Weak market sentiment set to limit PV growth to 3 percent in FY2019

FY2019 is on the verge of closure and where the industry started from high hopes of positive growth across segments, the actual situation went on to differ, and quite significantly at that.

With around eight months of slowdown since July 2018, FY2018-19 has been marred by negative consumer sentiment due to high interest rates and tough liquidity situation in the market.

FY2019 is on the verge of closure and where the industry started from high hopes of positive growth across segments, the actual situation went on to differ, and quite significantly at that.

Poor market sentiment, which has been a spoilsport to the industry's expectations since the start of Q2l, has not shown any improvement even until the penultimate month, with February sales continuing to be in the red across all vehicle segments.

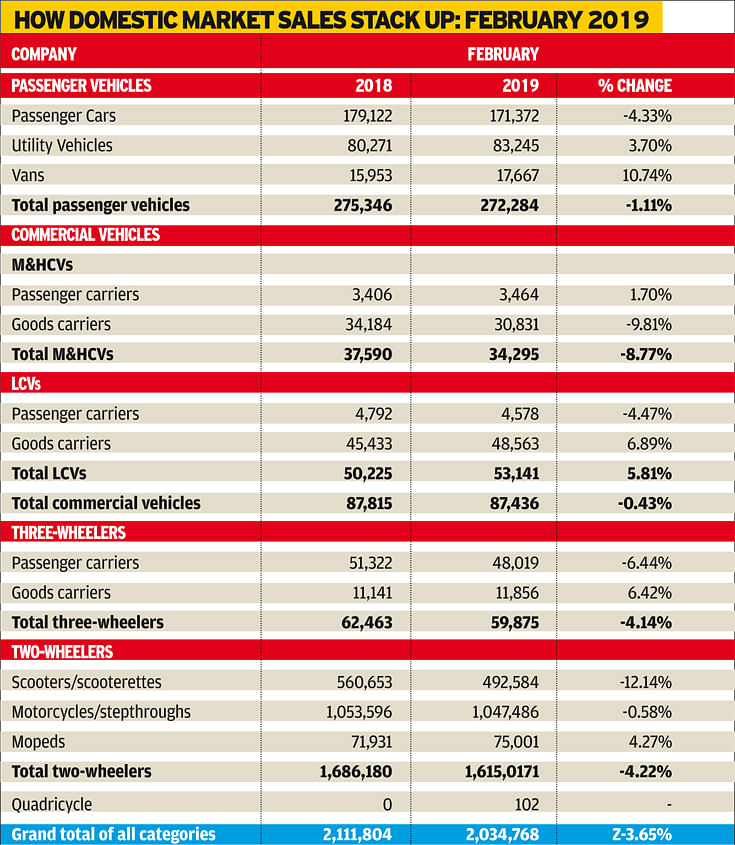

The industry clocked overall sales of 2,034,768 units in the month, registering de-growth of 3.65 percent (February 2018: 2,111,804). Of this, passenger vehicles (PVs) remained on a declining trend with a 1.11 percent slump with sales totalling 272,284 units (February 2018: 275,346).

Within PVs, passenger cars slumped significantly by 4.33 percent with volumes of 171,372 units (February 2018: 179,122), while utility vehicles (UVs) could only manage a low single-digit growth of 3.70 percent, clocking 83,245 units (February 2018: 80,271).

In the commercial vehicle (CV) segment, M&HCVs posted a decline by selling 34,295 units (February 2018: 37,590 / -8.77%) while LCVs registered a positive performance with 53,141 units of total volumes (February 2018: 50,225 / +5.81%). As a result, overall CVs remained almost flat with cumulative sales of 87,436 units (February 2018: 87,815 / -0.43%).

Three-wheelers and two-wheelers were both hit by the low availability of funds from the NBFCs and observed a similar 4 percent slump in the month. While three-wheelers reported sales of 59,875 units (February 2018: 62,463 / -4.14%), two-wheelers recorded total sales of 1,615,071 units (February 2018: 1,686,180 / -4.22%).

According to Vishnu Mathur, director general, SIAM, “Market sentiment continues to remain subdued. High interest rates and high insurance premiums have been keeping customers at bay in the PV and two-wheeler segments. As a result, the industry has not been able to recover consumer demand as expected.”

“While we do expect to see some improvement before the end of the year (CY2019) but as we move into an election phase, we are not certain as to how the situation will pan out over the next couple of months,” Mathur added.

“People at this juncture of a major political event are not ready to part with discretionary purchase, which is what is getting reflected in the numbers,” added Sugato Sen, deputy director general, SIAM, explaining the crunch situation.

Major revision of growth outlook

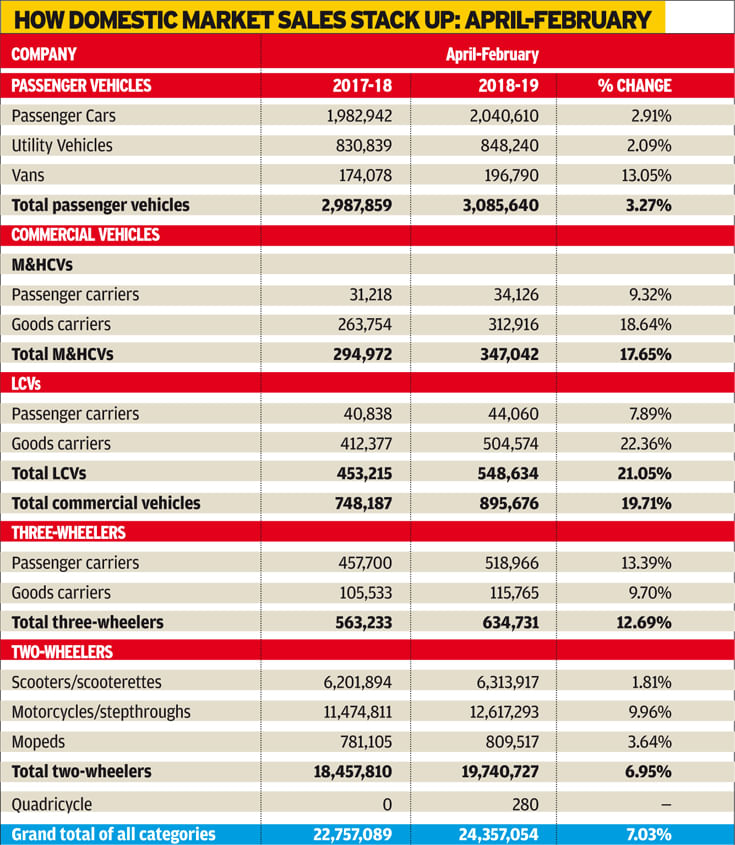

Even though February 2019 when compared to the previous year has shown a sluggish trend, however, on an overall basis, there has been growth in all key segments during the April 2018 to February 2019 period. PVs with cumulative sales of 3,085,640 units (April 2018-February 2019: 2,987,859) are in the black with a growth rate of 3.27 percent. Now, with just one month more of sales to contribute to the final numbers, SIAM is expecting the growth in the PV segment to be pegged at roughly 3 percent at the end of the fiscal, where its projection at the start was that of about 8-10 percent.

A comparative analysis of the overall industry numbers suggests that where gross domestic volumes stood at 24,972,788 units in FY2017-18 along with posting a strong growth rate of 14.22 percent, the surge has been absolutely halved to 7.02 percent between until February, with sales tallies recording overall volumes of 24,357,054 units and still having easy potential to surpass FY2017-18 volumes with March yet to close in.

What has hampered growth then is that some of the critical categories such UVs and scooters, both of which were running in the fast lane with over 20 percent growth in the last fiscal, are now hovering at around 2 percent, which is a significant drop in performance. While skyhigh fuel prices for the most part of the 2018 calendar year and high interest rates hit the UVs, low availability of financing in the non-banking sector, on the other hand, impacted sales of two-wheelers and UVs in the rural markets, which even though being better than urban sectors are relatively lower than compared to how they have performed in the past.

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

08 Mar 2019

08 Mar 2019

6781 Views

6781 Views

Autocar Professional Bureau

Autocar Professional Bureau