2018 opens on a strong note for Indian OEMs

Reflecting the improvement in the economy, all vehicle segments saw robust sales in January. While UVs led the charge in PVs, scooters notched 48 percent YoY growth even as CVs seem to be firmly accelerating in growth lane.

The Indian automobile sector, which has been driving in growth lane consistently for some time now, has opened 2018 on a robust note, with all vehicle categories reporting strong sales in January. Industry is certainly seeing happy days, with FY2018 pegged to be the first fiscal after a gap of five years since FY2013 (+2.49%), to be posting solid double-digit growth amidst a slew of economic reforms and regulatory changes being introduced in the first half of fiscal year FY2018.

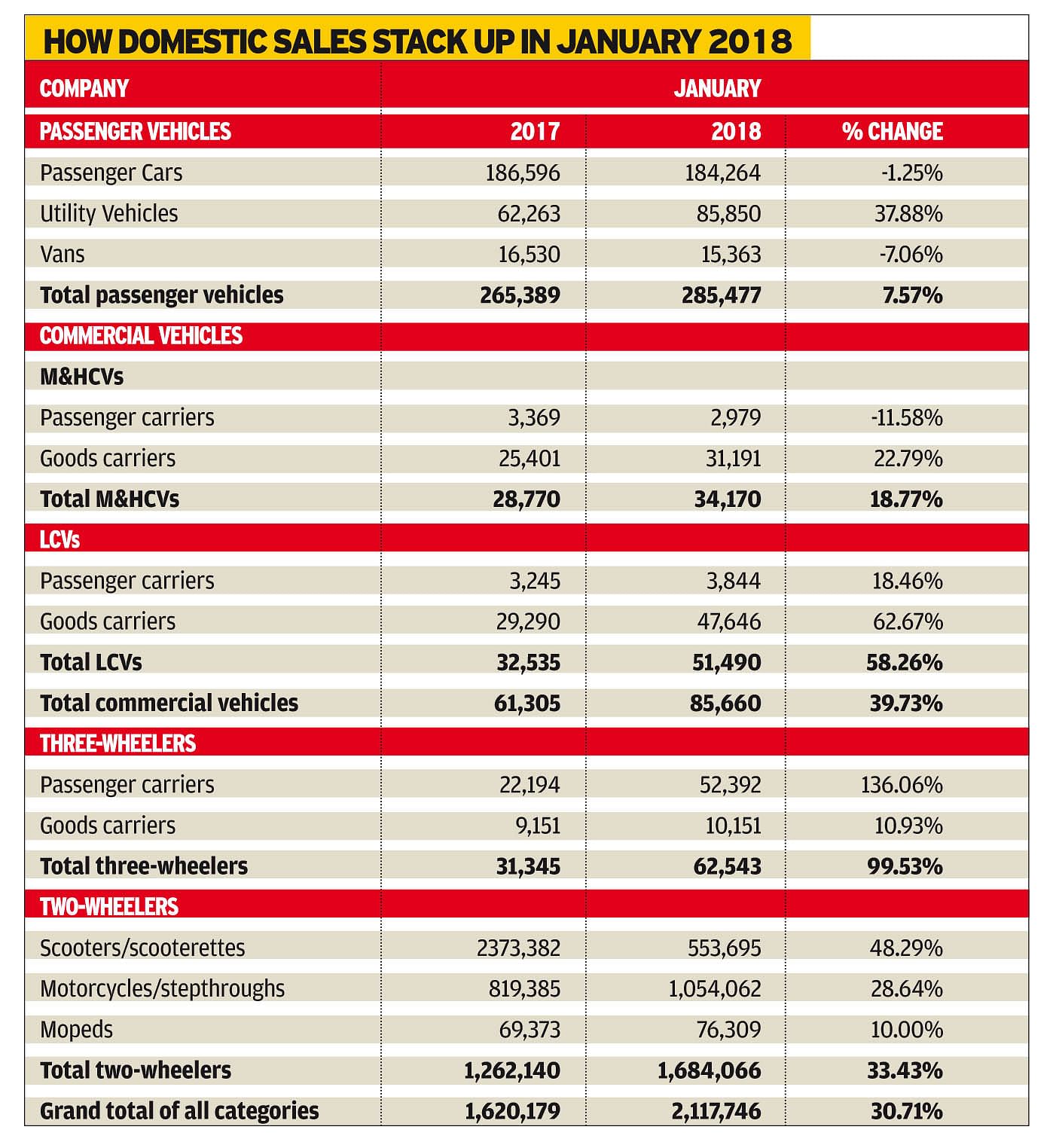

Total vehicle sales across segments in January stood at 2,117,746 units (+30.71%) with passenger vehicles (285,477 / +7.57%), commercial vehicles (85,660 / +39.73%), three-wheelers (62,543 / +99.53%) and two-wheelers (1,684,066 / +33.43%), all registering strong growth and continuing the industry’s momentum towards the fag end of the fiscal. Nonetheless, January 2018 sales have to be seen the backdrop of the low year-ago base, which was adversely impacted by demonetisation.

Utility vehicles, including compact crossovers, which remain the new favourite of car buyers within the passenger vehicle space, posted an astounding performance, selling 85,850 units and growing by a substantial 38 percent, year on year, in January. Over a duration of 10 months between April 2017 and January 2018, sale of passenger vehicles grew by 8.07 percent with 2,711,930 units (April-January 2017: 2,509,401), with UVs clocking 750,080 cumulative units (+21.29%) and overshadowing passenger cars, which grew by 3.61 percent, selling 1,803,746 units. “The line between UVs and passenger cars is slowly diminishing with the coming in of crossovers, which don’t necessarily need all that off-road ability. Both sub-segments are now seeing overlapping and we could see the pattern to follow in the future as well,” said Sugato Sen, deputy director general, SIAM. The sub-segment certainly has become the default choice for carmakers to bring in their new models and a slew of concept unveils at the Auto Expo is a testament to the strong consumer liking for such vehicles.

The commercial vehicle segment, which is also recording smart growth since the past few months, grew by 17.88 percent between April to January 2018, with M&HCVs clocking 257,001 units (+10.45%) and LCVs garnering cumulative sales of 402,996 units (+23.17%). While passenger carriers in both M&HCV and LCV segments continue to show a downward trend, selling 27,431 (-25.66%) and 36,053 units (-8.30%) in either categories respectively

over the 10-month period, goods carriers continue to surge ahead, selling 229,570 units (+17.25%) in the M&HCV category and 366,943 units (+27.47%) in the LCV category respectively.

On the two-wheeler front, cumulative sales in the first 10 months of FY2018 stand at 16,765,209 units (+13.62%), with scooters giving a shot in the arm and more to the two-wheeler segment, registering sales of 5,641,243 units to grow by a strong 20.91 percent and motorcycles reaching total sales of 10,414,790 units (+11.43%). January, though, turned out to be a bumper month for the two sub-segments, with scooters surging ahead with remarkable 48.29 percent YoY growth, selling 553,695 units and motorcycles growing 28.64 percent with 1,054,062 units going home to customers in the fresh year.

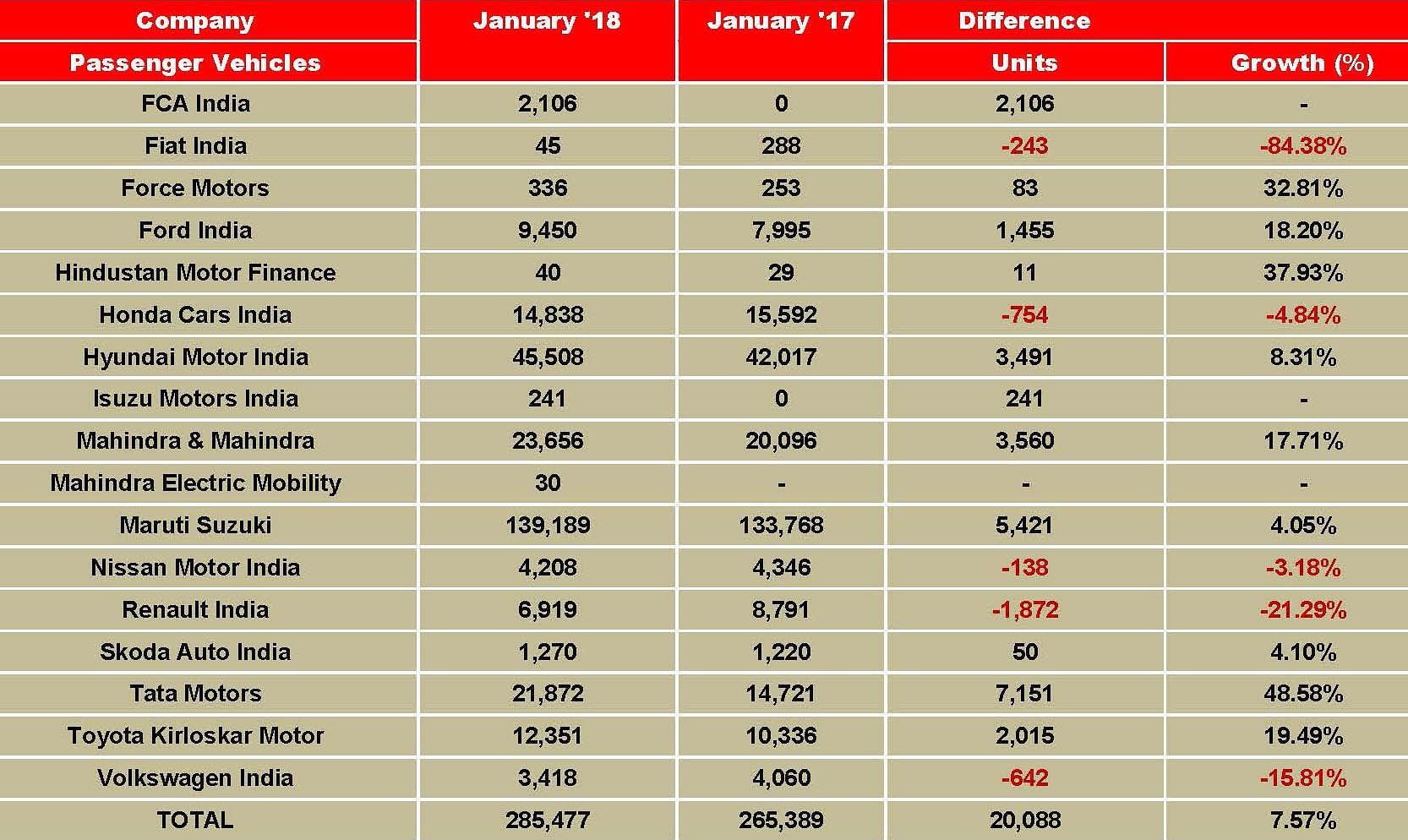

HOW THE PASSENGER VEHICLE MAKERS FARED IN JANUARY

Maruti Suzuki India sold 139,189 PVs, which is 4.1 percent growth (January 2017: 133,768). Cumulative sales for the first 10 months of FY2018 are 1,195,347 units, which marks 13.7 percent YoY growth. Having sold 1,443,641 units in FY2017, it is in line to cross the 1.5 million sales mark this fiscal. Right now, it is 248,294 PVs short.

The entry level Alto and Wagon R sold 33,316 units last month, down 12.2 percent, indicating demand is shifting to other company models. Acting as a strong buffer are the compact cars (Swift, Celerio, Ignis, Baleno and Dzire) and UVs (Gypsy, Ertiga, S-Cross and Vitara Brezza). At 67,868 units (January 2016: 55,817), they posted strong 21.6 percent growth. Now, with the new Swift getting launched, expect this segment to see a surge in demand. Maruti UVs, due to the continuing demand for the Vitara Brezza, sold 20,693 units, up 26.8 percent (January 2017: 16,313).

Sales of the premium Ciaz sedan are still down. In January, the car sold 5,062 units, down 22.5 percent (January 2017: 6,530). The two ubiquitous Maruti vans, the Omni and the Eeco together sold 12,250 units, down 13.6 percent (January 2017: 14,179).

Hyundai Motor India registered total domestic sales of 45,508 units (January 2017: 42,017), up 8.3 percent. The company has been seeing consistent demand for its new Verna sedan, launched in August last year. The car has cumulatively sold 28,251 units within five months until January 2018. The i20 hatchback and the Creta crossover continue to be strong buyer considerations.

Mahindra & Mahindra (M&M) has reported sales of 23,656 passenger vehicles, up 18 percent year-on-year (January 2017: 20,093). This comprised 22,235 UVs, a 16 percent increase over year-ago sales of 19,217 units, and 1,421 cars and vans, up 62 percent (January 2017: 876).

Tata Motors clocked domestic PV sales of 21,872 units (January 2017: 14,721), which marks significant 49 percent0 growth. What boosted sales is demand for the Nexon compact SUV, which has emerged a strong driver in in the voluminous sub-Rs 10 lakh UV segment. Driven primarily by the Nexon, Tata’s UV sales grew by 188 percent, and the sales of its passenger cars, driven by the Tiago hatchback, registered a 27 percent growth in the month.

Toyota Kirloskar Motor recorded robust sales growth in January 2018, selling 12,351 units which marks 19 percent year-on-year growth (January 2016: 10,336). The company unveiled its much-awaited C-segment offering, the Toyota Yaris at the Auto Expo, targeted directly at the likes of the Honda City, Hyundai Verna and the Maruti Suzuki Ciaz.

Honda Cars India sold 14,838 units in January 2018, down 5 percent (January 2017: 15,592). The WR-V led the charge, selling 4,273 units, followed by the City (3,968), Amaze (2,836), Jazz (2,257), BR-V (1,071), Brio (422) and CR-V (11).

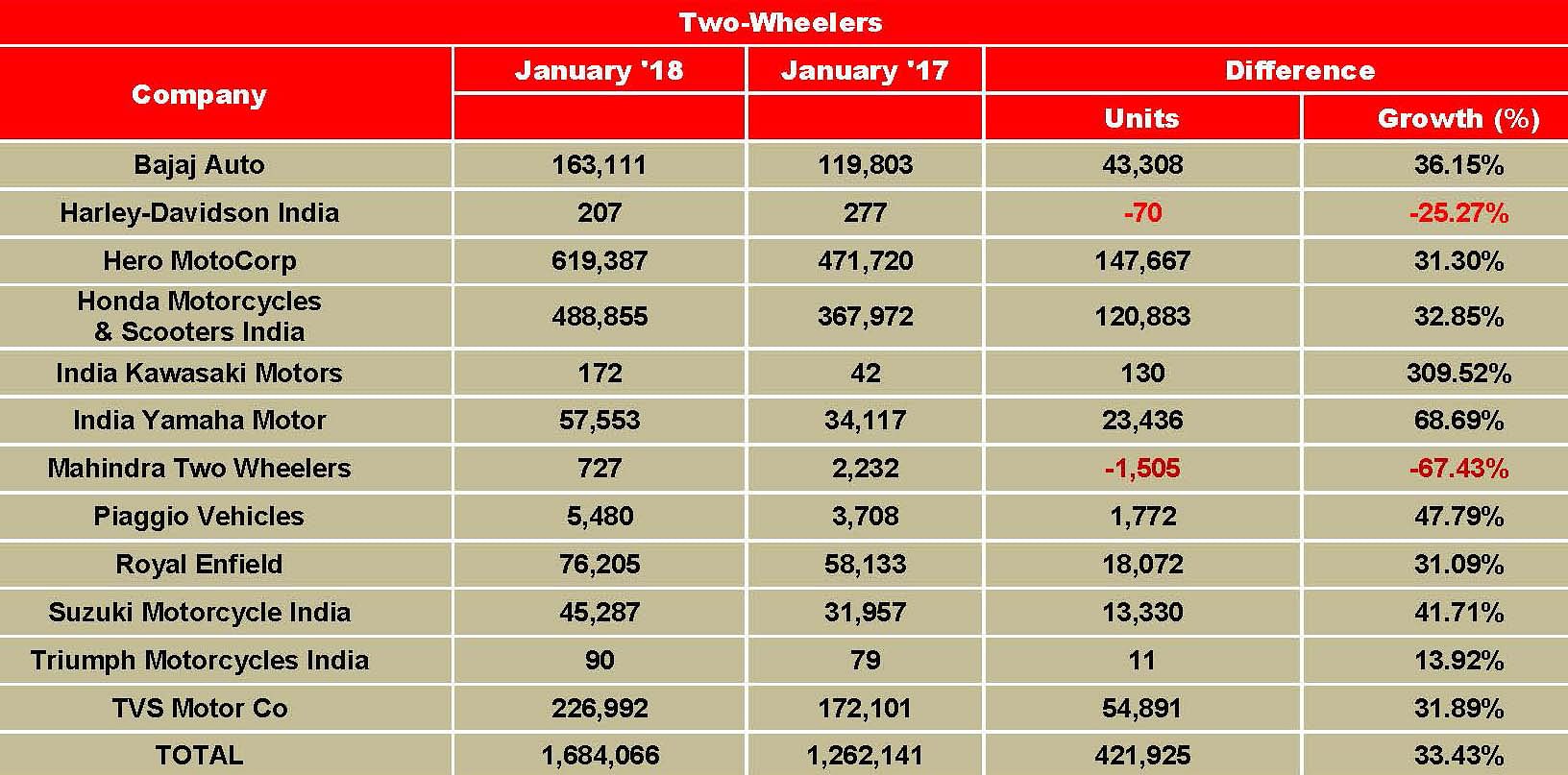

TWO-WHEELER OEMS ON A HIGH

The two-wheeler industry recorded impressive YoY growth of 33.43 percent in January 2018 at 1,684,066 units. While scooters recorded the fastest growth of more than 48 percent YoY, motorcycle sales grew by 28.64 percent YoY.

Growth for Hero MotoCorp, which sold 619,387 units in January 2018 (+31.30%), was partly fuelled by the sharp rise in its scooter dispatches (about 118 percent) and partly by the 20 percent YoY growth recorded by its 100cc-110cc motorcycles.Picking up some action lately, the Pawan Munjal-led company has unveiled a number of facelifts, new models and concepts in the past few months. .

Honda sold 488,855 units, up 32.85 percent. Of this, while scooter sales comprise strong volumes of 319,318 units (65 percent of overall sales), motorcycle sales contributed the remaining 1,69,537 units. The company, which has found initial success in its recently launched 125cc Grazia scooter, has updated its prime product – the 109cc Activa 4G with a new model under the Activa 5G moniker. It has also unveiled its fourth motorcycle in the 150cc-160cc category where it has tasted runaway success in the last few years at the 2018 Auto Expo - the X-Blade, which is expected to hit showrooms in March.

TVS Motor Company has reported total sales of 2,26,992 units in January 2018, up by 31.89 percent YoY. While it sold 66,543 motorcycles (Jan 2017: 35,994 units), its scooter sales stood at 84,140 units (Jan 2017: 66,734 units) in January 2018. The remaining sales of 76,309 units came from mopeds.

The company has recently forayed into the 125cc scooter segment with its Ntorq 125. Priced at Rs 58,750 (ex-showroom, Delhi), the TVS Ntorq 125 will rival Honda’s 125cc Grazia and Activa along with Suzuki’s Access 125 and Aprilia’s SR 125.

Bajaj Auto recorded sales of 1,63,111 motorcycles in January thereby registering a YoY growth of 36.15 percent. Pumping new life in its Discover brand, the company has recently rolled out the Discover 110 and Discover 125. The company has equipped the new Discover models with newer features that include LED DRLs, longer travel (front) suspension units and other cosmetic additions. Along with that the company has also updated its V series and the Avenger line up with 2018 editions. While this is aimed at boosting sales at one end, these updates keep the model at / above par with the incoming competition.

Royal Enfield, which has become India’s fifth largest bikemaker surpassing India Yamaha Motor, has reported sales of 76,205 units in January 2018, up 31 percent YoY.

India Yamaha Motor has sold 57,553 units last month, up 69 percent YoY. This included sales of 29,941 scooters (Jan 2017: 9,803 units) and 27,612 motorcycles (Jan 2017: 24,314 units) in January 2018. The company has launched the YZF-R15 Version 3.0 for Rs 1.25 lakh (ex-showroom, Delhi) and has re-launched the now BS VI-compliant YZF-R3 for Rs 3.48 lakh (ex-showroom, Delhi) .

Suzuki Motorcycle India sold 45,287 units in January 2018, up by 42 percent YoY. It has recently unveiled three models at the 2018 Auto Expo which included the naked street midsize GSX-S750 (powered by 750cc, four-cylinder, liquid-cooled engine) and the Access 125-based Burgman Street scooter (125cc).

In the big bike segment, Harley-Davidson continues to rule the roost. But with sales of of 207 units in January, it was down by 25.27 percent YoY. Japanese big bikemaker Kawasaki, on the other hand, sold 172 units last month, recording a massive jump of over 300 percent YoY. British motorcycle brand, Triumph Motorcycles India sold 90 units in January 2018, up by a decent 14 percent YoY.

The big bike companies are estimated to get the benefits of the reduced custom duty to 50 percent (on now all CBUs) from 60 percent (800cc and smaller CBUs) and 75 percent (bigger than 800cc CBUs) respectively. The duty relief to these premium bike makers comes as good news as the market continues to mature year-on-year.

With over 24 launches and 106 unveilings done at Auto Expo 2018, the automotive space is buzzing with some brisk action right now and is expected to see more customer footfalls in showrooms, as well as even more anticipation for some of the promising concepts showcased for the future

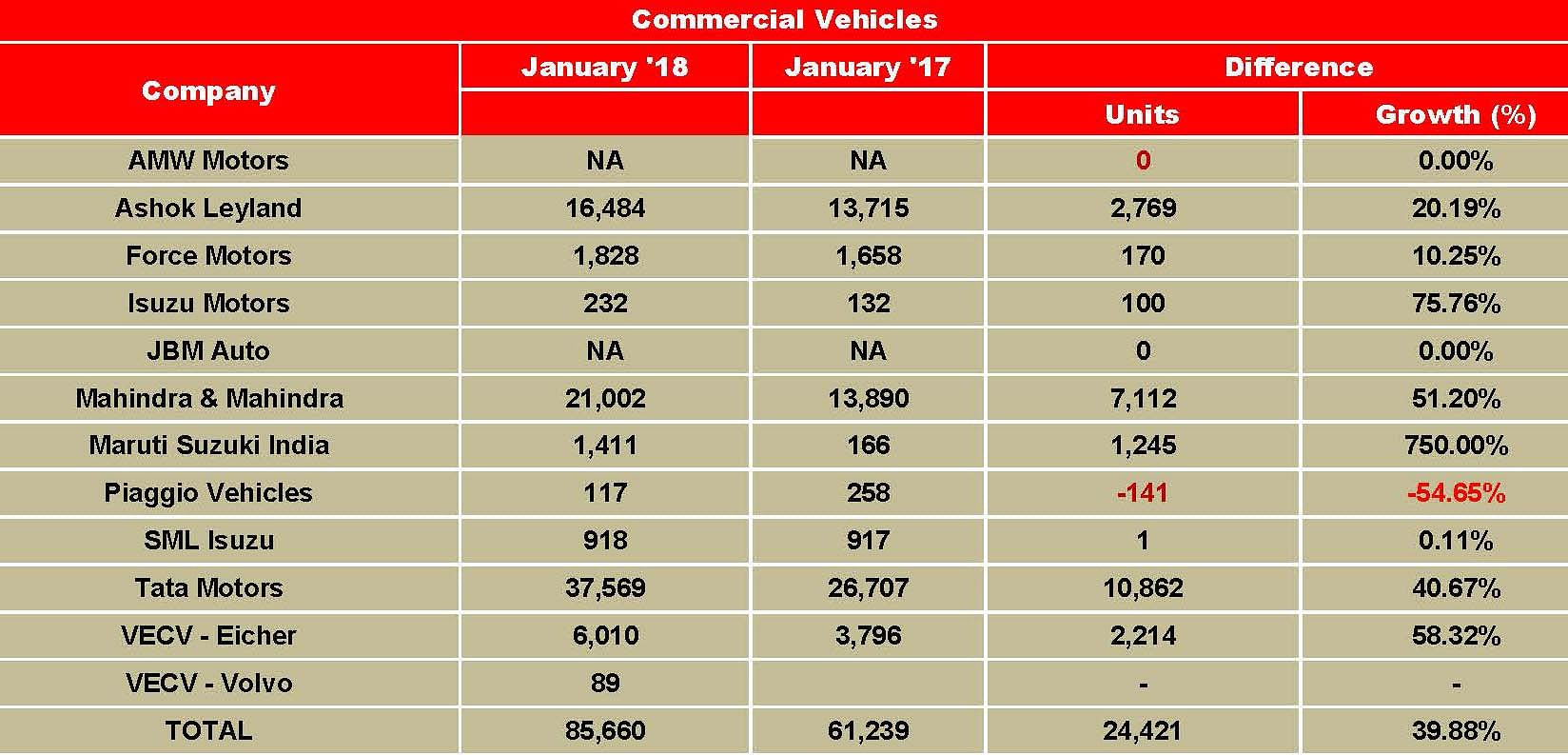

COMMERCIAL VEHICLES SEE ROBUST GROWTH

Commercial vehicle sales stayed firmly in growth lane positive in the first month of 2018 but there is an indication of growth moderating. After witnessing growth of over 50 percent in November and December 2017, CV majors Tata Motors and Ashok Leyland settled down at 38 and 22 percent respectively in January 2018.

As economic activities start improving on the back of a strong focus on infrastructure development, industry analysts anticipate Q4 FY 2017-18 to be a positive one for the CV sector.

In the first 10 months of FY18 (April-January 2018), the overall CV industry reported total sales of 659,997 units, which translates into growth of 17.88 percent YoY. With sales of 257,001 M&HCVs (+10.45%) and 402,996 LCVs (+23.17%), the CV industry is headed for good times.

The key drivers for the uptick in M&HCV sales can be attributed to stricter enforcement of overloading laws across the country, which has resulted in fleet operators preferring rated loads; this has also helped in driving demand for higher-tonnage trucks. Additionally, with GST, productivity of trucks has also improved significantly, in turn enabling M&HCV sales to remain in the fast lane. Fleet operators have been looking optimising operational costs with higher-tonnage trucks. With higher productivity, better turnaround time, optimium utilisation of trucks has gone up significantly, thereby benefitting fleet operators.

Tata Motors sold 39,386 units compared to 28,521 units in January 2017, an increase of 38 percent YoY. After witnessing robust growth over the last three months, its M&HCV sales moderated at 12,804 units, up 13 percent. The I&LCV truck segment grew by 55 percent YoY, on the back of an increased thrust in agriculture, FMCG and e-commerce sectors. The company also registered increasing demand for container and refrigerated trucks in I&LCV segment.

Tata's SCV cargo and pickup segment sales were 17,948 units, marking strong growth of 75 percent YoY due to new product launches and improvement in consumer sentiment especially within the e-commerce sector and government/municipal applications. The commercial passenger carrier segment saw sales of 4,093 units, a growth of 3 percent YoY.

According to Tata Motors, “The demand for M&HCV trucks was led by increasing restrictions on overloading, fresh tenders in the car carrier and petroleum sectors as well as coal and cement movement triggered by key infrastructure projects. However, the growth was lower than expected owing to challenges arising out of supply constraints on key parts.”

Ashok Leyland's sales appear to have moderated in January 2018. The company sold a total of 18,101 units, up year on year by 22 percent. (January 2017: 14,872). M&HCV sales remained positive, albeit growth has come down to 13 percent with sales of 13,643 units (January 2017: 12,056). The company reported LCV sales of 4,458 units, strong 58 percent YoY growth (January 2017: 2,816).

Mahindra & Mahindra’s overall CV sales grew by a strong 51 percent to 21,002 units (January 2017: 13,890). The company's M&HCV sales registered a growth of 70 percent to 1,049 units albeit on a low previous year sales (January 2017:618). The below-3.5T GVW segment saw strong growth of 52 percent YoY, selling 19,309 units (January 2017: 12,737), while those in the above-3.5T GVW segment grew by 20 percent with sales of 644 units (January 2017: 535).

VE Commercial Vehicles' domestic sales were up by 58.3 percent with total sales of 6,010 units (January 2017: 3796 units).

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

16 Feb 2018

16 Feb 2018

11916 Views

11916 Views

Shahkar Abidi

Shahkar Abidi