INDIA SALES ANALYSIS: FEBRUARY 2015

With four of the Big Five car manufacturers registering gains in their February 2015 sales, the mood is somewhat good in the Indian automobile industry.

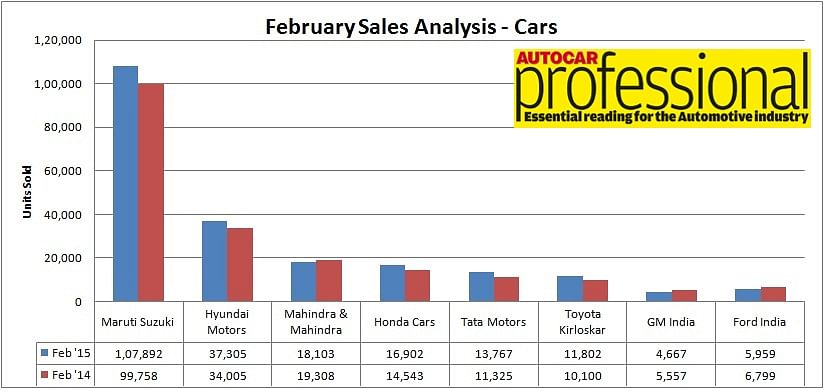

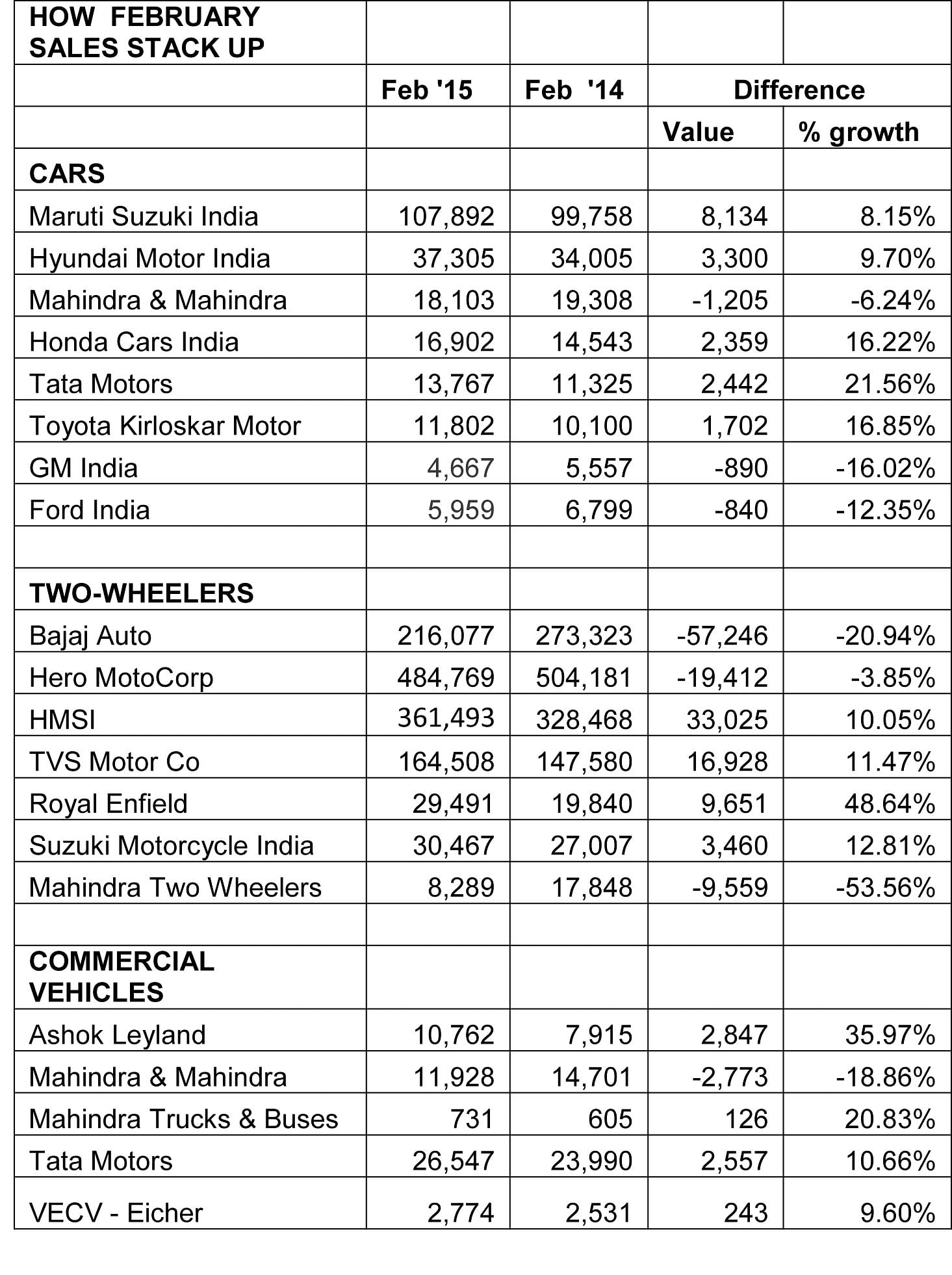

With four of the Big Five car manufacturers registering gains in their February 2015 sales, the mood is somewhat good in the Indian automobile industry. Other than Mahindra & Mahindra, Maruti Suzuki, Hyundai Motor India, Honda Cars India and Tata Motors all posted decent to good growth year on year. Coming on the back of January 2015’s overall sales growth of 3.14 percent for the passenger car sector, this will be good news for an industry battling high interest rates and lacklustre consumer interest, along with the withdrawal of excise sales sops in 2015.

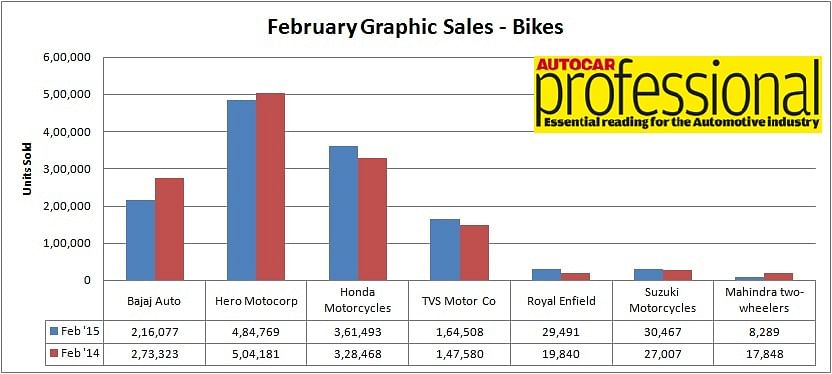

In comparison, two-wheeler manufacturers are feeling the pressure of slowing motorcycle sales, particularly in the rural market, and leading players have reported YoY declines in their bike numbers. Scooter sales though continue to perform with aplomb, giving a helping hand to overall numbers.

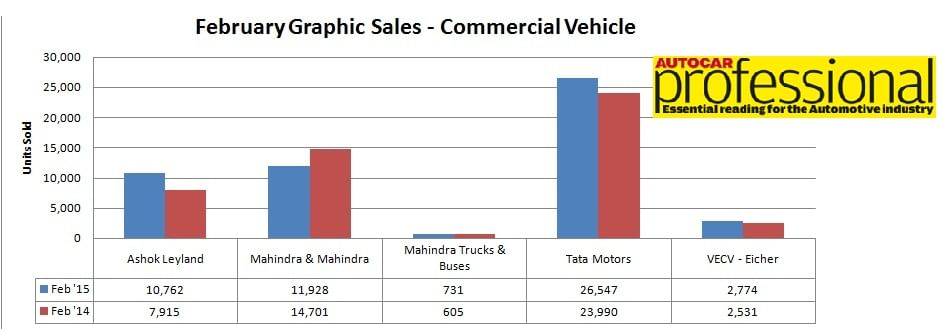

Importantly, commercial vehicle sales numbers for February continued to be in positive territory. The medium and heavy commercial vehicle (M&HCV) segment that has seen an uptick continues with double-digit growth and the LCV sector, which has been subdued, seems to be gaining momentum as well.

So, here’s looking at each of three vehicle categories.

FOUR WHEELERS

Maruti Suzuki India, the country’s largest carmaker, has recorded an 8.2 percent growth in its February 2015 sales to 107,892 units (February 2014: 99,758). The Alto and Wagon R sold 39,988 units, up 7.1 percent from 37,342 units in the year-earlier period. The Swift, Dzire, Ritz and Celerio together sold 42,778 units, up from 45,721 units, a dip of 6.4 percent. The Ciaz premium saloon sold 5,410 units in the month, taking its aggregate sales since its launch to just over 28,000 units.

Of Maruti’s UVs, combined sales of the Gypsy and Ertiga comprised 5,863 units, up 12 percent over year-earlier month figures. The Omni and Eeco vans sold 11,301 units, 13.8 percent over 9,932 units in February 2014.

On the export front, Maruti Suzuki India sold a total of 10,659 units, up 14 percent year on year (February 2014: 9,346). The carmaker’s total sales for February comprising domestic and exports totaled 118,551 units, up 8.7 percent (February 2014: 109,104).

Meanwhile, Maruti is planning to set up a new network of dealerships in India to sell its premium models. The company plans to rope in both existing and new dealerships for this. Over a year, it plans to open 30 to 55 new dealerships.

Hyundai Motor India has reported domestic sales of 37,305 units in February 2015, an impressive 9.7 percent growth over sales a year ago. The new Elite i20, once again, topped Hyundai's sales chart at 10,264 units. The Elite i20’s sales have crossed 64,000 units in the eight months since its launch. The company plans to launch another i20 variant, the i20 Active later this month.

Commenting on the company’s sales numbers, Rakesh Srivastava, senior VP (sales and marketing), said, “The growth in additional and repeat buyers is higher than that of first-time buyers.”

Domestic and export sales combined, Hyundai Motor India sold 47,612 last month compared to 46,505 units in February 2014. Exports however took a beating, falling 17.5 percent to 10,307 units.

Mahindra & Mahindra has announced its total auto sales numbers which stood at 38,033 units during February 2015 as against 42,166 units in February 2014, a fall of nine percent. The passenger vehicles segment (which includes UVs and the Verito) sold 18,103 units in February 2015 as against 19,308 units in February 2014, down 6.24 percent.

Pravin Shah, chief executive, Automotive Division, said, “The auto industry has not seen any major changes in the Union Budget 2015-16. However looking at the overall Budget proposals including planned spend on infrastructure and social reforms, we expect positive sentiments going forward. Further, with an expected revision in lending rates in the RBI policy in early April, the industry should see better times ahead.”

Tata Motors has reported strong growth in its passenger car sales. The company’s passenger vehicle division recorded sales of 13,767 units, up 22 percent compared to 11,325 units sold in February 2014. According to a company statement, the trend of growth in passenger vehicles continues with strong sales of the Zest sedan and a good market response to the Bolt hatchback. While sales of passenger cars in February 2015 were, at 11,805 units, higher by 31 percent over February 2014, UV sales declined by 15 percent at 1,962 units in February 2015. Cumulative passenger vehicle sales for Tata over the 11-month period for the ongoing fiscal are 119,041 units, down by 5 percent over sales in 2013-14.

Honda Cars India has recorded a 16 percent increase in sales with a February 2015 tally of 16,902 units as against 14,543 units sold in February 2014. The popular Amaze sedan was the top-seller with 7,163 units followed by the City which sold 6,505 units. The Mobilio MPV sold 1,697 units, the Brio 1,397 units and the CR-V 140 units, its highest in a year.

Since its launch in March 2013, the Amaze has totted up sales of 138,533 units. The Brio though is seeing a downturn. For the current fiscal (April 2014-February 2015), the small hatchback has sold 13,344 units, down 26 percent from a year earlier when sales were 18,044 units.

For Honda, 2014-2015 is turning out to be a good year. The carmaker has registered an overall growth of 44 percent during April 2014-February 2015 with 166,366 units sold as against 115,913 units during the corresponding period in FY 2013 -14.

Toyota Kirloskar Motor (TKM) has reported a sales increase of 16.85 percent in Febraury 2015. The company sold 11,802 units during the month compared to 10,100 units in February 2014. In January 2015, it had recorded a sales growth of 16 percent.

According to N Raja, director and senior vice-president (Sales and Marketing), “The growth wave continues this month as well with TKM registering 17 percent growth.,”

Combining domestic and export sales, TKM clocked a total of 13,280 units in February 2015 compared to 11,286 units a year ago. The company exported 1,478 units of the Etios series last month.

Ford India’s domestic sales in February 2015 were 5,959 vehicles (February 2014: 6,799), down 12 percent year on year. “We welcome the government’s clear focus on promoting infrastructure and investment as indicated in the Union Budget. This will have an indirect effect on the growth of the automotive sector, which is one of the biggest contributors to GDP. We also compliment the government for outlining the roadmap for GST implementation. A concerted effort to strike a balance between economic and social indicators for growth has been outlined by the Government, which is certainly positive and encouraging,” said Anurag Mehrotra, executive director (Marketing, Sales and Service), Ford India.

GM India sold a total of 4,320 vehicles in February 2015 against 5,607 units sold in February 2014, a fall of 22 percent. “The discontinuation of excise duty benefits has impacted the industry during the last two months. Even the Budget announcements are not enough to revive the consumer sentiment,” said P Balendran, vice-president, General Motors India, in an official statement. “Going forward, car sales will be driven mainly by new entries and we expect the market to gain only momentum if interest rates are reduced in phases to facilitate consumer spending since over 85 percent vehicles are purchased through financing,” added Balendran.

SCOOTERS KEEP UP THE SALES ACT BUT BIKES FALTER

February 2015 turned out to be a relatively tough month for motorcycle sales, while scooters continued to grow yet again. In a corporate announcement made on Bombay Stock Exchange’s (BSE) website, India’s largest motorcycle manufacturer, Hero MotoCorp has communicated that its monthly sales for February 2015 stands at 484,769 units as against 504,181 units sold in February 2014. The company has registered a fall of 3.85 percent YoY for this month.

However, it is known that in the near future, Hero MotoCorp is gearing up to launch its new scooters, starting from its 110cc Honda Activa competitor, Hero Dash, which was earlier unveiled at the Auto Expo in Greater Noida last year. To prepare itself on the front of the production capacity of scooters, the listed company is in the process of ramping up its capacity from 75,000-80,000 units per month to 100,000-150,000 units per month. According to sources, this process is estimated to end by mid-2015.

Hero, which has lined up a couple of new two-wheeler launches for 2015, has been boosting its R&D strengths over time. The company is known to have filed over 15 patents and also has registered 77 designs in FY2013-14. These developments included the idle start-stop switch (on the Splendor iSmart model), side-stand indicator, integrated braking system (brake actuator primarily for scooters), fuel lid, gas liquid separation apparatus, vehicle operation status monitoring system and several other features. Furthermore, the company is also known to have carried operations in the areas of new model technology absorption, indigenisation of the CKD parts, multi-source approval, meeting legislative norms, gearing up for future automobile regulations in India during that financial year.

February 2015 marked the highest domestic market share of 29 percent for Honda Motorcycle & Scooter India (HMSI). The company sold a total of 361,493 units during the month, marking a growth of 10.05 percent (including exports as well). HMSI’s February 2014 sales stood at 328,468 units.

However, on the motorcycle sales front, even HMSI witnessed a marginal dip of 2.25 percent during the said month, when it sold 139,334 units (February 2014 bike sales: 142,549 units).

Meanwhile, covering up for that was the scooter vertical for the largest scooter maker in India. HMSI sold a total of 208,811 scooters during Feb 2015, marking a rise in its sales by 22.13 percent (February 2014 scooter sales: 170,971 units).

A continued dip in the motorcycle sales saw Pune-based Bajaj Auto sell 216,077 units (including exports) during February 2015. The company, which marked a decline in its monthly motorcycle sales of 20.94 percent, had sold 273,323 units in February 14. In order to make up for the declining sales, Bajaj Auto is gearing up with several new launches for the remaining part of the calendar year, which will also include a number of refreshes and technology upgrades in the Pulsar line-up.

Hosur-based TVS Motor Company, on the other hand, continues to climb with respect to its YoY monthly sales numbers. The company has recorded a growth of 11.47 percent by selling 164,508 units in the domestic market (February 2014: 147,580 units).

The company continues to see a rise in its scooter sales, which are driving overall growth. TVS’ scooter sales grew by 35.15 percent in February 2015, when it sold 56,750 units (February 2014: 41,990 units). The motorcycle sales for February 2015 stood at 74,292 units, up by 18.37 percent (February 2014: 62,762 units).

Royal Enfield has recorded domestic market sales of 29,491 motorcycles in February 2015, up 49 percent (February 2014: 19,840). On the export front, it sold 749 bikes, again up 49 percent (February 2014: 503). Domestic and exports combined, it again notched a 49 percent year-on-year growth with sales of 30,240 units (February 2014: 20,343).

Meanwhile, Mahindra Two Wheelers has sold a total of 8,591 units during February 2015, down a considerable 53 percent (February 2014: 17,848). Of this, the company’s domestic sales stood at 8,289 units during the month, while exports stood at 302 units.

Suzuki Motorcycle India registered a 12.81 percent increase in its February 2015 sales of 30,467 units (February 2014: 27,007). Speaking on the company’s consistent growth, Atul Gupta, executive vice-president, said: “Consumers have responded positively to the launch of the new-generation Swish and the Access in the past few months. The Gixxer and the Let’s have also been well received.”

GROWTH MOMENTUM IN COMMERCIAL VEHICLES CONTINUES

The commercial vehicle sales numbers for February continued to be in positive territory. The medium and heavy commercial vehicle (M&HCV) segment that has seen an uptick continues with double-digit growth and the LCV sector, which has been subdued, seems to be gaining momentum as well.

After January 2015’s flat growth, Tata Motors’ overall domestic CV sales increased 11 percent. The company sold 26,547 units (February 2014: 23,990). The M&HCV segment continued to perform well for the company with a 34 percent growth, selling 12,190 units in February 2015 (February 2014: 9,109). Its LCVs continue to decline albeit the fall is narrowing down to single digits at just 4 percent. In terms of numbers, Tata Motors sold 14,357 LCVs last month (February 2014: 14,881).

Ashok Leyland’s overall sales grew 36 percent with the company selling 10, 762 units. (February- 2014-7,915 units) The M&HCV segment registered a 48 percent growth selling 8,230 units (February 2014:5,576 units). The LCVs increased by 8 percent with 2,532 units (February 2014: 2,339 units)

VE Commercial Vehicles registered nine percent growth in the month. In the local market in the 5-tonne and above category, it sold 2,774 units (February 2014: 2, 531 units). Mahindra Trucks and Buses recorded a 21 percent increase with sales of company sold 731 units. (February 2014: 605 units).

RELATED ARTICLES

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

TVS And Bajaj Auto Spar for E-2W Leadership, Ampere Outsells Ola

Powered by demand from the new and aggressively pricedChetak 2501 which takes on the popular TVS iQube2.2 kWh variant, B...

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

By Autocar Professional Bureau

By Autocar Professional Bureau

03 Mar 2015

03 Mar 2015

37343 Views

37343 Views

Ajit Dalvi

Ajit Dalvi

Shahkar Abidi

Shahkar Abidi