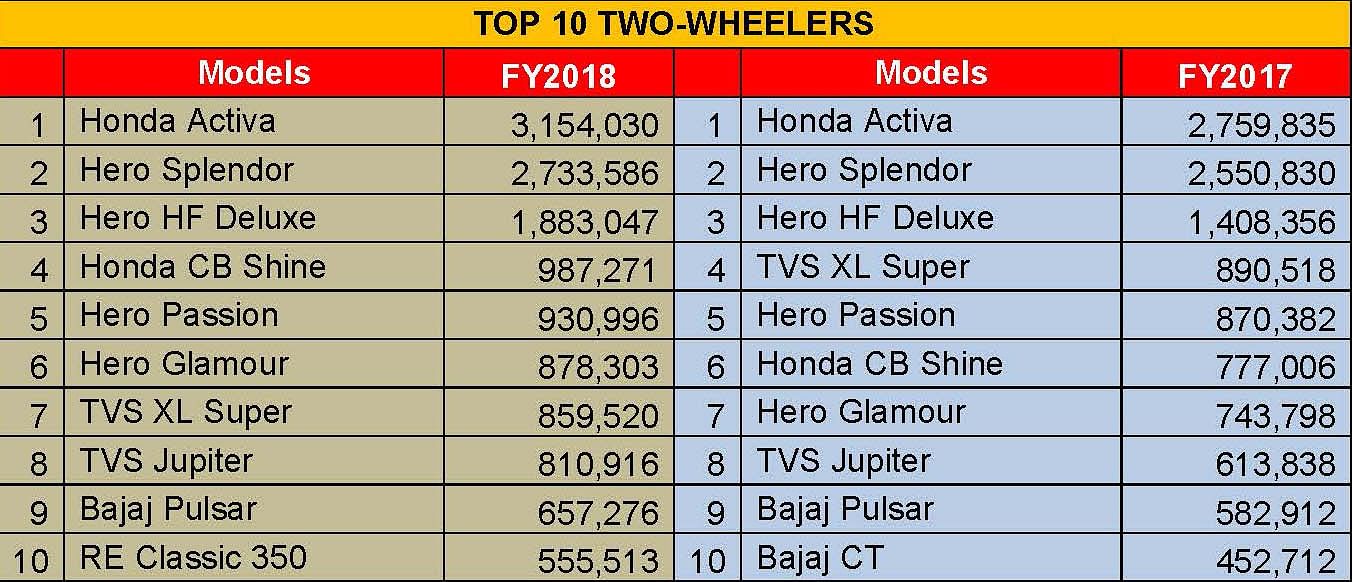

Top 10 Two-Wheelers – FY2018 | Honda Activa outsells Hero Splendor by over 400,000 units

With sales of 3,154,030 units, the Activa stamps its dominance on the two-wheeler industry with nonchalance, even though the Splendor beat it by a visible margin in March 2018.

With domestic sales of over three million units in the last fiscal, the Honda Activa’s dream run continues as it has comfortably outperformed the bestselling motorcycle brand – Hero Splendor – in FY2017-18, indicates recently released SIAM data.

India’s top-selling scooter brand, Honda Activa, has once again sealed its position of being the country’s bestselling two-wheeler brand in FY2017-18. It has reported cumulative domestic sales of 3,154,030 units for the 12-month period, thereby recording an impressive YoY growth of 14.28 percent.

Meanwhile, the Hero Splendor remains the second-largest selling two-wheeler brand with sales of 2,733,586 units in FY2017-18. It grew by 7.16 percent YoY through the 12-month period.

But the Splendor beats the Activa in March 2018!

However, it is to be noted that in the month of March 2018 alone, the Hero Splendor beat the Honda Activa by a visible margin. This, interestingly, has happened after a long gap of 13 months. The Hero Splendor had last outsold the Honda Activa in a single month in January 2017.

According to industry data, the Hero Splendor sold 262,232 units, up an impressive 16.37 percent YoY, in March 2018. The Honda Activa, on the other hand, sold 207,536 units, down by 13.29 percent YoY.

Meanwhile, Hero MotoCorp’s solid performer, the 100cc HF Deluxe commuter motorcycle continues to grow strong at the number three position. It recorded cumulative sales of 1,883,047 units in FY2018. This marked a laudable YoY growth of 33.71 percent. In March 2018, the Hero HF Deluxe sold 183,162 units, up by a solid 33 percent YoY.

Honda’s 125cc top seller, the CB Shine, bags the fourth rank with sales of 987,271 units in FY2018. It had sold 777,006 units in FY2017 and stood as the sixth largest selling two-wheeler in the domestic market. Clearly, this is a huge mark-up for the CB Shine and Honda will be looking to push this bike more in FY2019.

Hero’s third largest selling motorcycle brand, Passion, is the No. 5 in the Top 10 list of best-sellers with sales of 930,996 units, up 6.96 percent YoY. The company has recently added new 110cc facelifts – XPro and Pro – to correct the declining volumes of its Passion brand. This can be seen in the Hero Passion’s March 2018 sales, which stood at 105,214 units, up 23.54 percent YoY.

The Hero Glamour takes up the position of being the sixth largest selling motorcycle brand with sales of 878,303 units, up 18.08 percent YoY, in FY2017-18.

Losing three spots year-on-year, TVS Motor’s iconic moped – the XL Super – has reported sales of 859,520 units (down 3.48 percent YoY) for FY2017-18. The moped is now the seventh largest selling two-wheeler in the domestic market.

The Jupiter, TVS Motor’s top-selling scooter, makes it at the eighth position with sales of 810,916 units, up 32.11 percent, in the last fiscal. Growing with this pace, it can be estimated that TVS Motor may be able to record sales of more than a million units of its 110cc scooter Jupiter in the domestic market in FY2019.

Bajaj Auto’s Pulsar and Royal Enfield’s Classic 350 rank ninth and tenth respectively. While the Bajaj Pulsar has garnered sales of 657,276 units in FY2018, the Classic 350 sold 555,513 units during the same 12-month period. It can be noted that although the Bajaj Pulsar has grown by 12.76 percent YoY, it is slightly below the overall domestic motorcycle market’s annual growth for FY2017-18. The motorcycle market has registered a growth of 13.69 percent YoY during the last fiscal.

Royal Enfield’s Classic 350, on the other hand, continues its dream run with YoY growth of 33.31 percent. It had sold 416,693 units in FY2016-17. In March 2018, the model single-handedly garnered sales of 50,111 units, which is understood to be its first ever feat of crossing the 50,000 unit-mark in a month.

With the recent IMD forecasts of average rainfall this year, the two-wheeler industry is looking forward to an uninterrupted acceleration in the domestic market in the coming months, even as it gears up to meet BS VI norms by April 2020 and also plug into the new world of electric mobility.

RELATED ARTICLES

Maruti Jimny Crosses 150,000 Sales Since Launch, 80% Comprise Exports

Launched in June 2023, the Maruti Jimny five-door SUV has sold 158,678 units till January 2026, with exports (127,442 un...

Kia India Drives Towards Highest-Ever Sales in FY2026

Kia India has sold 259,923 vehicles in the first 11 months of FY2026, just 9,306 units short of its all-time high of 269...

Bajaj Auto Outsells Mahindra in e-3Ws for Second Month in a Row, TVS Ranked Third in February

Bajaj Auto, after overtaking Mahindra Last Mile Mobility for the first time in January, repeated the feat in February wi...

19 Apr 2018

19 Apr 2018

20247 Views

20247 Views

Ajit Dalvi

Ajit Dalvi

Autocar Professional Bureau

Autocar Professional Bureau