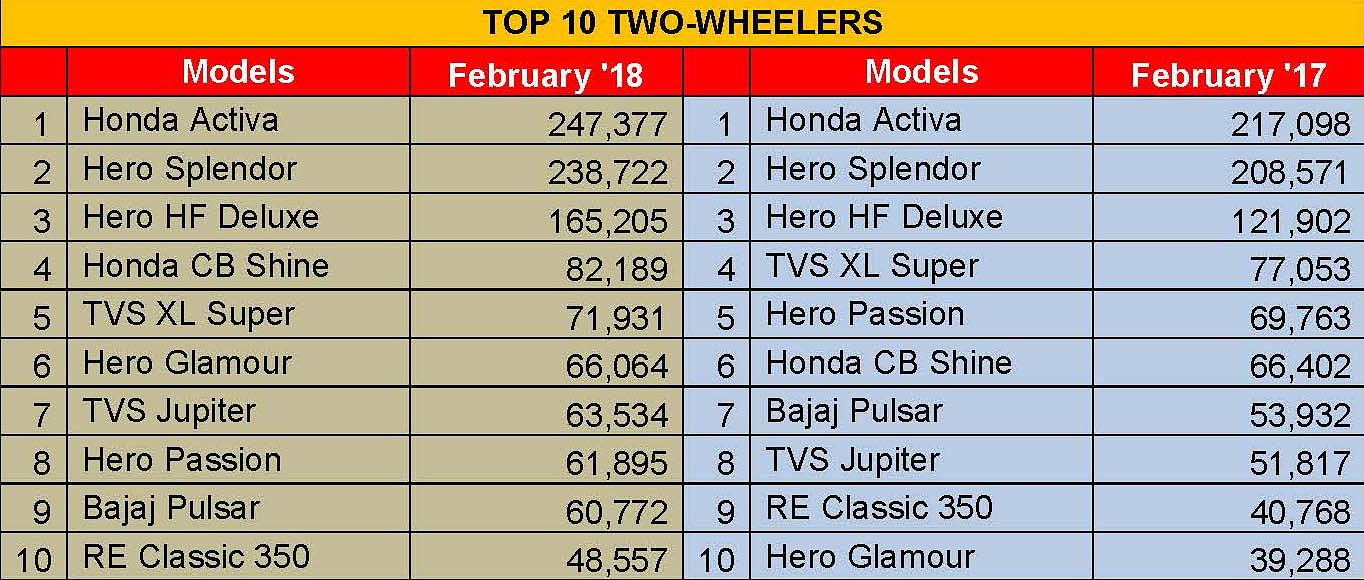

Top 10 Two-Wheelers – February 2018 | Honda Activa leads Hero Splendor for 13th straight month

The Honda Activa was last beaten by Hero MotoCorp’s staple brand, Splendor, in January 2017, when the domestic market was recovering from the ripple effects of the central government’s sales speedbreaker – demonetisation.

The Activa, Honda Motorcycle & Scooter India’s flagship scooter brand, continues to be the best-selling two-wheeler model in the domestic market, this time for the 13th month straight in February 2018. The Honda Activa was last beaten by Hero MotoCorp’s staple brand, Splendor, in January 2017, when the domestic market was recovering from the ripple effects of the central government’s sales speedbreaker – demonetisation. However, once demand for two-wheelers stabilised in the second half of 2017, the scooter brand took little time to outsell India’s largest selling mass commuter motorcycle brand.

In February 2018, the Honda Activa recorded sales of 247,377 units, marking a YoY growth of about 14 percent. It is also the best-selling scooter by far, way ahead of the next bext, the TVS Jupiter. Meanwhile, trailing the Honda Activa by a small margin of a little over 8,000 units, the Hero Splendor sold 238,722 units last month, recording growth of 14.46 percent YoY.

Both the bestselling brands have been recently embellished with new facelifted variants in a bid to boost sales this year. While the Honda Activa has the new 5G edition (fifth generation) in its portfolio, the latest addition to the Hero Splendor marquee is the 2018 edition of the 125cc Super Splendor.

Interestingly, the Honda Activa 5G’s starting price (Rs 52,460 ex-showroom, Delhi for standard variant) appears to be more competitive than that of the Hero Super Splendor’s (Rs 57,190 ex-showroom Delhi). Although, the 110cc Honda Activa 5G and the 125cc Hero Super Splendor belong to different categories (which are not distant to each other), they both are two-wheeler models primarily meant for commuting applications.

This also boldly underlines how far Honda has come in terms of successfully pricing its scooters, either matching or beating the retail price-tags of the largest selling mass commuter motorcycles in India. This aggressive pricing strategy including the passing of the benefits of the economies of large scale manufacturing by Honda has turned out to be a major driver of the success for the booming scooter market.

The third, fourth, fifth and sixth positions in India’s Top 10 two-wheelers list are occupied by the other top-selling motorcycle brands from Honda, Hero MotoCorp and TVS Motor Company.

The 110cc Hero HF Deluxe, the company’s second biggest success story that has overshadowed the success of the Passion brand over the past few years now, is a consistent performer that has sealed its position as the third top-selling two-wheeler brand in India. It sold 165,205 units in February 2018, up by 35.52 percent YoY.

The 125cc Honda CB Shine continues to be Honda’s largest-selling motorcycle brand in the domestic market catering to the demand for the executive commuter bikes. It garnered sales of 82,189 units last month, thereby recording YoY growth of 23.77 percent. Ranking fourth, it continues to beat its contemporary rival – the 125cc Hero Glamour – in its domain.

At number five is TVS Motor Company’s iconic moped – the XL Super, which continues to be one of the bestselling two-wheelers in India. It sold 71,931 units last month, down by 6.65 percent YoY. Notably, the moped was the only two-wheeler model that continued to witness strong demand when the entire market had recorded a sharp decline following demonetisation and the resultant sales slowdown November 2016 and February 2017.

The Hero Glamour rides in as the sixth top-selling two-wheeler brand with sales of 66,064 units (up by 68.15 percent YoY) in February 2018.

TVS Motor’s star scooter brand – the 110cc Jupiter – has fought its way to the seventh position in the coveted list of the top 10 two-wheelers list for February 2018. It sold 63,534 units last month, securing a healthy YoY growth of 22.61 percent. The TVS Jupiter had ranked eighth in the Top 10 list of February 2017. It is also the only other scooter brand (after Honda Activa) to appear on this list.

Hero’s Passion brand ranks eighth with sales of 61,895 units in February 2018. It has recorded a decline of 11.28 percent YoY (February 2017: 69,763). To address this gradual downfall in its demand, Hero MotoCorp has recently rolled out two facelifts under its umbrella – both 110cc Passion Pro and Passion X Pro motorcycles.

Bajaj Auto’s only entry in this list is its highest selling motorcycle brand – the Pulsar, which has reportedly sold 60,772 units in February 2018. While the Bajaj Pulsar has recorded YoY growth of 12.68 percent, it has ranked ninth in the list for February 2018 (as against No. 7 in February 2017). This clearly means that despite the YoY improvements in its sales, the brand has not kept up with the market growth registered by other motorcycle models.

Royal Enfield’s Classic 350 continues to be its largest selling bike with sales of 48,557 units in February 2018. The model, which has ranked tenth in the Top 10 list, has reported a YoY growth of 19.11 percent.

With a gaggle of new product launches and facelifts, the market is all set to further fuel growth in the coming months. All eyes, for now, though are on March 2018, the last month of the ongoing fiscal. Stay tuned for further sales updates.

You might like to read these too:

Top 10 Scooters – February 2018

Top 10 Passenger Vehicles – February 2018

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

20 Mar 2018

20 Mar 2018

18349 Views

18349 Views

Shahkar Abidi

Shahkar Abidi