India Auto Inc shows resilience in FY2021, bounces back in Q4

Cumulative vehicle sales impacted due to Covid outbreak but sales decline curtailed by the need for personal mobility.

FY2021 has been one of the toughest years in the history of the Indian automotive industry with the outbreak of the Covid-19 pandemic putting a spanner in the works. The automobile industry, which was already facing headwinds of a slowing-down economy, was brought to a standstill with the nationwide lockdown in April 2020. And this April, the pandemic once again threatens to spiral out of control.

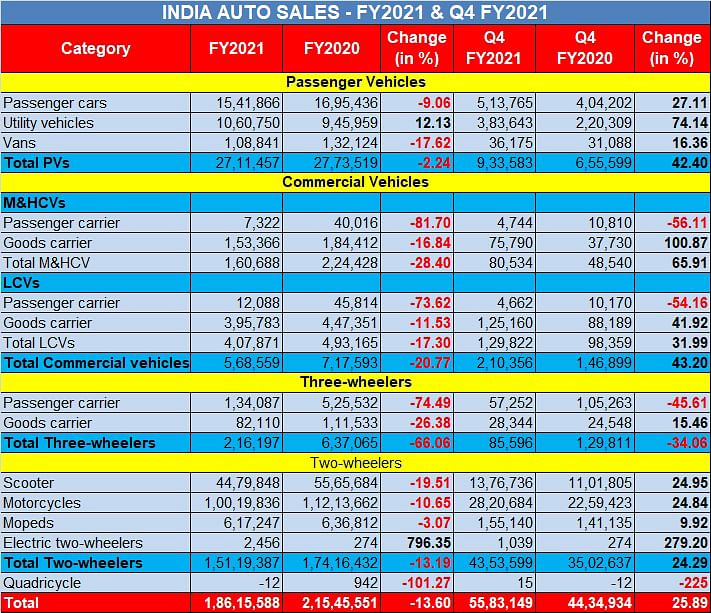

While India Auto Inc closed FY2021 with an overall (across segments) year-on-year sales decline of 13.6 percent and registered cumulative sales of 18,615,588 units (FY2020: 21,545,551), the past few months have been relatively better with Q4 FY2021 registering an uptick of 25.89 percent with total sales of 5,583,149 units (FY2020: 4,434,934).

Here’s a segment-wise analysis of the FY2021 performance:

Passenger Vehicles: 2,711,457 units / -2.24%

The passenger vehicle segment was hit hard with cumulative sales falling to 2,711,457 units (FY2020: 2,773,519 / -2.24%). The biggest impact was felt by passenger cars and vans, which clocked 1,541,866 units (1,695,436 / -9.06%) and 108,841 units (132,124 / -17.62%), respectively. However, the utility vehicles (UVs) emerged as a saving grace, registering a net YoY uptick of 12.13 percent and sales of 1,060,750 units (945,959). Interestingly, UV sales crossed a million units in a single year for the first time, ample proof of the surging demand for this vehicle segment.

New-model launches could be attributed to have played a big role in driving this growth, wherein the need for safer personal mobility coincided with these brand-new offerings entering the market. The Hyundai Creta, Kia Sonet, Mahindra Thar and the Nissan Magnite are some of the UV models introduced last year that were in the news for all the right reasons.

However, while the PV segment was impacted by the pandemic on an annual basis, its performance in Q4 FY2021 was particularly impressive with sales between January and March 2021 registering a strong YoY uptick of 42.40 percent and recording sales of 933,583 units (Q4 FY2020: 655,599).

Commercial Vehicles: 568,559 units / -20.77%

CVs are the barometer of the economy and clearly, were one of the worst-hit vehicles in terms of sales in a pandemic-impacted year when most non-essential economic activities including infrastructure development and construction, as well as public transportation, remained suspended for the substantial part of last year.

As a result, CVs registered cumulative sales of 568,559 units in FY2021 (717,593 / -20.77%), with M&HCVs facing a relatively severe impact at 160,688 units (224,428 / -28.40%), compared to LCVs that clocked 407,871 units (493,165 / -17.30%) in the entire fiscal.

If one gets into the further segmentation, then passenger-carrying M&HCVs (buses) recorded an 81.70 percent YoY drop to 7,322 units (40,016), while goods carriers were down 16.84 percent to 153,366 units (184,412).

On the other hand, LCV passenger carriers recorded a 73.62 percent YoY decline to 12,088 units (45,814) and goods carriers stood at 395,783 units (447,351 / -11.53%).

But, just like passenger vehicles, CVs too showed a strong resurgence in Q4 FY2021, with M&HCVs registering an uptick of 65.91 percent to reach volumes of 80,534 units (Q4 FY2020: 48,540) and LCVs recording a 32 percent YoY growth to sell 129,822 units (98,359). Cumulatively, CVs registered a 43.20 percent YoY uptick in Q4 FY2021 to 210,356 units (Q4 FY2020: 146,899).

Two-wheelers: 15,119,387 units / -13.19%

The most affordable means of individual mobility – two-wheelers – registered a 13.19 percent YoY sales decline with total sales of 15,119,387 units (17,416,432). While scooter sales were down 19.51 percent to 4,479,848 units (5,565,684), motorcycles, which find precedence in rural India, clocked overall sales of 10,019,836 units (11,213,662 / -10.65%).

Electric two-wheelers, for the first time, could be seen garnering some respectable numbers with cumulative sales of 2,456 units – an eight-fold increase over the previous fiscal.

But, in terms of the Q4 performance, two-wheelers struck back with a vengeance with overall sales touching 4,353,599 units between January and March 2021 (Q4 FY2020: 3,502,637 / +24.29%).Scooters registered a 25 percent YoY uptick at 1,376,736 units (1,101,805), and motorcycles went home to 2,820,684 buyers (2,259,423 / +24.84%). Electric two-wheelers clocked 1,039 units in the three-month period alone, and registering a substantial 279 percent growth – particularly attributed to the expansion of Ather Energy in ten more markets outside of Bangalore.

Three-wheelers: 216,197 units / - 66%

If the Covid-19 pandemic has cast a deadly spell for any vehicle segment, it is the three-wheelers. Most public transportation services are still running at minimal capacity, leading to a downfall in the requirement of shared transportation and last-mile connectivity services.

Three-wheelers recorded a YoY decline of 66 percent with sales coming down to 216,197 units (FY2020: 637,065). While public carriers bore a huge impact with volumes plummeting 74.49 percent to 134,087 units (525,532), goods carriers were slightly safeguarded with a drop of 26.38 percent to 82,110 units (111,533) in the last fiscal.

On a quarterly basis too, three-wheelers failed to show any substantial spike in volumes with an overall de-growth of 34 percent between January and March 2021, and sales touching 85,596 units (Q4 FY2020: 129,811). Passenger-carrying three-wheelers clocked 57,252 units (105,263 / -45.61%) and goods carriers registered 28,344 units (24,548 / +15.46%).

Growth outlook for FY2022

So, as India Auto Inc gets down to strengthen its efforts of recovery even amidst rising concerns of a second wave of the Covid pandemic, there is a likelihood of FY2022 emerging as a much better year for the industry overall. Still, no business guru would now hazard a guess on the long-term sector outlook.

“The Indian automobile industry continues to work hard amidst challengesof a second Covid wave, to maximise production and sales, while ensuringsafety of its people, partners and customers. We would like to thank andcompliment the government for a massive nation-wide vaccination driveand also for allowing vaccination of our employees in the factory premises,” said Kenichi Ayukawa, president, SIAM, in a press statement.

“On the sales front, a deep structural slowdown in the industry even beforethe pandemic, combined with the impact of the pandemic in 2020-21, haspushed all vehicle segments back by many years. Recovery from here will require time and efforts by all stakeholders. There is still uncertainty in thevalue chain owing to semiconductorshortage, fresh lockdowns and increasing raw material prices. In anenvironment of uncertainty, instead of trying to predict the future, we willall work hard to create it,”Ayukawa concluded.

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

13 Apr 2021

13 Apr 2021

10486 Views

10486 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi