Scooters fuel growth for Indian 2W OEMs in 2014-15

Even as individual Indian two-wheeler OEM sales numbers for March 2015 filter through, it’s becoming amply clear that scooters are keeping the momentum going for the overall segment.

Even as individual Indian two-wheeler OEM sales numbers for March 2015 filter through, it’s becoming amply clear that scooters are keeping the momentum going for the overall segment. Increasing urbanization, convenience of riding and improved technology are seeing scooters emerge as a challenge to the commuter motorcycle market.

In comparison, the motorcycle sector is feeling the heat of slowing sales. Poor monsoons and a consequent fall in rural incomes have hit numbers but OEMs are hopeful that the situation will improve in 2015-16.

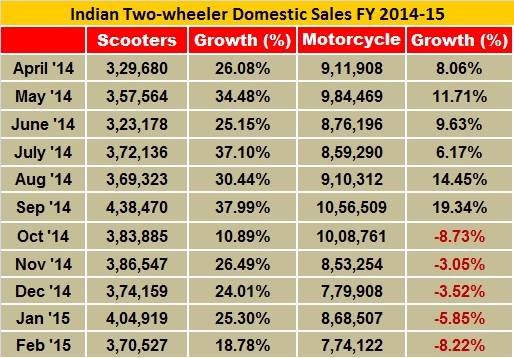

Motorcycles recorded their steepest fall in February 2015 when sales dipped by 8.21 percent (see table below). It was the fifth consecutive month of declining sales with the slide beginning in October 2014 when sales fell 8.73 percent over the year-earlier month figures.

This was bang in the middle of the festive season and may well have been a pointer of things to come but no one could have thought that the slide would continue. The overall two-wheeler industry March 2015 sales figures are yet to come but from the individual OEM figures, it wouldn’t be wrong to hazard a guess that motorcycles are riding in the slow lane.

According to sales figures put out by apex industry body SIAM, in terms of absolute numbers, bike sales fell from 853,436 units in February 2014 to 774,122 units in February 2015. In September 2014, bike sales had aggregated 1,056,509 units.

Motorcycles have always been at the vanguard of India’s two-wheeler sales. They outsell scooters by a factor of four is to one. The number of bikes sold for the 11-month period ended, as per SIAM data, in February 2015 was 9,884,028 motorcycles as against 4,109,628 scooters.

If sales of commercial vehicles are considered the barometer of the economy as a whole, bike sales are a beacon of middle-class prosperity. In many cities, apart from the major metros, the bike is a typical family’s first set of wheels..

While it is difficult to say if there is a clear preference for scooters over bikes in the urban markets, one component supplier Autocar Professional spoke to seems to suggest so adding that women buyers have been making a beeline for scooters in urban areas.

Another Pune-based supplier said, “The market is low on purchase sentiments, rural incomes are down and this is having an effect on the mass commuter motorcycle segment. Unseasonal rainfall across the country has only put further pressure on the farm output from states like Uttar Pradesh, Madhya Pradesh, Maharashtra and others. I believe that the motorcycle segment will take a while before it bounces back.”

COMMUTER BIKES TAKE A HIT

At the entry level, there are no less than 19 commuter brands spread across six OEMs. While the Splendor leads the segment, interestingly, the TVS Sport and HF Deluxe have made some ground-grabbing share from the Bajaj Discover that saw its sales fall by 50 percent in the 100cc segment for the April-February 2015 period.

In terms of individual OEMs, the fall has had an impact on the aggregate numbers for two-wheelers with Bajaj Auto impacted the most. During April 2014-February 2015, the Pune-based company’s market share fell from 20.15 percent to 16.55 percent. Numbers-wise, its sales fell from 1,929,361 units to 1,636,118 units. While all other 2W OEMs recorded an increase in their bike share by less than one percent, it was highest for Honda Motorcycle & Scooter India.

In terms of individual models, sales of the entry level offerings such as the Splendor have fallen from 189,882 units in February 2014 to 182,286 units in February 2015. Bajaj’s entry-level Platina saw sales fall to 34,215 from 36,121 units in the year-earlier period. Hero MotoCorp’s Passion has fallen from 119,235 units in February last year to under a lakh at 95,927 units, the steepest fall of the motorcycles that are in the top 10.

SCOOTER SALES REV UP

On the other hand, scooters sales have gone from strength to strength recording an increase of 20 percent on average in the past few months. As one supplier said, “We know that scooters are a preferred choice among youngsters as well as families in the urban market because of convenient features and utility.”

Honda Motorcycle & Scooter India (HMSI), the leader in the scooter market, is building its largest scooter-only plant in Gujarat. According to Y S Guleria, vice-president, sales & marketing, HMSI, “Positioning of scooters as a gender-neutral vehicle is seen as a key reason for its widespread appeal (Activa models). The scooter market is growing at 28 percent. The latent demand for automatic scooters is rapidly increasing as a result of the improving infrastructure in rural India. We believe that the automatic scooter has potential to reach 35-40 percent of overall two-wheeler sales in a 5-10-year horizon.

Like HMSI, Hero MotoCorp, which is No 2 scooter seller in India, is also aggressively adding production capacity. With the Neemrana facility on stream, the company is looking at Gujarat and Andhra Pradesh to set up new plants in the near future. Hero is also working on developing bigger scooters (157cc Zir models).

Meanwhile, TVS is quickly moving to close the gap in scooter sales with Hero MotoCorp, thanks to its well-received 109.7cc Jupiter scooter, which the company is now also producing at its Solan plant in Himachal Pradesh to cater to soaring demand.

MARCH NUMBERS ROLL IN

Hero MotoCorp (HMCL), the world’s largest two-wheeler manufacturer by volume, has registered sales of 531,750 two-wheelers during March 2015, up by a flat 1.47 percent (March 2014: 524,028).

Marking its highest ever annual sales for any fiscal year, in FY2014-15 the company recorded total sales of 66,31,826 units, a growth of 6.17 percent (FY2013-14: 62,45,960). March 2015 also saw Hero MotoCorp inaugurate its first autonomous production and development centre at Manesar in Haryana) under its JV with Magneti Marelli of Italy. The new facility, which will serve as a production and innovation hub for developing new-generation fuelling systems for two- wheelers, has made Hero the first 2W OEM to have its own production line for electronic fuel injection (EFI) systems.

Commenting on the 2014-15 sales, Pawan Munjal, vice- chairman, MD and CEO, HMCL, said: “FY2015 was a year of milestones for us in terms of sales, expansion of our global footprint, product innovation and customer engagement. Our record sales performance is reflective of all these efforts. In FY2015, the industry continued to be sluggish due to the overall market sentiment and the slowing rural economy. Despite such a challenging market environment, we managed to buck the trend and registered healthy growth, further consolidating our leadership. The journey from here promises to get better and exciting. Thanks to a series of measures undertaken by the new government at the Centre, the economic outlook is definitely better, and it is likely to fuel growth and help the industry.”

Honda Motorcycle & Scooter India (HMSI) has reported sales of 399,178 units (including exports) during March 2015, up by a flat 1.82 percent over 392,030 units sold in March last year.

Scooter sales powered HMSI’s March 2015 numbers, selling 238,919 units and notching 21.78 percent growth year on year (March 2014: 196,191).

In comparison, HMSI’s bike sales saw a drop – 145,508 units in March 2015, down 18.25 percent (March 2014: 178,035). As per the company’s monthly sales report, in March 2015 its domestic market share stood at 29 percent, its highest ever since HMSI’s inception.

FY2014-15 was a good year for the company as it grew by 19.62 percent, including exports. It sold a total of 44,52,010 units (2013-14: 37,21,942).

TVS Motor Company too has shown progress in the last month of FY2014-15. It sold 167,428 two-wheelers in the domestic market, marking flat growth of 1.17 percent (March 2014: 165,482). Like HMSI, scooters were the better performers on the sales front. TVS’ scooter sales grew 14.44 percent to 54,666 units (March 2014: 47,766). Motorcycle sales saw a growth of 12.88 percent to 76,936 units in March 2015 (March 2014: 68,158).

Royal Enfield continues its dream run with sales growing month on month. In March, the bikemaker sold 32,854 units, up 41.80 percent (March 2014: 23,170).

Mahindra Two Wheelerssold 11,826 units last month, down a steep 60 percent (March 2014: 18,953)

RELATED ARTICLES

Uniproducts India targets 15% growth till FY2027, eyes new EV OEMs for NVH parts

The Noida-headquartered company, which is a leading manufacturer of roof liners, floor carpets, sound insulation materia...

Ford to build more EV software capability at Chennai tech hub

Ford Business Solutions India, which currently employs 12,000 personnel set to add 3,000 more; Ford, which is known to b...

ASK Automotive to set up JV with Aisin to sell aftermarket parts for cars

Ask Automotive will have 51% of the equity of the joint venture to be set up with Aisin Asia (Thailand) Company and Aisi...

02 Apr 2015

02 Apr 2015

8584 Views

8584 Views

Autocar Pro News Desk

Autocar Pro News Desk