Bada Dost helps Ashok Leyland increase LCV goods carrier market share in FY2021

Recent addition to its LCV range helps Ashok Leyland notch gains in a difficult year, even as rivals felt the heat of the slowdown.

The Indian commercial vehicle (CV) industry has been fighting a number of challenges over the past two years and more. Be it the new axle norms, the shift to BS VI, the downturn in the economy or the back-breaking pandemic which has resulted in loss of demand, vehicle manufacturers are hard-pressed to sell their products.

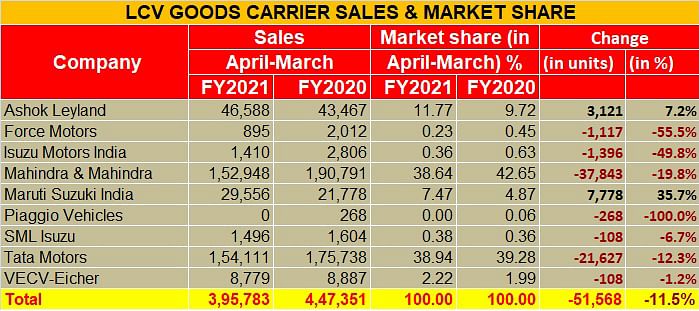

So, when an OEM notches growth amidst these difficult conditions, it is reason to celebrate that effort. Chennai-based Ashok Leyland sold a total of 46,588 light commercial vehicles in the goods-carrying segment in FY2021, up 7.18% year on year (FY2020: 43,467). This smart performance has helped the company expand its LCV (goods carrier) market share to 11.77% from 9.72% a year ago.

The Ashok Leyland Dost, comprising both the smaller Dost and the bigger Bada Dost, sold 45,657 units in FY2021, up 9.26% (FY2020: 41,784), accounting for the bulk of the company's sales. Add 931 Partner LCVs to that number and you get the LCV sales total of 46,588 (-45% / FY2020: 1,683) units. The Bada Dost, launched in 2.99T and 3.49T variants last September, is estimated to have contributed to the strong numbers.

Indigenously developed from grounds-up, the Bada Dost, which was introduced 10 years after the smaller Dost entered the market, seems to have clicked with LCV buyers. Ashok Leyland launched the Bada Dost in seven Indian states in the first round of introduction.

Look at the market share table above and it’s apparent that all OEMs, other than Maruti Suzuki, have seen sales declines. Maruti, with its single CV model – the Super Carry – sold 29,556 units, up 35% YoY.

Mahindra & Mahindra, the leader in FY2020 in this vehicle segment, felt the heat of the challenging year that FY2021 was with sales of 152,948 units, down nearly 20% YoY (FY2020: 190,791). As a result it has ceded that position this year to Tata Motors which clocked despatches of 154,111 LCVs, down 11.80% YoY (FY2020: 175,738) but enough to take it ahead of M&M.

Given the growing number of states, starting with Maharashtra, which have imposed lockdowns, the CV sector will once again be impacted albeit with the boom in the e-commerce business, demand will continue for last-mile mobility. It is here that versatile LCVs can steal a march over their M&HCV brethren.

ALSO READ India’s CV industry records second straight year in the red

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

17 Apr 2021

17 Apr 2021

43964 Views

43964 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau