Three-wheeler market remains flat this fiscal

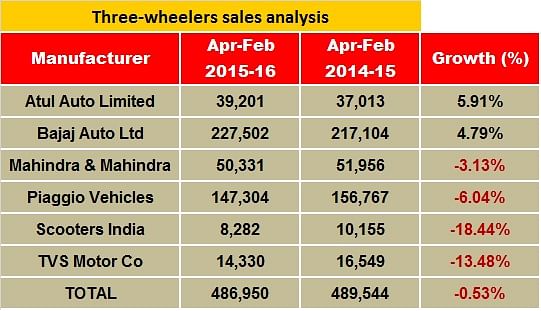

During April 2015-February 2016, the overall 3-wheeler segment has seen a decline of less than half a percent with total sales of 486,950 units. The passenger carrier segment, the largest category in the segment, sold 399,803 units.

At a time when the domestic commercial vehicle industry has started to recover from the prolonged slump that lasted over two years, the three-wheeler industry is struggling to maintain growth. In 2014-15, it had notched double-digit growth but it seeing tough times in 2015-16.

Of the OEMs, Bajaj Auto, the world’s leading three-wheeler maker, continues to dominate the domestic market with a 46.7% share. Interestingly, the company exports almost an equal number of three-wheelers what it sells in India.

Between April 2015-February 2016, Bajaj Auto sold 227,502 units in the domestic market, helping itself to a market share of 46.7% and growing marginally by 4.79% over the same period the previous year. It also shipped 266,072 units overseas to log in a market share of 69.9% in total exports.

According to the company’s website, it exports to nearly 36 countries globally. It has an extensive portfolio of three-wheelers which are compatible with all fuels including petrol, LPG, CNG and diesel and for all categories – small, medium and big.

During April 2015-February 2016, other manufacturers like Piaggio Vehicles sold 147,304 units (market share: 30%), followed by Mahindra & Mahindra which sold 50,331 units (market share: 10%). Rajkot-based Atul Auto sold 39,201 units (market share: 8%). While TVS Motors, which sold 14,330 units, is down 13.11% YoY (market share: 2.9%) its exports of 90,617 units give it a 12.44% growth.

Tough times in India

During April 2015-February 2016, the overall three-wheeler segment has seen a decline of less than half a percent with total sales of 486,950 units. The passenger carrier segment, which is largest category in the segment, sold 399,803 units, registering flat growth. During the same period, the goods carrier segment fell 3.74%. Exports grew by 3 % with a total 382, 832 units shipped.

In FY2015, the three-wheeler segment grew by 10.79% with sales of 531,927 units against 480,085 units in the previous fiscal. Overall exports grew significantly by 15.44% with total shipments of 407,957 units.

India largest market globally

In its latest report rating agency ICRA says India has the largest three-wheeler industry with both a large domestic market as well as an export base. With industry volumes of 940,000 units in FY2015, India is positioned as the largest manufacturer as well as market for three-wheelers globally.

According to the report over the past decade (FY 2006-2015), the Indian 3W industry has witnessed a CAGR of 8.9% in unit sales driven by steadily rising exports as well as domestic demand. Within the overall industry, the domestic 3W market stood at 532,000 units in FY2015 and registered a CAGR of 4.4% over the past decade. In contrast to domestic demand, exports of 3W from India have grown at much higher pace (i.e. 20.4%) during the same period. As a result of this trend, the share of exports in 3W industry volumes has risen from 18% (in FY 2006) to almost 43% (in 10-month FY 2016).

This trend has been supported primarily by two factors – strong demand from international markets on the back of rising demand for last-mile connectivity (owing to lack of a well-developed public transport system) in the emerging markets in Africa and South-East Asia, and the declining trend in demand for 3W goods carriers in the domestic market due to competition from Small Commercial Vehicles (SCVs).

Passenger carrier volume drivers

With annual sales volumes of 432,000 units in FY2015, the passenger carrier segment accounts for almost 80% of domestic 3W industry sales. Accordingly, the growth drivers of the domestic 3W industry are majorly influenced by factors that drive demand for passenger 3Ws. Over the past decade (i.e. FY 2006-15), the passenger carrier segment has witnessed a CAGR of 8.2% driven by increasing demand for last-mile connectivity in metros and major cities; improving penetration in T 3 and 4 towns and rural areas, gradually increasing availability of funding through organised channels.

In urban markets, replacement demand has also been an important growth driver where an improving network of CNG fuel stations is driving replacement of older petrol or diesel-powered 3Ws with ones based on CNG. Despite the fact that usage of CNG is only mandatory in Delhi, the acceptance for CNG-based 3Ws has caught up in other cities as well primarily on back of favorable operating economics.

However, the cargo segment faces tough competition from small CVs and with annual sales volumes of 100,000 units in FY2015, the goods carrier segment accounts for almost one-fifth of domestic 3W industry sales. Unlike the passenger segment, which has grown steadily over the past decade, the demand for goods carriers has actually declined by 4.2% over the same period. While opportunities to grow in international markets remain abundant, in the recent past, the industry has also witnessed some headwinds.

RELATED ARTICLES

Suzuki Dispatches 703 e-Access Scooters in January, Delivers 201 Units to Customers

Suzuki Motorcycle India’s first electric scooter, priced at Rs 188,000 and among the most expensive two-wheeled EVs, reg...

Honda Sells 5,445 Activa-e and QC1 e-Scooters in 12 Months

Since February 2025, Honda Motorcycle & Scooter India has produced 11,168 e-scooters, dispatched 5,445 units to its deal...

Kia Carens Sells 277,000 Units in Four Years, Clavis And Clavis EVs Power 24% Growth in FY2026

The Carens MPV, which turns four years old today, accounts for a 27% share of Kia India’s sales of 10,43,126 utility veh...

By Kiran Bajad

By Kiran Bajad

20 Mar 2016

20 Mar 2016

17536 Views

17536 Views

Autocar Professional Bureau

Autocar Professional Bureau

Ajit Dalvi

Ajit Dalvi