Cooling Rubber Prices Offer Margin Relief for Automakers

Rubber price trends in December 2025 offer a rare moment of cost relief for manufacturers facing margin pressures elsewhere.

While the automotive industry grapples with triple-digit inflation in battery minerals, the commodities that literally hit the road—natural and synthetic rubber, are providing a much-needed financial cushion. According to the latest data from the Society of Indian Automobile Manufacturers (SIAM), rubber price trends in December 2025 offer a rare moment of cost relief for manufacturers facing margin pressures elsewhere.

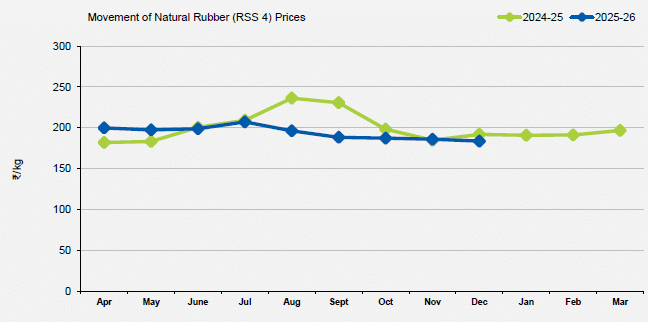

As per SIAM commodity data for the month of December 2025, natural tree-derived rubber (RSS 4) saw its average price settle at Rs 183.74 per kilogram, representing a 4% decline compared to last year. More importantly for quarterly planning, prices are now 11% lower than the peak witnessed in July 2025. While global consumption is slightly outstripping production (15.57 Mt versus 14.89 Mt), growth in key regions such as India and Thailand has helped stabilise the local supply chain.

The story for petroleum-based synthetic rubber (SBR) is even more favourable for the industry’s bottom line. Prices for this critical tyre component fell to Rs 161.70 per kilogram, a 9% year-on-year drop and a significant 17% decrease from the May 2025 peak. This price softening arrives at a critical time: while tyre production for light passenger vehicles (LMVs) has dipped by 12.8%, the two-wheeler and three-wheeler tyre segment has surged by 17.5%, keeping demand for synthetic varieties robust.

Specialised materials such as weather-resistant rubber (EPDM), which are crucial for tractor tyres and construction equipment, are also trending downward, with prices 6% lower than last year. This has supported a massive 54.4% jump in tractor tyre production, helping manufacturers capitalise on agricultural demand without the sting of high raw material costs.

However, industry insiders remain cautious. While commodity prices are cooling, the Indian rupee’s depreciation to 89.52 against the US dollar adds an import tax on synthetic rubber sourced from Korea and Japan. Nevertheless, in a year defined by margin-killing mineral inflation, the current rubber market remains a vital stable ground for the automotive sector.

RELATED ARTICLES

Subtle Steel Price Increases Add Fresh Pressure on Auto Costs

While finished steel prices are stable, rising iron ore and coking coal costs threaten to squeeze the margins gained fro...

The Magnetic Squeeze: Rising Motor Costs Threaten the EV Value Chain

Production of traction motors declined by 7.2%, a sharp reversal from the 12.8% growth seen last year.

The "Clean Air" Premium: Why Your Next Car Might Cost Significantly More

As per the SIAM commodity tracker updates for the month of December 2025, the most aggressive inflation is found in exha...

By Shahkar Abidi

By Shahkar Abidi

21 Jan 2026

21 Jan 2026

471 Views

471 Views