Festive season begins but PV sales still to light up

Dampened buyer sentiment, high fuel prices and insurance premiums are playing spoilsport at festive season time.

Even as Diwali season festivities bring joy and positive sentiments to the Indian automotive market every year, the scenario this time around is rather different, what with high insurance premiums, rising fuel prices and iffy consumer sentiment playing spoilsport.

While growth in the passenger vehicle (PV) segment has witnessed a mellowed response all through Q2 (July-September 2018) of the ongoing fiscal, largely owing to the high year-ago base due to a surge in sales immediately after GST implementation in July 2017, industry sales have further remained muted, leading to a dull festive season for most automakers.

Fuel prices have relentlessly been on a surge over the last few months, which hit a record high in October, with the prices of petrol soaring to Rs 91.34 a litre in Mumbai on October 4, and diesel roaring to Rs 80.10 a litre on the same day. Prices have retreated since then but consumer sentiment has been impacted, leading to purchase decisions being deferred. Adding premium to the fire, getting a long-term (3-5 years) vehicle insurance upfront has curtailed buyers due to the significant increase in insurance premiums while buying a new car.

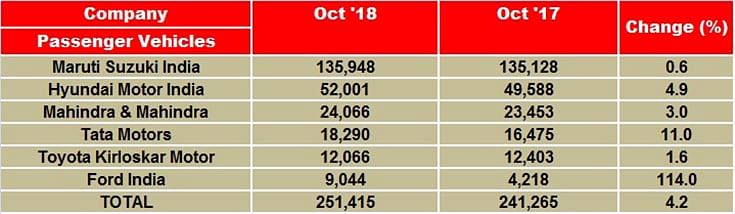

While a number of carmakers have dangled substantial discounts to draw buyers to showrooms, the market response is rather lukewarm. Here’s looking at how carmakers fared in October:

Maruti Suzuki India: The PV market leader sold 135,948 units in October, registering flat growth of 0.6 percent (October 2017: 135,128). Its quintet of compact cars, including the Swift, Baleno, Dzire, Celerio and the Ignis went home to 64,789 buyers, recording marginal growth of 3.7 percent (October 2017: 62,480). Of these, the Swift and the Dzire remain the top grossers, with the compact sedan facing heat from the latest Honda Amaze.

While the entry-level Alto and Wagon R sold 32,835 units and grew a marginal 1.1 percent (October 2017: 32,490), sales of the premium Ciaz sedan, which was updated in August, again went downhill, with the C-segment car going home to 3,892 buyers, and registering de-growth of 5.2 percent (October 2017: 4,107). On the other hand, Maruti's quartet of UVs – the Gypsy, Ertiga, Vitara Brezza and the S-Cross – registered substantial de-growth of 11.2 percent, selling a total of 20,764 units (October 2017: 23,382).

Hyundai Motor India: The No. 2 player by sales volumes, Hyundai Motor India sold 52,001 units in October, growing by 4.9 percent (October 2017: 49,588), and notching its highest-ever monthly sales. Reason it to the entry of the new Santro. The Korean carmaker stole all the limelight in this years’ festive season with the grand re-introduction of its iconic Santro hatchback in the country. Launched on October 23, the third-generation Hyundai Santro has already garnered well over 23,000 bookings and the company has high hopes riding on the model. The car also introduces Hyundai’s in-house developed AMT technology to the market for the first time, and targets it squarely against Maruti’s Wagon-R, Celerio and the Tata Tiago.

Mahindra & Mahindra: The UV specialist saw the month of October to be a challenging one with sales culminating at 24,066 units and marginally growing by 3 percent (October 2017: 23,453). While its UV numbers remained almost flat with sales of 22,279 units (October 2017: 22,040), its passenger car sales grew substantially, posting a surge of 26 percent and selling 1,787 units (October 2017: 1,413).

According to Rajan Wadhera, president, Automotive Sector, M&M, “For the past few months, the automotive industry has been witnessing subdued retail sales for the PV segment, because of low consumer buying sentiment. Therefore, one has to remain cautious on how the festive season, ultimately, turns out to be. However, at Mahindra we are happy with the response to our Marazzo as well as the uptake for our commercial vehicle portfolio, driven by the newly launched Maha Bolero Pik-up (with 1,700 kg payload) in October.”

Tata Motors: This carmaker is going pedal to the metal on the sales front and sold 18,290 units, growing 11 percent over last year (October 2017: 16,475). The growth comes on the back of good traction in some of its contemporary products in the market, including the popular Tiago hatchback and the Nexon compact crossover. Tata Motors also remained fairly active in the month, going ahead and launching the Tigor facelift, and also the more powerful versions of the Tiago and the Tigor twins, in the form of their JTP performance avatars, boasting a turbocharged petrol motor from the Nexon.

While the company also achieved the huge milestone of producing 500,000 units from its Sanand plant in the month, it is not looking to take a breather anytime soon, with the company being on a roll and also officially unveiling its new Land Rover Discovery-based Harrier SUV, which marked its SOP on a completely new dedicated production assembly line at its plant in Ranjangaon, in Pune. The company is set to launch the Harrier in Q1 of CY2019, and by the looks of it, the true-blue SUV could aid the company’s resolve of enhancing its UV market share further, which has substantially grown from being pegged at 3.31 percent between April and September 2017, to now 7.91 percent in the same period in the current fiscal.

Toyota Kirloskar Motor: Toyota Kirloskar Motor recorded cumulative sales of 12,606 units in October, registering flat growth of 1.6 percent (October 2017: 12,403). For the April to October 2018 period, Toyota Kirloskar Motor has reported a 15 percent growth in sales as compared to the same period in 2017. N Raja, deputy managing director, Toyota Kirloskar Motor, said,“ We are happy that we have been able to sustain good customer demand despite the dampening effect on consumer sentiment owing to hike in fuel prices, higher interest rates and increase in insurance premium.”

Raja further commented that while the Innova Crysta MPV saw growth of 11 percent, the Etios Liva hatchback registered growth of 17 percent in April to October 2018 period as compared to the same period in 2017.

Honda Cars India: The Japanese carmaker sold 14,233 units in October 2018, compared to 12,234 units in October 2017. The key driver for the company in recent times has been its latest market offering – the second-generation Amaze compact sedan – which surpassed the milestone of achieving sales of 50,000 units, within five months of its launch in May. The car has been the fastest Honda to have accomplished this feat, and with its overwhelming market reception, has remained an integral part of the Top 10 best-selling cars from June to September.

Honda also launched its flagship CR-V crossover in a new avatar on October 9; the soft-roader offers a diesel engine, as well as the option of a third-row of seating for the very first time.

According to Rajesh Goel, SVP and director, Marketing & Sales, Honda Cars India, ““Despite the festival season, the consumer sentiment has remained subdued last month in comparison to other years. However, Amaze continued its strong performance and the recently launched CR-V created fresh excitement in its segment with its premium offering.”

Ford India: The American carmaker has taken industry by surprise, with its domestic sales doubling and cumulatively touching 9,044 units in October, registering notable growth of 114 percent (October 2017: 4,218). Like its industry rivals, Ford also cashed in on the opportunity of the festive season and introduced the updated Ford Aspire compact sedan, giving it a host of aesthetic changes, while also bringing in new powertrains, and, at the same time, reducing the price of the car over its outgoing model.

“The industry continues to face headwinds of low consumer sentiment, high fuel price and interest rate in the near term,” said Anurag Mehrotra, president and managing director, Ford India.

With Diwali around the corner, the industry could see buyer sentiment recovering and the auspicious festival, when people prefer to bring home a new vehicle, bringing in some respite in numbers albeit momentarily. While the overall scenario looks a bit grim, growth will only depend on some major respite coming in on fuel prices, and on insurance premiums in the coming days. Tough times indeed, but hope also remains with some new model launches due at the start of 2019.

Also read: Commercial vehicle sales moderate in October, M&HCV sales slow down

RELATED ARTICLES

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

01 Nov 2018

01 Nov 2018

8105 Views

8105 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi