Ashok Leyland takes strong lead in bus sales, grows market share to 45%

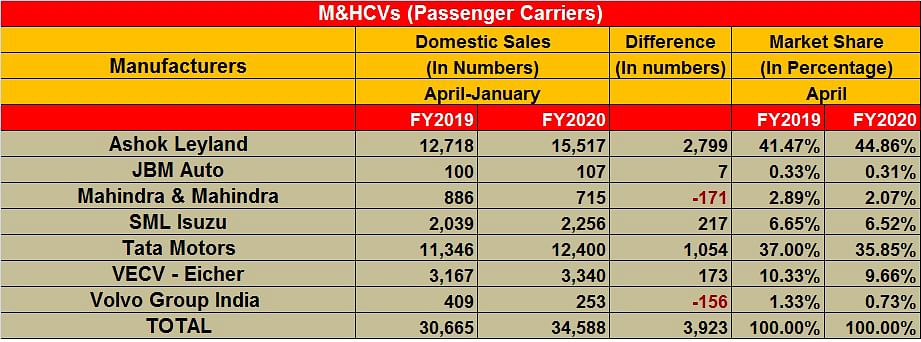

Chennai-based CV maker sells 15,517 M&HCV passenger carriers in first 10 months of FY2020, notching strong 22% growth and that too in a difficult period. Tata Motors, SML Isuzu and VECV also make gains.

In the ongoing difficult fiscal year that India Auto Inc is currently experiencing, all key vehicle segments are in negative sales territory. In the April 2019-Janaury 2020 period, overall industry sales are down 15.55% comprising passenger vehicles (-15.38%), commercial vehicles (-36.46%), three-wheelers (-1.25%) and two-wheelers (-15.83%). Attribute this to the hugely dampened consumer sentiment, the industry shift to BS VI emission norms and no revival-driven measures from the Government, albeit the much-delayed vehicle scrappage policy is set to be unveiled soon.

However, not all is doom and gloom. There are two vehicle sub-segments which are firing on all cylinders and the only ones to be in the black: Utility Vehicles (UVs) and M&HCV (passenger carriers) / Buses. The UV segment, which is helping buffer the overall passenger vehicle segment, is riding a wave of demand for compact SUVs and new products. Kia Motors India has snatched a 7.43% UV share in barely six months, the Hyundai-Kia combine 26%, Renault has sprung a surprise with 4.49%, and MG Motor India has taken 2.35%. But this news is not about UVs. It is about another sub-segment: buses.

Ashok Leyland sees accelerated sales

With demand growing across corporate India for quality executive staff buses, safer buses to transport children to schools, and premium inter-state buses for travellers, bus manufacturers across the country are benefiting. Of the seven bus manufacturers in the fray in India, five OEMs have recorded improved year-ago numbers in the first 10 months of FY2020.

Leading the charge is the Chennai-based Ashok Leyland, India's second largest CV manufacturer, with its expansive portfolio of buses. In the April 2019-January 2020 period, the Chennai-based CV maker has sold a total of 15,517 M&HCV passenger carriers (buses), which marks 22% year-on-year growth (April 2018-January 2019: 12,718). This performance has also seen the company increase its M&HCV (buses) market share in India to 44.86% from 41.47% a year ago. It is the sole OEM to have increased its market share; all other six players have seen a decrease in their sales in the past 10 months of this fiscal.

That's not all. Ashok Leyland recently announced that it has become the world's third largest M&HCV bus maker for 2019. This is based on reports released by SIAM, OICA (Organisation Internationale des Constructeurs d’Automobiles), and IHS Markit. The total number of buses sold by the Chennai-based Ashok Leyland in CY2019 stood at 23,100 units.

Commenting on the milestone, Vipin Sondhi, CEO and MD, Ashok Leyland said, “We are extremely glad to have become the third largest bus maker in the world. Our strong foundation in R&D, innovation and experience in the market makes us a unique commercial vehicle manufacturer. Despite the challenges and the market uncertainties, this achievement gives us the confidence to work towards our vision to be a Global Top 10 CV manufacturer. I take this moment to thank the team at Ashok Leyland and all the stakeholders who have been an integral part of this journey – without whom this would not have been possible.”

In the April 2019-January 2020 period, the Chennai-based CV maker has sold a total of 15,517 M&HCV passenger carriers (buses), which marks 22% year-on-year growth. This performance has also seen the company increase its M&HCV (buses) market share in India to 44.86% from 41.47% a year ago. It is the sole OEM to have increased its market share; all other six players have seen a decrease in their sales in the past 10 months of this fiscal.

The OEM has introduced several innovations like becoming the first company to introduce power steering, air brakes, rear engine bus and India’s first double-decker unit. Its bus range include the Jan Bus – world’s first single-step entry, front engine, fully flat floor bus; India’s first hybrid CNG plug-in bus, Sunshine – a pathbreaking, frontal crash protected, rollover compliant, aesthetically designed bus for school children, and the Circuit – India’s first electric bus.

Tata Motors' sales up 9%, benefits from STU orders

India's largest bus maker Tata Motors has also recorded an improved performance in the ongoing fiscal. With sales of 12,400 units, the year-on-year growth is 9.28% albeit its market share has marginally declined to 35.85% from 37% a year ago. However, the company, like the others who are making the shift to BS VI-compliant products, can be seen to be working to keep BS IV inventory to the minimum.

Tata Motors is benefiting from orders from various State Transport Undertakings (STUs). In early December 2019, it bagged orders for supply of over 2,300 buses from seven STUs – Rajasthan (RSRTC), Karnataka (KSRTC/ BMTC/ NWKRTC), Uttar Pradesh (UPSRTC), Tamil Nadu (IRT), and Andhra Pradesh (APSRTC). The company says it is working towards completing deliveries by February 2020.

Tata Motors has a comprehensive range of buses ranging from luxurious intercity travel options, to safe transport and driver-friendly choices and designed to suit travel conditions both in Indian cities and rural areas.

According to Rohit Srivastava, Product Line Head, Buses, Tata Motors, “With the government’s continued thrust towards providing smart safe and convenient alternatives of public transport, we at Tata Motors acknowledge the proactive approach of various STUs to maintain a sustainable mass public transportation system. Our in-depth understanding of sustainable public transport for different markets and customers is what differentiates us from our competitors. With an order size of over 2,300 Tata Motors buses, we look forward to a continued partnership with all the STUs, in their endeavour to reinforce the public transportation system in their respective cities.”

Tata Motors currently designs, develops and manufactures its buses at its plants in Pune, Dharwad, Pantnagar and Lucknow. Besides its partnership with ACGL of Goa for bus bodies, Tata Motors also has a joint venture with Marcopolo of Brazil, one of the largest bus body manufacturers in the world, for fully built bus (FBV) solutions.

SML Isuzu does well, targets new business with Hiroi buses

Meanwhile, SML Isuzu which has buses ranging from 12-seaters to 62-seaters for school, office staff and tourist applications, is seeing a smart uptick in demand. In the period under review, the company sold a total of 2,256 units, which marks 10.64% YoY growth.

At the recent Auto Expo 2020, the company showcased three BS VI-compliant passenger buses. Commenting on the new launches, Yugo Hashimoto, MD and CEO, SML Isuzu, said: “Our promising all-new range of front overhang buses is fondly named as ‘Hiroi, which in Japanese means ‘the spacious one’. Literally and figuratively living up to its name, the buses are wide and provide ample space for a safe and comfortable commute. The buses are designed for tourist, staff and school applications. The Hiroi Staff bus comes with a wide front door, fully reclined pushback seats with three- point seatbelts for superior comfort and safety, ambient lighting and USB ports to keep productivity on the go and a multimedia on-board entertainment system to accentuate the joy of travel. The Hiroi School bus is fully compliant with all school bus and safety norms. The Hiroi School Bus also comes with revolutionary all new SML EduConnect, the online School Management System, keeps the bus connected to smartphones and laptops. The other bus on the display is GS Bus, built on the popular Global Series platform with new interiors offers style with great comfort and economy.”

VE Commercial Vehicles ups the ante

VE Commercial Vehicles, which has a varied range of buses, registered sales of 3,340 units in April-January 2020, up 5.46 percent (April-January 2019: 3,167). The company, which opened a new 3S dealership in Bangalore on February 13, says it is seeing good traction in bus sales.

At present, Eicher has 296 dealerships across the country catering to the customers across the truck and bus segment in the 5-55 tonne range. With this dealership, Eicher now has 27 dealerships in Karnataka, including 14 3S facilities in the state and 9 dealerships in and around Bangalore alone.

VECV says from a business perspective, Bangalore's urban and rural activity constitutes over half of the Total Industry Volume (TIV) of Karnataka. Over the years, Eicher has developed a robust presence in Bangalore with a market share of over 32 percent in light- and medium-duty trucks, 25 percent in buses and 6 percent in heavy duty trucks. The OEM says it is a leader in staff buses in Bangalore with a strong presence in the State Transport Corporation (STC) fleet too.

Vinod Aggarwal, MD and CEO, VE Commercial Vehicles said, “It is a moment of great pride for us to inaugurate the state-of-the-art facility in Bangalore, which is going to be a one stop solution for any kind of aftermarket support required by our customers in that region. The region offers best-in-class infrastructure development, strong rural economy and a high potential for ecommerce and last mile delivery segments making it a perfect location for a 3S facility. Being an IT and industrial hub, the region also presents with a huge opportunity for staff transportation, which will further help Eicher to expand its Bus portfolio.”

March 2020 and the nex few months after that will see industry and consumers adjusting to the BS VI shift and its resultant market dynamics, which could lead to sales being on the lower side. It is estimated that it will take at least another two to three quarters for the overall CV industry to see growth. But with the demand for buses growing at a good clip, this is good news for the CV industry per se.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

23 Feb 2020

23 Feb 2020

92963 Views

92963 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi