INDIA SALES ANALYSIS: JUNE 2015

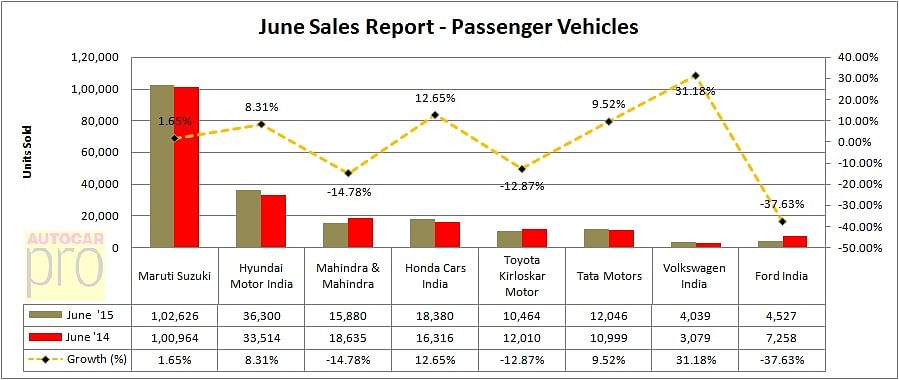

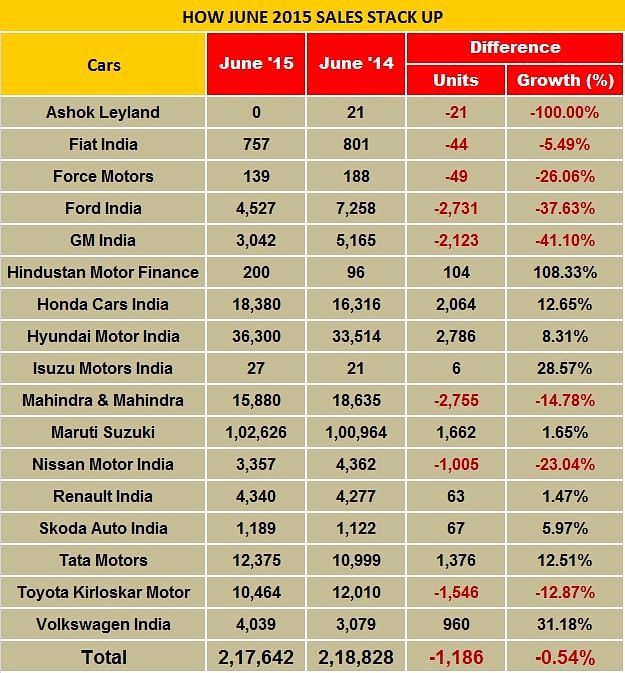

Of the carmakers which released their sales numbers for June 2015, most of either reported a year-on-year decline, flat sales or marginally improved numbers on a low sales base last June.

A combination of market fears of a weak monsoon this year along with slackening demand from rural India as a result of slower rural income growth is hitting passenger car sales. Of the carmakers which released their sales numbers for June 2015, most of either reported a year-on-year decline, flat sales or marginally improved numbers on a low sales base last June.

Global credit rating firm Moody’s had on June 30 picked India’s subdued rural economy as a credit negative and said the sluggish reform momentum posed “the greatest risk” to macroeconomic growth in the country. Moody’s has said that rural growth, which was over 20% in 2011, has been stuck in the mid- to low single-digit range throughout the first six months of 2015.

Maruti Suzuki India, the bellwether of the Indian market, saw flat sales in June. After selling 100,709 cars in April (+27.29%) and 102,359 units in May (+13.03%) albeit on lower year-on-year bases, the company reported total domestic sales of 102,626 units in June 2015, a year-on-year growth of 1.8% (June 2014: 100,964). With this, the carmaker wraps up the first quarter of FY2015-16 with 341,329 units, a growth of 13.8% over the same period the previous year (270,643 units).

In June, Maruti felt the pressure of slowing sales for the entry level duo of the Alto and Wagon R sold 34,336 units, down 27.9% (June 2014: 47,618), which could be a pointer to slowing sales from the rural market and Tier 2 and 3 towns.

Demand for the compact car quartet comprising the Swift, Celerio, Ritz and Dzire remained high at 45,701 units, up 24.4% (June 2014: 36,741) while the Dzire Tour (for cabs and fleet operators) sold 2,893 units as compared to 1,542 units in June 2014.

The premium Ciaz sedan sold around 3,700 units, which means it has crossed cumulative sales of 45,000 units since its launch in September 2014.

On the export front, Maruti Suzuki sold 12,130 units, up 2.7% (June 2014: 11,809) while for Q1 FY16 it has shipped a total of 35,635 cars, up 21.8% (Q1 FY15: 29,251).

Hyundai Motor India registered domestic sales of 36,300 units, up 8.3% year on year (June 2014: 33,514). Its exports, however, fell for the month – 15,762 units compared to 17,004 units in June 2014. The carmaker is gearing up to have the global launch of its compact SUV, the Creta on July 21.

Commenting on the June sales, Rakesh Srivastava, senior vice-president (Sales and Marketing), said: "In a market bearing low traction consistent demand for the Elite i20, Grand and Xcent, Hyundai’s volume grew by 8.3%. With the upcoming launch of the Creta, we are confident of sustained growth."

Honda Cars India, which is seeing good demand, sold 18,380 units in June 2015, up 12.65% (June 2014: 16,316). The sales comprised 7,187 Citys, 6,834 Amaze sedans, 2,336 new Jazz hatchbacks, 923 Brios and 1,043 Mobilios. The company is all set to launch the new Jazz on July 8 and shipped the 2,336 units to 340 dealers across the country to ensure their availability immediately after market introduction.

In the first quarter of 2015-16, Honda has sold a total of 44,447 units, marking a growth of 9% (April-June 2014: 40,718).

According to Jnaneswar Sen, senior vice-president (Marketing & Sales), Honda Cars India, “We are confident that we will continue to do well in respective segments. The new Honda Jazz will help us make further inroads in the Indian market.”

Toyota Kirloskar Motor, which sold 10,464 cars in June 2015, saw its numbers down 12.87% year on year (June 2014: 12,010). The company says there was limited production last month due to a planned annual plant shutdown from May 29-June 6 for regular maintenance.

The new Camry sold 113 units last month and within two months of launch has sold over 300 units, as compared to 720 units in all of 2014. Of this the Camry hybrid constitutes 87% of total Camry sales. N Raja, director and senior vice-president, Sales and Marketing, said, “We sold 10,464 units in the domestic market last month, due to limited production on account of the planned shutdown. We currently have a waiting period of 25–30 days for the Innova and about 50–60 days for the Fortuner. It is our endeavor to make the deliveries of vehicles on a timely basis.”

Mahindra & Mahindra’s passenger vehicles segment, which manufactures and markets utility vehicles, cars and vans, sold a total of 15,880 units in June 2015, down 14.78% (June 2014 : 18,635). The company, which has a predominantly diesel-engined vehicle portfolio, is feeling the pressure of stagnating sales from rural India and also the narrowing price differential between petrol and diesel.

Pravin Shah, president and chief executive (Automotive), Mahindra & Mahindra, “With a normal monsoon till date, an overall positive sentiment and a slew of new launches in the automotive industry, we expect buoyancy in demand going forward. The new XUV500 has been very well received by customers.”

Tata Motors’ passenger car sales, largely led by the Bolt hatchback and Zest sedan, grew 44%. The company sold 10,281 cars, marking a YoY growth of 30% (June 2014: 7,911). However, its UV sales dropped by 11% to 1,765 units. Overall, Tata’s sales totaled 12,046 units for June 2015, up 9.52% (June 2014: 10,999).

Volkswagen India sold 4,039 units in June 2015, an increase of 31% (June 2014: 3,079. This increase in sales is attributed to the recent launches of the new Vento and new Jetta sedans. The Polo, the only hatchback in its segment that comes with a 4-star NCAP safety rating for adult occupants, also continues to contribute to the sales increase. The company says the Polo GT TSI, with its powerful turbocharged petrol engine and 7-speed DSG transmission, is leading Volkswagen’s strong sales performance in the premium hatchback segment.

For the first six months of the year, the carmaker has notched 18.95% growth, selling a total of 23,943 cars compared to 20,128 in the January-June 2014 period.

Commenting on the sales growth, Michael Mayer, director, Volkswagen Passenger Cars, Volkswagen Group Sales India, “We have witnessed our fifth consecutive increase in monthly sales and attribute this achievement to our recently launched new Vento, growing trust in the brand amongst consumers and an excellent dealer network. This has been an exciting year for Volkswagen Cars, and an increase of 19% in our overall sales for the January-June 2015 period.”

Ford India sold 4,527 cars in June 2015, down 37.63% (June 2014: 7,258). “With three new products planned in next 9 months, we will usher in excitement with the introduction of our compact sedan Figo Aspire," said Anurag Mehrotra, executive director (Marketing, Sales & Service), Ford India.

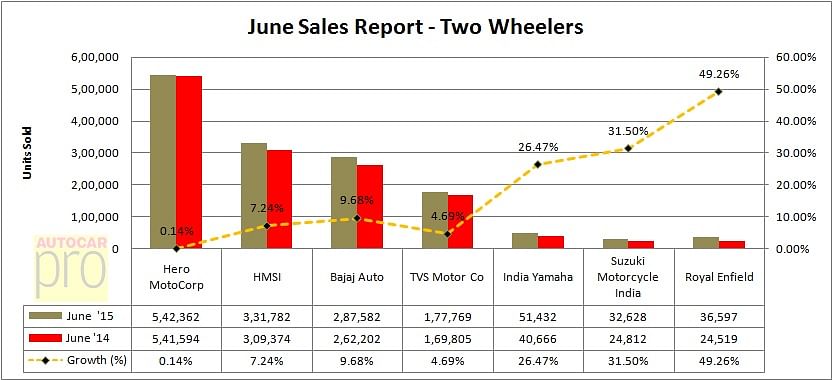

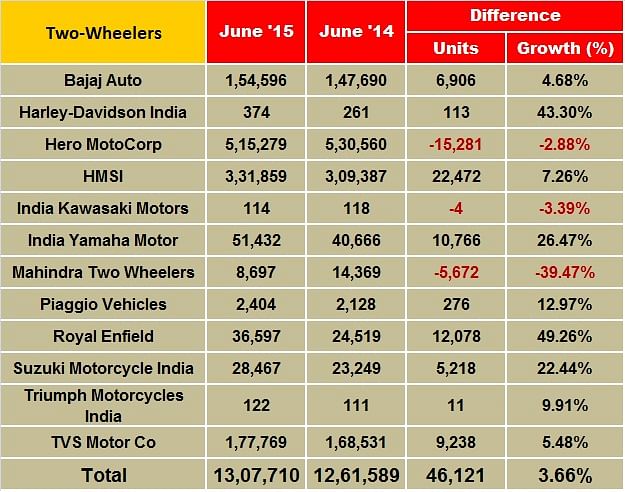

Slowing rural demand in India impacts motorcycle sales in June

Slowed-down demand from rural markets, low sentiments and delayed purchases continue to mar overall sales of the motorcycle segment, which constitutes nearly 70 percent of the overall two-wheeler market in India. June 2015 sales results reveal that the big four – Hero MotoCorp, Honda Motorcycle & Scooter India (HMSI), Bajaj Auto and TVS Motor Company – have posted positive numbers. But the notable development is Bajaj Auto, which has finally shown a year-on-year growth after eight months. September 2014 was the last month when the Pune-based motorcycle maker had shown a YoY monthly growth of 7.14 percent. Among other OEMs, Yamaha and Suzuki continue to improve on their monthly numbers.

Posting flat growth of 0.14 percent in June 2015, the largest two-wheeler seller, Hero MotoCorp sold 542,362 units (June 2014: 541,594). An official communication states “As the industry had built up stocks due to the sluggish market, HMCL reduced inventories in Q1. The company’s retails are currently better than dispatches,” which means that Hero has been working on reducing its accumulated stock at the dealership as well as the factory level.

Hero rolled out two models – Passion Pro and Xtreme Sports – recently to boost its regional sales in the motorcycle portfolio. While the company has planned a number of launches during the next four-five months, it is also looking at adding a few new export destinations this fiscal.

Honda Motorcycle & Scooter India has shown decent domestic growth of 7.24 percent during June 2015, but this has come on the back of its rising scooter sales year-on-year. The company, which had sold 309,374 units in June last year, sold an overall 331,782 units last month.

HMSI’s motorcycle sales are sharply slowing down and June 2015’s 112,132 bike sales are down 21.47 percent (June 2014: 142,782 motorcycles). However, countering this fall in volume, its scooter portfolio has notched 31.85 percent growth selling 219,650 in June 2015 (June 2014: 166,592). Notably, the company has, including its export volumes for Q1 FY2015-16, crossed one-million units mark for the first time. Between April-June 2015, HMSI has sold 1,056,810 units, which includes its domestic as well as export sales.

The company, which has recently rolled out the 2015 editions of its Activa and Aviator scooter models, is increasingly focusing on making India its largest contributor to its global sales.

At the launch event recently, Keita Muramatsu, president and CEO, HMSI and Honda Motor India, said: “India is a focus market for Honda and it is significant that Honda’s two-wheeler operations in India is the second largest contributor to Honda’s global sales. Today, one in every four two-wheelers sold by Honda worldwide is from India. I am confident that given our continued investment and growth, we will become No. 1 two-wheeler market for Honda globally within the next 2-3 years. Honda’s future growth in India will be co-driven by its scooter portfolio. Honda dominates this segment with every second scooter being sold today in India being a Honda. At the same time, Honda is expanding its production capacity foreseeing the future potential of automatic scooter demand. Our upcoming fourth plant will be the world’s largest only scooter plant and will start operation at Gujarat in early 2016.”

Bajaj Auto, which is now witnessing the results of its multiple launches in the early months of this calendar year, registered total sales of 287,582 units (including exports) during June 2015, up 9.68 percent (June 2014: 262,202). This is thanks to the sales of its CT commuter model, which is seeing a surge in demand.

TVS Motor Company sold 177,769 units in June 2015, up 4.69 percent (June 2014: 177,769). Surprisingly, the company recorded better growth in motorcycle sales than its scooter portfolio.

While its scooter sales grew 4.99 percent to 61,241 units in June 2015, from 58,328 units in June 2014, motorcycle sales grew by 15.56 percent, increasing to 88,675 units in June 2015 from 76,734 units in June 2014. Meanwhile, the company, which is soon planning to enter into the midsized motorcycle segment, is tightly keeping its new product developments tightly under wrap.

Banking on the growth of its scooter models, India Yamaha Motor registered total domestic sales of 51,432 units in June 2015, up by 26.47 percent (June 2014: 40,666). “The numbers are a sign of Yamaha’s robust business plan and strategic customer engagement programs. We witnessed brisk growth due to our robust product line-up and new launches during the year so far. Our new Fascino scooter and 125cc Yamaha Saluto have been key to boosting our sales. Also, the new range of Alpha, Ray and Ray Z scooters with Yamaha’s next- generation ‘Blue Core’ engine concept continues to be a fundamental growth driver for us,” said Roy Kurian, vice-president – Sales & Marketing, Yamaha Motor India Sales.

Suzuki Motorcycle India sold 32,628 units, 31.50 percent up (June 2014: 24,812). Atul Gupta, executive vice-president, SMIPL, said: “Several factors have come together to propel us onto a consistent growth path. This is because of Suzuki’s marketing efforts and also the perceived upswing in consumer mood. The aggressive marketing initiatives for the Gixxer have generated a lot of excitement and interest in Suzuki’s flagship product.”

India M&HCV sales rev up in June, above 1-tonne LCVs do better

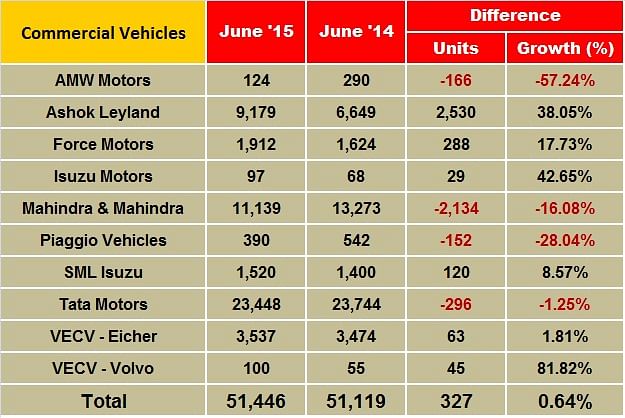

In what can be termed as positive news for the commercial vehicle segment, growth is gradually filtering down from the M&HCV market (which has seen continuous growth for the past 10 months) to the light commercial vehicle (LCV) segment.

Heavy and medium commercial vehicle (M&HCV) sales are continuing their strong run with all the OEMs recording higher sales month on month. Last month, Roland Berger Strategy Consultants had highlighted that the M&HCV segment in India is seeing a clear trend of demand for heavy vehicles, especially 25T and 31T trucks. While 2014-15 saw the 25T segment record 15 percent YoY growth, customers are now preferring higher-tonnage vehicles like 31T vehicles, which saw 53 percent YoY growth in the last fiscal. The firm expects that the small commercial vehicles segment will follow the trend in the M&HCV segment and will turn positive in next 6-8 months.

Sales in the above 1-tonne payload LCV segment are gradually increasing performing and Ashok Leyland continues to record double-digit growth in sales of its Dost. However, sales of small CVs of less than 1-tonne payload remain stuck in the slow lane mainly due to a slowdown in rural India growth as a result of a below-than-normal monsoon. Both Tata Motors and Mahindra & Mahindra saw negative sales in the category albeit M&M is seeing better sales for its pick-ups.

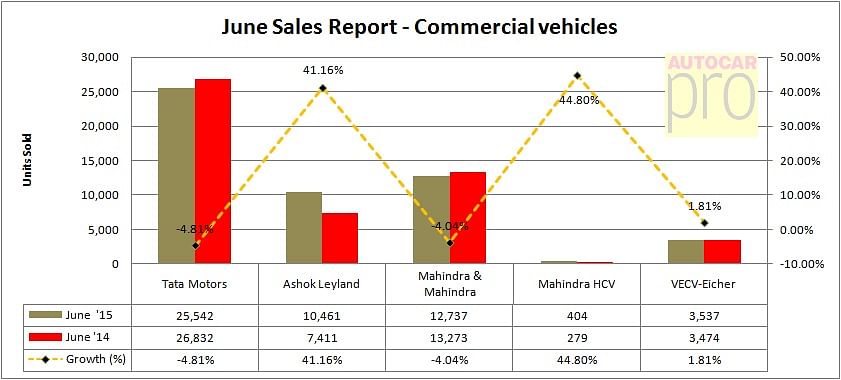

Tata Motors’ total sales of 25,542 units in June were down 5% (June 2014: 26,832) but its M&HCVs posted double-digit growth of 19% with sales of 11,450 units (June 2014: 9,620) Its LCVs though remain in negative territory – at 14,092 units sold, they were down 18% year on year (June 2014: 17,212).

Ashok Leyland’s total sales were up 41% at 10,461 units sold (June 2014: 7,411) Its M&HCV sales of 8,048 units marked a 46% increase over year-earlier sales (June 2014: 5,501). Its LCVs saw positive sales momentum with 26% growth with sales of 2,413 units (June 2014: 1,910 units).

VE Commercial Vehicles, which had seen double-digit growth in May 2015, saw flat growth of 2% in June. In the domestic 5-tonne and above category, the company sold 3,537 units (June 2014: 3,474).

Mahindra HCVs sold 404 units in last month, up 44% but on a low base (June 2014: 279).

RELATED ARTICLES

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

By Autocar Professional Bureau

By Autocar Professional Bureau

02 Jul 2015

02 Jul 2015

30136 Views

30136 Views

Ajit Dalvi

Ajit Dalvi