Varroc Group’s metallic division targets 30 percent CAGR

The Aurangabad-based Varroc Group, which has merged its forging and machining units with the metallic division, looks to accelerate growth through enhanced synergies.

What's well known about Aurangabad-based Varroc Group is that it is a fast-growing component major with a vast global footprint. The company’s product portfolio ranges from sophisticated automotive lighting solutions to rough and heavy forged-cum-machined components that could weigh upto 300kg.

What's not so much in the public eye is the forging division. This unit has its own growth roadmap for the foreseeable future. In a move to consolidate its operations, Varroc recently merged its forging and machining business, which had commenced operations in 2004 with one client, Bajaj Auto, with the metallic division.

Ashwani Maheshwari, who earlier headed the forging business at Varroc Engineering, is now the president for the entire metallic division. “We strategically merged the forgings business with the metallic division recently to extract complete synergies. This step to consolidate our businesses is taken to realise synergies on three fronts: forward, backward and managerial integration. The metallic business will now cover engine valves, forging and machining units,” he told Autocar Professional.

The consolidated turnover for Varroc Engineering’s metallic division (including the forging and machining verticals) for FY2016-17 is estimated to be in the range of Rs 800-Rs 850 crore.

While the forging and machining unit has a manufacturing footprint of six plants – three in Aurangabad, one in Pant Nagar and two in Italy – the merger with the metallic division has added another two facilities (both based in Aurangabad).

“The metallic division now covers eight facilities,” reveals Maheshwari. The two plants in Italy, acquired precisely five-six years ago, cater to Varroc's customers in Europe and the USA.

Talking in the context of its forging business, Maheshwari recalls, “We had a very humble beginning with just one client in 2004. Since then we have been expanding our operations, manufacturing footprint and adding new clients. The forging division now caters to more than 20 customers.”

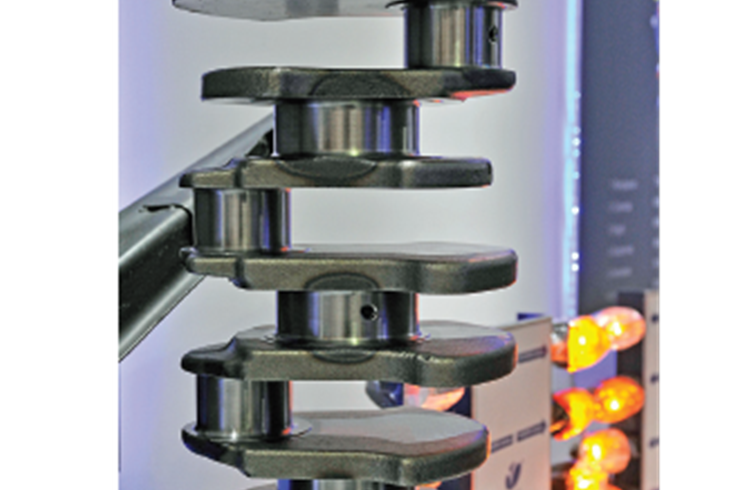

The company caters primarily to two-wheeler customers along with a few commercial vehicle OEMs. Under the forging division, it manufactures, machines and supplies fully finished camshafts, connecting rods, transmission assemblies and semi-finished blanks among other products.

“These are products that are supplied across the various stages of their development and assembly. Forging is a very capital-intensive engineering process. The return on capital employed (ROC) is always a challenge. To give you an idea, we do forging of parts weighing from 100grams to 300kg. That’s the spread of the entire range of forged parts that we make,” highlights Maheshwari.

CONFIDENT ABOUT FUTURE GROWTH

Maheshwari is optimistic about achieving growth in the coming three years. He estimates that his division should grow at a CAGR of 30 percent year-on-year over till the year 2020. This means the metallic division will soon cross the milestone of Rs 1,000 crore turnover.

The domestic market contributes to the tune of 85 percent to the division’s annual turnover. Export revenues, on the other hand, constitute 15 percent.

“We have a strong growth plan to grow domestically. The exports business will grow based on our strategic partnerships,” he adds.

The top official has laid down a five-point strategy to fuel growth as part of the company’s 2020 roadmap. These core areas include growing with the existing customers with existing products; existing customers with new products; demand for existing products from new customers; completely new product lines and advanced engineering efforts.

Elaborating on the same, Maheshwari explains, “Our core strategies to grow are simple. They are aligned with the developments by the OEMs. We co-develop products with our customers for existing and new incoming models. When our customers plan new models, we pitch with ideas on how we can help and what new products we can make for them. We also enter into adjacent product categories via associated products. For example, if we are manufacturing transmission assemblies then we can move into primary gears. Lastly, we are also focusing on how can we create our own IPs. There is where we would like to innovate and manufacture products on our own.”

“We are also focusing on the advanced engineering front. The developments under this head would be critical almost three to four years from now. The ongoing projects under this head may not benefit us this year but after, say, three years,” he adds.

The metallic division has established notable product design capabilities. It has a full-fledged R&D centre buzzing with a number of industry projects.

FORGING R&D

Commenting on R&D in the forging front, Maheshwari says, “We use this software called Forge, which I believe only two to three companies in India are using currently. We employ this software while doing initial designs. It basically guides the engineers through the various forging techniques, how to forge a product, how the material flow looks like, what size of slugs should we start with, and so on and so forth.”

The R&D team dedicated to the forging and machining operations comprises around 40-50 engineers.

Varroc Engineering’s metallic division is understood to have earmarked a capital expenditure in the range of Rs 60-Rs 100 crore in FY2018. The expenditure would be routed towards capacity expansion, plant and machinery and development of new products excluding the R&D operations. “Capacity expansion does not only mean adding new machinery. It can also mean that the existing capacity can be used more efficiently. Same machines can be used to deliver more output,” clarifies Maheshwari.

Commenting on the uncertainty pertaining to new-age vehicle propulsion technologies, Maheshwari remarks, “There are uncertainties in every business. The uncertainty can become certain by responding to it. The ultimate beneficiary is always the consumer. This also depends on the flexibility and internal culture of an organisation, which covers the risk-taking and investment capabilities, talent retention and changing the face of the company. Varroc, as an organisation, has the capabilities to transform itself rapidly as per market requirements.”

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

01 Jul 2017

01 Jul 2017

10890 Views

10890 Views

Autocar Pro News Desk

Autocar Pro News Desk