Honda, TVS & Suzuki - The Gainers of FY25 Two-Wheeler Market

Honda strengthened its grip on the second position, boosting its market share considerably from 23.36% to 25.37%, while Hero MotoCorp's share fell from 30.79% in FY24 to 28.84% in FY25.

The financial year ending March 2025 (FY25) marked a period of significant transition within the Indian two-wheeler (2W) market. While the overall segment posted moderate growth, the competitive landscape saw notable shifts, particularly with Honda Motorcycle and Scooter India (HMSI) making substantial inroads, according to the latest retail sales data from the Federation of Automobile Dealers Associations (FADA).

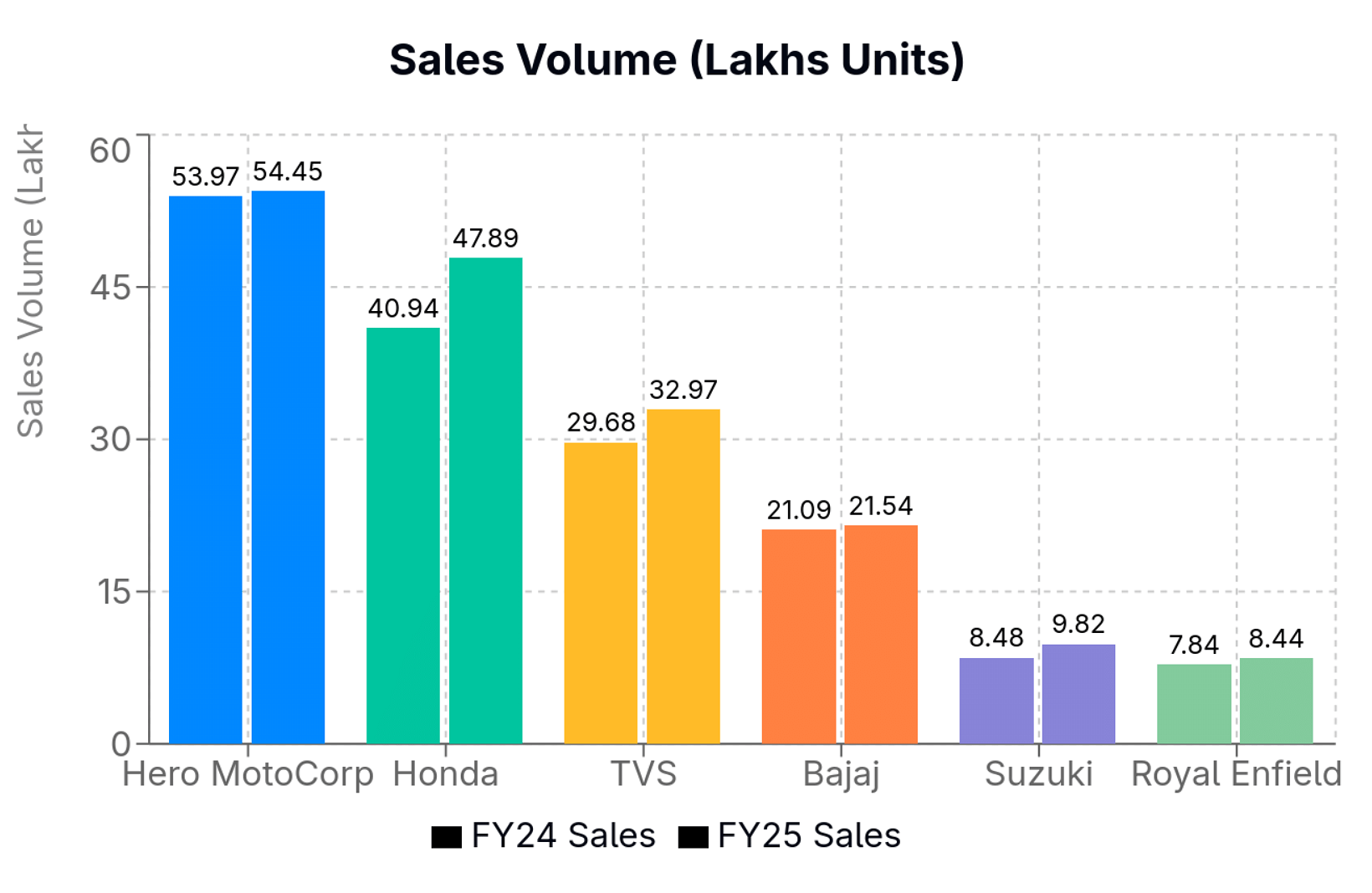

The 2W segment achieved a 7.71% year-on-year (YoY) growth in FY25, with total retail sales reaching 1,88,77,812 units, up from 1,75,27,115 units in the previous fiscal year.

This growth, although positive, fell short of the double-digit expansion the industry had hoped for. A significant driver was the rural market, which outpaced urban areas with an 8.39% growth compared to 6.77%.

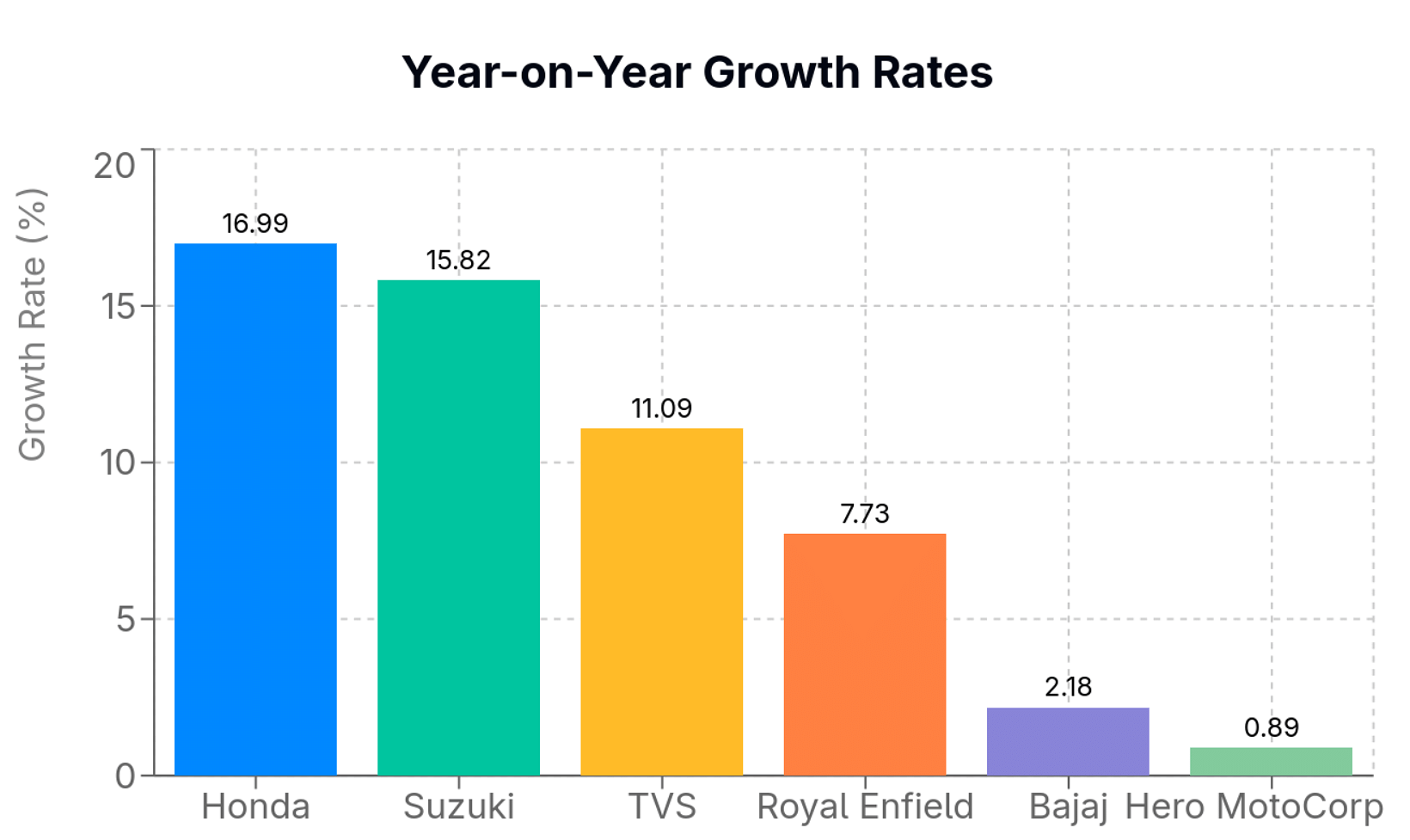

The most striking change was HMSI's performance. Honda strengthened its grip on the second position, boosting its market share considerably from 23.36% in FY24 to 25.37% in FY25. This translates to 47,89,283 units sold in FY25 compared to 40,93,895 units the prior year. Industry observers note that Honda's focus on introducing technological innovations resonated well with buyers, contributing to this strong showing and making FY25 a standout year for the brand.

In contrast, Hero MotoCorp Ltd, the perennial market leader, experienced a dilution in its dominance. Its market share fell from 30.79% in FY24 to 28.84% in FY25, even though its absolute sales volume saw a marginal increase to 54,45,251 units.

This relative decline is partly attributed to the prevailing macroeconomic conditions that created divergent economic realities across consumer segments.

While the upper-middle and affluent classes, buoyed by a strong capital market performance, increased their spending on higher-value goods, Hero's core customer base – the lower-middle and working classes – remained under significant economic pressure, impacting their purchasing power for entry-level two-wheelers. Consequently, the gap between Hero and Honda narrowed significantly during the fiscal year.

Other major players also navigated this shifting landscape. TVS Motor Company Ltd held onto its third spot and slightly increased its market share to 17.49% from 16.93%. Bajaj Auto Group, however, saw its share dip from 12.03% to 11.41%. Suzuki Motorcycle India Pvt Ltd continued its positive trajectory, improving its share from 4.84% to 5.20%, while Royal Enfield's share remained stable around 4.47%.

The electric vehicle segment also continued its expansion, with overall EV penetration in two-wheelers rising from 5.4% to 6.1%, led by players like Tata (in PVs), MG, Ola Electric, and Ather Energy, though growth rates varied among them.

Despite the overall positive annual growth, FADA noted challenges including pressure on dealers from OEMs regarding targets and concerns over financing availability and rural liquidity constraints at times. March 2025 itself saw a minor YoY dip in 2W sales, though festive demand provided some momentum.

Looking forward, FADA projects mid-to-high single-digit growth for the 2W segment in FY26, banking on new models, EV growth, and potential improvements in rural income, while remaining cautious about ongoing economic headwinds.

RELATED ARTICLES

TVS iQube Rides Past 800,000 Sales, 100,000 Units Sold in 3 Months

Launched in January 2020, the TVS iQube takes six years to hit the 800,000 sales milestone. While the first 300,000 unit...

Thar Roxx Races Past 100,000 Sales In 16 Months

Launched on September 25, 2024, the five-door Thar Roxx has been a huge success and helped propel the Thar brand into Ma...

India’s Top 30 SUVs, MPVs In CY2025 – Hyundai Creta Pips Tata Nexon To Top Spot

Of the 2.95 million utility vehicles sold in CY2025, the Top 30 models accounted for 2.82 million units (95% share). Mar...

By Shruti Shiraguppi

By Shruti Shiraguppi

07 Apr 2025

07 Apr 2025

32317 Views

32317 Views

Ajit Dalvi

Ajit Dalvi