India commercial vehicle exports hit a new high in FY2017

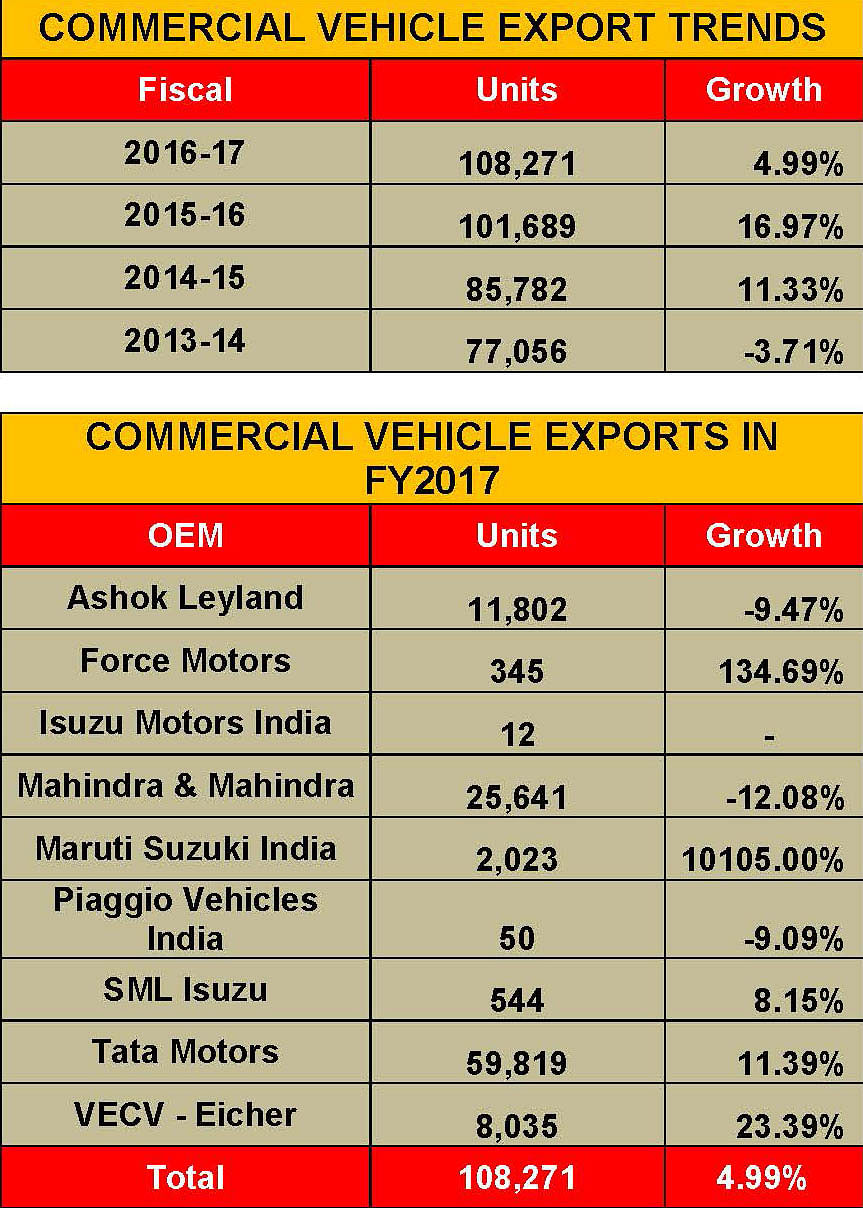

Acting as a buffer to sluggish domestic demand, exports of commercial vehicles at 108,271 units are the best ever yet as OEMs actively search new markets for growth.

Despite headwinds in the domestic market, the commercial vehicle (CV) industry has seen gains in the export market. Exports, which constitute a buffer to slow domestic market demand, have seen CV manufacturers expand into newer markets in Africa and the Middle East besides the traditional markets of SAARC countries.

In FY2016-17, total CV exports remained above the 100,000 units mark at 108,271 units (2015-16: 101,689). LCVs were the prime overseas shipments at 64,552 units (2015-16: 43,719).

CV market leader Tata Motors remains the largest exporter, shipping 59,819 units in FY2017 (2015-16: 53,704), growing 11.39%. Of this number, LCVs with 29,999 units were the export driver.

In the M&HCV segments, Tata Motors has gained most in the 16T and 25T rigid categories. In the 16T segment the company has exported 10,318 units in FY’17 as compared to 5,833 units thus growing by massive 77%. Similarly, the 25T rigid segment, the company shipped 3,792 units (2015-16: 2,398 units) growing by 58%. In the LCV segment, the 2-tonne mini truck segment, where the company dominates in the domestic markets, remains the largest segment in exports too. Tata exported 15,883 units in 2016-17, to post flat growth. In the 2-3.5-tonne pick-up segment, it saw a fall of 15% at 11,015 units.

At No. 2 is Mahindra & Mahindra, which exported 25,641 units (2015-16: 29,139), down 12 percent. M&M, which dominates the 2-3.5-tonne pick-up segment in the domestic market, has maintained a significant lead in exports too. The segment contributed the highest to M&M exports. In the pick-up segment, the company shipped 19,933 units in FY’17, down by 12.8%. (2015-16: 22,877 units)

Ashok Leyland which largely exports its M&HCVs and has clinched a number of new export orders for its buses from African countries, despatched 11,802 units during 2016-17, down 9.47% (2015-16: 13,037). The company’s largest exports come from its HCV buses; however, in the last fiscal, its exports in the category were down by a sizeable 31%. In the 16-tonne heavy duty buses segment, the company shipped 3,716 units. (2015-16: 5,366 units). In the 2-3.5T pick-up segment, where it exports the Dost, saw a sharp drop of 54% to 717 units (2015-16: 1550 units).

VE Commercial Vehicles registered double-digit growth, albeit on a low base; it exported 8,035 units, up 23.39%. Force Motors and SML Isuzu exported 345 units and 544 units, growing by 134% and 8.15% respectively.

Passenger vehicle manufacturer Maruti Suzuki India, which entered the CV market with its Super Carry in September 2016, has seen more exports than domestic sales of the small CV. The company exported a total of 2,023 units of the Super Carry to various countries including Africa and SAARC, compared to 900 units sold in India.

RELATED ARTICLES

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

13 Apr 2017

13 Apr 2017

15339 Views

15339 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi