Auto retails in May grow 2.61%: 2Ws, 3Ws and CVs up, PVs and tractors down

Retail sales in May 2024 were impacted by a combination of growth-impeding factors like elections, market liquidity, high dealer inventory levels as well as heat-wave conditions across parts of India which considerably reduced customer walk-ins to showrooms.

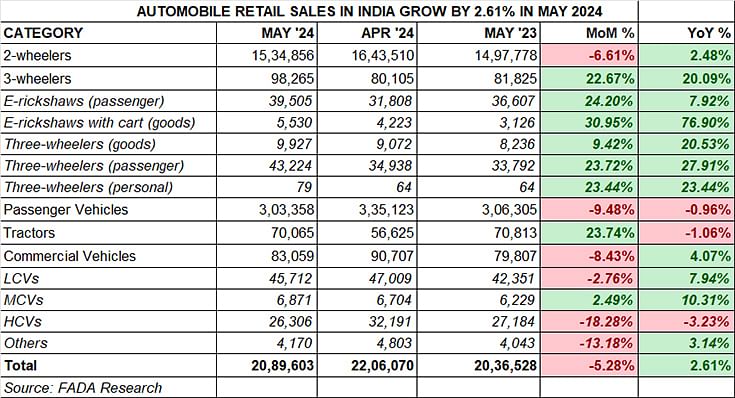

Compared to OEM wholesales dispatch numbers that OEMs provide, the real-world retail sales numbers for India Auto Inc’s performance in May 2024 are out. The Federation of Indian Automobile Dealers Associations (FADA) has released the data for last month – total sales of 2.08 million units for five vehicle segments represent a modest 2.61% year-on-year growth (May 2023: 2.03 million units). However, month-on-month, May 2024’s retails are down by a marked 5.24% (April 2024: 2.20 million units).

While two-wheelers (1.53 million units) have registered 2.48% YoY growth but down 6.61% MoM, three-wheelers continue to shine with sales of 98,265 units, up 20% YoY and also 23% MoM. Commercial vehicles was the only other segment to see growth in May 2024: 83,059 units, up 4.07% YoY but down 8.43% MoM. Demand for cars and SUVs fell by 1% YoY to 303,358 units and was down by 9.48% on Apil 2024’s 335,123 units. Tractor sales too were down by 1% YoY (May 2024: 70,065 units) but up 24% on April 2024’s 56,265 units, indicating that demand has returned to the segment with the monsoon season kicking in.

TWO-WHEELERS: 15,34,856 units, up 2.48% YoY, down 6.61% MoM

Hero MotoCorp market share down by 6% to 29% in May 2024, HMSI’s up by 7% to 25%

This volume-providing segment sold 1.53 million units last month in which, as per FADA president Manish Raj Singhania, “dealers reported supply constraints, lack of OEM marketing activities and impacts from extremely hot weather and elections. Positive rural demand due to the expected good monsoon and improved finance availability kept the counters ticking.”

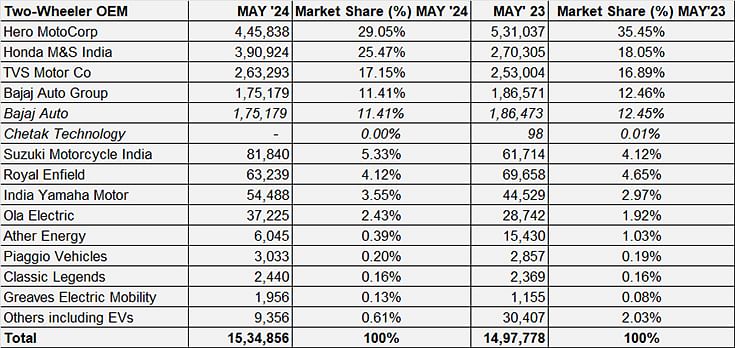

Market leader Hero MotoCorp, which posted retail sales of 445,838 units in May 2024, was down 16% YoY (May 2023: 531,037 units), which has seen its market share come down to 29% from 35% a year ago. Month on month, May sales are down 13% (April 2024: 511,599 units). In an effort to rev up sales of its popular entry level commuter motorcycle, on May 30, the company launched the new Splendor+ Xtec 2.0 at an ex-showroom (Delhi) price of Rs 82,911. Therefore, one can expect improved motorcycle sales numbers for June 2024. With Bajaj Auto set to launch India’s first-ever CNG motorcycle, which promises reduced motoring costs compared to petrol power, on June 19, Hero MotoCorp will face renewed pressure in the entry-level bike market. Meanwhile, though model-wise sales statistics are not available, Hero MotoCorp continues to benefit from its focus on the premium motorcycle market as seen in the launches of the Xtreme 125R and the Mavrick 440.

Honda Motorcycle & Scooter India (HMSI), the firm No. 2 OEM, recorded strong growth last month – 390,924 units, up 45% YoY (May 2023: 270,305 units) and 0.81% down on April’s 3,94,147 units. This has seen HMSI’s market share increase substantially to 25.47% from 18% a year ago.

TVS Motor Co, with 263,293 units in May 2024, saw a more modest 4% YoY increase (May 2023: 253,004 units), which see its market share rise marginally to 17.15% from 16.89% a year ago.

Bajaj Auto sold a total of 175,179 units, down 6% YoY and down 10.55% on April 2024’s 195,842 units. This sees its share reduce to 11.41% from 12.45% a year ago.

Suzuki Motorcycle India did well to sell 81,840 units, an increase of 32% and 20,126 units more than it sold a year ago.

In sixth rank is Royal Enfield with 63,239 units, down 9% YoY and 12% down on April’s 72,056 motorcycles.

India Yamaha Motor has delivered a strong performance: 54,488 units, up 22%, which sees its market share increase to 3.55% from 2.97% in May 2023.

Amongst the pure EV makers, Ola Electric continues to ride the wave of demand with 37,225 units, which gives it an overall two-wheeler market share of 2.43% versus 1.92% a year ago.

THREE-WHEELERS: 98,265 units, up 20% YoY, up 22% MoM

THREE-WHEELERS: 98,265 units, up 20% YoY, up 22% MoM

Bajaj Auto increases stranglehold on market with 36% share, Piaggio sales up 23%

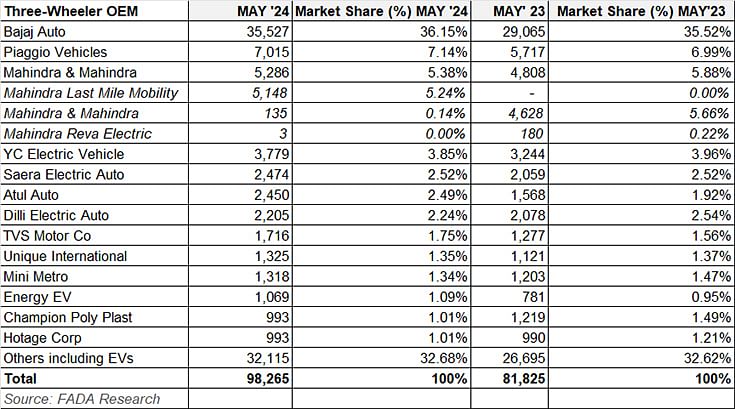

The three-wheeler industry continues to shine and May 2024 numbers prove that. At 98,265 units, sales were up 20% YoY and 22.67% over April 2024’s 80,105 units. Market leader Bajaj Auto sold a total of 35,527 units last month, up 22% YoY (May 2023: 29,065 units), which helps further strengthen its grip on the market to 36% from 25% a year ago. Bajaj Auto, which entered the electric three-wheeler market a year, is seeing a good contribution from its EV sales. In May 2024, as per Vahan data, the Pune-based auto major sold 2,537 electric three-wheelers, which makes for an EV penetration level of 7.14% in May 2024. Bajaj is now the No. 4 in a field of 485 electric three-wheeler players in India, a very creditable performance.

Piaggio Vehicles retains its No. 2 rank with 7,015 units which are a 23% increase over year-ago sales of 5,717 units.

Mahindra & Mahindra, with 5,286 units, registered YoY growth of 10% (May 2023: 4,808 units). Of this, EVs comprised 3,141 units which gives it market-leading status in the EV field.

PASSENGER VEHICLES: 303,358 units, down 1% YoY, down 9.48% MoM

PASSENGER VEHICLES: 303,358 units, down 1% YoY, down 9.48% MoM

18% reduced walk-ins to showrooms dampen demand for both mainstream and luxury carmakers

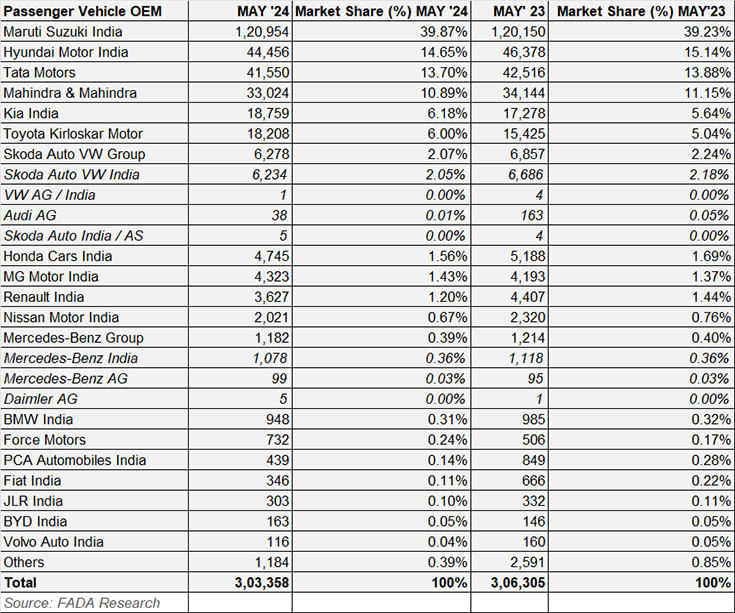

Though the passenger vehicle clocked retail sales of over 300,000 units for the second month in a row in the ongoing fiscal, demand at 303,358 units was down 1% YoY and down by 9.5% on April 2024’s 306,305. Echoing dealer opinion, FADA president Manish Raj Singhania cited the reduced sales due to the impact of the elections, extreme heat and market liquidity issues. Furthermore, “despite better supply, some pending bookings and discount schemes, the lack of new models, intense competition and poor marketing efforts by OEMs affected sales. Additionally, increased customer postponements and low enquiries further contributed to the challenging market conditions. Due to the extreme heat, the number of walk-ins to showrooms dropped by around 18%.

PV leader Maruti Suzuki saw flat retail sales at 120,954 units (May 2023: 120,150) and also maintains the same 39% market share it had a year ago. Strong sales of its nine-strong utility vehicle portfolio continue to save the blushes for the company which has been witnessing dampened demand for its hatchbacks and sedans. The recent launch of the Swift though is expected to power growth in June.

The high level of heat-wave conditions across India in May 2024 impeded buyer movement and despite most of the top players having robust UV portfolios, demand was slack. This was seen in the performances of Hyundai Motor India (44,456 units, down 4% YoY), Tata Motors (41,550 units, down 2.27% YoY) and Mahindra & Mahindra (33,024 units, down 3.28% YoY). Kia India (18,759 units, up 8.77% YoY) and Toyota Kirloskar Motor (18,208 units, up 18% YoY) though managed to buck the trend.

Luxury carmakers’ combined sales of 2,587 units accounted for 20.85% of total PV retails in May 2024 but were down 9.3% on May 2023’s 2,854 units.

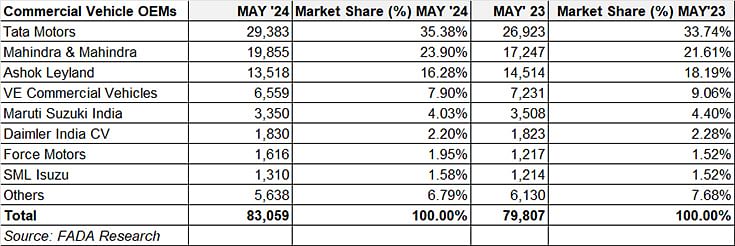

COMMERCIAL VEHICLES: 83,059 units, up 4% YoY, down 8.5% MoM

Elections and extreme climatic conditions impact CV sales adversely

In May 2024, India’s commercial vehicle segment witnessed modest 4% YoY growth at 83,059 units, but down 8.5% on April 2024’s 90,707 units. According to FADA president Manish Raj Singhania, “Dealers reported that elections and extreme climatic conditions heavily impacted sales. Despite growth due to a low base from last year and increased bus orders, the industry faced challenges from wholesale pressures, government policy effects, and negative market sentiment.” However, he added that “good movement in market loads, cement, iron ore and coal sectors contributed positively,” to retail sales last month.

Market leader Tata Motors sold a total of 29,383 CVs in May 2024, up 9% but down 11% on April’s 32,914 units. Mahindra & Mahindra, with 19,855 units, was up 15% YoY but marginally down on its April 2024 sales of 20,620 units. Demand for its range of pickup trucks continues to be strong. Ashok Leyland’s sales at 13,518 units were down 7% YoY (May 2023: 14,514 units).

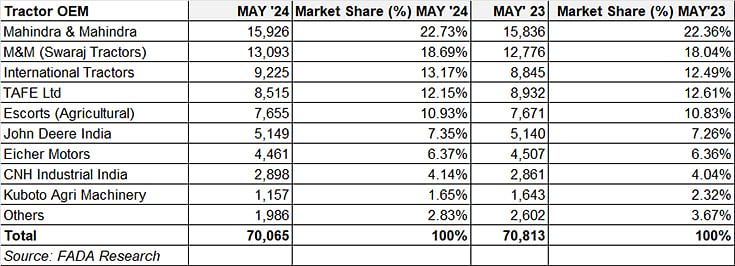

TRACTORS: 70,065 units, down 1% YoY, up 24% MoM

The IMD’s forecast of a normal monsoon this year augurs well for tractor manufacturers who sold a total of 70,065 units in May 2024, down marginally on year-ago numbers but up 24% on April 2024’s 56,625 units. What has impacted demand has been the elections, low reservoir water levels, reduced haulage operations and also a moderate rabi crop.

FADA’s near-term outlook remains cautiously optimistic

In his near-term commentary for India Auto Inc, Manish Raj Singhania said: “The near-term outlook for automobile retails is ‘cautiously optimistic’, influenced by a mix of positive and challenging factors across various segments. Post-election results are expected to bring stability and improve market sentiment, while the formation of a continued government could boost infrastructure projects and economic activities. Dealers are hopeful about better supplies and positive movement in key sectors like cement, coal and iron ore. The India Meteorological Department (IMD) has forecast above-normal rains at 106% of the long-period average (LPA) this year, which is expected to enhance rural demand and support economic activities. However, extreme weather, such as heatwaves and heavy rains, along with the reopening of schools in July, might delay purchase decisions. Despite these positive indicators, challenges persist, including intense competition, lack of new model launches and poor marketing efforts by OEMs. Liquidity issues and high inventory levels continue to strain profitability for Dealerships. Although discount schemes and good product availability are in place, low customer enquiries and postponements due to seasonal factors remain concerns.”

ALSO READ LATEST EV SALES ANALYSES:

Electric 2W sales cool off in scorching May at 63,700 units

Electric 3W sales bounce back in May, Mahindra share at 9%, Bajaj Auto moves up to No. 4

Electric car and SUV OEMs sell 6,300 units in May, down 18%

Strong demand for e3Ws helps EV industry clock 123,000 units in May

RELATED ARTICLES

Revolt Motors First Indian Electric Bike Maker to Achieve 50,000 Deliveries

Haryana-based EV OEM, which was the first in India to launch an electric motorcycle in August 2019 and target the entry-...

The 200cc Motorcycle: India’s Quiet Premiumisation Story

While the motorcycle market’s attention remains on 110cc volumes and the 350cc Royal Enfield phenomenon, a quiet revolut...

100,000 and Holding: Electric Scooters Cross a Threshold

India’s electric two-wheeler market has achieved a landmark, with monthly wholesale volumes now consistently exceeding 1...

10 Jun 2024

10 Jun 2024

9425 Views

9425 Views

Ajit Dalvi

Ajit Dalvi

Arunima Pal

Arunima Pal