M&HCV sales fall sharply in April

Heavy discounting in March 2017 to clear BS III stock, a price hike for BS IV-compliant trucks from April 1 and delayed purchase decisions have resulted in a marked fall in monthly sales.

The first month of 2017-18 has not been a positive one for the commercial vehicles sector. All the manufacturers have recorded negative growth in the month, and the medium and heavy commercial vehicle (M&HCV) sector is clearly under pressure as sales have fallen as high as 35 percent. Heavy discounting in March 2017 to clear BS III stock, implementation of BS IV emission norms from April and the subsequent price increase in vehicles has resulted in sharp fall in sales.

Market leader Tata Motors saw its overall sales fall by 36 percent in April. The company says this is an unusual decline, in exceptional circumstances and expects production, wholesales and retails to pick up in May and June. Ashok Leyland and Mahindra & Mahindra have registered almost 43 percent and 41 percent declines in their M&HCV sales respectively in the month. Likewise, VE Commercial Vehicles’ total domestic sales slid 44.5 percent in April.

Industry analysts expect the April-June quarter to be slow though growth would likely pick up in with GST in place from July. It appears that fleet operators have delayed buying of new heavy trucks for the time being and the replacement demand is fading.

In its outlook for FY2018, rating agency ICRA says, “Industry is likely to witness 6-8 percent growth in FY2018 aided by higher budgetary allocation towards the infrastructure and rural sectors; potential implementation of scrappage program will also trigger replacement demand.”

ICRA estimates that during FY2018, “M&HCV trucks will grow by 6-8 percent by higher budgetary allocation towards the infrastructure and rural sectors, LCV trucks by 6-8 percent on replacement demand to continue following 3 years of declining trend and pick-up in demand for consumption-driven sectors, rural markets and e-commerce. Buses are likely to grow by 5-7 percent on orders from SRTUs to support sales in M&HCVs; and smart cities initiatives. Demand from the school and staff carrier segment remains stable and exports are to grow by 8-10 percent.”

“Profitability indicators of CV OEMs will moderate marginally because of recovery in material prices and gradual pass through of BS-IV costs,” says ICRA

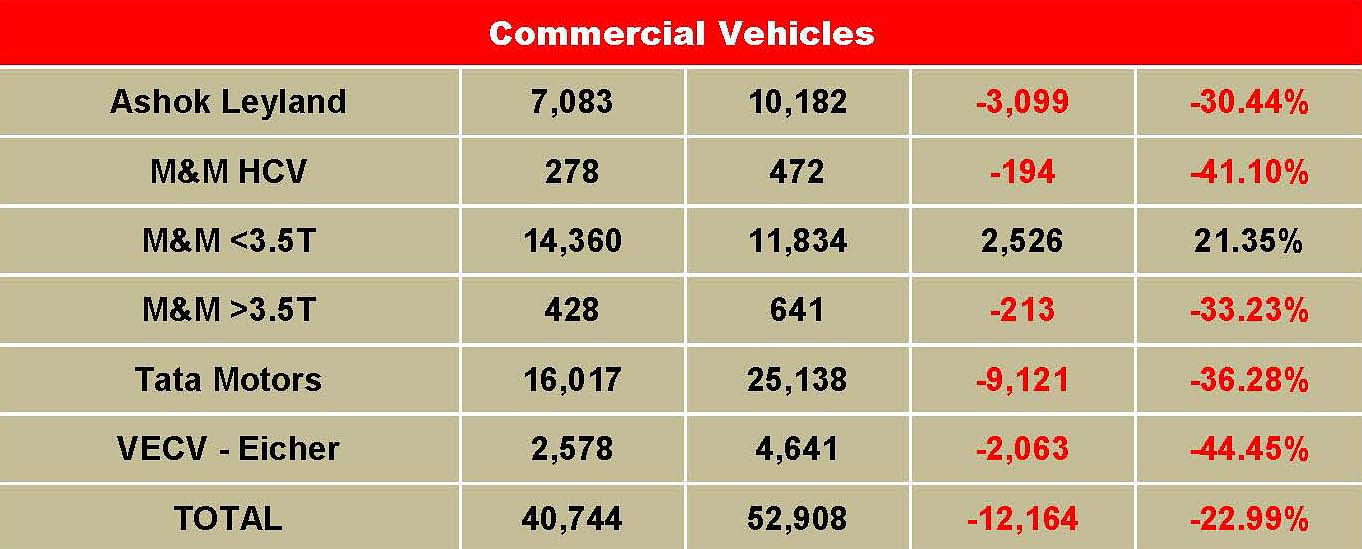

How the OEMs fared in April

In the monthly sales, Tata Motors’ overall CV sales in April 2017 declined by 36 percent to 16,017 units. According to Tata Motors, CV sales were affected by the Supreme Court judgement announced on March 29, with the ban on BS III sales leading to the need for a higher quantity of BS IV stock for April sales. The higher demand at short notice was not met in production, as vendors struggled to meet with the higher demand, especially in the M&HCV segments. Moreover, after the strong pre-buying of BS III vehicles in March, and the price increase of BS IV vehicles (especially in M&HCVs and buses at 8-10 percent), demand for BS IV vehicles was also weak.

Ashok Leyland’s total sales declined 30% YoY with total sales of 7,083 units (April 2016: 10,182 units). Its M&HCV sales have seen a sharp correction – down 43 percent to 4,525 units (April 2016: 7,873 units). LCVs were down 11 percent with sales of 2,558 units (April 2016: 2,309 units).

Mahindra & Mahindra’s total commercial vehicles total has gained 16% with sales of 15,066 units (April 2016: 12,947 units). The M&HCV sales dropped 41% with sales of 278 units. (April 2016: 472 units). The below-3.5T GVW products maintain strong double digit growth with 21% increase in sales with 14,360 units sold. (April 2016: 11,834 units), while those in the above-3.5T GVW segment declined by 33% with sales of 428 units (April 2016: 641 units).

VE Commercial Vehicles’ domestic sales declined by 44.5% with total sales of 2,578 units (April 2016: 4,641 units).

RELATED ARTICLES

Mahindra Farm Equipment Posts 46% Domestic Growth, Sells 38,484 Tractors in January 2026

Mahindra Farm Equipment reports 46% January tractor sales surge driven by strong rural demand and record Rabi sowing, wi...

SML Mahindra Records 30% Sales Growth in January 2026 Amid Broader Market Softness

SML Mahindra posts 30% January sales increase with balanced growth across cargo and passenger segments, bucking broader ...

Mahindra Auto Clocks 63,510 SUVs and 104,309 Total Vehicle Sales in January 2026

Mahindra & Mahindra reports 24% January sales growth with record SUV demand reaching 63,510 units, alongside strong comm...

03 May 2017

03 May 2017

10632 Views

10632 Views

Shahkar Abidi

Shahkar Abidi