Robust PV sales in September point to strong industry growth in FY2018

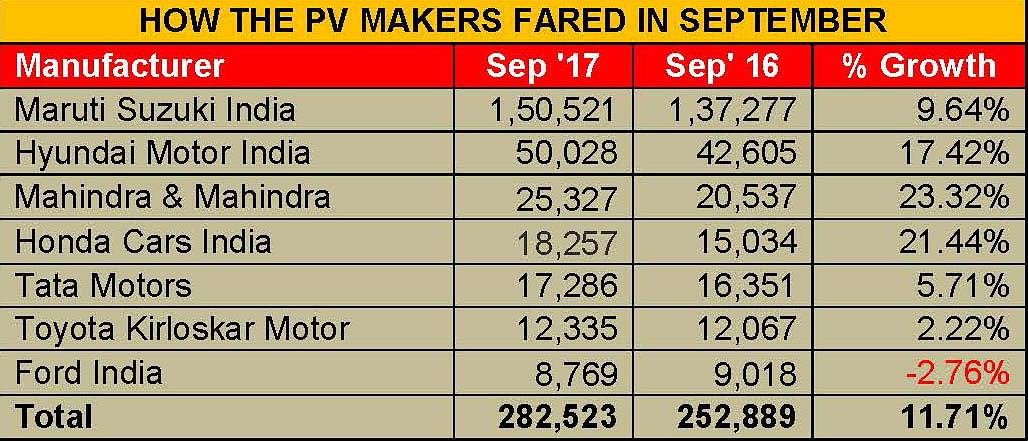

Cumulative Maruti, Hyundai, Tata and Toyota sales for September 2017 add up to 230,170 units, up 11.95 percent over year-ago sales for these four automakers (September 2016: 205,600).

With Maruti Suzuki India, Hyundai Motor India, Tata Motors, Mahindra & Mahindra, Honda Cars India, Toyota Kirloskar Motor and Ford India announcing their September sales numbers, it’s amply clear that new launches, a boost in consumer demand from the Navratri festival and Dussehra, which is seen as an auspicious day to buy vehicles, have helped automakers post robust numbers.

As a result, expect overall PV industry numbers for September 2017 to drive past September 2016 sales of 278,428 units (+19.92%). With the remaining 7 PV makers yet to reveal their sales numbers, expect cumulative numbers to be higher than year-ago sales by a fair margin.

Cumulative sales of the above-mentioned OEMs for September 2017 add up to 282,253 units, up 11.71 percent over year-ago sales (September 2016: 252,889).

Maruti Suzuki India, which looks well set to notch its best-ever sales for a fiscal year, sold 150,521 units (+9.64%) last month. Other than for the entry-level hatchback duo of the Alto and Wagon R, which sold 38,479 units, down -13.3% (September 2016: 44,395) and the premium Ciaz sedan at 5,603 units (-14,4% / September 2016: 6,544), sales for other segments are all up.

Demand for the five compact cars (Swift, Celerio, Ignis, Baleno and Dzire) rose smartly by 44.7% year on year to 72,804 units (September 2016: 50,324), reflective of the surging demand for the premium Baleno hatchback and the new Dzire sedan.

While the Baleno, the largest of the company’s hatchbacks which comes with ABS and dual airbags as standard across the 11-variant range, continues to draw buyers, the big surprise has been the spurt in demand for the Dzire which had notched its best-ever monthly sales – 26,140 units (comprising 14,083 diesel and 12,057 petrol)) in August 2017. Expect the Dzire to have done well in September too and contributed a large share to overall numbers. Total sales of Maruti passenger cars in September were 116,886 (+11.1%) over the 105,236 units sold a year ago.

Sales of Maruti Suzuki’s utility vehicles – Gypsy, Ertiga, Vitara Brezza and S-Cross – surprisingly have slowed down: at 19,900 units (+8.0% / September 2016: 18,423). Expect the Maruti Vitara Brezza, which notched its best-ever monthly sales of 15,243 units in July 2017 and 14,396 units in August 2017, to have contributed the bulk of the UV numbers.

However, going forward, the Brezza will have to contend with the Nexon, Tata Motors’ first-ever compact SUV and possibly its first strong challenger. The compact SUV battle for the consumer just turned a lot more exciting.

Bringing up the rear are the two vans, the Omni and the Eeco which together sold 13,735 units, making for flat sales of 0.9% (September 2016: 13,618).

Hyundai Motor India, the second largest car manufacturer in the country, has recorded sales of 50,028 units in September 2017, a growth of 17.42 percent (September 2016: 42,605). Helping drive the sales momentum is the recently launched new Verna sedan, which went home to over 6,000 owners even as the Creta SUV, Elite i20 and Grand i10 hatchbacks continue to see popular demand. In August 2017, the Korean carmaker had sold 47,103 units in the domestic market.

Mahindra & Mahindra registered sales of 25,327 units in September (+23%), compared to the 20,537 units sold in September 2016. While UVs, including the Scorpio, Bolero, XUV500, TUV300 and KUV100 accounted for the chunk of the volumes selling 24,109 units (September 2016: 19,206), cars and vans sold 1,218 units (September 2016: 1,331).

Commenting on the sales resurgence, Rajan Wadhera, president, Automotive Sector, M&M, commented on the sales performance and said, “The auto industry has witnessed a buoyant demand in September leading up to the festive season. This upsurge has been witnessed both in urban and rural markets. At Mahindra, we are very happy with our September 2017 performance with our passenger and commercial vehicle sales having grown at 23 percent and 19 percent respectively. We are particularly happy with the performance of our Scorpio brand, which has had its highest monthly sales in September since inception. Going forward, we are confident of sustaining a growth momentum for the rest of the festive season”.

Honda Cars India posted strong growth of 18,257 vehicles, up 21 percent, (September 2016: 15,034). The strong growth momentum was led by the company’s high-selling sedan City (6,010), along with stable sales from the WR-V (4,834); they together accounted for more than 50 percent of Honda’s domestic sales. The other contributors were the Brio (504), Jazz (3,001), Amaze (2,561), BR-V (1,298), CR-V (31), and Accord Hybrid (18). Commenting on the numbers, Yoichiro Ueno, president and CEO, Honda Cars India, said, “Honda Cars India is witnessing one of its fastest growth years in sales, backed by strong performance of our latest models , the City and WR-V. We have had a good start to the festive season, clocking strong sales in September. With the festive purchase on full swing, our sales outlook for the season is very promising."

Tata Motors has reported sales of 17,286 passenger vehicles, a YoY growth of 5.71 percent (September 2016: 16,351) and mainly driven by demand for the Tiago, Tigor and Hexa. The recently launched Nexon compact SUV has also received a strong response in the market. Tata Motors says its cumulative PV sales for the April-September 2017 period are 81,417 units, a growth of 12 percent compared to 72,665 units, in the same period last fiscal.

Meanwhile, Toyota Kirloskar Motor sold 12,335 units in September 2017, 2.22 percent up year on year (September 2016: 12,067). The company has recently launched limited editions in the form of the Etios Cross X-Edition and Fortuner TRD Sportivo to make the most of the festive season. It has also introduced festive offers across its dealerships on the Etios series and Corolla Altis.

Commenting on the monthly sales, N Raja, director and senior vice-president, Sales & Marketing, TKM, said, “We revised the price of our products on September 12, 2017 in line with the cess hike which nearly reflects the prices in the pre-GST scenario. We are happy that our customer demand had minimum impact of the cess hike and the festive season has ushered in a positive growth in the domestic sales. With demand on the rise, the current waiting period for the Innova Crysta has gone up to around 6-8 weeks and Fortuner to 10-12 weeks respectively.”

Ford India’s sales declined 2.76 percent in September 2017 at 8,769 units, as opposed to 9,018 units a year ago. Anurag Mehrotra, president and managing director, Ford India, said, “New model launch planning along with ongoing constraints in the supply chain continued to impact our wholesale in September. We believe these should be addressed by the fourth quarter, helping us move back into the growth trajectory.”

RELATED ARTICLES

Bajaj Auto launches new Chetak 3503 at Rs 110,000

The Chetak 3503, with a claimed range of 155km, 63kph top speed and a slower charging time than its 35 Series siblings, ...

Hyundai walks the eco talk with biogas plant, material recovery plant in Gurugram

Operational since October 2022, the facility targets sustainable waste management in Gurugram by undertaking scientific ...

Rajiv Bajaj reappointed MD and CEO of Bajaj Auto for five-year term

Bajaj Auto’s Board of Directors has approved the re-appointment of Rajiv Bajaj as the company’s MD and CEO for another f...

01 Oct 2017

01 Oct 2017

6937 Views

6937 Views

Autocar Professional Bureau

Autocar Professional Bureau