CV OEMs bear brunt of Covid resurgence, April sales down 52% over March

Both Tata Motors and Ashok Leyland sees sharp month-on-month sales declines.

As India witnesses the surging second wave of Covid-19 and many states like Maharashtra, Delhi, Karnataka and Jharkhand announce lockdowns, the automotive industry, like other segments, is feeling the heat.

For commercial vehicle manufacturers, the situation continues to be a challenging one with almost a year of low sales volumes, dealing with local lockdowns, tepid consumer sentiment, and excess capacity. In FY2021, the CV industry reported a sales declines for the second year in a row. Total sales were 568,559, down 20.77% (FY2020: 717,593).

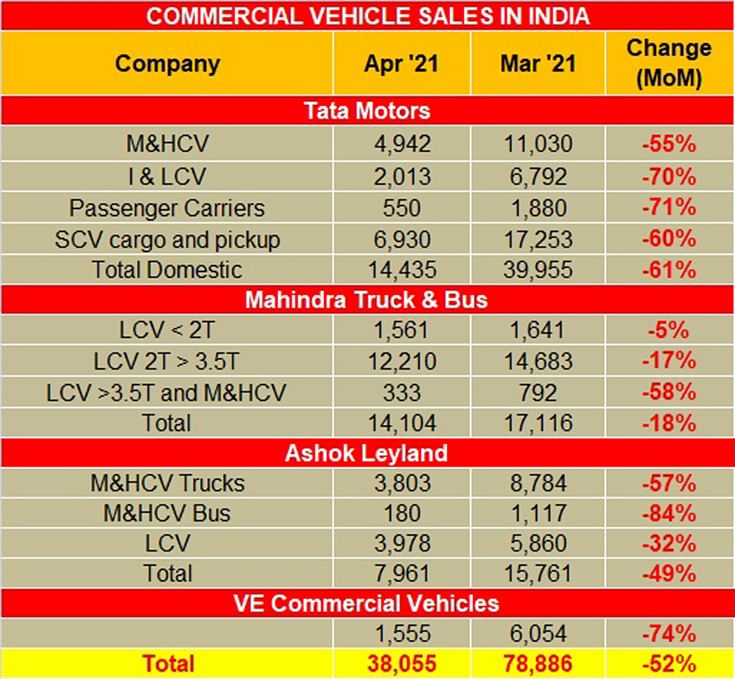

As per the sales data gathered for April 2021, cumulative wholesales for April 2021 add up to 38,055 units, which is 52 percent lower than March 2021.

CV market leader Tata Motors reported sales of 14,435 units in April, which is 61 percent lower than month-on-month sales of 39,955 units in March 2021.

Ashok Leyland reported despatches of 7,961 CVs, down 49 percent on March 2021 numbers of 15,761.

For Mumbai-headquartered Mahindra & Mahindra, total sales comprised 14,104 units (-18% MoM) compared to 17,116 units in the previous month.

According to Veejay Nakra, CEO, Automotive Division, Mahindra & Mahindra “With the increase in lockdown restrictions in many parts of the country we foresee continuing supply chain related production challenges. While demand remains good, there would be some impact in the first quarter as a result of low customer movement and dealership activity due to the lockdown restrictions. In times like these, our focus is the well-being and safety of all our associates and those of our dealers. Our customers will continue to experience unrestricted personalised as well as digital; contactless sales and service support.”

Volvo Eicher Commercial Vehicles (VECV) witnessed a drop of 74 percent in sales for April, selling 1,555 units, compared to 6,054 units in the month of March.

The tepid demand notwithstanding, it is to the credit of the domestic industry that it is keeping the wheels of the economy turning and also rushing critical medical supplies to far-flung corners of the country.

ALSO READ

Car sales feel the heat in April, OEMs brace for a tough May

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

02 May 2021

02 May 2021

12492 Views

12492 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau