INDIA SALES ANALYSIS: December 2015

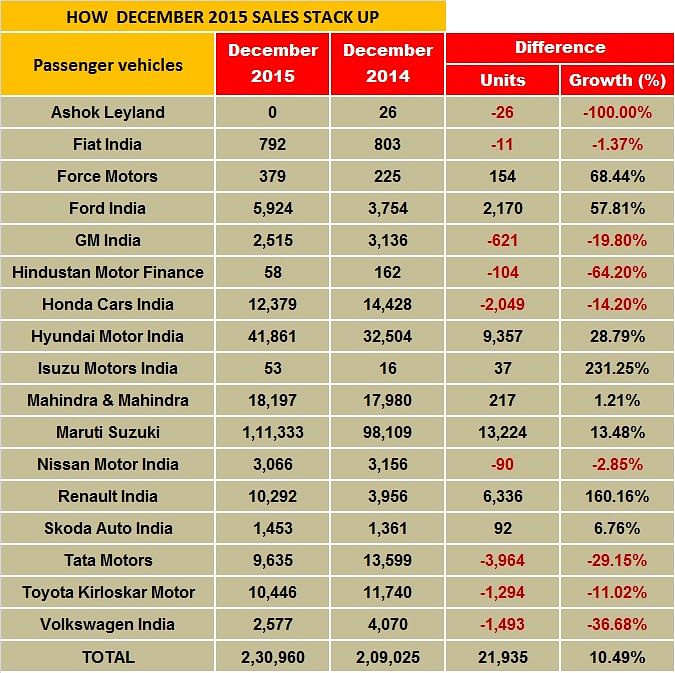

The last month of 2015 saw the industry register a mixed bag of sales with leading carmakers like Maruti Suzuki and Hyundai registering double-digit growth while other players reporting a dip in sales.

December gives Maruti and Hyundai a sales high even as other OEMs disappoint

The last month of 2015 saw the Indian passenger car industry register a mixed bag of sales with leading carmakers like Maruti Suzuki India and Hyundai Motor India registering high double-digit growth on one hand and most other players reporting a dip in sales on the other.

While petrol carmakers like Maruti and Hyundai were able to push despatches at the fag end of the year, predominantly diesel passenger vehicle manufacturers like Toyota Kirloskar Motor, Tata Motors and Mahindra & Mahindra saw muted demand, largely due to the selective diesel-car ban in Delhi-NCR. Another sales dampener was the flood-hit Chennai which received its heaviest rainfall in a century in early December and affected most major automakers, along with their component supply chain, in the region.

Hefty year-end discounts, benign fuel prices and favourable interest rates augured well for the country’s largest carmaker Maruti Suzuki India as it registered 13.5 percent growth in December 2015 to 111,333 (December 2014: 98,109). The entry level duo of the Alto and WagonR sold a total of 37,234 units, up 7.5 percent year on year (December 2014: 34,625). Meanwhile the five compact cars (Swift, Ritz, Celerio, Baleno and Dzire) together sold 47,354 units, up 14 percent (December 2014: 41,532). The premium Baleno seems to be giving sales a new fillip. Ciaz sales (which are clubbed with the now-discontinued SX4) however were down 23.9 percent, with the carmaker selling 2,841 units (December 2014: 3,731).

Maruti’s total sales of passenger cars increased 11.6 percent to 91,043 units as compared to 81,564 units in December 2014. Utility vehicles sales, including the Gypsy, Grand Vitara, Ertiga and the S-Cross rose 58.8 percent to 9,168 units in December 2015 (December 2014: 5,774). Meanwhile, sales of the Omni and Eeco vans rose 3.3 percent to 11,122 units in December 2015 (December 2014: 10,771).

Hyundai Motor India posted record sales in December to notch its highest annual sales in 2015. The country’s second largest carmaker posted a 28.8 percent rise in domestic sales at 41,861 units (December 2014: 32,504). The company also exported 22,274 units with cumulative sales of 64,135 units for the month of December 2015.

Commenting on the month’s sales, Rakesh Srivastava, senior VP (Sales and Marketing), said: “With the strong performance of the Grand i10, Elite i20 and Creta in December, Hyundai’s calendar year sales were an all-time high record of 476,001 units with a cumulative growth of 15.7 percent and projected highest ever market share of 17.2%.”

Mahindra & Mahindra’s passenger vehicles division (which includes UVs, cars and vans) sold 18,197 units in December 2015 (December 2014: 17,980), indicating flat growth of just 1 percent.

M&M, which has a large stable of diesel-engined SUVs, is among the companies adversely affected by the recent ban on new diesel vehicle registration in Delhi and the National Capital Region.

Speaking on the sales performance, Pravin Shah, president & chief executive (Automotive), M&M, said, “Inspite of a challenging external environment, we at Mahindra have closed December on a positive note. Having been encouraged with the positive response to our upcoming KUV100, we are excited about this compact SUV launch on January 15, especially with our first mFalcon petrol offering.”

Toyota Kirloskar Motor (TKM) sold 10,883 units in the domestic market (including exports) in December 2015, down 11.04 percent compared to a year ago (December 2014: 11,738 units). The decline in sales is mainly due to the ban on registration of diesel vehicles with engine capacity of more than 2000cc in Delhi and NCR where Toyota is significantly present, apart from the floods in Chennai and car buyers postponing their purchases to the new year.

Commenting on the sales, N Raja, director and senior VP, sales and marketing, said, "We have seen a cumulative growth of 5 percent in calendar year 2015 when compared to sales in 2014. The growth would have been higher if we didn’t have to face few challenges like the ban on registration of diesel vehicles in Delhi and NCR and the flood situation in Chennai."

In CY2015, TKM sold a total of 139,815 units, registering a cumulative growth of 5 percent YoY (2014: 132,673 units).

Honda Cars India registered monthly domestic sales of 12,379 units in December 2015 against 14,428 units in the corresponding month in the year 2014, down 14.20 percent. The sales were aided by the consistent demand of the City, followed by the Amaze and Jazz. The company registered cumulative domestic sales of 144,474 units in the period April-December 2015 against 131,133 units for the corresponding period of the year 2014 marking a growth of 10%.

Despite attractive year-end discounts and offers on its vehicles, Tata Motors’ passenger vehicle division reported a 33 percent decline in sales in December 2015. Passenger vehicle sales were down at 8,069 units (December 2014: 12,040). Wholesales of passenger cars in December 2015 were lower by 31 percent at 6,900 units (December 2014: 9,956) and UV sales declined even more by 44 percent at 1,169 units in the month.

The usual trend of car buyers postponing their purchases to the new year also weighed on most carmakers and Tata Motors was no exception. Additionally, the company said that the ‘unusual’ surge in sales in December 2014, in anticipation of increase in excise duty, also resulted in a sharp YoY fall in sales last December.

Renault India continued to benefit from the sustained demand for the Kwid hatchback and reported a 160 percent jump in domestic sales at 10,292 units in December 2015 (December 2014: 3,956). In calendar year 2015, Renault India sold 53,847 units compared to 44,849 units in 2014, which marks a growth of 20.1 percent.

The carmaker says it has substantially increased its sales and service network reach in India, from 14 sales and service facilities in mid-2011 to 190 currently, and will reach 240 facilities by end-2017, which includes expanding its presence in existing and new markets in urban, semi-urban and rural India.

Ford India’s domestic sales for December 2015 stood at 5,924 units, 57.81 percent up (December 2014: 3,754). Exports last declined to 4,941 units compared to 10,647 units in December 2014.

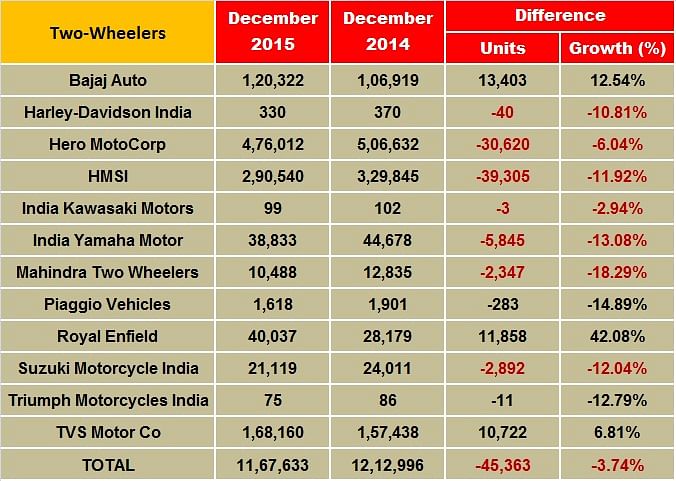

India two-wheeler sales tumble in December

Sales reports from a few of the major two-wheeler companies indicate that the market continued to contract during December 2015. Sales reports from the big four (Hero MotoCorp, Honda Motorcycle & Scooter India, Bajaj Auto and TVS Motor Company) and the ever-growing Royal Enfield underline a YoY decline of 3.41 percent for the last month.

While HMSI stood as the largest volume loser (39,267 units) for December 2015, Hero’s decline (26,432 two-wheelers) in unit terms overshadowed the growth registered by Bajaj Auto, TVS Motor Co. and Royal Enfield.

Industry experts say that the month of December is usually low on two-wheeler sales due to delayed purchase decisions and the winter season in major parts of the north and central regions of the country.

The largest two-wheeler manufacturer, Hero MotoCorp, reported sales of 499,665 units in December 2015, down by 5.02 percent (December 2014: 526,097). The company that launched two new scooter models – Maestro Edge and Duet – is registering an uptick in its scooter sales. Interestingly, the Hero Duet has also become one of the top 10 best-selling scooters in the market soon after its commercial launch. The model ranked fourth in the top selling scooters in India for November 2015.

While the company is said to be preparing itself for the upcoming Auto Expo in New Delhi in February 2016, it is expected that it might roll out a slew of new scooter and motorcycle models as it did at Auto Expo 2014.

HMSI, which registered consistent growth throughout the year, has reported declining sales for the second month in a row. According to the company, it sold 290,712 units across the domestic territories in December 2015, down by a substantial 11.90 percent YoY (December 2014: 329,979).

Marking its dominance in the domestic scooter segment, HMSI reported sales of 198,332 scooters and 92,380 motorcycles. The company document also highlighted that for December 2015 it held a domestic market share of 25 percent.

Bajaj Auto reported sales of 247,782 units in December 2015 (December 2014: 246,233), a marginal growth of 0.63 percent YoY. The company is known to be working upon new products for the Auto Expo, the capacity crunch at its Chakan plant and its pan-India supply chain for improved reach across the domestic markets.

TVS Motor Company registered domestic sales of 168,160 units (December 2014: 159,918). The company, which is ready with its new products to take on the two-wheeler market in 2016, grew by 5.15 percent YoY for December 2015.

Though low on its base, Royal Enfield finished the calendar year maintaining its healthy double-digit growth rate. The company grew by 42.08 percent YoY in December 2015 when it recorded total domestic sales of 40,037 units. It had sold 28,179 units in December 2014. The company, which hired a number of officials from Triumph Motorcycles in the UK to work on consolidating its position in the global markets, is known to be working on at least two all-new engine platforms. Keeping its focus on the midsized motorcycle segment (250cc-750cc engine displacement), the company is working towards the goal of becoming the largest player in the category globally.

Two-wheeler players such as India Yamaha Motors, Suzuki Motorcycle India and others are expected to report their December 2015 sales numbers later this month.

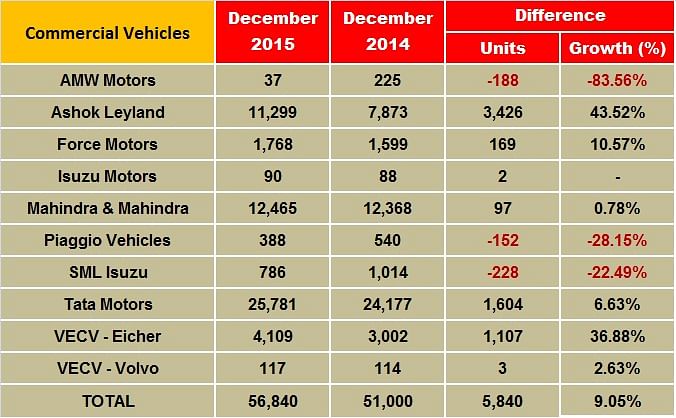

Commercial vehicle sales register growth in December, LCVs break the fall

The last month of the calendar year 2015 witnessed mix sales for the commercial vehicle segment with the medium and heavy commercial vehicles (M&HCV) witnessing a slowdown in growth. The good news though is that LCVs, which saw a decline in December for the last two years, has turned positive in December 2015.

Tata Motors and Ashok Leyland registered double digit growth in the LCV segment, while Mahindra & Mahindra’s below 3.5T GVW segment recorded flat growth, and above 3.5T GVW segment declined 25 percent.

Credit rating agency ICRA predicts that, the LCV passenger vehicle segment is likely to remain under stress, but the LCV goods carrier segment might see some modest revival on the back of economic recovery, improving viability due to decline diesel prices and replacement demand.

There is still surplus fleet in the market and tight financing norms on the back of rising delinquency levels have put pressure on the growth of LCV segment. Industry analysts are keenly watching if the LCV segment manages to sustain the growth curve after persistence fall since 2013.

As regards specific manufacturer sales, Tata Motors’ total sales of 27, 347 units in December were up 6 percent (December 2014: 25,736 units). M&HCVs saw a marginal growth of 2 percent, selling 12,673 units (December 2014: 12,438). Meanwhile, the LCV segment has registered an upward trend growing by 11%, with sales of 14,674 units (December 2014: 13,298).

Ashok Leyland’s total sales were up 31 percent at 12,209 units sold (December 2014: 9,290). While M&HCV sales notched up an impressive 35 percent growth selling 9,758 units (December 2014: 7,210); LCVs also gained double digit growth of 18 percent with sales of 2,451 units (December 2014: 2,080 units).

Mahindra’s M&HCV sales went up 74 percent, with sales of 528 units last month (December 2014: 303 units). While the below 3.5 T GVW segment registered flat growth with sales of 11,530 units (December 2014: 11,525 units), the above 3.5T GVW segment went down by 25 percent with sales of 407 units (December 2014:540 units).

VE Commercial Vehicles recorded a strong 36 percent growth selling 4,114 units in the domestic market last month (December 2014: 3,013 units).

RECOMMENDED:

- Indian auto industry sales grow 2.27% in April-December 2015

- Two-wheeler sales drag overall December numbers

(With inputs from Shourya Harwani, Amit Panday & Kiran Bajad)

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

By Autocar Professional Bureau

By Autocar Professional Bureau

05 Jan 2016

05 Jan 2016

28931 Views

28931 Views

Ajit Dalvi

Ajit Dalvi