Commercial vehicles struggle for sales traction in July 2020

The CV segment, which had been the most adversely impacted in the past couple of years, needs a growth revival injection in the form of a scrappage policy.

Even as the green shoots of recovery are seen in the passenger vehicle and two-wheeler segments, they are missing in the segment that matters most – commercial vehicles – when it comes to overall recovery of India Auto Inc. Known to be the barometer of the economy, the CV industry’s current fortunes are mirroring that of India’s.

The Q1 FY2021 (April-June 2020) numbers were horrific to say the least. All segments and 13 sub-segments were in the red, with YoY sales declines are all between 68-95 percent. The CV sector is the worst hit with overall sales down 84% at 31,636 units (Q1 FY2020: 208,310). While M&HCVs were down 94% at 4,403 units (Q1 FY2020: 74,333), LCV sales at 27,233 units were down 84% (208,310). Clearly, the industry has doled out its worst-ever performance in over two decades with the impact of coronavirus-induced lack of demand. Furthermore, there is an added caution on the profitability of companies, which had heavily invested into the transition to the BS VI emission norms that came into effect earlier this year in April, and are now looking at extremely delayed returns.

How’s the scene in July?

Not very different. We’ve got our hands on the sales numbers of three CV majors barring the market leader Tata Motors albeit that should not make much of a difference given the general state of lack of demand for M&HCVs and LCVs. Nonetheless, seen month on month, things are improving for the sector albeit rather slowly.

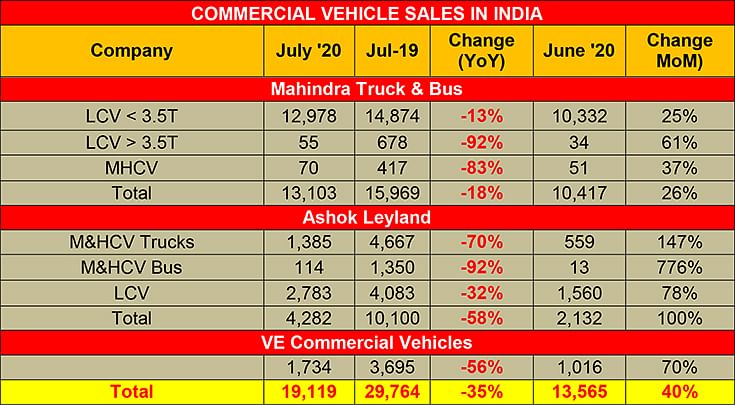

Cumulative sales of three OEMs – Ashok Leyland, Mahindra & Mahindra and VE Commercial Vehicles – are 19,119 units, down 35% on year –ago sales of 29,764 units.

The month of July has offered no respite to the M&HCV segment. The only ray of hope came from the small commercial vehicle segment, as more and more industries, particularly the e-commerce segment, look to catch up to the demand of last-mile deliveries.

In July, Ashok Leyland reportedly sold 4,282 CVs (-58% YoY) compared to 10,100 units for the same period last year. This includes 1,499 M&HCV comprising 114 buses (-92%) and 1,385 (-70%) trucks. The LCV segment contributed towards the bulk of sales or 2,783 units (-32%) compared to 4,083 for the same period last year.

For Mahindra, the scenario was no different. The company reported total sales of 13,103 CVs, a drop of 18 percent YoY (July 2019: 15,969 CVs), including 12,978 sub-3.5-tonne LCV segment, followed by LCV above 3.5-tonne (55 units) and 70 M&HCVs.

Volvo Eicher Commercial Vehicles (VECV) reported sale of 1,734 commercial vehicles, a drop of 53.1 percent (July 2019: 3,695 units).

The CV industry is in dire need of a growth revival incentive, which can come in the form of the much-delayed vehicle scrappage policy. Speaking at the Q1 results meeting, SIAM president Rajan Wadhera had said: “It is the CV industry that shadows the GDP and the economy. We are forecasting a de-growth of 26-45 percent for FY2021, that itself is a very large de-growth and will not warrant any fresh investments. We don’t see sales reaching pre-2018 levels before the next three- to- four years. Survival is going to be very difficult.”

Over to the government then.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

04 Aug 2020

04 Aug 2020

17064 Views

17064 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau