INDIA MARKET ANALYSIS – October 2017: Sales cool off after a bumper September

After a cracker of a month in September, all vehicle segments have seen muted sales in October as a result of huge dealer inventory fill and overall industry numbers entered negative territory after nine months. Mayank Dhingra takes a closer look at the numbers.

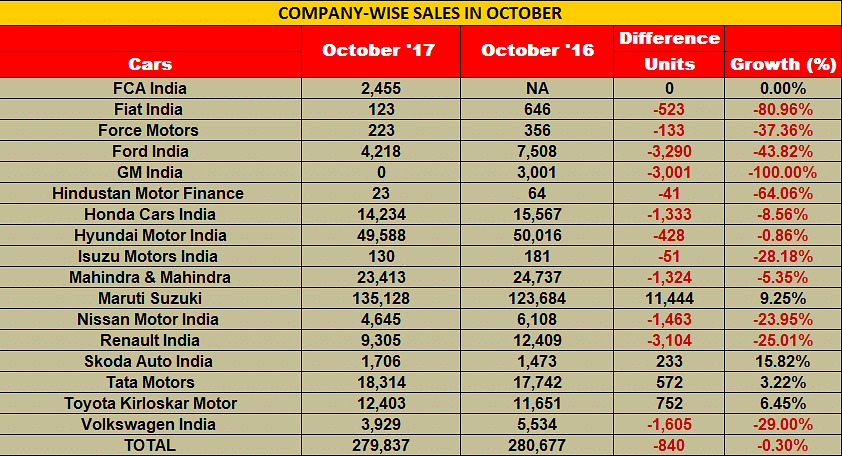

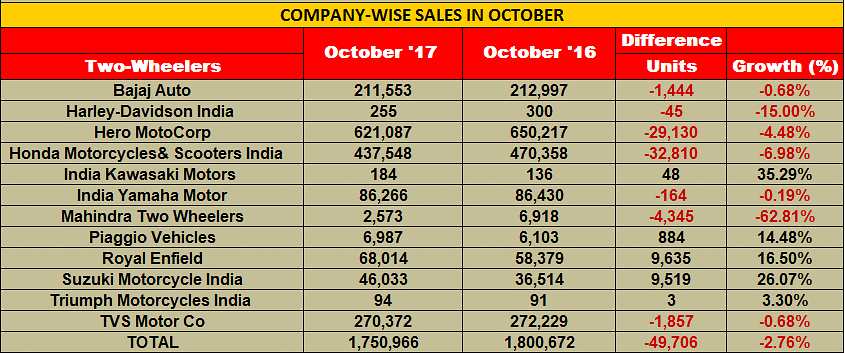

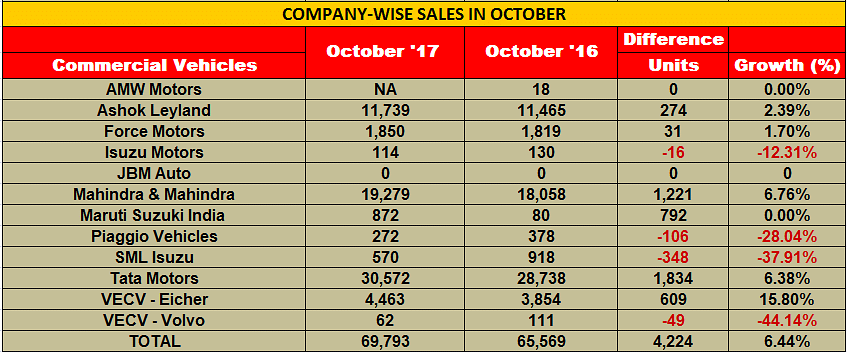

After a bumper month of festive September, when passenger vehicle sales hit a record 309,955 units and overall industry sales notched 2,490,034 units for a year-on-year growth of 10 percent, October 2017 witnessed fewer dealer dispatches making their way out from OE stockyards. The overall industry dipped into negative growth after maintaining a solid run for nine months since January. Total vehicle sales across segments stood at 2,162,164 units (-1.79%), with passenger vehicles (279,837 / -0.30%), commercial vehicles (69,793 / +6.44%), three-wheelers (61,568 / +12.81) and two-wheelers (1,750,966 / -2.76%), showing a mixed bag in performance. According to industry apex body SIAM, since there was a huge inventory-fill, which was done a month in advance in anticipation of the upcoming demand during Dhanteras and Diwali, October wholesales stood lower to allow for stock correction.

However, with the salaried class and business owners pre-occupied with the GST structure, and many also recently coming into the income tax net and left with little cash to splurge, sales didn’t materialise as per expectations, leading to a subdued performance by the passenger vehicle and the two-wheeler segments.

Cumulative numbers for the April-October 2017 period, on the other hand, still look positive for most segments, with a total of 14,913,307 units (+7.62%), hinting at a good overall fiscal for the industry. PV sales between this time (1,910,782 / +7.67%) are in line with the SIAM outlook (+7-9%) for FY2018, with two-wheelers (12,258,274 / +8.09%) falling a little behind the 9-11 percent growth projection. Commercial vehicles (423,135 / +6.04%) too are adhering to the 4-6 percent outlook, and a good agricultural output, and tons of infrastructural activities augur well for the segment, which had faced a lull in the starting months of the fiscal in lieu of a lot of pre-buying before the implementation of new and expensive BS IV technology, as well as a flat period in the Q3 of FY2017 due to the demonetisation drive in November last year. Three-wheelers (321,116 / -6.27%), however, pose a serious concern as they continue to plunge but with things improving over recent months, they could still battle it out hard to near their growth projection of 4-6 percent.

Utility vehicle sales (519,333 / +16.95%), along with scooters (4,148,852 / +14.63%) and LCV goods carriers (241,795 / 18.19%) continue to maintain their surge, helping give a shot in the arm to their respective segments in these growing categories.

HOW THE PASSENGER VEHICLE MAKERS FARED

Maruti Suzuki India, the bellwether of the industry, has reported sales of 135,128 vehicles in October 2017, a year-on-year growth of 9.25% (October 2016: 123,684). Its numbers are marginally lower than expected given that the festive season of Diwali, when consumers prefer to drive home their new set of wheels, was in mid- October itself.

Its entry-level Alto and the Wagon R see a sales decline of 4.2 percent in October 2017 with 32,490 units (October 2016: 33,929), but the quintet of compact cars – Swift, Celerio, Ignis, Baleno and the Dzire – registered solid 24.7 percent growth with sale of 62,480 units (October 2016: 50,116). Expect the bulk of the contribution to these numbers to have come from the new third-generation Dzire compact sedan, which has set the sales charts afire for the company.

The Ciaz, the company’s sole C-segment offering, however, is on a downward path, clocking sales of 4,107 units (October 2016: 6,360), a sharp drop of 35.4 percent. What is giving Maruti sales the charge is the surging demand for its UV offerings particularly the Vitara Brezza. The company’s UV portfolio, comprising the Gypsy, Ertiga, Vitara Brezza and the newly introduced S-Cross facelift, sold 23,382 units last month, marking sizeable 29.8 percent growth (October 2016: 18,008).The two vans, the Maruti Suzuki Omni and the Eeco, sold a total of 12,669 units, which makes for flat growth of 0.9 percent (October 2016: 12,790).

Like Maruti, Hyundai Motor India, the No. 2 player, too posted lower-than-expected sales. In October 2017, the Chennai-based manufacturer sold 49,588 passenger vehicles, down 0.8 percent (October 2016: 50,017).

Commenting on the October sales, Rakesh Srivastava, director - Sales and Marketing, said, “Hyundai did its highest retail of over 50,000 units in a festival month, with a wholesale of 49,588 units on the strength of strong demand for the Grand i10, Elite i20 and Creta. The new Verna has received a strong customer response with over 20,000 cumulative bookings and 150,000 enquiries.

Like Hyundai, Mahindra & Mahindra, the No. 3 domestic market player, too felt the pressure of slowing sales. The UV major has witnessed a performance slump, despite the festive period generally giving a boost to sales. The company sold a total of 23,413 PVs in October 2017, a 5 percent de-growth (October 2016: 24,737). UVs, its forte, de-grew by 6 percent with models including the Bolero, Thar, TUV300, Scorpio and the XUV500 clocking sales of 22,040 units (October 2016: 23,399).

M&M’s line-up of its cars and vans, including the KUV100 and the Verito performed decently, bringing in sales of 1,373 units (October 2016: 1,338), a 3 percent growth. The KUV100 has also been given an update by the company in the form of the KUV100 NXT and aims to improve on some of the aesthetics of the original model introduced in early 2016.

Rajan Wadhera, president, Automotive Sector, M&M, said, “The auto industry has had a mixed month in terms of sales in October. The build up to Dhanteras and Diwali was good but the demand tapered off subsequently. Last year, all festivals were in the month of October and the industry volumes had a high base. This year, September and October combined, we have grown by 7.9 percent in the auto division. Going forward, we enter into a year-end period of lower sales. Our refreshes and new variants, that have been launched, will carve out a niche and we expect to sustain the growth momentum for the remaining period of the current financial year.”

Tata Motors’ passenger vehicle division recorded sales of 18,314 units in the domestic market, a growth of 3.22% over October 2016. According to the company, continued good performance of new- generation vehicles like the Tiago, Tigor and Hexa and the strong market response to the recently launched compact SUV, Nexon have contributed to the numbers.

For Tata, its cumulative sales in the domestic market for the fiscal (April-October 2017) total 110,415 units, a growth of 9.23 percent compared to 88,976 units, in the same period last fiscal.

Commenting on the October sales performance, Mayank Pareek, president, Passenger Vehicles Business Unit, Tata Motors, said, “We continue to keep the sales momentum going, led by a strong product pipeline of the Tiago, Tigor and Hexa. We have successfully completed the launch of the Nexon across the country and are delighted with the response – it is currently witnessing a waiting period of around 8 weeks. We maintain cautious optimism in the market and hope to see this momentum continue.”

Toyota Kirloskar Motor sold 12,403 units in the domestic market in October 2017, a 6 percent year-on-year growth (October 2016: 11,651). The company also exported 1,597 units of the Etios series, thus clocking a total of 14,000 units registering 6 percent growth as compared to same period last year.

According to the company, despite the price rise in line with the GST cess hike, customer demand for the Innova MPV and Fortuner SUV continues to be strong and the Bidadi plant capacity is being utilised to the maximum. The newly launched limited editions Etios Cross X-Edition and Fortuner TRD Sportivo have also seen a good market response.

Commenting on the monthly sales, N Raja, director and senior vice-president, Sales & Marketing, TKM, “We are happy that the festive season has given a positive push to domestic sales in the auto industry. There is a spur in the customer demand. The Innova Crysta and Fortuner continue to enjoy good growth in demand and we are utilising one of our plants to the maximum capacity to ensure the waiting period is reduced.” TKM has also reported a slight improvement in customer demand for the Camry Hybrid.

Honda Cars India sold a total of 14,234 units in the festive month, an 8.56 percent drop in performance (October 2016: 13,958). Its City sedan went home to 4,366 buyers, with the crossover range including the BR-V and the WR-V bringing in sales of 3,443 units combined. While the Brio hatchback, its compact sedan sibling Amaze, as well as the Jazz sold a total of 5,131 units, its flagship CRV crossover sold a meagre 14 units and is set to be updated with a new third-generation model towards the middle of 2018.

Ford India registered a weak performance with total domestic sales of 4,218 units (October 2016: 7,508), registering de-growth of 43.82 percent. According to Anurag Mehrotra, president and managing director, Ford India, “The ramp-up for new model introduction has impacted our wholesales for October.” The company launched the updated EcoSport on November 9 and with an increased localisation level of 85 percent, has kept the prices of the crossover in check, to revive its sales in the country.

TWO-WHEELER OEMS FEEL THE HEAT TOO

The two-wheeler industry also felt the heat in October dispatches, coming in from a rather buoyant inventory restoration in September.

India’s No 1 two-wheeler brand, Hero MotoCorp sold a total of 621,087 units, registering de-growth of 4.48 percent (October 2016: 650,217). The company recorded its best-ever sales in the month of September 2017, with a total of 720,739 units, a remarkable feat for any two-wheeler manufacturer across the world. Its scooters which sold 80,535 units (October 2016: 88,790), registered a drop of 9.29 percent, while motorcycles too encountered a slight dip of 3.27 percent, selling 540,552 units (October 2016: 561,427).

Honda Motorcycle & Scooter India recorded sales of 437,548 units (-6.98%), with scooters contributing almost 67 percent to the overall numbers, selling 293,117 units, albeit down by 3.21 percent (October 2016: 302,862). The company also introduced its new Grazia scooter in the 125cc segment, which is its second 125cc automatic offering after the Activa 125 and is targeted to strengthen its stranglehold in the scooter space by luring in younger buyers. On the other hand, Honda’s motorcycle sales stood at 144,431 units (October 2016: 167,496), declining 13.77 percent in the month of October.

TVS Motor Company clocked cumulative sales of 270,372 units, marginally falling by 0.68 percent (October 2016: 272,229). Holding the baton for the company in the scooter segment is its Jupiter model, which is quite a hit with the masses, taking the company’s overall scooter sales to 103,020 units (October 2016: 87,810), a growth of 17.32 percent. TVS’ motorcycle sales with 92,315 units declined by 4.5 percent (October 2016: 96,673), and mopeds too saw a notable drop of 14.48 percent to 75,037 units (October 2016: 87,746).

Bajaj Auto saw its sales remaining near flat with total of 211,553 units being sold, a drop of 0.68 percent (October 2016: 212,997). Its cumulative sales between April-October 2017 stand at a 1,222,112 units, and apart from September 2017, the home-grown manufacturer has seen it tough to post positive growth in the current fiscal.

Chennai-based motorcycle marque, Royal Enfield registered cumulative sales of 68,014 units, a remarkable surge of 16.5 percent (October 2016: 58,379). The company also unveiled its new 650cc twin-cylinder motor, which will spawn two newly developed products in the mid-size category. Its Interceptor INT 650 and Continental GT 650, unveiled at the EICMA 2017 will be gunning for the midsize segment in India, as well as in mature markets, including Europe, Australia and North America.

Suzuki Motorcycle India posted sales of 46,033 units, bringing in a phenomenal jump of 26.07 percent (October 2016: 33,435). While scooters, with the refreshed Suzuki Access 125 continue to remain its strong drivers, selling 40,045 units (October 2016: 27,447) and growing by 45.89 percent; motorcycles sold a total of 5,988 units (October 2016: 9,067), declining by 33.95 percent. The company recently launched its new Intruder 155 in the market and seeing more opportunity in the scooter and the premium motorcycle segment, has announced to exit the commuter motorcycle segment by 2020 and focus completely only on trendy scooters, as well as motorcycles higher than 150cc in capacity. It will also aim to offer at least two new products into the market every year.

With five months still remaining in the fiscal year, the industry has just received a boost with the finance minister dropping GST rates on thirty essential consumables, a move which will drive consumption across the country and in turn fuel demand for vehicles. Also, with consumer sentiment improving and economic indices marginally better, expect vehicle manufacturers across segments to record improved numbers month on month, fingers firmly crossed.

LCVs SAVE THE BLUSHES FOR CV INDUSTRY

After notching speedy growth in Q2 FY2018, overall commercial vehicle sales have seen a slight moderation in growth in October 2017. Both the top OEMs – Tata Motors and Ashok Leyland – which recorded brisk growth in M&HCVs in the second quarter saw their sales drop from the highs scaled in August and September.

While Tata Motors’ M&HCV sales have grown 8 percent, Ashok Leyland’s M&HCV numbers saw a decline of 5 percent albeit overall CV sales are up by 3 percent. This is the first decline for Ashok Leyland’s M&HCV sales since May 2017 and in August and September the company registered strong growth of 29 and 32 percent respectively. Mahindra & Mahindra and VE Commercial Vehicles maintained reasonable growth in their overall sales, mainly due to demand for last-mile connectivity in the form of LCVs.

The lingering impact of BS IV and GST seems to have settled and fleet operators have started renewing their fleet buys on the back higher demand for transport of industrial and sundry goods. There is also an uptick in tipper sales due to the government’s infrastructure push.

How the OEMs fared in October

After recording consistent double-digit growth over the past three months, CV market leader Tata Motors’ overall sales in October 2017 moderated to 32,411 units, a year-on-year growth of 7 percent (October 2016:30,169).

According to the company, the increase in sales comes on the back of a further ramp-up of production, growing demand for newly launched products as well as higher customer uptick due to increased consumption across sectors. This also coincided with peak festive season buying trends across segments.

Tata saw decent growth in the critical M&HCV truck segment which grew by 8 percent to 11,391 units as a result of increasing acceptance of the company’s SCR technology, infrastructure development led by government funding and restrictions on overloading. A combination of these factors has led to greater demand for new high-tonnage vehicles, especially 37T multi-axle trucks and 49T tractor-trailers.

The I&LCV truck segment also saw an upward trend, growing by 7 percent at 3,760 units in month driven by new product introductions. The pickup segment, with sales of 5,604 units in October 2017, reported strong growth of 45 percent with the Xenon Yodha and Ace Mega XL gaining acceptance and demand across markets. Growth in the SCV cargo segment though was flat with sales of 8,413 units.

Growth was missing from the passenger carrier (including buses) segment: at 3,243 units sold in October 2017, demand was lower by 17 percent over October 2016. It is understood that fresh purchases by STUs and the release of permits have been subdued.

Speaking on the company’s sales performance, Girish Wagh, head, Commercial Vehicle Business Unit, Tata Motors said, “With our business turnaround, our commercial vehicle business will continue to be our key focus and we will undertake appropriate measures to improve our performance across segments and cater to the discerning needs of our customers.”

Ashok Leyland recorded marginal 3 percent growth in overall CV sales to 12,914 units (October 2016: 12,534). Its M&HCV sales, after seeing sustained growth over the past few months, have fallen by 5 percent to 9,110 units (October 2016: 9,575) while LCVs posted strong 29 percent YoY growth at 3,804 units sold (October 2016: 2,959).

Mahindra & Mahindra’s overall CV sales are up 7 percent to 19,279 units (October 2016: 18,059). M&HCV sales registered growth of 59 percent to 748 units albeit on a low year-ago base (October 2016: 471). The below-3.5T GVW segment is up by 5 percent YoY, at 18,057 units (October 2016: 17,182), while those in the above-3.5T GVW segment grew by 17 percent with sales of 474 units (October 2016: 406).

VE Commercial Vehicles’ domestic sales were up by 15.8 percent with total sales of 4,463 units (October 2016: 3, 854 units).

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

13 Nov 2017

13 Nov 2017

16455 Views

16455 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal