Hyundai Motor India’s share of global sales rises to 15% in FY2024

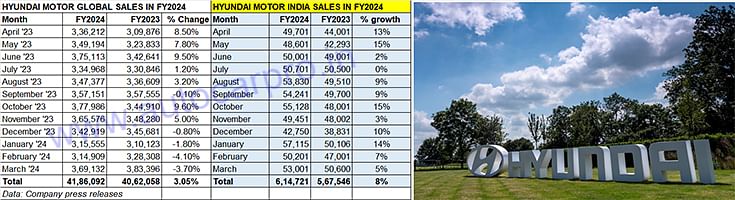

With its best-ever fiscal year sales of 614,721 units, Hyundai Motor India’s share of Hyundai’s global sales of 4.18 million passenger vehicles has grown to its highest level of 14.68 percent, maintaining India’s strong position as a key growth market for the Korean automaker.

With the Indian passenger vehicle market firing on all cylinders in FY2024 with estimated total wholesales of a record 4.23 million units, up 8.74% on FY2023’s 3.89 million units, all the top car and SUV makers in India have recorded best-ever numbers including the Hyundai Motor Group’s Indian vehicle manufacturing arm, Hyundai Motor India. In FY2024, Hyundai Motor India delivered its best-ever fiscal year domestic market performance of 614,721 units, up 8%, which sees its contribution to global sales of Hyundai Motor rise to its highest ever – 14.68 percent.

A collation of the last 12 months’ wholesales figures for Hyundai Motor’s global sales reveals that the Korean auto major recorded total sales of 4.18 million units, up 3.05% YoY (FY2023: 4.06 million units). As a result, Hyundai Motor India’s 614,721 units gives it a 14.68% share of Hyundai’s global sales.

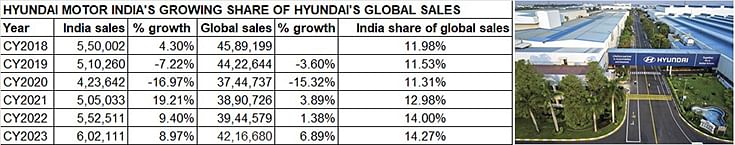

At 614,721 units, Hyundai Motor India's share of Hyundai's estimated global sales of 4.18 million units is 14.68 percent, bettering the 14.27% in CY2023.

At 614,721 units, Hyundai Motor India's share of Hyundai's estimated global sales of 4.18 million units is 14.68 percent, bettering the 14.27% in CY2023.

India: a key global growth market for Hyundai

The Indian car and SUV market continues to be a key contributer to Hyundai Motor Group and is the second-best performing global market for the Korean chaebol after the home market of South Korea.

In CY2023, Hyundai Motor India, with its best-ever annual sales of 602,111 units in the domestic market, contributed to 14.27% of Hyundai’s global sales, marginally up from the 14% in CY2022 (552,511 units of 39,44,579 global sales). Data reveals that Hyundai Motor India’s share of Hyundai’s global sales has steadily increased over the years – from 12% in CY2018 to 14.27% in CY2023.

India, which is currently one of the world’s most promising automotive markets, ranking third behind China and the US, is witnessing a massive boom in demand for utility vehicles, particularly SUVs. In FY2024, the UV segment is expected to account for nearly 60 percent – 2.53 million units – of the 4.23 million passenger vehicles sold.

Hyundai Motor India retails a total of 11 vehicles comprising four cars (Grand i10 Nios, i20, Aura and Verna) and nine SUVs (Creta, Venue, Exter, Alcazar, Tucson, Ioniq 5 and Kona). Demand for the company’s overall passenger vehicle range continues to be powered by the Creta midsize SUV and the recently launched Exter compact SUV. Like the other leading PV makers in India, SUVs are the key growth drivers for Hyundai. In FY2024, it is understood the Creta, Exter, Ioniq 5 SUVs and the Aura sedan registered their highest ever fiscal numbers.

As per industry data for the April 2023-February 2024 period, Hyundai’s top selling SUVs were the Creta (146,315 units), Venue (119,281 units), Exter (62,826 units in 8 months since launch) and the Alcazar (19,333 units). Their numbers will increase when the March 2024 wholesales numbers are revealed. This performance has meant that the Creta, Venue and Exter were ranked fourth, seventh and 15th in the Top 20 UVs chart for the first 11 months of FY2024.

Hyundai Motor India is fast upping the ante. The company, whose existing 830,000 units per annum manufacturing capacity at its plants in Sriperumbudur, Tamil Nadu is stretched to accommodate growing domestic and export market demand for its products, completed the acquisition of GM’s plant in Talegaon, Maharashtra in January 2024. Hyundai has committed to invest Rs 6,000 crore in Maharashtra to upgrade and refurbish the Talegaon plant, which had a production capacity of 130,000 units. That’s not all. Hyundai has also committed a mega investment of Rs 26,000 crore in Tamil Nadu over a decade, which will go towards new product development, particularly EVs and also fresh production capacity.

India's passenger vehicle market is expected to exceed 7 million units by 2030. That's reason why the Hyundai Motor Group is pressing the accelerator to achieve speedier growth through its two vehicle manufacturing arms - Hyundai Motor India and Kia India.

ALSO READ:

SUVs power Maruti, Hyundai, Tata, M&M and Toyota to best-ever sales in FY2024

Hyundai Motor Group bets big on Brazil, will invest over $1.1 billion by 2032

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

04 Apr 2024

04 Apr 2024

10974 Views

10974 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi