EV sales in India charge past 1.5 million units in CY2023, stellar growth in all segments

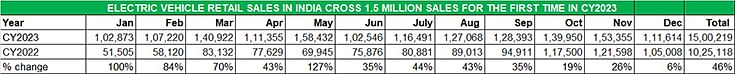

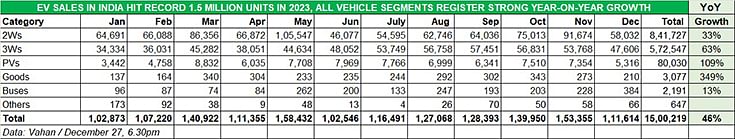

After clocking a million units in CY2022, the shift to electric mobility picked up even more pace in 2023 with sales growing 46% to over 1.5 million units and all segments – two- and three-wheelers, cars and SUVs, goods vehicles and buses – recording stellar growth.

Four days before CY2023 comes to a close, India’s electric vehicle industry has registered another record-breaking year, surpassing the 1.5-million-unit sales milestone for the first time, recording stellar 46% year-on-year growth.

At the end of November 2023, India EV Inc needed 111,395 units to hit the big number which it has done in 27 days of December 2023. As of December 27 (6.30pm), as per the government of India’s Vahan website which tracks retail sales across the country, total EV sales were 15,00,219 units, a year-on-year increase of 46% and an additional 475,101 EVs over CY2022’s 10,25,118 units when EV sales crossed a million units for the first time.

India EV Inc sold a total of 15,00,219 units between January 1 and December 27, 2023, recording 46% growth and an additional 475,101 EVs YoY.

India EV Inc sold a total of 15,00,219 units between January 1 and December 27, 2023, recording 46% growth and an additional 475,101 EVs YoY.

Total electric vehicle retail sales in CY2023 (till December 27) accounted for 6.33% of total automobile sales in India.

Total electric vehicle retail sales in CY2023 (till December 27) accounted for 6.33% of total automobile sales in India.

A deep dive into 10-year retail sales (see decadal data table above) reveals that a total of 3.42 million EVs have been sold in India since CY2014. In the early days of electric mobility in the country, demand understandably was tepid between 2014 and 2017, but crossed the 100,000-unit sales mark for the first time in 2018 with 130,252 units, up 49% YoY.

The rapid growth in EV sales numbers is reflected in the EV segment’s growing share of total automobile sales in India. The decadal data table above reveals that from just a 0.01% share in CY2014, EV sales have risen to 6.33% in CY2023.

Demand for EVs rose 91% in 2019 to 166,828 units but fell 25% to 124,652 in the Covid-impacted 2020. It was CY2021 when the consumer shift to e-mobility, particularly in the two- and three-wheeler segments, took off – sales jumped 166% YoY to 331,495 units and repeated the strong growth trajectory in CY2022 with a 209% increase to 1.02 million units. CY2023 has been the best year to date: 1.5 million units, which constitutes robust 46% YoY growth. It would have hit 50% if it weren’t for the expected slowdown in sales in December 2023 – up 6% at 111,614 units – as consumers await the new year CY2024 registration to buy a new vehicle.

Let’s now take a closer look at how each of the EV sub-segments have performed in the record-setting CY2023.

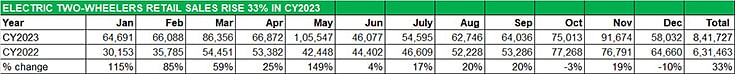

TWO-WHEELERS LEAD THE CHARGE: 841,727 UNITS, UP 33%

Despite the slashed FAME II subsidy by 25% in June, sales have rallied back and 452,173 EVs were bought at higher prices between June and December.

Despite the slashed FAME II subsidy by 25% in June, sales have rallied back and 452,173 EVs were bought at higher prices between June and December.

The most affordable category continues to lead the charge of the EV brigade. This sub-segment, which has around 175 players, sold 841,727 units in CY2023 (till December 27), recording 33% YoY growth (CY2022: 631,463 units). Compared to CY2021’s 156,368 units, CY2023 is a massive 438% increase which reflects the huge demand in just over three years.

While the initial cost of an electric scooter or motorcycle remains higher than its petrol-engined sibling, what is making a growing number of riders make the transition to e-mobility is the wallet-friendliness nature of EVs in the long term. There is also sustained demand for last-mile deliveries from urban India as well as town and country, which is acting as a sales catalyst for cargo-transporting electric two-wheelers and a number of EV manufacturers are benefiting from bulk orders.

The top three OEMs – Ola Electric, TVS Motor Co and Ather Energy – have each sold in excess of 100,000 units this year. Ola Electric is the unrivalled leader with 257,899 units and a 30.63% market share. TVS Motor Co, with 164,304 units, has a 19.51% share while Ather Energy with 103,104 units has a 12.24% share. Club these three leading OEMs and what you get is 62% coverage of the e-two-wheeler market, leaving the remaining 38% to the other 172 players to fight for.

What is creditable about this segment’s performance is that despite the sharp slashing of the FAME II subsidy by 25% in June, sales have rallied back in the subsequent months. The fact that 452,173 e-two-wheelers were bought at higher prices compared to 389,554 units between January-May 2023 reflects a growing maturity in the market and a level of resilience, which offers hope to OEMS when the FAME II subsidy, which is active at present till March 31, 2024, is completely withdrawn.

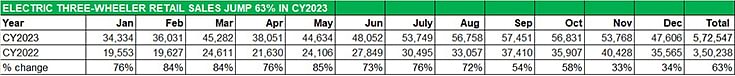

THREE-WHEELERS RECORD 63% GROWTH WITH SALES OF 572,547 UNITS

The e-three-wheeler category has seen sustained YoY growth in each of the 12 months of CY2023, benefiting from the demand for last-mile mobility.

While the electric scooter and motorcycle segment leads in terms of sheer volumes, the rate of transition to zero-emission mobility is fastest in the three-wheeler market, where now every second product sold is an electric model. This e-three-wheeler sub-segment, which sells passenger-transporting e-rickshaws and cargo-carrying three-wheelers, continues to witness strong double-digit growth thanks to sustained demand for passenger transportation and from last-mile operators for e-commerce applications, food deliveries and other applications.

CY2023 numbers retail sales are ample proof of that. The 572,547 units sold till December 27, 2023 are a robust 63% YoY growth (CY2022: 350,238 units) and if one looks at the monthly split, unlike the two-wheeler category where sales were down in two months, the three-wheeler category has seen YoY growth in each of the 12 months of CY2023.

This also means that the share of EVs in total three-wheelers sold in India (CNG, diesel, electric, LPG, petrol, petrol/CNG, petrol/LPG) has risen to 54% in CY2023 (572,547 EVs / 10,63,294 total units) compared to 51.69% in CY2022 (350,238 EVs / 677,475 total 3Ws) even as the overall three-wheeler segment has recorded 57% YoY growth.

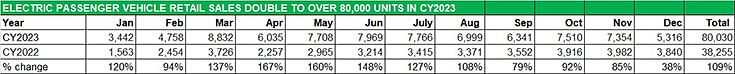

DEMAND FOR ELECTRIC CARS & SUVs DOUBLES TO OVER 80,000 UNITS

With an expanded model parc and improving EV charging infrastructure, demand for electric passenger vehicles rose 109% YoY

An indication of the growing shift to e-mobility on four wheels is seen on our roads in the form of green-plated SUVs, sedans and, more recently, hatchbacks as an increasing number of passenger vehicle buyers are preferring to put their money on a wallet-friendly EV, despite the higher initial price compared to their petrol or diesel brethren.

This movement is reflected in the retail sales this year. As per Vahan (till December 27), a total of 80,030 electric passenger vehicles (light motor vehicles / light PVs) were sold in the first 12 months of CY2023, up 109% YoY (CY2022: 38,255 units). The data table above is indicative of the sustained demand across all of 2023. While March 2023 (8,832 units) was the best month, May (7,708 units), June (7,969 units), July (7,766 units), October (7,510 units) and November (7,354 units) have each seen sales above 7,000 units. December sales dropped 28% month on month to 5,316 units (November 2023: 7,354 units), mainly as a result of vehicle buyers delaying their purchase decision to benefit from a new-year registration.

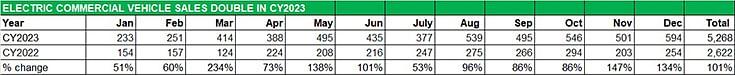

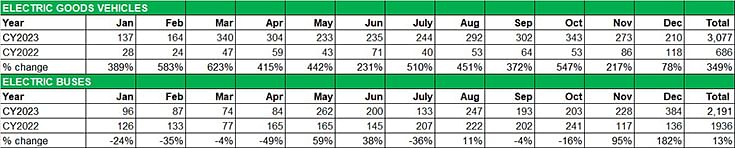

ELECTRIC COMMERCIAL VEHICLE SALES GROW TO OVER 5,000 UNITS

The commercial vehicle industry, where electric mobility makes eminent and wallet-friendly TCO sense given the much larger number of kilometres driven, compared to personal EVs, has registered cumulative sales of 5,268 units, up 101% YoY. The CV sector essentially comprises goods carriers and passenger-transporting buses.

As per Vahan, electric goods carriers accounted for 3,077 units (up 349% Yoy) and electric buses for 2,191 units (up 13% YoY), corresponding into 58% and 42% respectively of the total e-CV pie (see sub-segment splits below).

EV-OLUTION OF THE INDIAN EV INDUSTRY

India, which is the third-largest automobile market in the world, is among the global markets which are aggressively driving awareness and adoption of EVs as a countermeasure to its serious air pollution problem. As is known, India is home to over 20 most polluted cities in the world. By 2030, the government has targeted EVs to account for 70% of commercial vehicle sales, 30% of passenger vehicles, 40% of buses and 80% of two-wheelers and three-wheelers.

CY2023 as well as the preceding two years have shown how India EV Inc is evolving when it comes to the overall electric mobility ecosystem. Whether it is the growing number of new EVs being launched, a growing level of R&D and significant investment from component manufacturers in making EV parts and creating a robust supply chain, the gradual expansion of EV charging infrastructure across the country through to exclusive EV retail showrooms from OEMs and both the Central and most State governments rolling out EV-friendly policies for EV manufacturing as well as EV buyers, the EV market dynamic is here to stay.

Initial cost of an EV compared to a conventional internal combustion engine remains 25-30% higher mainly due to the battery cost but as technology evolves, localization levels increase and OEMs benefit from economies of scale, this is bound to reduce and EV-ICE vehicle price parity could be foreseen in the not-so-long-term future in India.

What’s more, e-mobility is no longer an urban India phenomenon and has now spread to town and country as scores of vehicle users recognize the wallet-friendly nature of EVs while also contributing to eco-mobility. At present, over 30 lakh EV users are celebrating their independence from fossil fuels and helping reduce the carbon footprint. Uttar Pradesh, Maharashtra and Karnataka are the top three Indian states in terms of EV ownership, followed by Rajasthan, Delhi and Tamil Nadu.

As Shailesh Chandra, Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility, said at Autocar Professional’s EV Conclave in Chennai on November 21, ”The long-term story of BEVs is not a choice. It is an imperative because all the nations have signed for net carbon zero. The same pressure is on all the OEMs. There is no choice. It is only a matter of how fast this is going to happen.”

EV India Inc will plug into CY2024, which dawns in a few days, on a cautiously optimistic note, what with the jury still out as to whether the FAME II subsidy will be continued after April 2024. Nevertheless, what the industry is confident about is the growing shift of consumers to the promise of electric mobility and also the vast potential of exports of both made-in-India EVs and EV components.

Ola Electric becomes first Indian OEM to sell 250,000 EVs in a year

TVS iQube and Bajaj Chetak ride surging wave of EV demand in India

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

27 Dec 2023

27 Dec 2023

15587 Views

15587 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal