Electric CV OEMs sell 680 units in August and 7,071 e-CVs in Jan-Aug, Tata Motors share at 62%

Demand for electric commercial vehicles across the bus and light goods segment continues to see growth. Total retails in the first eight months of 2024 at 7,071 units are a 162% YoY increase.

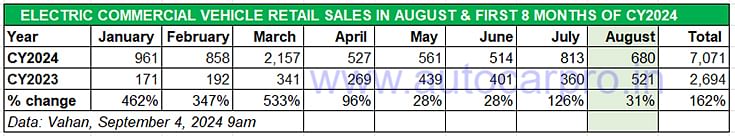

Demand for zero-emission commercial vehicles continues to rise in the Indian automobile market. As per the latest retail sales data sourced from Vahan, a total of 680 e-CVs were sold in August 2024, up 31% year on year (August 2023: 521 units), albeit this number is 16% down on July 2024’s 813 units.

The news for the domestic e-CV industry is better when seen on the cumulative sales front. Between January and August 2024, a total of 7,071 e-CVs have been sold, which constitutes 162% YoY growth (January-August 2023: 2,694 units) and average monthly sales of eCVs of 883 units compared to 336 units a year ago. What’s more, the e-CV industry has surpassed its entire CY2023’s deliveries of 5,011 units and could be headed towards hitting a new record of over 10,000 units in CY2024.

The CV sector essentially comprises light-, medium- and heavy-duty goods carriers and passenger-transporting buses. As compared to personal electric mobility in the form of e-two-wheelers and passenger vehicles, the CV industry is where electric mobility makes wallet-friendly TCO sense given the much larger number of kilometres driven.

As the monthly sales numbers (see retail sales tata table below) shows, the FY2024-ending month of March 2024 witnessed the highest demand – 2,157 e-CVs, followed by January (961 units). Combined retails for the first five months of FY2025 at 3,095 units are up 55% YoY (April-August 2023: 1,990 units).

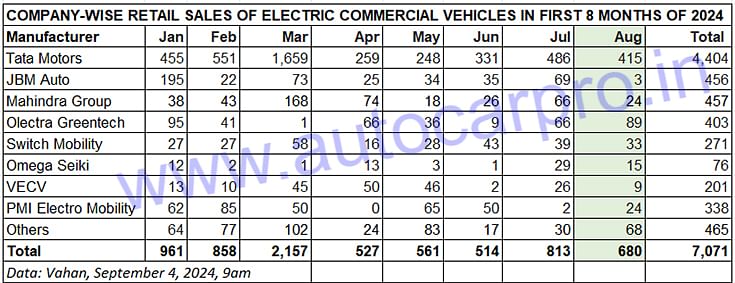

In terms of e-CV model-wise share for the January-August 2024 period, demand is tilted towards light goods carriers – an estimated 4,252 units and 60% share – while electric buses account for 2,663 units (38% share) and heavy goods 152 units (2% share). Let’s take a look at how the main players have fared in August and for the year to date.

New Ace EV 100 gives Tata Motors’ eCV sales a fresh charge

In terms of OEM sales which constitutes combined sales tally of goods carriers and passenger-transporting buses, Tata Motors is the strong eCV market leader with 415 units – 300 light e-goods carriers and 115 buses – in August (61% market share) and 4,404 units –3,346 e-LCVs SCVs and 1,058 buses – in January-August 2024 (62% share).

These strong numbers for e-LCVs/SCVs can be attributed to the launch of the new Ace EV 1000 small mini-truck in May this year. This zero-emission SCV offers a higher rated payload of one tonne and a certified range of 161km on a single charge. Targeted at last-mile mobility providers, the newest variant of the Ace EV has been developed to address evolving needs of sectors like FMCG, beverages, paints and lubricants, and dairy.

The electric bus-only JBM Auto is the No. 2 OEM with a total of 456 units in the first eight months of 2024, which gives it a current market share of 6 percent. In August, the company sold 3 buses with the best monthly sales coming in January (195 units).

Olectra Greentech has sold a total of 403 e-CVs including 387 buses (89 in August) in the Janaury-August 2024 period.

Switch Mobility, the electric commercial vehicle arm of Ashok Leyland has sold 33 eCVs in August (5% market share) and a total of 271 in January-August (market share: 4%)

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

04 Sep 2024

04 Sep 2024

8282 Views

8282 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau