India's Best-Selling Scooters – February 2019 | Jupiter reclaims No. 2 spot from Access, Hero Destini 125 beats NTorq again

While the Honda Activa remains unassailable albeit with sales slowing down, the TVS Jupiter has regained its No. 2 position after the sharp upset by the Suzuki Access 125 in January.

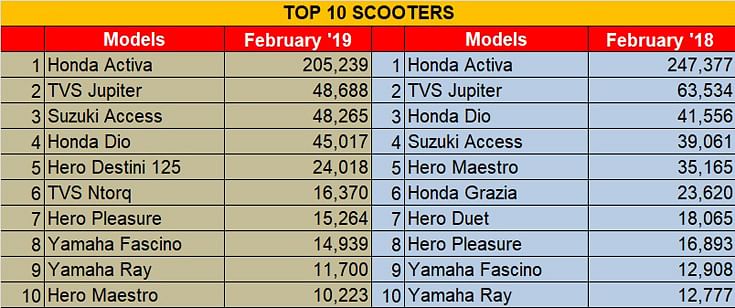

The domestic scooter market, which is currently experiencing a sharp slowdown, still has the Honda Activa as the unassailable favourite. But there is some churn happening below the numero uno position. The Honda Activa, with total despatches of 205,239 units in February 2019, remains the No. 1 scooter and the second-best-selling two-wheeler in the country (after the Hero Splendor). But look back and a year ago, the Activa had sold 247,377 units in February 2018, a good 17 percent down YoY.

In what was quite an upset in January 2019, the Suzuki Access 125 had taken second spot, relegating the longstanding No. 2 player the TVS Jupiter to third. But the TVS Jupiter has fought back in February, with despatches of 48,688 units, ahead of the Suzuki scooter. The 110cc Jupiter continues to be a strong contributor to TVS Motor’s monthly sales performance.

Continuing demand for the Suzuki Access 125 means that the scooter jotted up numbers of 48,265 units in February 2019. The Japanese company’s turnaround efforts are finally visible as it continues to work not only on its product portfolio but also on the dealer development side. The consistent and linear growth in the demand for Suzuki Access 125 is to be attributed for this achievement along with the company’s expanding reach across the country. This is a first for Suzuki as well as the Access 125 scooter in at least the last 8 years or more.

The closest contender to the Jupiter and Access appears to be the Honda Dio. However, the Suzuki Access continues to outsell Honda Dio due to its family scooter appeal. The Honda Dio stays strong among young college going buyers, with Jharkhand, Karnataka and Maharashtra being strong markets.

The Dio, which is the No. 4 best-selling scooter in India, saw despatches of 45,017 units in February 2019. These numbers only suggest that the Honda Dio continues to enjoy strong brand equity amongst young and the new-age commuters across cities.

At No. 5 is the Hero Destini 125 whose volumes continue to surge. The scooter’s aggressive pricing (sub-Rs 55,000 ex-showroom) appears to be working for Hero MotoCorp, which intends to desperately make a mark in the scooter segment, in this case the fast-growing 125cc category in this case. While it is natural for the largest two-wheeler manufacturer to receive to a good response for its newly launched 125cc scooter, thanks to its widespread distribution network across the country, the real report card will be defined by the market response of at least three quarters.

The TVS NTorq, at No. 6, saw despatches of 16,370 units, which means monthly volumes for the the latest TVS 125cc scooter have stabilised at around 15,000 to 17,000 units.

Hero MotoCorp’s 102cc Pleasure scooter, which targets urban female commuters, secured wholesale volumes of 15,264 units in February 2019, more than the 12,892 units in January 2019 but less than the 16,893 units it notched a year ago. It stands at the seventh spot in the Top 10 best-selling scooters list.

At No. 8 is the Yamaha Fascino with 14,939 units, better than the 12,493 units it did in January 2019. Yamaha needs to do more if the uptick in demand is to be maintained. It is followed by another Yamaha, the Ray, with 11,700 units.

Hero MotoCorp’s one-time strong scooter brand Maestro, which used to fetch volumes of about 40,000 units per month and gave tough competition to the TVS Jupiter and Suzuki Access in the past, is now ranked tenth with 10,223 units. It would be interesting to gauge how Hero MotoCorp, which has been under tremendous pressure to perform in the growing domestic scooter market, realigns its position when it rolls out the new Maestro Edge 125 in the coming months. Stay tuned for more updates in this exciting vehicle segment.

Also read: India's Best-Selling Two-Wheelers – February 2019

India's Best-Selling Passenger Vehicles – February 2019

India's Best-Selling Utility Vehicles – February 2019

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

19 Mar 2019

19 Mar 2019

35702 Views

35702 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau