Bajaj Auto sells 463,413 three-wheelers in FY2024, increases market share to 67%

Three-wheeler market leader Bajaj Auto increases its dominance in both passenger and cargo model sales with best-ever fiscal performance, market share jumps to 67% from 61% in FY2023; Piaggio sells 100,060 units for a 14% share in FY2024 when the industry saw its second-best performance yet at a shade below 700,000 units.

India Auto Inc’s strong performance with sales of 23.85 million units in FY2024, up 12.5%, saw all vehicle segments register growth. While most of the headlines for the number-crunching sales analyses have been dominated by passenger vehicles or two-wheelers, the three-wheeler sub-segment has been carving out its very own solid growth trajectory.

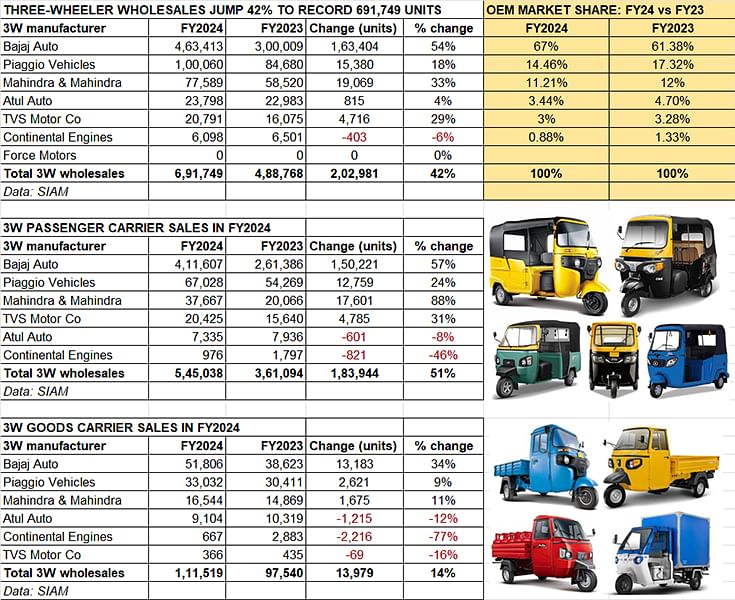

In FY2024, three-wheeler wholesales, which are split into passenger carriers, goods carriers, e-rickshaws and e-carts, were 691,749 units. This means an additional 202,981 units were sold, which constitutes handsome 42% year-on-year growth (FY20023: 488,768 units).

FY2024 was the Indian three-wheeler industry's second-best fiscal with 691,749 units, falling short of its best-yet FY2019 figure of 701,005 units by just 9,256 units!

The bulk of the sales in the three-wheeler segment in FY2024 belong to the passenger carrier category. The 545,038 passenger carriers sold comprise 79% of total segment sales and up 51% YoY (FY2023: 361,094 units). In comparison, goods carrier sales were more muted at 111,519 units, up 14% YoY (FY2023: 97,540 units).

Of the seven SIAM member companies, five have recorded growth, four of them in double digits. Let’s take a closer look at these OEM performances.

BAJAJ AUTO TIGHTENS ITS STRANGLEHOLD, EATS INTO RIVALS' SHARE

This segment’s strong performance can be credited in a large part to Bajaj Auto, which can be termed as the Maruti Suzuki of the three-wheeler market. With total sales of 463,413 units in FY2024, the company recorded 54% YoY growth, selling an additional 163,404 units which constitutes 80.50% of the total 202,981 additional units sold by the industry.

Bajaj Auto’s dominance is across both the passenger and cargo segments. The company sold 411,607 passenger models, up 57%, and had 75.51% of the market. Cargo model sales at 51,806 units were up 34% and accounted for 46.45% of the 3W cargo market.

This all-round show gives Bajaj Auto a total 3W industry market share of 67% in FY2024, up from the 61% it had in FY2023.

Piaggio Vehicles has done well too, surpassing the 100,060 units mark for the first time and registering 18% YoY growth. This gives it a 14.46% market share, albeit with a much expanded market Piaggio’s FY2024 share has dropped below its FY2023’s 17.32% share. The bulk of its sales came from passenger models – 67% or 67,028 units, up 24% YoY. Cargo model sales at 33,032 units comprised 33% of total company sales.

Mahindra & Mahindra is ranked No. 3 on the three-wheeler ladder board with sales of 77,589 units, up 33% YoY. These comprised 37,664 passenger models, up 88%, and 16,544 cargo variants, up 11 percent.

Atul Auto, which dispatched 23,798 units and saw 4% growth is at fourth place, followed by TVS Motor Co with 20,791 units, up 29% YoY.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

16 Apr 2024

16 Apr 2024

26010 Views

26010 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau