Bajaj Auto is No. 1 electric 3W cargo OEM in January, Mahindra leads in FY2025

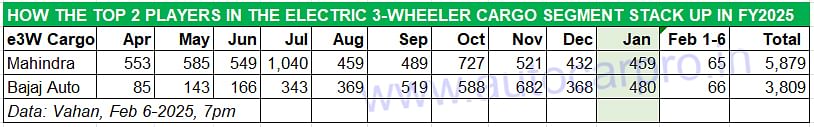

Despite being a late entrant in the electric 3-wheeler market, Bajaj Auto is seeing growing demand for its Maxima XL Cargo E-Tec 9.0 and 12.0 models. In January 2025, it sold 480 units, going ahead of market leader Mahindra Last Mile Mobility for the third month in the current fiscal year but MLMM with 5,879 units and a 27% market share will top the e3W cargo chart in FY2025.

The electric 3-wheeler cargo (goods carrier) category might be the smallest in volumes and the growth slower compared to the passenger carrier and e-rickshaw categories but it is also seeing a good fight at the top between market leader Mahindra Last Mile Mobility and Bajaj Auto. Of the total 59,930 e3Es retailed in January 2025, zero-emission goods carriers comprised 2,493 units, up 10.50% YoY (January 2024: 2,256 units). As per the latest retail sales data from Vahan, Bajaj Auto has topped this EV category in January 2025 with 480 units. . . just 21 units ahead of MLMM’s 459 units.

With this, January 2025 becomes the third month after September 2024 and November 2024 that Bajaj Auto has sold more units of its two models – the Maxima XL Cargo E-Tec 9.0 and 12.0 – than Mahindra (see month-wise data split below).

While MLMM leads with its cumulative retails for FY2025, Bajaj Auto has outsold it in September and November 2024, and in January 2025.

While MLMM leads with its cumulative retails for FY2025, Bajaj Auto has outsold it in September and November 2024, and in January 2025.

While Mahindra Last Mile Mobility remains the market leader in e3W goods carriers in the current fiscal with 5,879 units, Bajaj Auto has outsold it in September and November 2024, and in January 2025.

As per the company website, the zero-emission cargo-transporting Bajaj Maxima XL Cargo E-Tec 9.0, which develops 4.5 kW power and 36 Nm torque, has a lithium-ion (LFP) battery – 8.9 kWh – which gives it a higher range of 149km per charge. The time taken for an 80% charge is four-and-a-half hours. Suspension duties are handled by twin shock absorbers with spring in front and an independent trailing arm with helical spring at the rear.

The Bajaj Maxima XL Cargo E-Tec 9.0 is shod with 130/80-R12 tubeless radial tyres. Other highlights are a regenerative braking system and hill-hold assist. Bajaj Auto is offering a warranty of 60 months / 120,000km on the cargo model which is currently priced at Rs 371,699 (ex-showroom Indore) including the EMPS subsidy.

Bajaj Maxima XL Cargo E-Tec 12.0 gets a bigger battery of 11.8 kWh, which gives it a higher range of 183km per charge and takes 5 hours and 40 minutes for a 80% charge. Maximum power is 5.5 kW and 36 Nm torque. This variant is priced at Rs 418,442 (ex-showroom Indore) after factoring in the EMPS subsidy.

MAHINDRA TAKES A STRONG LEAD IN FY2025

MLMM, which has the Treo and Zor Grand models as part of its e3W cargo portfolio, remains the well-entrenched market leader in the current fiscal. At a cumulative 5,879 units sold between April 1, 2024 and February 6, 2025, as per Vahan data, it has a strong lead of 2,070 units over No. 2 e3W cargo OEM Bajaj Auto.

There are four other players in this category with four-figure retails – Omega Seiki (2,735 units), Euler Motors (2,491 units), Piaggio Vehicles (1,657 units) and Atul Auto (1,024 units).

MLMM, with 5,879 e3W (cargo) units, currently has a 27% market share and will go on to win the No. 1 title for this EV category in FY2025.

RELATED ARTICLES

Mahindra Sells 600,000 SUVs in 11 Months of FY2026, Goes ahead of Tata Motors

Mahindra’s 600,004 SUV wholesales put it ahead by 34,809 units over Tata Motors’ 565,195 passenger vehicles in the first...

Tata Motors, JSW MG, M&M Command 86% of e-PV Sales in February, Maruti Sells 214 e-Vitaras

With 5,558 units sold, Tata Motors captured a 41% share of the 13,669 e-PV market last month, while JSW MG Motor and Mah...

TVS Sells 31,600 e-Scooters in February for a 28% Share; FY2026 to see 1.35 Million e-2W Sales

With 31,600 e-scooters, TVS commanded a 28% market share even as Bajaj Auto, Ather Energy and Hero MotoCorp witnessed st...

08 Feb 2025

08 Feb 2025

11387 Views

11387 Views

Ajit Dalvi

Ajit Dalvi