Ashok Leyland maintains leadership in heavy-duty buses in FY2019

Ashok Leyland is the dominant player in the 12-16.2T category, where mostly private players and STUs are big customers, with an over 60 percent share.

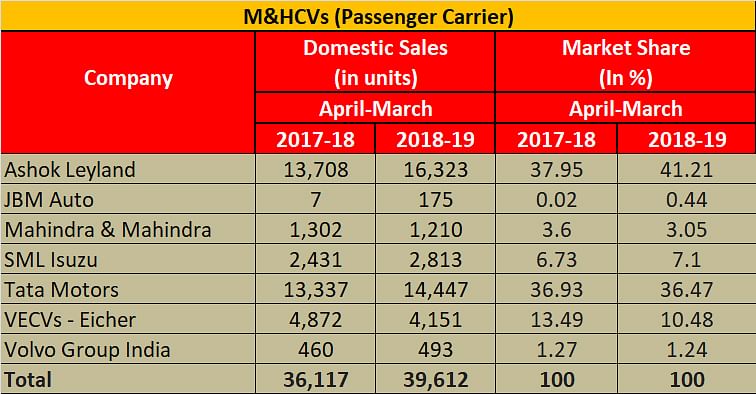

Backed by sustained demand from private fleet operators and the bulk orders by various state transport undertakings (STUs), the heavy-duty bus segment – 7.5 tonnes and above – which declined in FY2018 by a substantial 25 percent has rebounded in FY2019 with a growth of 10 percent with sales of 39,612 units. (FY17-18: 36,117)

This segment is largely dominated by two large domestic players – Ashok Leyland and Tata Motors – who have a combined market share of 78 percent. Ashok Leyland once again maintains its leadership with an overall market share of 41.2 percent. The company has sold 16,323 units in FY2019 and gained 3.2 percent market share YoY.

Tata Motors, which is a fierce competitor for the leadership, saw flat growth and sold a total of 14,447 units which gives it a market share of 36.4 percent YoY. VE Commercial vehicles, SML Isuzu and Mahindra & Mahindra are the other players in this segment with market shares of 10.4, 7.1 and 3 percent respectively.

Ashok Leyland bosses the 12-16T segment, Tata leads in 7.5-12T market

The heavy bus market is categorised into two large sub-segments – Mass exceeding 7.5 tonnes but not exceeding 12 tonnes and Mass exceeding 12 but not exceeding 16.2 tonnes.

While Ashok Leyland leads in the overall bus market, each of the two sub-segments are dominated by the market leaders. Ashok Leyland is the dominant player in the 12-16.2T category, where mostly private players and STUs are big customers, with an over 60 percent share. The Viking, Cheetah and 12M are the company’s tried-and-tested products in the segment. Tata Motors is a distant second with a 33 percent share.

Similarly, in the 7.5-12T category, Tata Motors leads with a 41 percent market share with its Starbus and Starbus Ultra range of buses whereas Ashok Leyland has 21 percent market share with its Lynx range of buses.

High growth potential in India's bus market

Like the heavy truck market, the Indian heavy bus segment is the second largest market globally behind China. Growing urbanisation, higher density of population and an increasing need for public transport services across cities and towns is likely to drive demand for buses in India. However, demand for the buses segment is still small as compared to the goods carrier segment. In FY2019 the total M&HCV truck segment registered total sales of 351,128 units, whereas bus sales were 39,612 units, a little above 10 percent of the number of trucks sold. Globally, in developed markets, the bus segment is between 35-40 percent of the total CV market, which is indicative of the high growth potential for buses in India.

In the global bus market, India is behind China with a volume of 39,612 units sold last year. Europe as a whole accounts for about 30,000 units, Latin America 25,000 and Africa even less. The bus market in India is expected to grow over time, considering the average bus penetration is far below than what is essential for mobility needs of the country’s vast population. Historically, the Indian market has grown at an average of 9 percent between 2000-2012, after which the sales momentum slowed down until 2017, which meant the average growth rate of the total bus market from 2000-2017 was 4 percent. This may look moderate but given the overall size of the total bus market, this is sustainable for a long time.

RELATED ARTICLES

Top 10 MPVs in First 10 Months of FY2026: Maruti Ertiga to Kia Carnival

Demand for multi-purpose vehicles remains strong, with their share of UV sales rising to 17% in FY2027 from 11% in FY202...

Skoda Slavia and VW Virtus Sales Cross 150,000 Units, Virtus First to Cross 75,000 Units

Skoda Volkswagen India’s two MQB-A0-IN–based sedans have reached a new milestone, with the Slavia at 73,378 units and th...

Renault Triber Sales Cross 200,000 Units in India; Facelifted Model Spurs Demand

Launched in August 2019, the seven-seater Triber has sold 200,253 units in India and 34,238 overseas. The facelifted Jul...

12 Apr 2019

12 Apr 2019

69351 Views

69351 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau