INDIA SALES ANALYSIS: GST casts a shadow over sales in June

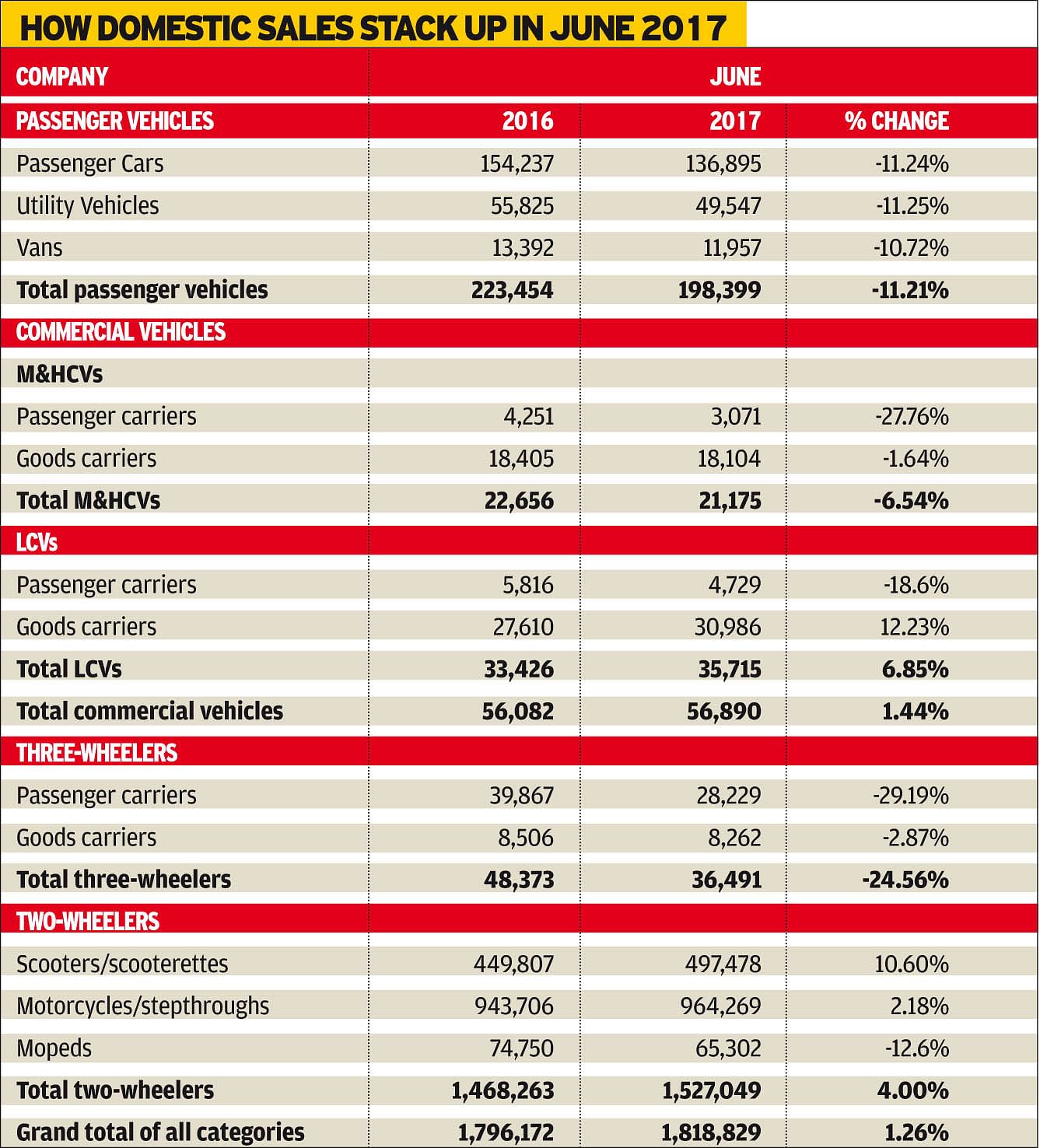

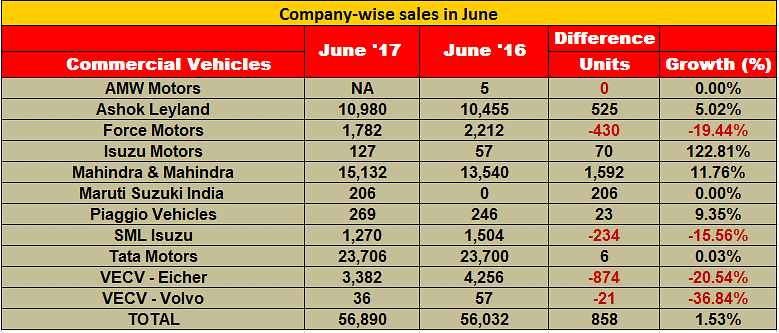

With dealers expediting inventory liquidation over purchasing new stock and buyers delaying purchase decisions to after GST kicking in, passenger vehicle sales hit a new low in June 2017. CV sales were also hit albeit two-wheeler numbers saw a marginal uptick.

With predictions of reduced pricing of passenger vehicles (PV) following implementation of GST from July 1, customers in India experienced considerable confusion as regards their purchase decisions in June, in lieu of benefiting from the tax cut on most vehicles effected by the country’s biggest-ever tax reform.

For many vehicle manufacturers, all of June went into stock rationalisation, especially at the dealer end, with most dealers focusing on liquidating their existing inventory so as to not carry it forward into July. The key reasons for this was the upcoming drop in prices and a very grim clause from the government to credit only the excise duty paid on all vehicles procured before July 1, and not the entire tax and associated cesses being subsumed under the GST, which add up to about 6-7 percent in addition of the excise.

As a result, dealers resorted to not placing a high level of fresh orders with OEs, bringing down the June wholesale numbers to 198,399 units, a substantial 11.21 percent year-on-year drop, making it the slowest month sales since May 2013, when due to the economic slowdown and rising fuel prices, overall PV numbers were down by 11.24 percent. The next biggest decline was, not surprisingly, in December 2016 when the sales speedbreaker in the form of demonetisation saw sales de-grow 8.14 percent. However, retail sales in comparison were substantially better at 15-20 percent higher than in June 2017.

This is because demand still prevailed in the market but customers were only holding back in anticipation of better prices in the coming few weeks as a response to which alluring discounts were passed on, jointly supported by both dealers and OEs, in order to clear dealer inventory and also make way for more stock movement from OE stockyards, to now be billed with the new GST rates after June 30.

According to Dr Pawan Goenka, managing director, Mahindra & Mahindra, speaking at a GST-related media conference on July 6, "With maximum stocks being liquidated in June, dealers are right now sitting on an inventory lower than the industry average of 4-6 weeks. There is a shortage of around a week’s inventory at the dealership level. There should be an inventory refill in the short term, going up to the month of August, after which the stock situation will be back to normal."

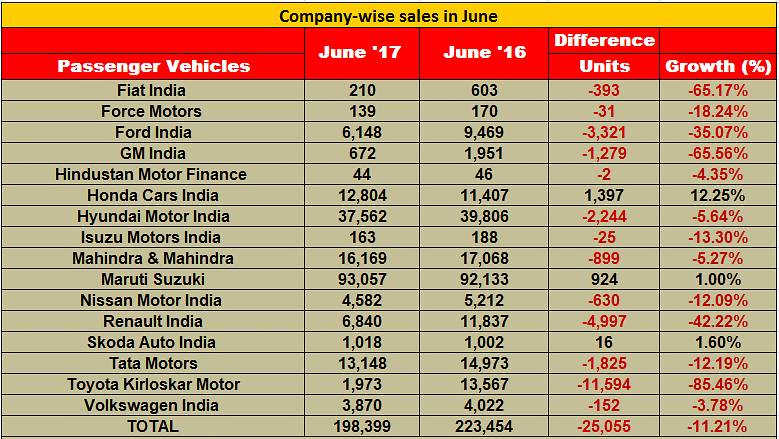

How the PV makers fared in June

A closer look at the individual company stats reveals red ink on 13 of the 16 passenger vehicle manufacturers. The three OEMs to stand out in the black are Maruti Suzuki India (93,057 / +1%), Honda Cars India (12,804 / 12.25%) and Skoda Auto India (1,018 / 1.60%).

Even Hyundai Motor India, the No. 2 player after Maruti, sees its sales drop by 5.64 percent to 37,562 units while Mahindra & Mahindra saw its June numbers drop 5.27 percent to 16,169 units. And Tata Motors saw its June numbers drop 12.19 percent to 13,148 units. Of the 16 automakers, only five logged sales of over 10,000 units last month and two over 5,000 units.

Domestic sales in first quarter FY2018

For the first quarter of FY2017-18 ended June, overall industry numbers at 5,880,641 units mark a YoY growth of 6.02 percent. PV sales grew by 4.38 percent (Cars: 494,313 / +3.89 percent; UVs: 190,098 / +7.53 percent; Vans: 43,247 / -2.96 percent)

The CV sector declined by 9.08 percent in April-June 2017 as compared to the same period last year. Sales of medium and heavy commercial vehicles (M&HCVs) dropped sharply by 31.82 percent, while LCV numbers grew by

7.78 percent in April-June 2017 YoY.

Three-wheeler sales declined by 24.75 percent; while passenger carrier sales registered a de-growth of 30.82 percent, goods carrier sales grew by 3.68 percent in April-June 2017.

Two-wheeler sales were up 7.78 percent in April-June 2017 over April-June 2016. Scooter and motorcycle numbers grew by 20.06 percent and 3.44 percent respectively, while mopeds declined by 10.92 percent.

FADA ASKS GST COUNCIL FOR A REVIEW

With the GST Council's decision of not refunding the entire tax paid on entities billed before July 1, the Federation of Automobile Dealers Association (FADA) has asked the Council for a review on the matter. According to John K Paul, president, FADA, "The automotive industry has been singled out by the government with this kind of an approach. There is only a provision of merely 60 percent credit of the excise duty paid, and that too on stocks billed in the last one year. The situation is even more adverse from the spare parts perspective as companies have to maintain stocks for up to seven years for even defunct cars. So, there is a huge inventory of such parts as well and there will be substantial losses there."

"Transitional losses are going to be huge and as of now, it is the dealers, who are going to bear the brunt of it. While GST overall is the best thing to have happened to the industry, with the current issues, it is seeming as not being trader-friendly," he added.

Vishnu Mathur, director general, SIAM, says: "While there is an anti-profiteering provision in the GST law, there should very well be an anti-loss policy as well. Why be this unfair and cause transitional losses, which would be huge in this case?"

Nevertheless, the Indian automotive sector, as a whole, is very much upbeat about GST and considers it as being a reformative step indeed, bringing in seamless, more transparent procedures, quicker logistics, as well as lower costs.

CONSUMERS AWAIT WALLET-FRIENDLY GST-LED FUTURE

Vehicle buyers the world over always scout for the best deal and haggle for the best discounts. Indian consumers are no different and having known, well in advance, that the prices of most vehicles – particularly the much-in-demand SUV category – would see a dip after the Goods & Services tax kicks in on July 1, they preferred to adopt a wait-and-watch policy in June 2017. Proof of that customer stance is in the lacklustre sales numbers released by most automakers, beginning with the bellwether of the Indian automobile industry.

With GST directly impacting the ex-showroom prices of cars, customers are bound to benefit further in the final on-road car prices, with subsequent prices of motor insurance premium and road registration tax also coming down, which are both calculated on the ex-showroom value of a vehicle.

Maruti Suzuki India sold 93,263 units in the domestic market in June 2017, up barely 1.2 percent year on year. June 2017 sales, which dipped below the 100,000-unit mark, are the lowest yet for Maruti this year which has sold 133,768 units in January (+25.7 percent), 120,599 units in February (+11.5 percent), 127,999 units in March (+7.7 percent), 144,081 in April (+23.1 percent) and 130,248 units in May (15.1 percent).

Now, let's look at how the company’s sales moved, model-wise, in June 2017. With overall passenger car sales at 69,970 units in June, down 3.6 percent YoY (June 2016: 72,551), Maruti’s utility vehicle sales of 13,879 units (+43 percent) compared to year-ago sales of 9,708 units, helped prevent the carmaker's overall passenger vehicle numbers from entering negative territory.

Demand for the entry level, bread-and-butter duo of the Alto and Wagon R dipped 7.9 percent at 25,524 units (June 2016: 27,712).

The company’s six compact cars comprising the Swift, Ritz, Celerio, Ignis, Baleno and Dzire sold 40,496 units, up 1.3 percent (June 2016: 39,971). The Ciaz premium sedan, which is now sold only from the premium Nexa channel, sold a total of 3,950 units, up 41 percent YoY (June 2016: 2,800).

The two vans – Omni and Eeco – sold 9,208 units, down 6.7 percent (June 2016: 9,874).

Sales of Maruti UVs (Gypsy, Ertiga, Vitara Brezza, S-Cross) rose 43 percent to 13,879 units (June 2016: 9,708). However, UV sales this June are the lowest for the carmaker this year, indicating that a good number of consumers have waited for GST to kick in and deliver sizeable price benefits, considering that UVs and larger cars are the biggest beneficiaries of the biggest tax reform ever attempted in the country.

But going forward, the company can expect to harvest rich dividends given that other than the hybrid vehicle category, all other segments benefit from reduced taxation. Maruti Suzuki, like other OEMs, reduced vehicle prices following implementation of GST as a result of which the ex-showroom prices of its models have been reduced by up to 3 percent.

However, pricing of the Ciaz SHVS and Ertiga mild hybrids has increased. As is known, hybrids have been heavily taxed in the GST regime and the SHVS-equipped Ciaz and Ertiga diesels get price hikes of Rs 188,000 and Rs 169,000, respectively, due to the increase in duty.

Hyundai Motor India, like Maruti Suzuki India, has felt the pressure of slow sales in June. The Korean carmaker has reported domestic market sales of 37,562 units, down 5.6 percent year on year (June 2016: 39,807). Commenting on the June sales, Rakesh Srivastava, director - Sales and Marketing, said, “In a challenging market fuelled with speculations on the GST tax structure, Hyundai registered highest ever half year (H1: January-June 2017) domestic sales at 253,428 units with a growth of 4.1 percent on account of strong acceptance of the Grand i10, Elite i20 and Creta. We expect a positive demand pull after the successful implementation of GST in the coming months as industry will witness heightened level of customers’ interest in a seamless unified single market.”

UV major Mahindra & Mahindra registered sales of 16,170 units in June 2017, a YoY decline of 5.27 percent (June 2016: 17,070). Commenting on the numbers, Rajan Wadhera, president, Automotive Sector, M&M, said, “Our focus has been to minimise channel stocks to reduce the transition losses, on account of GST implementation. We are closely observing GST and strongly believe that once we tide over the initial uncertainties, GST is set to usher in a new era for the economy in general and the automotive industry in particular. Going forward, we expect that our wide product portfolio will drive our growth”.

Targeting a strong comeback this fiscal, in a recent interview to Autocar Professional, managing director, Dr Pawan Goenka spoke about the company’s high hopes from the upcoming U321 MPV, which will be launched later in CY2017 and also being determined about a turnaround in its market hold in the segment. “We have one major product launch in 2017 and that is the U321. And, we expect it to become a high-volume driver and add to our numbers that we are doing today. I am pretty confident, this year we will see a turnaround, whether it is 2 percent, 5 percent, or 7 percent, but we will see a turnaround for sure,” he said.

Tata Motors, which has seen an uptick in its PV sales in recent months as a result of demand for the Tiago and Hexa, sold 11,176 units in June, down 10 percent YoY (June 2016: 12,482). Overall performance, however, for Q1, ended June 2017, stands an 11 percent growth as compared to Q1 of FY2017.

Toyota Kirloskar Motor's sales of 1,973 units in the domestic market in June are down a sizeable 85 percent year on year (June 2016: 13,567). Not surprising, since customers were aware that the popular Innova Crysta MPV and Fortuner SUV would both see their price-tags reduced substantially with GST, what with taxation on UVs and larger cars dropping by 12 percent from 55 percent to 43 percent.

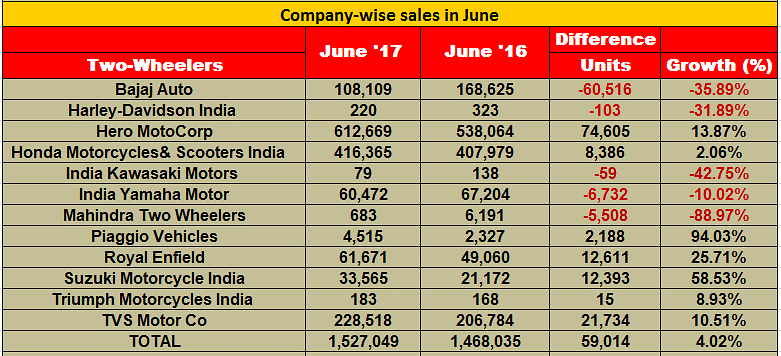

TWO-WHEELER OEMS SEE AN UPTICK

Hero MotoCorp, India’s largest two-wheeler manufacturer, stands out as the biggest volume gainer in June 2017. The company has reported total sales of 624,185 units last month, up by 13.58 percent YoY (June 2016: 549,533).

June 2017 sales numbers indicate growth is riding in for the Indian two-wheeler industry. Barring Bajaj Auto, other players, including Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), TVS Motor Company and Suzuki Motorcycle India, have reported growth year-on-year (YoY).

According to an official company release, Hero registered robust growth on the back of solid performances by both – scooters as well as motorcycles. The company sold 547,185 motorcycles (up by 13 percent YoY) and 77,000 scooters, up by 22 percent YoY.

While demand, according to the company, is up for its commuter bikes that include the Splendor, Passion, HF Deluxe, Glamour and Achiever, scooter volumes appear to have gained from its marketing activities.

Like other OEMs – both in the two-wheeler and four-wheeler space – Hero MotoCorp has begun passing on GST benefits to vehicle buyers, the quantum of reduction ranging from Rs 400 to Rs 1800 on mass-selling models.

On the Q1 front (April-June 2017), Hero MotoCorp claims to have registered its highest ever sales for any quarter. The company has sold 18,49,375 units in Q1 FY2018. Its previous best quarterly performance was in Q2 FY2016-17 when it registered sales of 18.23 lakh units.

Honda Motorcycle & Scooter India has reported domestic sales of 416,498 units in June 2017, growing by a flat 2.09 percent YoY (June 2016: 407,979). While it sold 271,017 scooters, up by 2.08 percent YoY (June 2016: 265,361), it sold a total of 145,481 motorcycles in June 2017 (June 2016: 142,618). The company is passing on GST-related benefits on its models, with the savings going up to Rs 5,500, depending on the model and the state of purchase.

Honda’s recently launched 110cc Cliq, which has become India’s most affordable scooter in the 100cc and above categories, is expected to soon start contributing substantially to its monthly volumes. The company is working to make the model available across India in a phased manner.

TVS Motor Company has clocked sales of 228,518 units in June 2017, up by 10.39 percent YoY (June 2016: 207,012). Its scooter sales grew by 33.8 percent YoY, taking June 2016’s sales of 67,590 units to 90,448 units in June 2017. Notably, this growth is driven by its bestselling 110cc Jupiter scooter, which is also India’s second largest selling scooter model month-on-month.

TVS’ motorcycle sales rose by 17.4 percent YoY from 95,542 units in June 2016 to 112,146 units in June 2017.

For Q1 FY2018, the company’s two-wheeler sales grew by 12 percent, increasing from 701,000 units in Q1 FY2016-17 to 785,000 units in Q1 FY2017-18. Its GST savings accrue between Rs 350 to Rs 1,500 in the commuter bike segment and up to Rs 4,150 in the premium segment.

Bajaj Auto has reported a decline of 35.89 percent YoY in its June 2017 sales. It sold 108,109 units last month as against 168,625 units sold in June 2016. The company has just rolled out the Pulsar NS160 in the premium commuter motorcycle segment in an attempt to boost its sales. The model will compete with Honda’s 160cc Unicorn models, Suzuki’s 155cc Gixxer family and TVS Motor’s Apache RTR 160.

In Q1 FY2018, Bajaj Auto's motorcycle sales are down by 22 percent to 426,562 units as against 548,880 units sold in Q1 FY2017. Now, with consumer demand expected to rise in the wake of GST cuts, things should be back on track soon.

Suzuki Motorcycle India registered sales of 33,573 units in June 2017, up by an impressive growth of 58.59 percent YoY. Suzuki’s 125cc Access 125 scooter continues to drive its monthly volumes in the domestic market. It is estimated that the Access 125 is the largest selling model for Suzuki in Asia, including its volumes from India and Asian countries.

According to an official note from Suzuki, the company’s total sales stood at 38,454 units (in June 2017) as against 30,188 units in June 2016. “This is the fifth consecutive month in which Suzuki has witnessed double-digit growth in its total sales, inclusive of exports,” quotes the document.

With the monsoon picking up and GST giving a new charge, there is no reason why the Indian automobile market should not fire on all cylinders.

Also read: INDIA SALES: Top 10 Two-Wheelers – June 2017

INDIA SALES: Top 10 Passenger Vehicles – June 2017

INDIA SALES: Top 5 Utility Vehicles – June 2017

Scooters power two-wheeler industry growth in Q1 FY2018

INDIA SALES: Top 10 Scooters – June 2017

RELATED ARTICLES

TVS maintains e-2W lead over Bajaj Auto, Ola and Ather in first two weeks of June

TVS Motor Co, which topped monthly electric two-wheeler sales in April and May, maintains its lead in the first two week...

Maruti Jimny crosses 100,000 sales since launch, 74% comprise exports

Launched on June 7, 2023, the Maruti Jimny five-door has sold a total of 102,024 units till end-April 2025. While the do...

Exclusive: Bajaj Auto sells 75,000 electric 3Ws in two years, readies to launch e-rickshaw

India’s largest three-wheeler manufacturer and exporter, which entered the electric 3W market in June 2023, clocks new r...

19 Jul 2017

19 Jul 2017

12305 Views

12305 Views

Autocar Professional Bureau

Autocar Professional Bureau