Top 10 Motorcycles – January 2018 | Splendor gives Hero MotoCorp new pep

What motorcycles are to Hero, scooters are to Honda. While Hero has a 51.25 market share of motorcycles, HMSI has 15.72 percent. In scooters Honda has 57.28 percent, while Hero has 13 percent.

Motorcycles, especially the mass-market commuters, have been the volume drivers in the Indian two-wheeler segment and the past few months have received a shot in tha arm with the return of good sentiment in rural India. Cumulative motorcycle sales totaled 1,054,062 units in January, growing 28.64 percent (January 2017: 819,385).

The segment is seeing a lot of action, with manufacturers having a slew of new models lined up for the year, many having already revealed some at the Auto Expo.

The strong rivalry between Hero MotoCorp and Honda Motorcycle & Scooter India (HMSI) remains a talking point for industry. In the overall two-wheeler market (motorcycles, scooters, mopeds), Hero has a 36.22 percent market share right now, while HMSI has 29.04 and third-placed TVS Motor Co with 14.20.

What motorcycles are to Hero, scooters are to Honda. While Hero has a 51.25 market share of motorcycles, HMSI has 15.72 percent. In scooters Honda has 57.28 percent, while Hero has 13.02 percent.

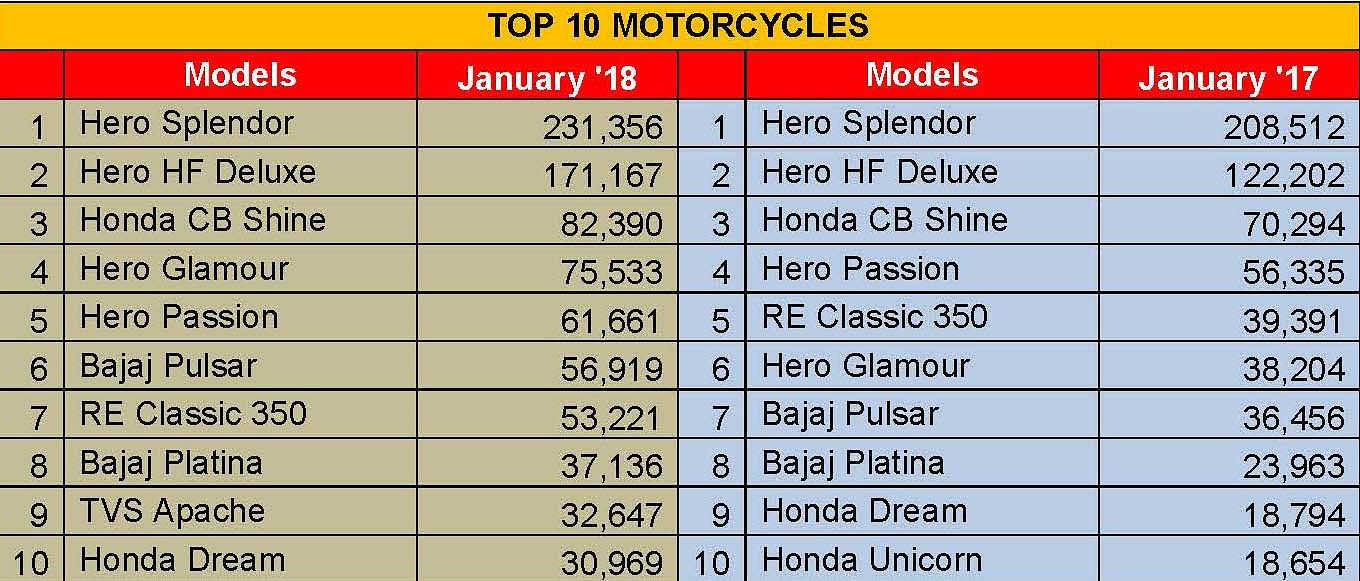

In the month of January, Hero’s Splendor, the 125ccc commuter offering, leads the Top 10 chart with total sales of 231,256 units, growing 11 percent (January 2017: 208,512). The popular Splendor family, which is well known for its frugal fuel-sipping habit, remains a strong buy particularly in rural India. Hero MotoCorp has recently expanded the range with an updated Super

Splendor, which comes with a brand new in-house developed air-cooled 125cc motor. The new engine comes tuned for better torque and power output, rated at 9bhp.

At No 2 is another Hero product, the HF Deluxe, which sold 171,167 units in January and grew by a significant 40 percent (January 2017: 122,202). Honda’s CB Shine glistens at the No 3 position, going home to 82,390 buyers and growing 17.20 percent (January 2017: 70,294).

The Hero Glamour sold 75,533 units, registering a sizeable 98 percent growth (January 2017: 38,204) and closed in at the No 4 position. The motorcycle runs neck and neck with the CB Shine and both cater to the executive commuter segment, with their pleasing styling and being light on the pocket.

Hero MotoCorp’s Passion takes the No 5 spot, with sales of 61,661 units, growing 9.45 percent (January 2017: 56,335) The Passion range has been expanded with Hero launching the Passion Pro and the Passion XPro with an aim of boosting its sales in the domestic market. The new Passion models get Hero MotoCorp’s in-house developed air-cooled, single-cylinder, 110cc torque-on-

demand engine, which also powers the Splendor iSmart 110.

At No 6 is the Bajaj Pulsar, which sold 56,919 units and grew a significant 56 percent (January 2017: 36,456). However, Bajaj Auto has been struggling a bit in the recent times. Between April-January 2018, the company sold 16,40,101 units, reducing its market share to 15.75 percent, from the earlier 18.27 percent, when it clocked 17,07,655 units between the same period in 2017.

Royal Enfield’s Classic 350 is the No 7 brand, selling 53,221 units in January, growing by 35.10 percent (January 2017: 39,391). The Classic and the other models, including the Thunderbird and the Continental GT have seen the company increase its market share to 6.30 percent with sales of 655,555 units between April-January 2018, as against 535,821 units sold during the same period in 2017.

Bajaj Auto’s Platina and TVS Motor’s Apache grab the eighth and ninth positions respectively in the Top 10 list. While the Platina sold 37,136 units (January 2017: 23,963) and grew 55 percent, the

TVS Apache reported sales of 32,647 units. The Apache brand has now also been expanded with the introduction of the Apache RR310, which has given extremely positive first impressions with its looks and performance.

Last but not the least, Honda’s Dream series sold a total of 30,969 units, growing a significant 65 percent with sales in January 2017 standing at 18,794 units.

While the bulk of the sales are still concentrated in the commuter motorcycle space, the Indian market is gradually moving to premium products, with companies looking to offer a mix of

sportiness and affordability. Hero MotoCorp recently unveiled its Xtreme 200, which is a step in that direction. According to Malo Le Masson, head - global product planning, Hero MotoCorp, "If you look at the premium market, in India, 70 percent is below the Rs 1 lakh price bracket. So, this is why first we are concentrating on bringing the Xtreme 200R and the XPulse."

Also read: Top 10 Two-Wheelers - Honda Activa and Hero Splendor continue to battle hard

Top 10 Scooters - Honda Activa and TVS Jupiter firing on all cylinders

Top 10 Passenger Vehicles – January 2018 | Maruti stays supreme, Tata Tiago drives in

Top 5 UVs – January 2018 | Surging demand continues for popular models

2018 opens on a strong note for Indian OEMs

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

24 Feb 2018

24 Feb 2018

42975 Views

42975 Views

Shahkar Abidi

Shahkar Abidi