M&HCV sales in India fall after 23 months of growth

While M&HCV sales have slowed down in the past couple of months and could be a result of replacement demand. Once this demand moderates, new vehicle sales should rise as the country's economic indicators point to growth in the sector.

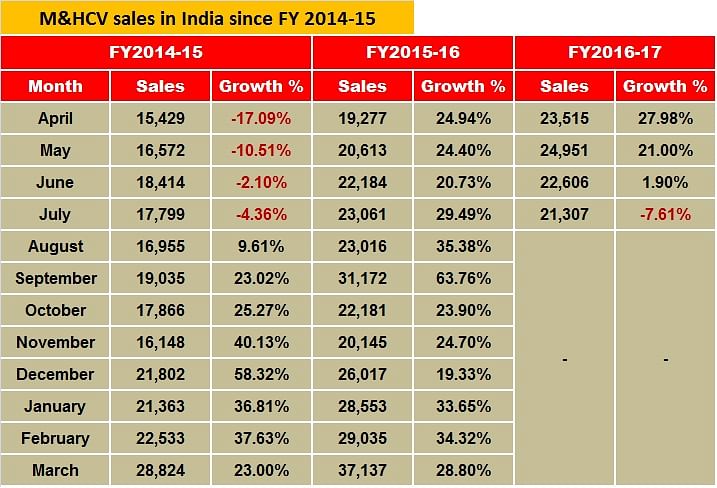

After as many as 23 months of consistent growth, the medium and heavy commercial vehicle (M&HCV) segment has seen its sales decline in July 2016. July 2016 saw total sales of 21,307 units, down 7.61% (July 2015: 23,061). In June 2016, M&HCV numbers grew marginally by 1.9%.

Interestingly though, the light commercial vehicle (LCV) sector, which saw a sales slowdown for over two years, is experiencing a growth momentum since the past couple of months. In July, total LCV sales were up 6.31% with 51,583 units sold. Thanks to the LCV numbers, growth in the overall CV segment showed flat 0.11% YoY growth in July 2016, preventing it from falling into negative territory.

It may be recollected that after seeing sales declines in FY2013 and FY2014, the M&HCV sector saw growth in August 2014, up 9% YoY, enabled by a strong market recovery driven by replacement demand.

In FY2015-16, the M&HCV segment notched strong 30% growth with sales of 302,373 units as against 232,755 units in FY2014-15. While trucks sold 258,488 units (+32% YoY), the bus market saw sales of 43,885 units (+19% YoY).

While the July 2016 numbers indicate growth slowing down, compared to the over 30% growth notched in FY2015-16, industry expects overall sales numbers in FY2016-17 to achieve moderate growth of 10-12%, largely driven by replacement demand and an uptick in construction tippers due to a pick-up in the infrastructure and mining sectors, and pre-buying of trucks due to implementation of BS IV by April 2017.

Growth headed M&HCVs way

Anticipating sustained growth in M&HCVs, Ravi Pisharody, executive director, commercial vehicles, Tata Motors, in a recent interview, told Autocar Professional, “The overall economy is doing fine but the consumer goods sector is not doing well. We are seeing a strong uptick in the infrastructure and construction side. Road construction is definitely moving yet; mass retail has yet not picked up.”

“The first phase of the growth was driven by cargo and now construction tippers will also drive growth this year, largely driven by change in emission norms. The overall economy is still buoyant and the sentiments positive with the passage of GST,” he said.

Likewise, Vishnu Mathur, director general of apex industry body SIAM, said in an interview with Autocar Professional: “There is decent and good growth in the commercial vehicle segment. There has been some level of moderation in the last one-and-a-half month, which means demand is coming back into the economy. Right now, most of the growth is being fuelled by the demand for replacement vehicles. Once this replacement demand starts moderating, we will see the actual growth in the new vehicle segment as well.

"The real demand will only come when there is a surge in economic activity across the country and more freight to be moved. The prognosis is good with a healthy monsoon thus far and a turnaround in rural market sentiments. The light vehicle industry is also showing good growth for a few months now and is coming back on steam, which is good news.

"The mining and infrastructure segments are also witnessing additional investments. The outlook certainly is better than last year. Although we do not forecast growth, we are saying that the (market demand) prospects are better than last year.

"The latest news of GST coming in is also going to be extremely good for the industry. Also, there are certain reasons why we are expecting more vehicles to sell towards the end of this year. For example, BS IV emission norms will come into effect, especially for commercial vehicles by April next year. This means sales, particularly of trucks, will see some pre-buying later this year.

"However, once this pre-buying happens, there will be a dip (in market demand) for a particular period. After all, this would be only an advancement in demand and not the additional demand. Overall, the industry is improving and it is on the revival path.”

Highlighting the transporters’ point of view, S P Singh, senior fellow, Indian Foundation of Transport Research and Training, said, “The decline in M&HCV sales has been due to various reason as micro-economic indicators are still weak and transporters are wary of buying of new trucks as there is large fleets are currently under-utilised in the market.”

However, all this could change as a result of the good monsoon, arrival of agricultural produce, upcoming festival season and the impact of spending from the dues of the 7th Pay Commission, which would lead to higher freight and higher truck utilisation.

Recommended: Full India CV Sales Analysis

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

By Kiran Bajad

By Kiran Bajad

16 Aug 2016

16 Aug 2016

12419 Views

12419 Views

Shahkar Abidi

Shahkar Abidi