Diesel price cut fails to energise CV sales in November

Overall industry wholesales at 55,822 units, are down 4% albeit market leader Tata Motors has posted smart growth across all CV sub-segments.

Diesel is the lifeline of the commercial vehicle industry. Till November 4, 2021, the price of the fuel had hit a record high of Rs 106.62 a litre in Mumbai, Rs 102.59 in Chennai, Rs 101.56 in Kolkata and Rs 98.42 in Delhi. Fuel cost is estimated to be around 30-40% of the total operational cost of CVs and any reduction leads to improved profitability and a reduction in the CV mantra of TCO (Total Cost of Ownership).

So, when on November 4, the Central government slashed its excise duty on diesel by all of Rs 10 a litre, it was felt that the move, welcomed by truckers and CV fleet owners across the country, would lead to an uptick in sales during the month albeit truck and small CV purchase decision are not solely based on fuel pricing. However, that did not happen belying the marginal positive momentum that was seen in October 2021.

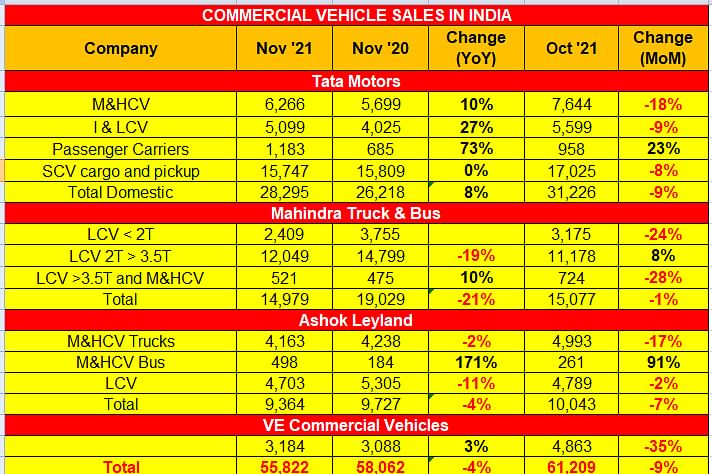

Overall wholesales for the CV industry last month were 55,822 units, a year-on-year decline of 4% (Novemebr 2020: 58,062) and worrying 9% lower than October 2021’s 61,209. In terms of demand across the sub-segments, M&HCV trucks are seeing increasing sales on the back of growing investment in infrastructure development, the construction market and the e-commerce boom.

Market leader Tata Motors reported wholesales of 28,295 units, which marks growth of 8% YoY, but 9% lower compared to October 2021 (31,226 units). Segment-wise, the company saw robust demand for its passenger carriers (buses), thus indicating demand for people movement on the back of offices and schools opening up.

Ashok Leyland, the country’s second largest CV maker, saw its November sales decline by 4 percent to 9,364 units, compared to 9,727 units for the same period last year. Month on month, sales for the Chennai-based manufacturer are down 7% (October 2021: 10,043 units).

For Mahindra & Mahindra, which has been facing the biggest impact of semiconductor shortage, wholesales numbers were 14,979 units, a sharp drop of 21% compared to November 2020, and a percent lower MoM. Veejay Nakra, CEO, Automotive Division, Mahindra & Mahindra said that the issues around semiconductor-related parts continue to remain a challenge for the industry and the company is monitoring the situation closely and taking appropriate steps.

VE Commercial Vehicles saw YoY improvement in its wholesales with 3,184 units sold in November 2021 (November 2020: 3,088) but was lower 35% compared to the previous month.

Growth outlook

All in all, the market situation remains fluid amid constantly changing dynamics. With a few cases of the Omicron virus being detected in Karnataka, most states across the country are clamping down on movement, particularly air travel, and opening of schools and colleges is being deferred for a fortnight or so. This would impact sale of passenger-ferrying buses.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

04 Dec 2021

04 Dec 2021

9854 Views

9854 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau