HMSI makes biggest gains in 2-wheeler market share in Q1, FY15

Honda Motorcycle & Scooter India (HMSI) has notched the maximum gains in the first quarter (April-June 2014) of fiscal year 2014-15.

Honda Motorcycle & Scooter India (HMSI) has notched the maximum gains in the first quarter (April-June 2014) of fiscal year 2014-15.

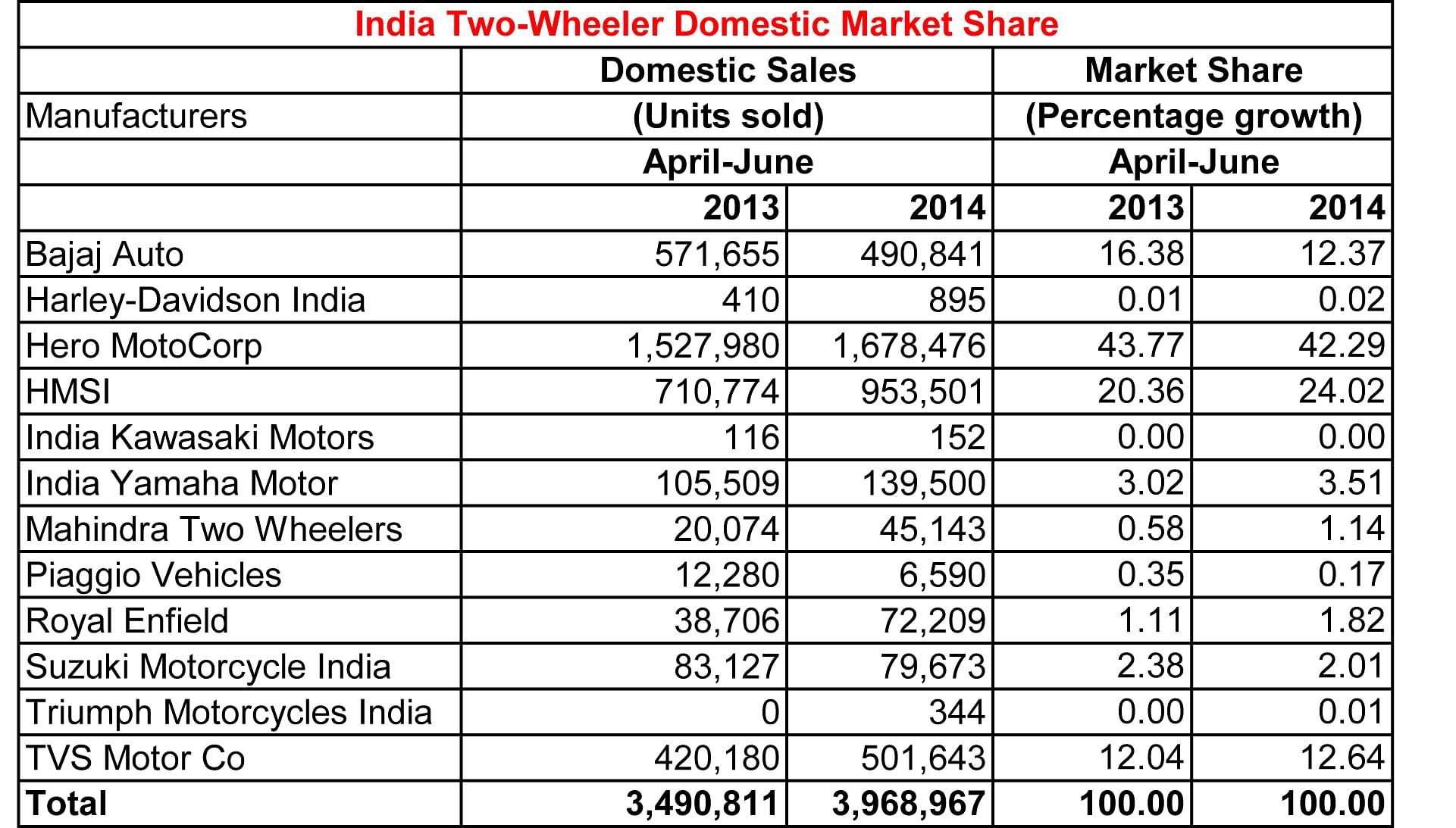

Recently released SIAM sales numbers for Q1 FY2014-15 reveal that the domestic Indian two-wheeler industry has grown by a healthy 13.70 percent, selling a total of 3,968,967 units.

The fiscal’s first quarter sees some shuffling of positions among the top four players – Hero MotoCorp, HMSI, Bajaj Auto and TVS Motor Company, where Hero and Bajaj lose some market share and the other players gain some crucial percentage points.

Marginal gainers (in terms of the market share) were India Yamaha Motor, Mahindra Two Wheelers, Royal Enfield, Harley-Davidson Motor Company India and India Kawasaki Motors. The brands that performed below their last year’s sales were Piaggio Vehicles (for Vespa scooters) and Suzuki Motorcycle India (SMIL). SIAM numbers also highlight that the new entrant – British bike maker Triumph Motorcycles India has sold 344 units during Q1 FY2015.

Hero’s market share for Q1 FY2014-15 stands at 42.29 percent as against 43.77 percent a year ago. Interestingly, Hero’s sales for Q1 this year grew by 9.85 percent lost out on market share. The company sold 16,78,476 units between April-June 2014 as against 15,27,980 units during April-June 2013. Hero’s aggressive new product development will largely define its growth and market share retention over the next two years.

Standing out was HMSI, which primarily ate into the market shares of industry leader Hero MotoCorp and also Bajaj Auto. Honda registered domestic sales of 953,501 units during Q1, up by an impressive 34.15 percent over 710,774 units sold during Q1 of the last fiscal. With this, HMSI’s market share has jumped up by 3.66 percentage points to 24.02 percent (Q1 FY2013-14: 20.36 percent).

Chasing its ambitious sales target of 45 lakh units for the ongoing fiscal, the company will now focus on more than quadrupling the Q1 sales numbers in the next three quarters. To do so, besides penetrating deeper into the country’s rural pockets, HMSI plans to clearly depend on the newly launched 110cc mass commuter motorcycle, CD 110 Dream, also the most affordable Honda in India ever. Another project expected to bolster its (urban) sales in the near future will the upcoming 160cc premium commuter motorcycle, which will be squarely targeted at Bajaj’s Pulsar 150, Yamaha’s FZ-S and FZ16, and TVS’ Apache RTR 160 bikes.

Q1 FY2014-15 results also point at another interesting development –TVS Motor Company is now the new No. 3, overtaking Bajaj Auto (BAL) in the domestic market. Slipping from a domestic market share of 16.38 percent from Q1 last year, BAL now stands with 12.37 percent (Q1 FY2014-15); its domestic sales have fallen by 14.14 percent to 490,841 units during Q1 this fiscal. For Q1 last year, BAL’s domestic sales stood at 571,655 units.

TVS Motor Co, with sales of 501,643 units, sees its market share grow from 12.04 percent a year ago to 12.64 percent during Q1 this fiscal and its India market share now marginally stands above Bajaj’s by 0.27 percentage points. The company is planning a number of launches starting this year and the first product under its alliance with BMW is expected to roll out next year.

India Yamaha Motor’s share has gone up to 3.51 percent (Q1 this year) from 3.02 percent. Thanks to its scooter portfolio, the company’s Q1 sales saw a substantial growth in the first quarter.

Royal Enfield is another gainer with an updated market share of 1.82 percent (Q1 FY2014-15). The iconic brand has nearly doubled its Q1 sales YoY. It has sold 38,706 Bullet bikes during Q1 last year and has sold 72,209 units in Q1 this year.

The big-bike segment is also seeing positive action with Harley-Davidson India doubling its Q1 sales YoY. The company, which sold 410 bikes in Q1 2013-14, has sold 895 units between April-June 2014, thanks to the new Street 750 model, which is the most affordable Harley in India so far.

Meanwhile, India Kawasaki Motors has sold 152 bikes compared to 116 units during Q1 2013-14. In a bid to drive new momentum for its brand in India, Kawasaki plans to bring in fresh models in domestic markets soon.

RELATED ARTICLES

TVS maintains e-2W lead over Bajaj Auto, Ola and Ather in first two weeks of June

TVS Motor Co, which topped monthly electric two-wheeler sales in April and May, maintains its lead in the first two week...

Maruti Jimny crosses 100,000 sales since launch, 74% comprise exports

Launched on June 7, 2023, the Maruti Jimny five-door has sold a total of 102,024 units till end-April 2025. While the do...

Exclusive: Bajaj Auto sells 75,000 electric 3Ws in two years, readies to launch e-rickshaw

India’s largest three-wheeler manufacturer and exporter, which entered the electric 3W market in June 2023, clocks new r...

17 Jul 2014

17 Jul 2014

23399 Views

23399 Views

Autocar Professional Bureau

Autocar Professional Bureau