Indian two-wheeler industry headed for over 10% growth in FY2017

The domestic two-wheeler industry could clock impressive year-on-year growth of more than 10 percent in FY2017, if the market continues to grow until March 2017.

The domestic two-wheeler industry is likely to record good growth of over 10 percent in the ongoing fiscal year, all thanks to the steam the market has gathered over the past eight months.

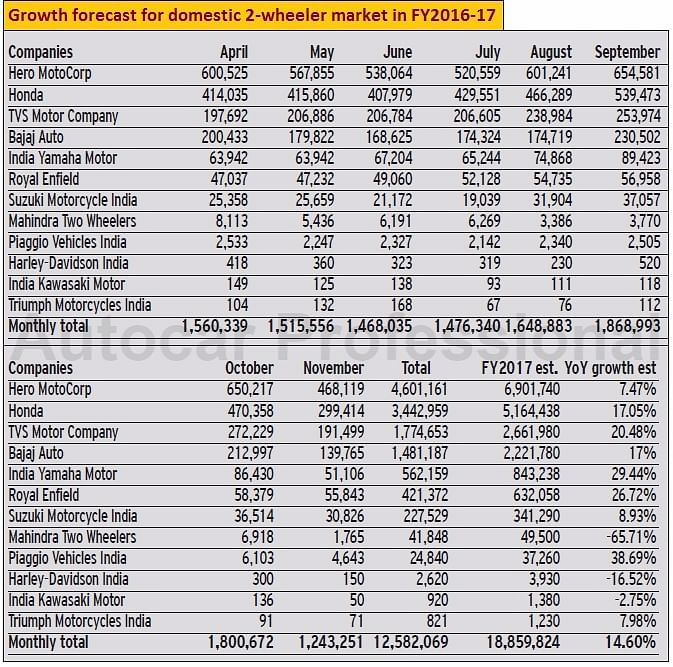

In comparison, in FY2015-16, total sales were 16,455,911 units and 3.01 percent year-on-year growth. In the April-November 2016 period, industry data shows that the OEMs which report their monthly production and sales data to SIAM have recorded an overall YoY growth of 13.41 percent.

If the government’s demonetisation strategy, implemented from November 8, 2016, does not leave behind a lasting impact on the market, industry could grow up to 14.60 percent YoY in FY2017. Although the step taken by the finance ministry has impacted month-on-month sales performance, OEMs are also taking corrective measures in terms of promoting online payment gateways, digital transactions and financing facilities at the dealer level.

These initiatives, as OEMs point out, are likely to negate any lasting impact of demonetisation, which did shake up sales in the first week of its announcement. Secondly, customers purchasing two-wheelers on EMIs and those using financing schemes are also expected to remain largely unaffected. Conservative industry experts, however, believe that the sales performance at various manufacturers will depend on the timely circulation of new currency notes in the overall economy.

Two-wheeler manufacturers in India are also likely to take new steps to boost their exports from India during the remaining months of this fiscal. This is expected to bear a positive result on overall cumulative exports by end-March 2017.

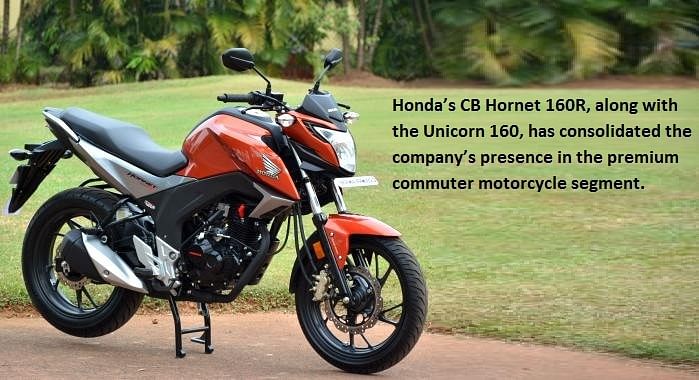

A clear example would be Honda Motorcycle & Scooter India (HMSI), which began full-fledged exports of its Dio scooter model from its Gujarat plant in November 2016. The company, as per its official communication, has also started exporting the Navi models, which are based on the proven 110cc engine that powers Activa models, to the new market of Sri Lanka. For Honda alone, the aggressive focus on exports in November resulted into a sharp YoY growth of more than 80 percent. It is estimated that all leading manufacturers would take up a similar step.

Our forecast for FY2017 points out that HMSI is likely to achieve the yearly domestic sales milestone of five million units this fiscal. The company’s total annual domestic sales stood at 4.28 million units in FY2016.

New products to be volume drivers

On the other hand, newly launched products are expected to drive new volumes in the market. For example, Bajaj Auto, which has recently launched its much-awaited Dominar 400 models, also rolled out a smaller, 125cc sibling to its successful 150cc V15 model along with the new 2017 line-up of the Pulsar range. While the Dominar 400 would garner profitability for Bajaj Auto (alongside pushing premium brand position for the OEM), the 125cc model under its V brand along with new Pulsar editions will serve to fetch additional domestic sales for the Pune-based company.

Furthermore, Bajaj Auto, which had earlier never promoted the digital platform to sell its motorcycles unlike rivals including Hero MotoCorp, will now allow customers to make bookings for the Dominar 400 through a centralised online booking platform. With deliveries commencing in January 2017, the all-new model is likely to garner required sales volumes for the company.

The company, which also plans to boost its exports by planning to ship out the Dominar 400, aims to enter lucrative European markets with this premium model.

“The Dominar 400 is the biggest motorcycle in its class. We are looking to sell 15,000 units a month, comprising both domestic and export markets. Exports will start in February 2017, initially to Europe and then to ASEAN markets like Indonesia, Philippines and Malaysia,” said Eric Vas, president, motorcycles, Bajaj Auto at the Dominar's official launch on December 15 in New Delhi.

Interestingly, our analysis also finds out that Bajaj Auto is likely to cross the two million unit sales milestone in the domestic market in FY2017. The company’s total domestic sales in FY2016 stood close to 1.9 million units.

On the other hand, industry leader Hero MotoCorp, which sold 6.42 million units in FY2016, is estimated to inch closer to the seven-million-unit mark this fiscal. Continuing to perform at its current pace, the company may close FY2017 at 6.9 million units. While the sales momentum across its high-volume performers will remain crucial for Hero MotoCorp, new models, launched earlier this year, such as the 110cc Splendor iSmart 110 and 150cc Achiever 150 are expected to fetch additional sales for the company in the remaining months of the ongoing fiscal year.

Yamaha, which is expected to end FY2017 with overall sales of close to 0.85 million units, is known to be chasing its target of achieving sales of one million units in CY2017. This clearly highlights the company’s aggressive plans of new model launches next year, along with making deeper inroads into rural territories.

Royal Enfield, which has averaged sales of more than 52,000 units a month in the April-November 2016 period, is estimated to easily clock domestic sales of more than 620,000 units in FY2017. The company, which is adding new production capacity by building its new plant in Chennai, plans to build total capacity of around 900,000 units by FY2019.

Its newly launched 411cc adventure-tourer Himalayan model is delivering an average domestic sale of 1,000 units per month, thereby becoming the bestselling model across the 400cc, 500cc and 535cc portfolio for Royal Enfield. To push exports further, the company has also started exporting the Himalayan to the new markets of Colombia and Australia, and has set up its first ever exclusive retail store in Melbourne. According to Rudratej Singh, president, Royal Enfield, sales in the Australian market have grown by 63 percent YoY for the first three quarters of CY2016. Expect the Chennai-based manufacturer to achieve YoY growth of more than 25 percent in the domestic market this fiscal.

Among relatively smaller players, Mahindra Two Wheelers will see a further decline in its sales as the company plans cut down its marketing spend on the two-wheeler business by 80 percent and now plans to focus only on the premium segment (Mojo) moving forward. While the company plans to continue producing the Centuro motorcycle and Gusto scooter as per demand, it will roll out new variants of the Mojo over the next two years. On the premium front, the company looks to build new models under the recently inducted BSA and Jawa brands as the management seeks a timeframe of two years to fructify.

Piaggio, on the other hand, will continue to record additional sales, thanks to the Aprilia SR 150 in the remaining months. New variants under the Aprilia scooter umbrella will only boost the sales performance of this company next year.

Premium bikes likely to see demand grow

At the premium end of the motorcycle market, new models like the Roadster for Harley-Davidson India and the Street Twin, Bonneville T100 / T120 for Triumph Motorcycles India are likely to drive sales. Interestingly, Ducati India, which does not report its sales to apex industry body SIAM as yet, is offering a handsome discount of Rs 90,000 on its most affordable product, the Scrambler model(s) to boost sales.

All in all, FY2017 is expected to deliver good, if not decent, growth to India’s two-wheeler industry albeit OEMs will be keeping their fingers firmly crossed that market sentiment improves sooner rather than later.

You may like:

- INDIA SALES ANALYSIS: December 2016

RELATED ARTICLES

TVS Motor: The New King of India's Electric 2-Wheeler Market

January 2026 sees TVS Motor solidify its position with 34,558 units Bajaj struggles to keep pace.

Electric PV Sales Stabilize after GST Hit

Fresh FADA data shows January 2026 registrations surging 55% year-on-year, with Tata, JSW MG, and Mahindra all posting s...

Bajaj Chetak production plunges by 47% in July due to shortage of rare earth magnets

Bajaj Auto manufactured 10,824 Chetaks last month, 9,560 fewer units than the 20,384 Chetaks produced in July 2024. As a...

By Amit Panday

By Amit Panday

14 Jan 2017

14 Jan 2017

9565 Views

9565 Views

Angitha Suresh

Angitha Suresh

Arunima Pal

Arunima Pal

Ajit Dalvi

Ajit Dalvi