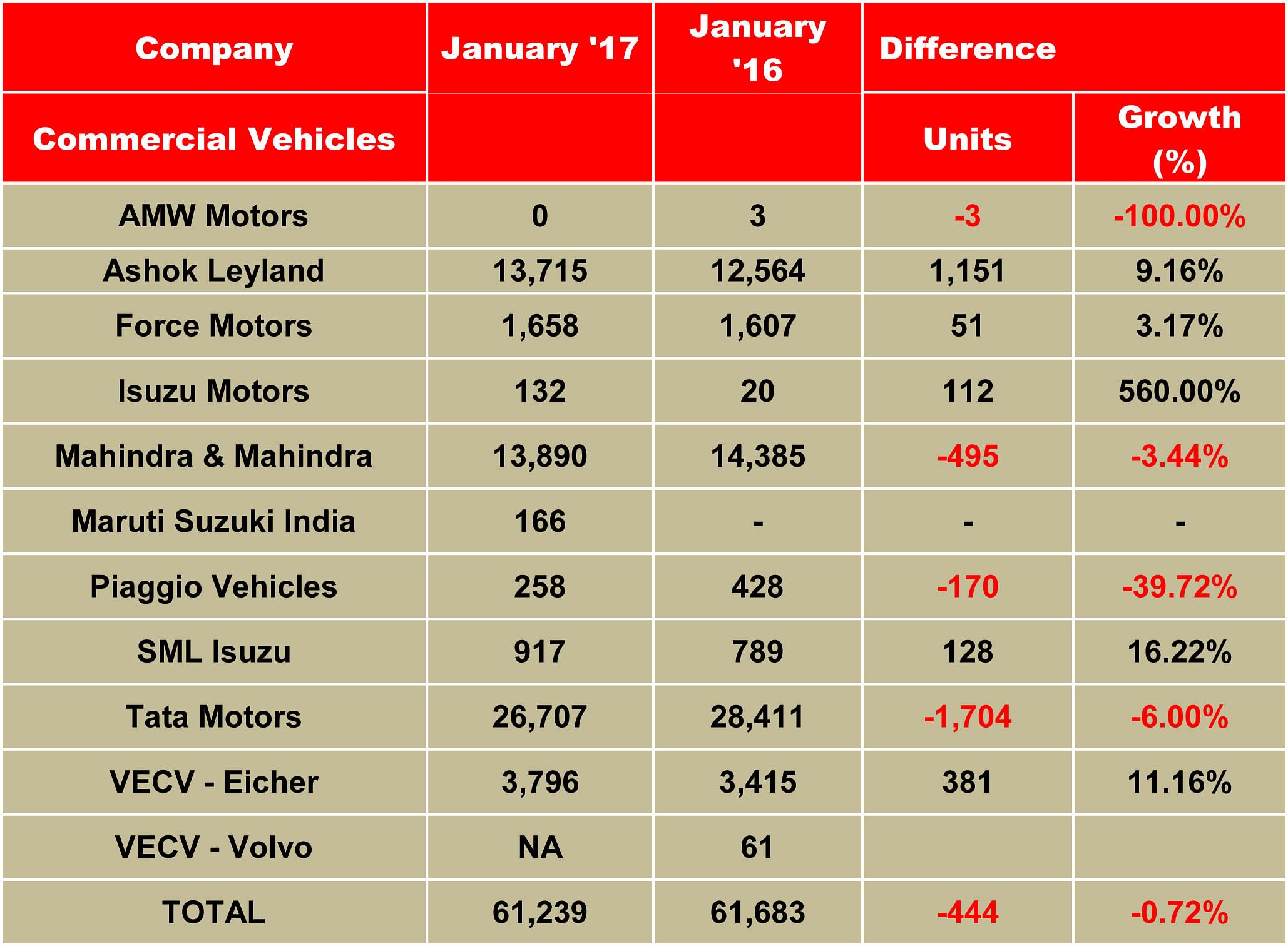

TATA MOTORS, ASHOK LEYLAND SEE UPTICK IN CV SALES After December 2016’s sluggish sales, January 2017 numbers point to improved performance for most commercial vehicle OEMs who had seen reduced offtake after demonetisation. Tata Motors, the largest CV player in the country, registered higher growth in the construction segment of M&HCVs, its buses also seeing double-digit growth thanks to demand from STUs, corporates and schools. Ashok Leyland’s M&HCV sales saw single-digit growth as did Mahindra & Mahindra and VE Commercial Vehicles. The upcoming BS IV emission norms from April this year, mandatory for the entire CV industry, are expected to accelerate sales in Q4 of fiscal 2016-17. It appears that the marginal recovery in January sales is an indication of the same trend of customers making purchases ahead of the new regulation, which is likely to hike CV prices.

Speaking to Autocar Professional recently, RT Wasan, vice-president, (Sales and Marketing), Commercial Vehicle Business Unit, Tata Motors, said, “After a sharp decline in November 2016, there is an improvement in December and that gain continues in January. As we approach the April 2017 deadline, there is likely to be strong pre-buying will happen to BS III vehicles. Going forward, the economy is going to be buoyant as the GST is getting implemented.”

Tata Motors’ overall sales remain under pressure and declined by 7% in January 2017 to 28,521 units. The rate of decline would have been higher but for demand for construction segment vehicles which grew strongly by 26.5% YoY as a result of road construction projects as well as coal and iron ore mining activities. Sales of intermediate and M&HCV buses sales were also up, by 12%. The company says the M&HCV segment is witnessing a surge in enquiry levels after a weak Q3.

Like Tata, Ashok Leyland’s sales also turned positive in January – 7% up YoY – at 14,872 units (January 2016: 13,886 units). Similarly, due to a recovery in M&HCV demand, the company sold 12,056 units to record 8% growth (January 2016: 11,208 units). Ashok Leyland’s LCV sales were up by 5% to 2,816 units (January 2016: 2,678 units).

Mahindra & Mahindra’s total CV sales were down 3% at 13,890 units (January 2016: 14,385 units). M&HCVs were marginally up by 1% at 618 units (January 2016: 611 units). While the below-3.5T GVW products were down 4% with sales of 12,737 units (January 2016: 13,297 units), the above-3.5T GVW segment maintained double-digit growth to record 12% growth with sales of 535 units (January 2016: 477 units).

VE Commercial Vehicles’ overall sales in January registered 19.8% growth. Its sales in the domestic market rose 11.2% to 3,796 units (January 2016: 3,415 units).

(With inputs from Amit Panday and Kiran Bajad)

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

By Autocar Professional Bureau

By Autocar Professional Bureau

13 Feb 2017

13 Feb 2017

26892 Views

26892 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal