India's Current Account Balance Records Surplus in Q4 FY25

Current account balance expected to register surplus of USD 7 billion after three quarters of deficit.

India's current account balance turned to a surplus of approximately USD 7 billion (0.7% of GDP) in the fourth quarter of FY25, marking the first surplus after three consecutive quarters of deficit, according to India Ratings and Research (Ind-Ra).

The surplus represents an improvement from USD 4.6 billion (0.5% of GDP) recorded in Q4 FY24 and a significant turnaround from the deficit of USD 11.5 billion (1.1% of GDP) in Q3 FY25.

However, Ind-Ra projects the current account balance will return to deficit in Q1 FY26, driven by deteriorating global trade conditions and increased uncertainty following US tariff announcements.

Trade Performance in Q4 FY25

Merchandise exports declined 4.4% year-on-year in Q4 FY25, attributed to high base effects and weak demand from key partners including the European Union, China, Bangladesh and Singapore. Despite the annual decline, exports reached a four-quarter high of USD 115.1 billion sequentially.

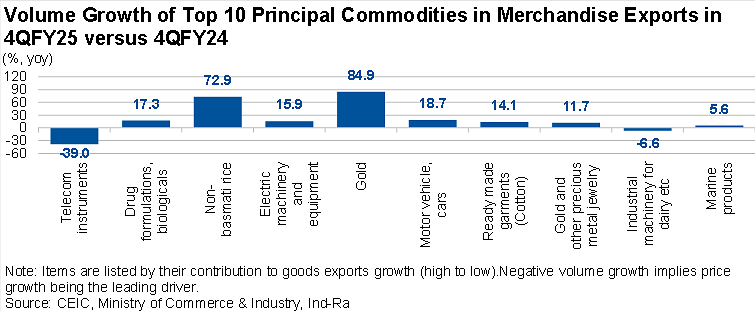

The top export performers included telecom instruments, drug formulations and biologicals, non-basmati rice, electric machinery and equipment, and gold. Volume growth for these items ranged between negative 39.0% and 84.9% year-on-year.

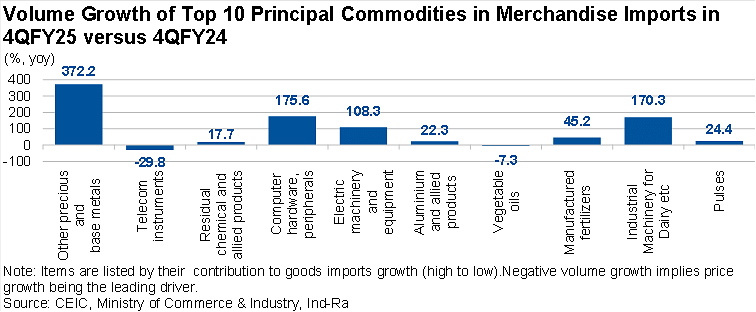

Merchandise imports grew 1.2% year-on-year to USD 173.9 billion in Q4 FY25, the lowest growth rate in five quarters. Primary goods imports dropped 9.4% year-on-year, while intermediate and infrastructure goods imports rose 11.1% and 8.8% respectively.

Outlook for FY26

The global trading environment faces significant challenges following US reciprocal tariff announcements in April 2025. The World Trade Organisation expects merchandise goods trade volume to contract 0.2% year-on-year in 2025, down from a baseline forecast of 2.7% growth.

"Overall, Ind-Ra expects the goods trade deficit to rise 22.4% yoy to around USD76 billion in 1QFY26," the rating agency stated. Services trade surplus is expected to moderate to approximately USD 48 billion in Q1 FY26.

"All in all, Ind-Ra expects CAB to turn into a deficit of around 1.2% of GDP in 1QFY26," said Paras Jasrai, Economist & Associate Director, Ind-Ra.

Geopolitical Risks

The escalating Israel-Iran conflict adds uncertainty to the global economic environment. Iran's potential closure of the Strait of Hormuz, which handles over 20% of the world's oil supply, could significantly increase oil prices and push India's current account deficit beyond 1.5% of GDP in the latter part of FY26.

The global manufacturing Purchasing Managers' Index fell to a five-month low of 49.6 in May 2025, with emerging markets leading the contraction. Services PMI moderated to 52.0 in May 2025 from 53.8 in December 2024, though it has remained in expansion territory for 29 consecutive months.

RELATED ARTICLES

Setco Automotive Enters Suspension Segment with Launch of Load Cushion and Torque Rod Bush

The company expands its commercial vehicle product range with new suspension components designed to enhance ride quality...

Tata Motors Announces Introductory Prices for Harrier.ev Starting at ₹21.49 Lakh

Bookings for rear-wheel drive variants open on July 2; prices for dual-motor versions to be revealed on June 27; Harrier...

Montra Electric Opens New Three-Wheeler Dealership in Bengaluru in Partnership with Rainland Autocorp

The Murugappa Group-backed Montra Electric expands its presence in Karnataka with a new dealership on Mysore Road, Benga...

By Shruti Shiraguppi

By Shruti Shiraguppi

23 Jun 2025

23 Jun 2025

577 Views

577 Views

Sarthak Mahajan

Sarthak Mahajan