Tata Motors Q3 Profit Down 48%; Revenue Up 17%

The company reported consolidated exceptional items of ₹1,647 crore, related to New Labor Code implementation, in demerger expenses, and acquisition costs.

Tata Motors Limited reported a consolidated net profit of ₹705 crore for the third quarter of fiscal year 2026, compared to a loss of ₹867 crore in the previous quarter (Q2FY26). On a year-on-year basis, however, the profit declined 48% from ₹1,355 crore in Q3FY25, impacted by exceptional items totaling ₹1,647 crore related to labor code implementation, demerger expenses, and acquisition costs.

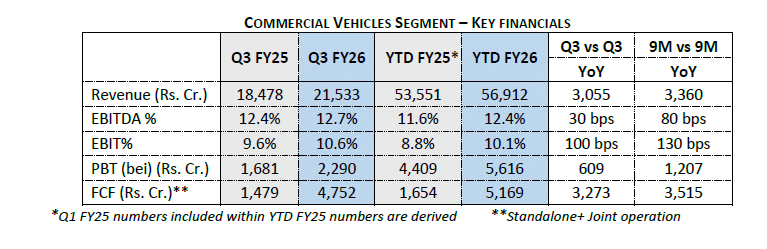

The commercial vehicles segment reported revenue of ₹21,533 crore for Q3FY26, up 17% from ₹18,478 crore in Q3FY25. EBITDA increased 19% to ₹2,732 crore, with margins expanding by 30 basis points to 12.7%, marking the 10th consecutive quarter of double-digit EBITDA margins.

EBIT margin reached 10.6%, up 100 basis points from the prior year. The company attributed this improvement to higher volumes and improved realizations, partially offset by rising input costs and the absence of the maiden PLI (Production Linked Incentive) benefit that was recorded in the prior period.

Profit Before Tax (excluding exceptional items) for Q3FY26 stood at ₹2,290 crore, an increase of ₹609 crore or 36% compared to Q3FY25. Free cash flow (FCF) reached ₹4,752 crore for the quarter, up ₹3,273 crore from ₹1,479 crore in the year-ago period.

The nine-month FCF stood at ₹5,169 crore. Return on Capital Employed (ROCE) for the quarter was 53%, compared to 38% in Q3FY25. The domestic business reported net cash of ₹3,900 crore as of December 31, 2025.

Exceptional Items

The company reported exceptional items totaling ₹1,647 crore in consolidated financials. These included ₹603 crore related to the New Labor Code implementation, ₹962 crore for demerger expenses, and ₹82 crore in acquisition costs. The standalone financials reflected exceptional items of ₹1,500 crore.

On a consolidated basis, revenues were ₹21,800 crore (up 16%), with EBITDA margin at 12.5% (up 30 basis points) and EBIT margin at 10.4% (up 100 basis points). The company reported net cash of ₹6,100 crore as of December 31, 2025, which includes TMF Holdings gross debt less market value of TMF Holdings investments in Tata Capital Ltd.

CV segment wholesales were 116,800 units, up 20% year-on-year. Domestic volumes increased 18% while export volumes grew 70% compared to Q3FY25. The company's overall domestic CV VAHAN market share was 35.5% for Q3FY26, up 100 basis points sequentially.

During the quarter, Tata Motors announced several product initiatives:

- The company launched 17 next-generation trucks and introduced the Azura series for the ILMCV (Intermediate and Light Medium Commercial Vehicle) segment.

- Tata Motors displayed trucks.ev, described as India's widest electric truck range. All truck platforms -- Prima, Singa, Ultra, and Azura -- now meet European safety standards (ECE R29 03).

- The company presented its Euro 6 range for Middle East and North Africa markets.

The Board of Directors approved a Composite Scheme of Amalgamation to merge TMF Holdings Limited and TMF Business Services Ltd, both wholly owned subsidiaries, with Tata Motors Limited. The proposed scheme will not result in any change to the shareholding of TML and is subject to receipt of necessary creditors, regulatory, and other approvals.

Girish Wagh, MD & CEO of Tata Motors Ltd, said, "Disciplined execution of an agile strategy delivered yet another strong financial performance this quarter, supported by demand tailwinds from GST 2.0 and the festive season. Our recent launch of 17 next-generation trucks under the 'Better Always' philosophy sets new benchmarks in safety, total cost of ownership, and smarter, emission-free mobility, reinforcing our commitment to innovation and industry leadership. With infrastructure spending accelerating, we are well positioned to sustain momentum and drive continued growth."

GV Ramanan, CFO of Tata Motors Ltd, said, "We delivered another strong quarter, translating robust operational execution and healthymdemand across key segments into meaningful financial outcomes. The quarter marked significant milestones, including our 10th consecutive quarter of double-digit EBITDA margins and achievement of double-digit EBIT margins. This strong operating performance coupled with disciplined working capital management led to robust free cash flow generation. With this trajectory, we remain confident of delivering on our stated financial guidance."

Company Outlook

The company stated it expects demand to strengthen in Q4FY26 across most commercial vehicle segments. It cited government infrastructure spending and expansion in end-use sectors as key drivers for 2026.

Tata Motors stated it has an optimized portfolio with product availability, pricing strategy, and customer engagement initiatives aimed at maintaining demand across segments.

The quarterly results reflect the company\'s operational performance in the commercial vehicles segment, with revenue and margin growth offset by exceptional items. The company\'s market share in domestic CV increased to 35.5%, with new product launches across truck platforms during the quarter.

RELATED ARTICLES

Why Biofuels, Not EVs, Will Drive India's Auto Market Growth: Insight from Deputy DG Dr. Ojha

For a country that currently imports roughly 90% of its crude oil, the push for biofuels is a cornerstone of national se...

Two- and Three-Wheel EVs Key to India’s Clean Mobility Push: Bajaj Auto

According to the company, electric two- and three-wheelers are central to India’s clean mobility transition, offering lo...

Govt to Come up with Compressed Biogas Policy Soon: Hardeep Singh Puri

The minister indicated that the new policy would build one existing measure in the CBG value chain.

By Arunima Pal

By Arunima Pal

29 Jan 2026

29 Jan 2026

440 Views

440 Views

Shahkar Abidi

Shahkar Abidi

Prerna Lidhoo

Prerna Lidhoo